September 9, 2021

Arbaza’s senior global account manager on Brazil’s dry bean production and exports, and his expectations for the future.

Brazil, the world’s top dry bean market, is going through changes. This was made abundantly clear at the GPC’s Ask the Experts South America virtual event, where a presentation on Brazil’s dry bean market highlighted several trends: the dry bean area is losing ground to high-priced corn and soybeans; carioca bean production is shifting from dryland to irrigated fields; per capita consumption is falling; a greater diversity of bean classes are now being produced; and exports, which have tripled since 2014, are projected to increase even further in the coming years.

The event, sponsored by Arbaza Alimentos, a leader in Brazil’s dry bean sector and a GPC President’s Club Platinum Partner, included a panel on Brazil’s mung beans and cowpeas that counted with the participation of Pietro Schisler, the company’s senior global account manager. Although Brazil’s dry bean production was hit hard by drought in 2021, Pietro struck an optimistic tone. Even with significant crop losses, exorbitant freight rates and logistical headaches, he said, Brazil’s exports continue to trend upward and, he added, he expects an even bigger export campaign in 2022.

Pietro is a newcomer to the pulse industry, having previously practiced law and worked as a sales executive in other sectors prior to joining Arbaza last year.

“I love trading commodities,” he says. “What I love most about this industry is that it keeps me on my feet. There is always something new to learn. It’s indeed an organic and ever-changing industry.”

The GPC reached out to Pietro to get his fresh perspective on the outlook for Brazilian dry beans in 2021-22 and his take on what current trends may mean for the future of Brazil’s dry bean sector.

GPC: To begin with, tell us a little bit about Arbaza and how it became a leader in Brazil’s dry bean sector.

Pietro: It started 30 years ago thanks to the unwavering entrepreneurial spirit of the Balestreri family. They began as small pulse farmers in a small town and grew their business to become, in a matter of decades, the single largest black bean importer in the world and the largest pulse player overall in South America.

As Brazil’s agribusiness sector developed, professionalized and grew into the world-class powerhouse it is today, it pulled up all those who could keep pace. Arbaza was no exception. The company professionalized its operations and diversified its product portfolio. Today, Arbaza focuses mainly on supplying its monumental domestic market and also on exporting agricultural products, which is where I personally focus the most.

We have our eye on the market and maintain constant, direct and clear channels of communication with our clients. We believe in going beyond the client-provider relationship and forging lasting partnerships.

GPC: Brazil grows three dry bean crops a year. What has the production been like in 2021?

Pietro: Speaking from a broad perspective, Brazil’s bean production has indeed fallen off in 2021. However, thanks to the great effort of Brazil’s entire pulse supply chain, exports should actually remain at the same level as in 2020.

Originally, we had hoped to surpass last year’s export level, but because of high freight rates and the limited capacity of shipping lines, we are unable to properly supply some markets.

GPC: The IPCC’s latest report on climate change highlighted the impact of drought and extreme weather events on agriculture. Have you seen this reflected in Brazil?

Pietro: Without a doubt. This year’s drought took us all by surprise and caused a lot of damage. It impacted bean production intended for both the domestic and export markets. In the case of green mung beans, for instance, 40% of the crop was lost this year.

GPC: Do you expect that Brazil will need to import beans to satisfy domestic demand this marketing year?

Pietro: Not a lot of people seem to know this, but Brazil has not been self-sufficient in black beans for many years and there is no telling when we will become so. This means we have been importing black beans for domestic consumption for years and that will likely continue into the foreseeable future.

GPC: You mentioned difficulties with shipping logistics. How has that affected Brazil’s bean exports? Do you see the situation improving anytime soon?

Pietro: Our feeling is that at the beginning of the pandemic, the situation was already hurting our exports. But that is nothing compared to the last couple of months. It is now extremely difficult to export. All of us are seeing our potential limited. We are being held hostage by the shipping lines. The situation is very serious and, unfortunately, there is no end in sight.

GPC: At the GPC’s Ask the Experts South America, it was mentioned that the area seeded to dry beans is decreasing, as is per capita consumption. What are the reasons for this? Do you see these trends continuing?

