October 3, 2024

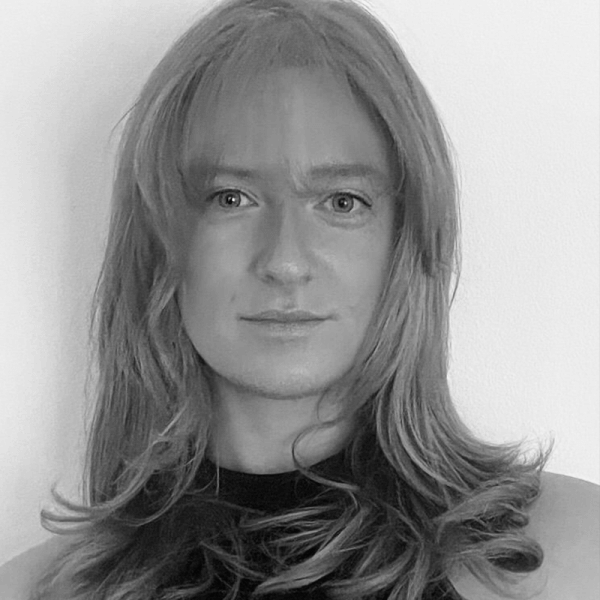

The International Trading Manager at Kelley Bean talks to Lara Gilmour about the U.S. harvest, white bean markets and trade with the EU.

Kelley Bean / Pierfrancesco Sportelli / dry beans / US beans / USA / Mexico / pinto beans / black beans / white beans / navy beans Great Northern beans

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.