June 3, 2024

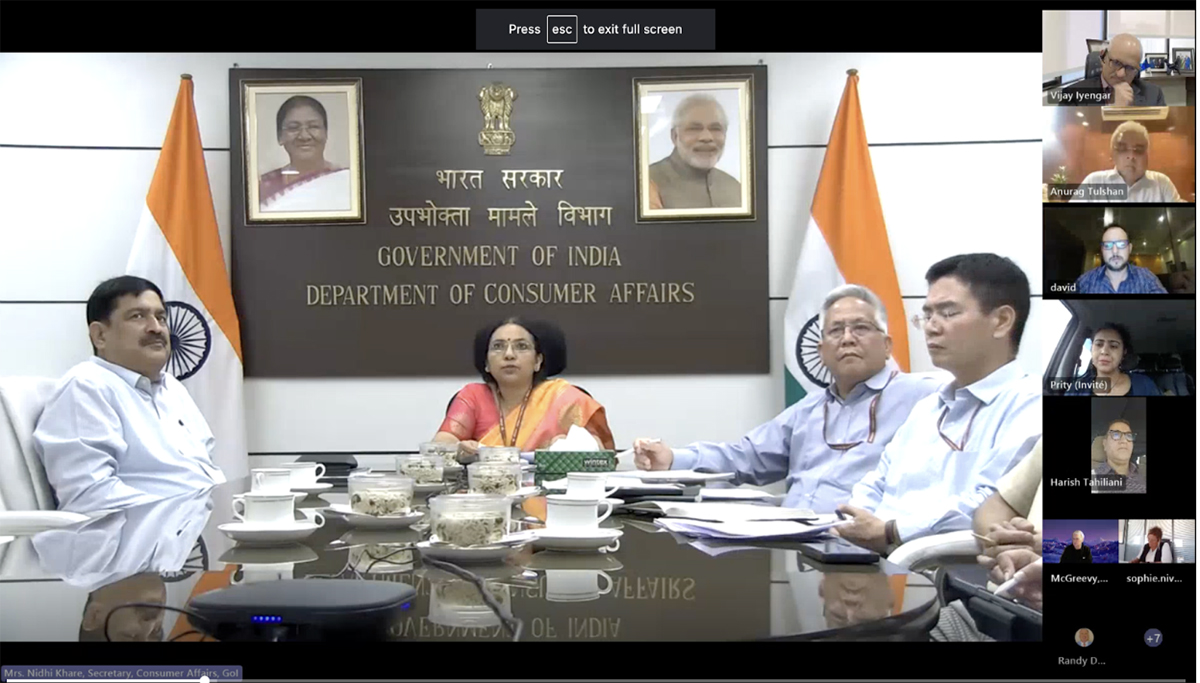

In a dynamic conversation attended by GPC Board members and national association leaders, President Iyengar and Secretary Khare discuss Indian consumption, policy changes and much more.

On Tuesday May 28, GPC President Vijay Iyengar, along with several Board members and national association leaders, was in conversation with Mrs. Nidhi Khare, Secretary of Consumer Affairs, Govt of India. This dynamic discussion, moderated by GPC and Nafed Additional Managing Director Mr. Sunil Kumar Singh, covered a range of topics and gave space to each side to ask the most pressing questions on their minds.

In her opening remarks, Secretary Khare explained that the Department of Consumer Affairs has been “looking at pulses supply and trying to calibrate our steps according to the demand-supply gap” and is “trying to make pulses available to different Indian consumers.”

India, she indicated, is on a growth path and demand for pulses is growing. In the coming years, since the government has “been successfully able to control food inflation, especially during lockdown”, Secretary Khare predicts that more and more state governments will “understand that the supply of pulses would add a better nutritional dimension to about 80 crore households.”

With the import duty on at least three major pulses reduced in India, Mrs. Khare pointed out that “this is a great opportunity for all players across the globe, which must be taken with both hands,” indicating that “particularly those countries in the southern hemisphere can calibrate and calculate how much and which pulses to plant for the next 3-4 months.” She requested, however, that the industry “be mindful of the reciprocity required at this junction,” in order to avoid “unnecessary sensationalism and exploitation.”