Pietro: If the price of soybeans and corn continue at current levels, then we will see pulse production continue to trend downward. This creates a butterfly effect that ends up pushing up consumer prices and this is what is leading to the reduction in per capita consumption.

It is important to mention, though, that pulse exports represent less than 5% of Brazil’s total pulse market right now. This is why we believe that, if Brazil has favorable weather, a competitive exchange rate and fluid logistics, it will continue to expand its exports and this would cause production to pick up again.

In my opinion, therefore, Brazil’s pulse production will continue to decline in the short term, reducing the available supply and causing prices to rise in the domestic market. High prices, in turn, will result in reduced per capita consumption.

GPC: How about plant-based foods? Are they catching on in Brazil?

Pietro: I will start by admitting that I once thought it to be a fad. But it isn’t. It’s a movement that is here to stay. You are certainly seeing that in developed countries. Here in Brazil, though, I really haven’t been following this closely enough to comment on it.

GPC: Looking ahead and given current trends, how do you see the future of Brazil’s dry bean sector developing over the next decade?

Pietro: For 30 years, the country’s pulse production has been fairly stable. Now it’s being impacted by high priced soybeans and corn, and currency fluctuations. I see this year’s reduction in output as only temporary. Over the long term, I expect production will remain stable.

If we look at exports, last year Brazil sold 180,000 MT of pulses to foreign markets. I believe we are in a position to expand that to 500,000 MT over the next decade. That is a realistic goal in my mind, but it depends heavily on the shipping situation cooling down. Once it does, we will be able to do our jobs and grow our export business.

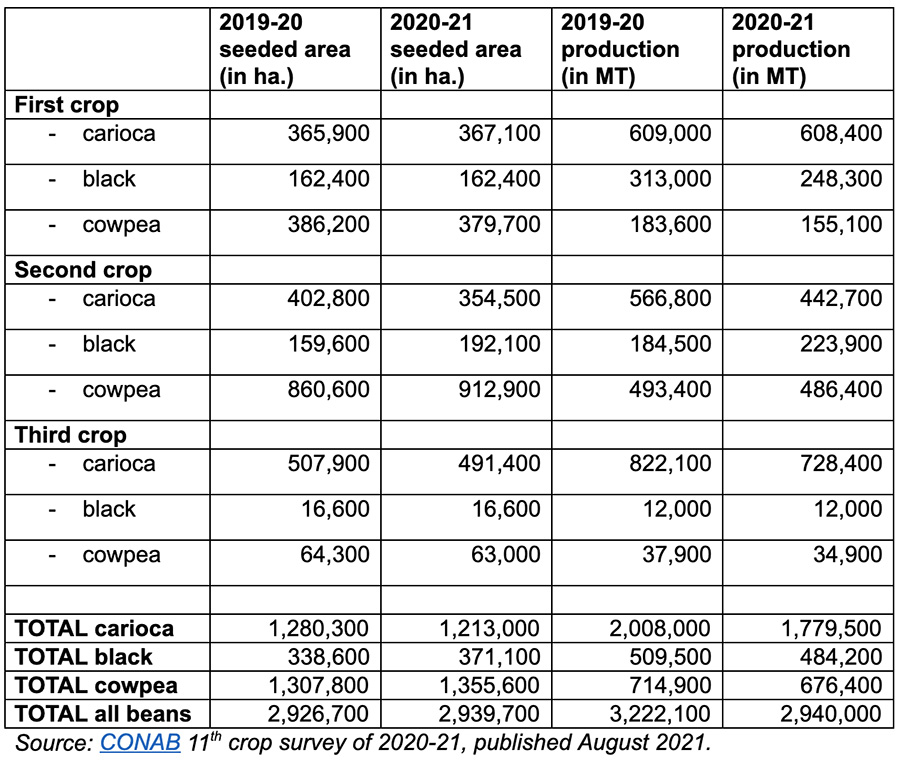

In its August crop survey, CONAB indicates the first dry bean crop of 2020-21 has already been harvested and the harvest of the second crop is nearly wrapped up. The seeding of the third crop is just starting.

CONAB 11th crop survey of 2020-21, published August 2021.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.