April 14, 2021

The company started 35 years ago exporting mainly black beans to Mexico; today, despite the economic hardships brought by the global pandemic, the company continues to find ways to grow.

In global pulse trade circles, the name Desdelsur is synonymous with Argentine origin cranberry beans and chickpeas. But the company is much more than the country’s leading exporter of those two agricultural products. It also works with a variety of other dry bean classes, including the country’s prized alubia beans, as well as a number of other specialty crops, such as peanuts, popcorn, dry peas and chia and sesame seeds. What’s more, just 15 years ago, the company added livestock to its growing business portfolio.

Indeed, since its founding in 1986, Desdelsur, a GPC Gold Partner, has only grown larger and larger. Even with the world in the grip of a global pandemic, the company continues to find ways to grow. Last September, for instance, as Argentina was just beginning to ease lockdown restrictions, Desdelsur hosted a virtual conference organized by the IPCVA (Institute for the Promotion of Argentine Beef) that was broadcast from its farm in Tartagal in the province of Salta. In the same indefatigable spirit, the company continued to move forward on a $30 million, seven-year project financed by the Inter-American Development Bank and Rabobank to expand and modernize its pulse and peanut processing plants and increase its feedlot to 80,000 head of cattle. It also opened a fractionation plant and started selling its own brand, DDS, in Argentina and neighboring markets.

With the seeding of the 2021 dry bean crop wrapped up, the GPC checked in with Desdelsur’s founder and CEO José Macera to discuss his history in the country’s agriculture sector and his expectations for Argentina’s pulse crops in 2021-22.

José: After graduating with a degree in economics from the University of Buenos Aires, I started my career with Bunge y Born (one of Argentina’s leading agribusiness companies) and that was the beginning of my experience with the agriculture sector. From 1980 to 1985, I was the commercial manager at the National Grain Board, a government organization that had an active and decisive role in the sale of Argentine grain at the time. Finally, in late 1985, I founded Desdelsur.

At first, we were strictly a commercial company. I had ties to Mexico and the company started out exporting black beans to that market. Eventually, we expanded into the production side and acquired farmland of our own. Over the years, our landholdings grew and we now own about 50,000 hectares of farmland.

José: Right, in terms of cranberry beans, we are the main producer in Argentina and have earned a solid reputation in the market for our quality and reliability. But that is only one of the bean varieties we grow. We also produce significant volumes of alubia beans, dark red kidney beans, light red kidney beans, blackeye peas and mung beans. And we are the main producer and exporter of chickpeas from Argentina. We also work with dry peas and chia and sesame seeds, and are ramping up our production of these other crops.

In total, we seed between 35,000 and 40,000 hectares of various pulse crops a year. Our export program is based on our own production, but we contract with other growers, too.

Our newest venture is in the livestock business. Desdelsur breeds and raises approximately 50,000 head of cattle and is also involved in generating the entire feed chain required to nourish the animals; this includes making use of the subproducts derived from the processing of our pulse crops.

José: In general, we had a very busy year. This was mainly because of the high demand caused by people stocking up during the COVID-19 pandemic. People were already incorporating more and more pulses in their diets and the pandemic accelerated that trend, which continues to move upward to this day.

The weather in 2020 significantly impacted production in Argentina and brought down the total supply. Because of this, we were unable to satisfy the demand in the market for most pulses. Only a few alubia beans remain and we expect they will sell out before new crop becomes available in July.

José: In our production, processing and exporting operations, we were able to establish a rigorous sanitary protocol, which allowed us to maintain our activity with a very low incidence of COVID-19. Our work was declared essential because exports are one of the major drivers of Argentina’s economy and also because we are involved in food production. On the demand side, as previously mentioned, we noticed a significant increase in consumption. This was true in the domestic market as well and this happened just as we launched our fractionated retail line for the internal market. We now have a presence in various supermarkets.

José: Planting conditions have been favorable for dry beans this year. The seeding of the crop began in mid-February and is wrapped up. It took place during the optimal window and subsoil moisture levels have been reasonable. Temperatures have perhaps been a bit high and that may hurt the beans that were seeded first in late February. But overall we are expecting a good crop. The harvest will take place in June and July, with dates varying depending on the climate, the area and the bean class.

With respect to chickpeas, the seeding of the crop begins in May and runs through July, and the harvest takes place between October and December. Moisture levels are low throughout most of the country, and the expectation is that fewer chickpeas will be seeded unless there is improvement in both climate conditions and market prices. The same holds true for dry peas.

José: We believe that the area seeded to dry beans is about the same as in 2020. We expect to see a big difference in yields, though, which should help us recoup the volume and caliber size distribution that we didn’t have last year.

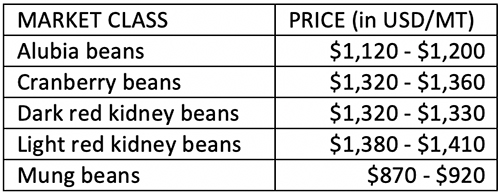

José: We see the market as stable with steady demand from the various markets that we normally supply. New crop CFR prices are listed in the table below and may vary depending on caliber size and final destination.

José: Our future plans for pulses include several lines of action. We are looking to expand production in new growing areas with technological packages adapted for each environment. We also plan to increase production by leasing more farmland and/or partnering with smaller-scale farmers by giving them support in terms of buying, processing and exporting their production. In terms of fractionation, we intend to increase our participation in the retail sector, where we are beginning to have a growing presence. In the value-added area, we plan to begin producing pulse flours to meet the growing demand for these products.

We see a very positive outlook for pulses on the world stage and great opportunities for Argentina to grow with these products. We expect that Desdelsur will continue leading this process of growth in our sector.

Source: José Macera, Desdelsur

Desdelsur / Jose Macera / Argentina / alubia beans / kidney beans / red beans / kabuli chickpeas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.