Finally, the Secretary underlined India’s “vibrant tie with certain African countries as well as Myanmar, with whom the past several years have seen “a relationship of great trust and confidence develop, with imports swelling and becoming stable and both parties benefitting.”

In his introduction, President Iyengar highlighted GPC’s close relationship with the Indian government in recent years and pointed out that India sets the tone for the global pulses agenda. He congratulated the Indian government for the “clarity it has brought to the landscape in the last few years, which has helped the global industry to produce more and supply India well.” The industry, President Iyengar explained, has been suffering from “the yoke of high interest rates and uncertain freight rates exacerbated by conflicts around the world and India’s policy has been helpful, particularly on yellow peas and desis.”

Finally, President Iyengar said he was “impressed by the way the Ministry of Consumer Affairs deals with the dynamics of balancing farmer welfare and policy; producer and consumer.” He also commented on the importance of having a dynamic Minimum Support Price in order for India to achieve the goal of self-sufficiency by 2027.

President Iyengar then opened the space for questions. Taking the lead, he commented on the issue of pulses production and consumption figures often being variable, meaning the trade struggles to establish demand and supply statistics and figures, asking the secretary how India manages this problem.

Secretary Khare agreed that it was a complicated issue, due to “factors like the seasonal and regional variety in consumption and production.” From a consumption perspective, she said there are “no set rules” because the Indian consumer likes variety in their daily food. She explained that establishing consumption patterns will be “nightmarish” because the growing prosperity of Indian consumers across different regions means they are now aspirational and often trying different pulses they didn’t traditionally consume.

Secretary Khare indicated her desire to work with the Department of Agriculture to improve data on production. This, she explained, can help signal farmers, adding that “the trade also helps in this respect as we can see that if they have started taking a position it shows they are sure of a steady consumption in those pulses.”

“Consumption will only increase in the coming decade,” said Mrs. Khare, adding that “the global supply chain should prepare for this challenge and look to innovate.” She pointed out several factors, such as the development of climate-resilient and shorter duration crops, that are placing India in good stead for self-sufficiency but clarified that “although this is the goal, I still see that an aspirational India will only go for more consumption.”

“Consumption will only increase in the coming decade,” said Mrs. Khare, adding that “the global supply chain should prepare for this challenge and look to innovate.”

President Iyengar said that predicted consumption growth was “music to our ears”, adding that “the global pulse industry hopes to rise to the challenge of meeting India's needs from year to year.” He then asked some of the Australian members present about the outlook for desi chickpeas, starting with Peter Wilson, Chair of the Grains Australia Pulses Council.

Peter, who was in a field driving a tractor throughout the call, explained that Australian farmers are indeed seeding desi chickpeas, adding that “in the northern part of the cropping zone, we are seeing significant areas diverted from cereals to desi, limited only potentially by seed availability.”

When asked by Mr. Singh for an estimate on this year’s production, Peter underlined the “variable nature of yields in pulses” but that “based on the seed going into the ground today, I’d say we’d achieve between 1.3-1.6 MMT.” He also indicated that farmers are “chasing seed to plant, which is why the old crop position is very tight,” adding that Australians are “respectfully responding to the Indian market signal and understand the importance of the Indian market to Australia and vice versa. We see it as a partnership.”

Brad Mcconnachy of ADM confirmed Peter’s range of production, saying he was “optimistic" on having a good crop to export, adding that “it’s exciting to be back in that market.” He also mentioned the potential issue of dryness in the southern lentil and bean production regions, commenting that “we’ll have to watch winter rainfall events that may cause production to slip coming into the ‘24 harvest.”

Mr. Singh then commented on the recent quotes for pigeon pea and black matpe in East Africa and Myanmar, posing the question to President Iyengar as to why, despite the MoUs in place and good production at origins, prices remain high?

