The second day’s sessions analysed pulse quality throughout the supply chain and provided outlooks on chickpeas and peas in Canada.

Missed the conference? Members can find our main takeaways for Day 1 here and for Day 2 below.

Panel: Defining Quality Throughout the Food Supply Chain

In this panel, representatives from across the pulse industry gave insights into issues of quality and what challenges are facing growers, processors and plant breeders.

Tom Warkentin, a professor and the Ministry of Agriculture Chair in Pulse Crop Breeding and Genetics, discussed how the definition of pulse quality has changed over the last thirty years.

- In the 90s and early 00s, the emphasis was mostly aesthetic and focused on size, shape and colour

- Pulses tend to be purchased with little processing so buyers want them to look nice at the outset. With peas, for example, bleaching resistance is important

- In the past decade, more quality traits have been added: eg. protein concentration in peas and faba, seed coat quality, trypsin inhibitors and tannins

- Work is being done on micronutrients and into the future, the amino acid profile will become increasingly important

- Amino acids are difficult to measure as there are a lot of different ones and the traditional measuring system (HPLC) is expensive and impractical however there are several other tests that are easier and quicker although less accurate

Steve Innes of Bonduelle explained how pulse quality can be viewed through several lenses

- The characteristics of the pulse in terms of colour, consistency, size, water-holding capacity, protein and starch

- Sustainability factors: where they’re grown, the country of origin, consistency of supply, pesticide residue, how they’re produced and logistics

- Food safety

- Logistics: quality of delivery and making sure the product arrives on time

The panelists agreed that pulse quality is getting more and more comprehensive, across the whole process from farm to fork.

Charlie Kauffman, Sr. Product Specialist in charge of Ingredient Performance at PerkinElmer, discussed what common quality attributes are important to stakeholders.

- Quality encompasses a complete characterisation of the product starting with an accurate and efficient measurement of protein, starch, fibre and fat

- He reiterated that eventually acid breakdown will be commonly measured

- Many clients are focused strongly on “pulse performance”, particularly for plant-based meat and dairy, such as starch cooking, gelling performance and hydration behaviour

- As they become involved in increasingly complicated ingredient systems, there are modifications that get made to the pulse protein ingredients or starches to either add functionality or improve palatability, which have an effect on characteristics

- Companies look at the effect of heat, fermentation and other chemical modifications.

The panelists then analysed some of the challenges in pulse quality.

- Innes explained how lentils often have difficulties when being canned or frozen as it’s hard to get them to hold together after processing

- Likewise, he explained how the color of chickpeas is a challenging aspect. The color of those grown in North America have difficulty meeting the colour requirements for certain markets

- Higher end markets want a bright yellow colour after cooking and canning

- With dry beans, the cracking of seeds is the number one challenge, especially in larger varieties

Mehmet Tulbek of AGT had further insights on the topic:

- There is an issue of whole seed hardness and how some seeds do not absorb water because dry conditions can make them develop an impermeable husk

- The pulse ingredients industry is still quite young and AGT is learning a lot about whether products are consistent or not when it comes to processing them for animal protein substitutes

- Overall, though, he said they were pleased but highlighted the importance of monitoring quality throughout the whole process

Mr. Kauffman outlined the most difficult quality aspects to measure in pulses.

- There are two sides to the pulse quality coin: what it is - protein, fat, fibre, etc -, and how it is - how it reacts to processing and cooking, the seed coat permeability, how the starch performs when cooked, how it is as a flour vs as a whole pulse, how does it retrograde to form a gel with proteins?

- Functional attributes are harder to quantify and the current movement in the industry is towards finding ways to measure those in a scientifically responsable way and quantify them so as to be able reproduce them as quickly and effectively as possible

- For example, with whole lentils being canned and cooked, it’s hard to predict how permeable the seed coat will be and it is necessary to have a versatile performance analyser to evaluate them and identify any issues while at the same time keeping them intact.

Finally, the panelists discussed how the Canadian pulse in can differentiate itself in terms of quality

- Kauffman gave the US perspective and discussed how the Canadian origin designation has lots of marketability as it is favourably seen and manufacturers adding an origin destination to consumer-facing labels would go a long way towards driving market share

- Tulbek highlighted the importance of collaboration to help strengthen crop quality and supply as well as working on creating a stronger food safety and regulatory framework

- Innes stressed the importance of keeping up Canada’s reputation for being a good provider and excelling to the next level. He highlighted the work to be done in pesticide use, measurement and residue and suggested following movements in Europe about restrictions and consumer demands.

- He pointed to life cycle analysis, carbon footprint, better nutrient levels, less fertilizer and water usage as differentiating factors

- Warkentin reiterated the idea of promoting the low carbon footprint of pulses, specifically their nitrogen fixing qualities. He also suggested some promotion of the active research community in Canada and their work on innovating pulses for the future

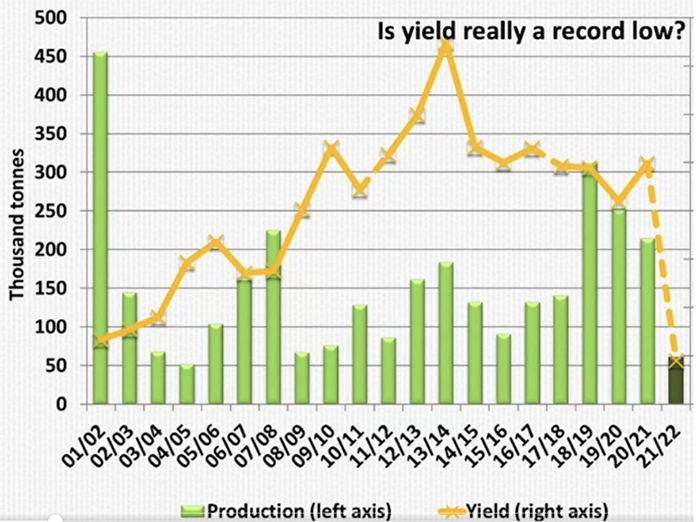

Chickpea Market Outlook

In this highly informative session, Chuck Penner of LeftField Commodity Research gave his insights into the chickpea market for 2021/22.

