October 13, 2020

STATPub’s founder tells the story behind his celebrated ag news website and talks lentils and about his participation at Pulses 2.0.

Ask anyone in the pulse industry where to go for trusted information and analysis on the pulse trade, and STATPub is sure to be near or at the top of their list. But it wasn’t always that way.

“The first five years were extremely difficult,” recalls Brian Clancey, who founded STATPub in 1988. “There was quite a bit of resistance in the industry. People felt I was evening out the playing field for everybody in terms of knowledge and expertise. But it hasn’t really done that.”

STATPub subscribers, Brian explains, are not immune from that most human of tendencies—to read what they want to into the information they are presented.

“When you have staked out an economic position in a market, it is natural to focus on what supports your position and ignore what doesn’t. My concept for STATPub was to describe things how I felt they were likely to work out and what I actually felt was going on, and not worry about the price impact of what I was doing.”

Despite the rough start, Brian stayed at it, honing the accuracy of his information and offering detached, impartial analysis.

“I understand people use this information to make money, so I have to do my best to give them the best information and analysis that I can, with integrity and honesty,” he says.

Today, STATPub has become an authoritative source of news and analysis on pulses and specialty crops, with subscribers all over the world. And Brian has become a fixture at industry conferences and conventions. Case in point: he was the guest analyst at Pulses 2.0 for both the red and green lentil market outlook sessions.

The GPC reached Brian by phone at his home office in Panama City, Panama, where he relocated from Vancouver some four to five years ago.

“I like it here because it’s hot,” the Canadian native told us with a laugh.

Over the course of nearly an hour, Brian was kind enough to speak with us about his background, the history and future of STATPub and, of course, the latest on Canada’s red and green lentil crops.

Brian: When I was in college, my idea was to become a creative writer, writing novels, plays, poems and that sort of thing. Back then, I took to studying anything that interested me. One of the interesting things that happened is that I became the editor of the university newspaper, and in that role, I wrote some articles on the food industry in Canada. Soon after, I was invited to speak before an agricultural economics class on the subject. That was my first run-in with agriculture.

Then, when I graduated, my very first job was a project funded by the province of Manitoba to write a history of agricultural cooperatives in Western Canada for a high school curriculum. My next job was as an agricultural grain reporter for a newspaper called The Report on Farming. I held that job until I was offered the job of export grain trader by the Allstate Grain Company.

Throughout my life, whatever I did, wherever I went, agriculture was always present.

To me, agriculture is really amazing and interesting. It doesn’t get the kind of coverage it should because, if you really think about it, it dominates a third of the life of every human being on this planet. Ag is one of the most important, if not the most important, industry because food is a basic human need and that is what agriculture is there to fulfill.

Brian: The way I first got involved with pulses was really simple. When I was a reporter, we started a feature every year where we did brief stories on the outlook for the minor corps that were being grown in Canada, and at that time that included lentils, peas and faba beans.

Brian: I was a grain trader for many years, but then I got tired of it and really wanted to get back to writing. My wife supported my decision and that was the genesis of STATPub.

The idea behind it actually dates back to when I was a journalist. At that time, I started a newsletter and it dealt with pulses and canola, because my focus was on cash crops. It was because of that newsletter that I ended up getting a job as an export grain trader. The industry was starting to expand back then and the company that hired me wanted somebody who didn’t have a background as a grain trader, because they can teach you that, and were looking instead for someone with a basic understanding of the industry. When I worked as a grain trader, I was one of the very few that did supply-demand analysis on the commodities I was trading in. That interest in understanding the fundamentals completely is what went into creating STATPub. And my combination of skills, as a writer and a grain trader, gave me a different perspective on markets and an ability to understand what was going on.

The early years were difficult. There was a lot of resistance from the industry. People felt they knew everything and didn’t need someone writing about it or doing statistical analysis. And they thought STATPub was evening out the playing field for the less experienced and knowledgeable traders, and they didn’t like that. But I was stubborn and persisted. And the industry began to change.

I started STATPub in 1988. The attitudes people in the industry had towards information were very different back then. The people in control of the industry were people who traded during the Great Depression, the Second World War and the 1950s. It was a different generation and people back then had their own methods of obtaining the information they needed. What I was doing with STATPub didn’t fit into the thinking of the people who ran the show back then. But as newer generations came onboard, with different ideas about information, my customer base grew. There are people in the industry today who grew up with me writing about it.

Brian: In terms of the number of subscribers, the growth was slow for a long time. When we started, STAT was a print edition, distributed by mail. Then, when we started getting subscribers from all over the world, we started offering a fax service and most of the subscribers migrated from a print mailing over to fax. As the internet became available, we started experimenting with sending it over email. Interestingly enough, the first people to subscribe for email delivery were farmers. When it became possible to have a website, we became one of the first agricultural sites on the internet.

The internet allowed us to get information out to our subscribers instantly. So instead of preparing the print edition to mail out on a Monday, we now post information immediately and our subscribers get it instantly.

The quick delivery of timely information is what STATPub is all about. People think that the STAT in STATPub refers to statistics, but it comes from the TV series M*A*S*H. In M*A*S*H, whenever doctors needed something fast, they would call out “STAT!” And my idea from the beginning was to be fast.