President Iyengar responded that, as the biggest consumer, “when India is importing it naturally has some market implications in various producing countries.” He pointed out that “if there isn’t enough time for producers to respond to Indian policy measures, there is usually a big move in prices because the quantities India brings to bear are sizable and influence market behavior and prices.” He added that now for desis, fortunately the Australian farmer has the ability to respond because the notification was timely, meaning that “a bumper crop in Australia should keep a lid on prices.” President Iyengar stressed the importance that “the policy narrative is clear and indicates a long pathway so farmers can respond and prices will be stable,” adding that, “this is what GPC believes and what all our members stand for.” He also touched on the complications brought about by the domestic dispute in Mozambique.

Mr. Singh moved onto Myanmar, stating that India has been open to imports of pigeon pea and black matpe for the last three years and, despite good production of both crops, “those MoUs are not taken into account nor the three-year policy consistency.” He asked President Iyengar for clarity on Myanmar’s reciprocation in the MoU.

President Iyengar pointed out that Myanmar has gone through some challenging times in the last few years, due to issues such as exchange rate volatility. As a result, he said, “Myanmar exporters tend to keep money in terms of stock as it appreciates or depreciates along with the dollar,” adding that “an environment of uncertainty has likely contributed there.”

Expanding on the topic, Shyam Narsaria, President of the Overseas Agro Traders Association Myanmar said that “Myanmar is a most reliable partner for India for pulses,” pointing out that the country’s production of pigeon pea has more than tripled in the three years since the policy change in 2021 and black matpe has more than doubled, also due to the consistency in Indian policy. “That’s why,” he expressed, “we always request long-term policy and I am requesting you maintain it for five years.”

When it comes to exports, Shyam went on, despite the challenges in the country, “Myanmar always exports 90% of what it produces to India.” He clarified that the “big difference between the market rate and the rate exporters get means some big exporters do tend to hold in order to cover the fluctuations.”

Shyam also requested the government of India “take action on logistics and shipping” to combat the increase in freight rates. He suggested that “for shipping companies, they should negotiate and work together to ensure Myanmar production gets to India on time.”

He also added that “over information” was a contributing factor to the rise in pigeon pea prices, explaining that there are many Whatsapp groups dedicated to the crop and “they are all saying India is short 1-1.5MMT of pigeon pea.” He stressed the need to control the “over information” to stabilize prices as “it is creating confusion in the minds of the supplier and leading to many forward trades.”

Zirack Andrew, President of the Tanzania Pulses Network, commented briefly on the situation in Tanzania, saying the situation is “generally positive in the sense that we are likely to have an increase of production of chickpea and pigeon pea.” He added that Tanzania is “like an oasis in the desert in the sense that it is surrounded by three major pigeon pea producers who are battling with El Nino effects that have impacted production.” The fact that Tanzania has not been impacted, Zirack said, “will contribute to increased demand for pigeon pea and chana from Tanzania,” adding that “prices last year were the highest in 7 years, which has encouraged farmers to increase the production areas.”

Will Watchorn, Global Head of Pulses at Viterra, then added his comments, indicating that “how India moves in the market is what defines it.” He said that the opening of yellow pea imports, for example, has “moved prices away from feed, which has increased supply for India.”

He pointed out that “to a lot of our farmers around the world, pulses are a break crop” and “by increasing prices, we will increase supply globally” but that this will “take time”. He stressed that “a stable, consistent import policy that traders, producers and consumers can all work with will, over the long term, increase supply for India when it needs it.” Will added that “moving in and out of policy decisions makes it harder for farmers to plan.” Some commodities, he pointed out, can be increased quickly, like yellow peas, but for others it’s harder.

Expanding on the yellow pea outlook for 2024, Will explained that “Russia’s area is up 15-20%”. However, he went on to say that “it’s dry in the south and we’re expecting yield reductions'', which, combined with the lack of carry-in means production may be unchanged year-on-year. He said India’s decision to imports at the beginning of season meant “you have access to the entire supply of peas and means you will see supplies from non-traditional origins such as the EU, the Baltics and Argentina,” adding that “because the price is now high for feed, you will see increased supply into india, which will help the shortfall.” Commenting on India’s move to open to desis, he said “this has allowed farmers to respond and, with consistent policy, I believe they will respond again next year to supplement and increase supply,” adding that consistent policy means “the price will allow us to increase.”