Main takeaways

- Fewer acres and poor yields in Canada

- More acres but poor yields in the US

- Old-crop stocks in very strong farmer hands

- No big production response in other countries, small improvement only in Russia

- Globally, things don’t feel as tight as 2015/16 so prices will probably not return to record highs

- The U.S will be the most aggressive bidder in Canada but will also need to look elsewhere

Western Canada outlook: production

- Statscan just came out a few days ago with a production estimate of 63,000 tonnes

- Not a record low but a very small crop

- Yield numbers were at a record low at 780 lbs/acre

- Estimates may be lower than actual because statscan numbers are based on a model and they are not able to ask farmers what their harvested acres will be

- If yields were really that low, some fields may have just been written off and not harvested at all

- LeftField guesses between 60-80kt production

- Final production numbers in December will be important to watch

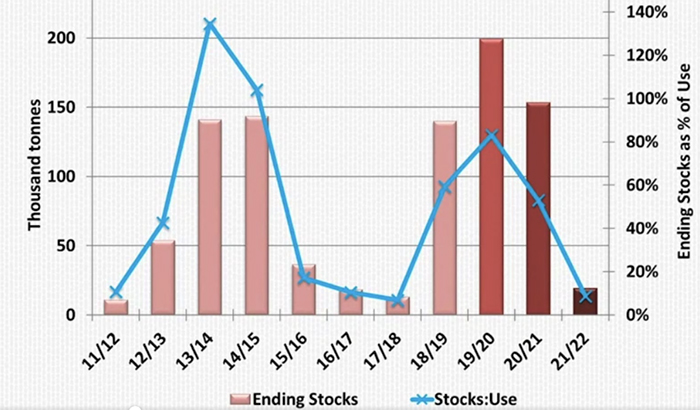

Price ideas

- In the posted bids, direction and momentum is clearly higher

- No signs yet that demand is being rationed

- Farmers are very reluctant to sell if they have product - in some cases they don’t

- Where will demand start to slow in response to prices

- Prices are moving towards highs of 2016/17/18

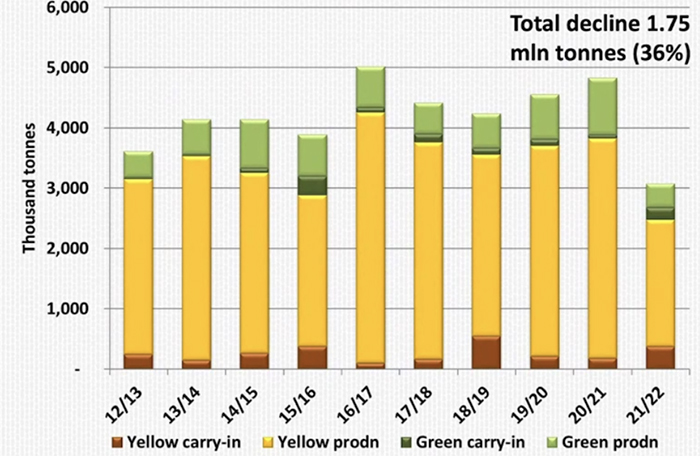

Dry Pea Market Outlook

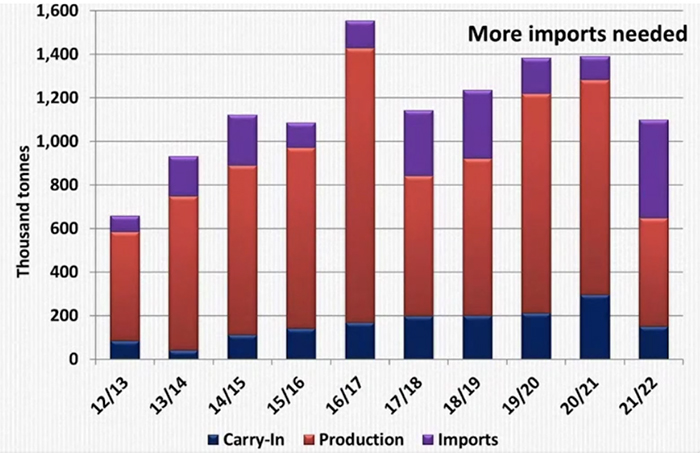

Once again, it was Mr. Penner of LeftField who provided a comprehensive analysis of the dry pea market as it stands

Canadian pea production

- Much smaller crop than last year

- StatsCan estimated 2.63 million tonnes: a 2 million drop from last year

- Yields were a little over 25 bushels/acres

- StatsCan’s model doesn’t include an estimate of harvested area so yields this low would suggest a number of fields were written off and not taken to harvest

- LeftField estimates a little lower than StatsCan: around 2.5 million tonnes

- Yellows down 42% from last year, greens 60% (because of shift of acreage out of greens into yellows) and 60% drop for minor classes of peas

Supplies

- Looking at carrying forward some larger supplies of around 500,000 tonnes into 2021/22

- But combined with the drop in crop size, total supplies are still down 1.75 million tonnes from last year (36%)

- Already seeing this decline in the price behaviour