It didn’t always work that way, though. Working from home, my office door was always open to my sons, and that was a special joy because I was able to fully participate in their growing up. But sometimes it was frustrating because it pulled me away from work and slowed my progress.

Brian: The biggest challenge is getting the information and data you need. Countries like Canada and the U.S. have good public information on agriculture. Europe is not bad. Most European countries are great for statistics, but a bit of mixed bag when it comes to production data.

So, in the absence of information, one of the things I look at are trading patterns. For instance, I might look at Russian trade data and try to infer the size of their crop. It does require creativity and artistry. That’s a big part of it. But the idea behind it is to properly understand the trends in production in the various countries in the world, to pay attention to emerging exporters and importers, things like that.

For me, the more data I can have, the better. It is satisfying when you get it, and very frustrating when it is difficult to obtain.

Brian: I have this idea I would like to create for my users. I’d like to present them with editable supply-and-demand tables that allow them to do their own what-if analysis. My intention is to apply formulas to the numbers they input, so that they can see how it impacts other variables. For instance, a change in production would result in a change in export availability. And a change in domestic consumption would change exports and ending stocks.

The idea is for people to do their what-if analysis right on the website and save it. Then they could come back later and compare their previous ideas to what is really going on and see how close they were.

What would be really cool, but perhaps more difficult, is to try to do an analysis that, based on the numbers plugged into the table, projects what the following year’s seeded area could be.

It’s all about creating tools that are accessible and backing that up with some objective analysis of what is likely to happen.

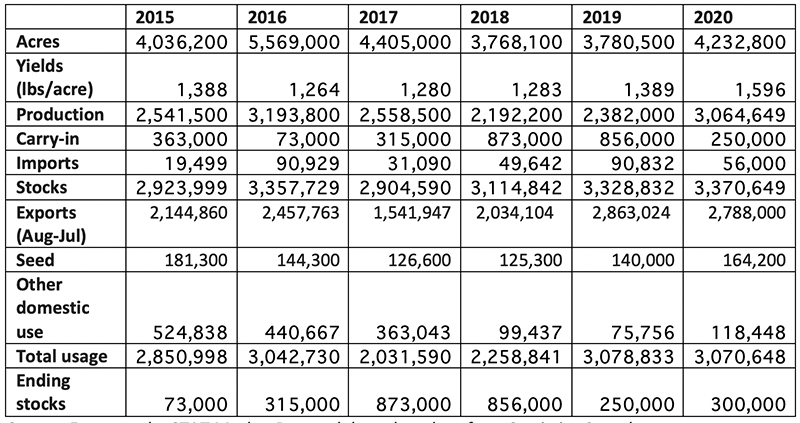

Brian: The way it looks right now, the market is going to be challenging. There are a lot of question marks. On reds, the big question is how demand will evolve from India. To tame food price inflation, the government recently lowered tariffs again from 30% to 10% through October 31. My guess is there are logistical problems in the country that are contributing to food inflation as well.

With green lentils, the yields look good, but one of the things we don’t know is how much impact the above-normal temperatures had later in the growing season on seed fill and the size of the lentils. Quite often, when lentils are faced with extreme heat and somewhat dry conditions, the seeds don’t fill as much, so there is a possibility we will have a lower percentage of large caliber green lentils this year than we normally would. That may change the outlook for some of the different classes. For instance, some buyers may decide to buy smaller-caliber large green lentil varieties instead of the medium-sized varieties that they would normally buy.

Another thing I like to do is look at the relationship with other grains and commodities. For instance, the strength we are seeing in oilseeds recently and things of that sort that can influence the planting decisions of farmers next year.

Brian: We already had indications from the provinces that yields could be above average, but the yield reports have been highly variable. There are areas of Saskatchewan that were really hurt and areas that really benefitted from the higher moisture levels. Some had drought conditions and bad heat damage, and others did well. There were some heavy windstorms and that could affect standing crops and anything that was in swaths, so there are potential yield losses because of that. We could see yields reduced further. It remains to be seen.

Right now, if you want to be bullish about the market, you are going to focus on the fields that suffered the worst. If you want to be bearish, you’ll focus on the areas where everything is absolutely amazing and the yields are super high. My job is to balance those out without regard to market impact.

In a way, I am not surprised by the yield number because much of the growing season was excellent. We’ll have to wait and see if that number holds up. But as I mentioned earlier, I’m concerned about the caliber sizes of the crop.

So, the crop is possibly not as big as reported, but it is still pretty darn big! Looking at the seeded area alone, we are going to have a larger crop than last year no matter what. If the demand is there, which it looks like it could be, then ending stocks may not go up much. So, Canada may have available supplies of all types of lentils, very similar to what it had the previous two years, which means it can support exports at a relatively high level. And if that occurs, ending stocks can come down further.

And if prices hold up or begin to show some firmness, especially through the winter, then that could possibly provide impetus for the seeded area to expand in 2021.

Source: Forecasts by STAT Market Research based on data from Statistics Canada.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.