Commenting on India’s move to open to desis, Will said “this has allowed farmers to respond and, with consistent policy, I believe they will respond again next year to supplement and increase supply,”

President Iyengar then passed over to Anurag Tulshan to comment on the situation in Africa.

Anurag reiterated that Tanzania is poised to produce a good crop, adding that Malawi and Mozambique have had weather issues with Malawi declaring a state of emergency. With regards to Mozambique, he expressed concern that “the domestic feud prevented them from shipping good quantities of pigeon peas,” adding that “it was sad to see the government there didn’t intervene in spite of feelers sent by the Indian government.” Since the dispute is ongoing, Anurag agreed that “Tanzania is the best supplier from Africa and we can depend on them from October onwards.”

Shyam took the opportunity to make a request to Secretary Khare, asking if the Indian authorities could make a long-term policy for produce from Myanmar, especially pigeon pea. He explained that “if we have early notifications of long-term policies like we have witnessed from 2021, I’m sure we can increase pigeon pea production to 500 KMT next year.” He also requested that green mung beans be considered.

Secretary Khare explained that although there has been “a very stable policy with Myanmar, concerns from Indian authorities are falling on deaf ears.” She added that India “cannot be tied to one source” and if an origin is “not able to deliver on time and thinks it can continue to work on taking positions” India will likely “look at other options.” She indicated that the “long-term association we had with Myanmar is not coming to any rescue,” suggesting that “it would be best to bring something to the table so that we can go ahead for a longer-term policy.”

Anurag also made a request that there be more coherency between the Agriculture Ministry figures and the reality on the ground, pointing out that “India has to look after farmer and consumer interests and if mistakes occur it means you have to do some firefighting at the last moment.” He suggested the appointment of a private agency who is well-equipped to do things like satellite mapping, “so as to ensure accurate data.”

The Secretary confirmed that this is already in progress and Mr. Singh added that “for India it’s mainly a challenge but for others it’s a design.” Secretary Khare concluded that India’s policy consistency is dependent on the agreements being “mutually beneficial” and if this was not deemed to be the case they “will probably not engage.”

Finally, President Iyengar asked Tim McGreevy, CEO of the American Pulse Association, to give an update on pulse crops in the USA.

Tim noted that the planting season for peas, lentils and chickpeas is almost over with beans now going into the ground, adding that supplies were “tight but there is still some available.” He said that there was an “expected increase in acreage, not much in peas but substantial in lentils, especially in greens, up to 40%,” meaning that “if yields hold and there’s no drought, we’re expecting 340-350 KMT.” Likewise, the USA expects an “increase in kabuli chickpeas, with production to be between 245-255 KMT and about 900 KMT of peas, both green and yellow.”

Tim concluded by requesting the Indian government consider lowering the green pea and kabuli chickpea tariffs as “it would send great signals to farmers.”

Mr. Singh also took the opportunity to compliment GPC on the newly launched weekly price report, adding that he “shows it to the Government of India every week when it comes out.”

In his closing remarks, President Iyengar expressed satisfaction about what had been a “good interaction to sound out each other’s priorities and share input into the policy measures.” He affirmed that, from the GPC perspective, “we will not shy away from giving you exactly the info you need about where the global production stands,” indicating to Secretary Khare that “the industry hears your comments loud and clear and we will share them with other members.”

India / government of India / Secretary of Consumer Affairs / Mrs. Nidhi Khare / Vijay Iyengar / Sunil Kumar Singh / Nafed / Myanmar / USA / Australia / desi chickpeas / yellow peas / Viterra / Will Watchorn / ADM / Brad Mcconnachy / Peter Wilson / pigeon peas / black matpe / Shyam Narsaria / OATA / Tanzania Pulses Network / Zirack Andrew / Anurag Tulshan / Tim McGreevy / USA Pulses

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.