September 25, 2023

The CEO of Edao International Trading on Ethiopia’s radical contract farming reform, the drive for modernization, and how this year’s giant white pea crop is attracting European attention.

I graduated in public health and worked for international humanitarian organizations like Save the Children USA and GOAL Ireland that are based in Ethiopia but funded by mostly international donors, like USAID. After working like that for 6-7 years, in 2007 I founded Edao International then made my first shipment of chickpeas to Pakistan in 2012.

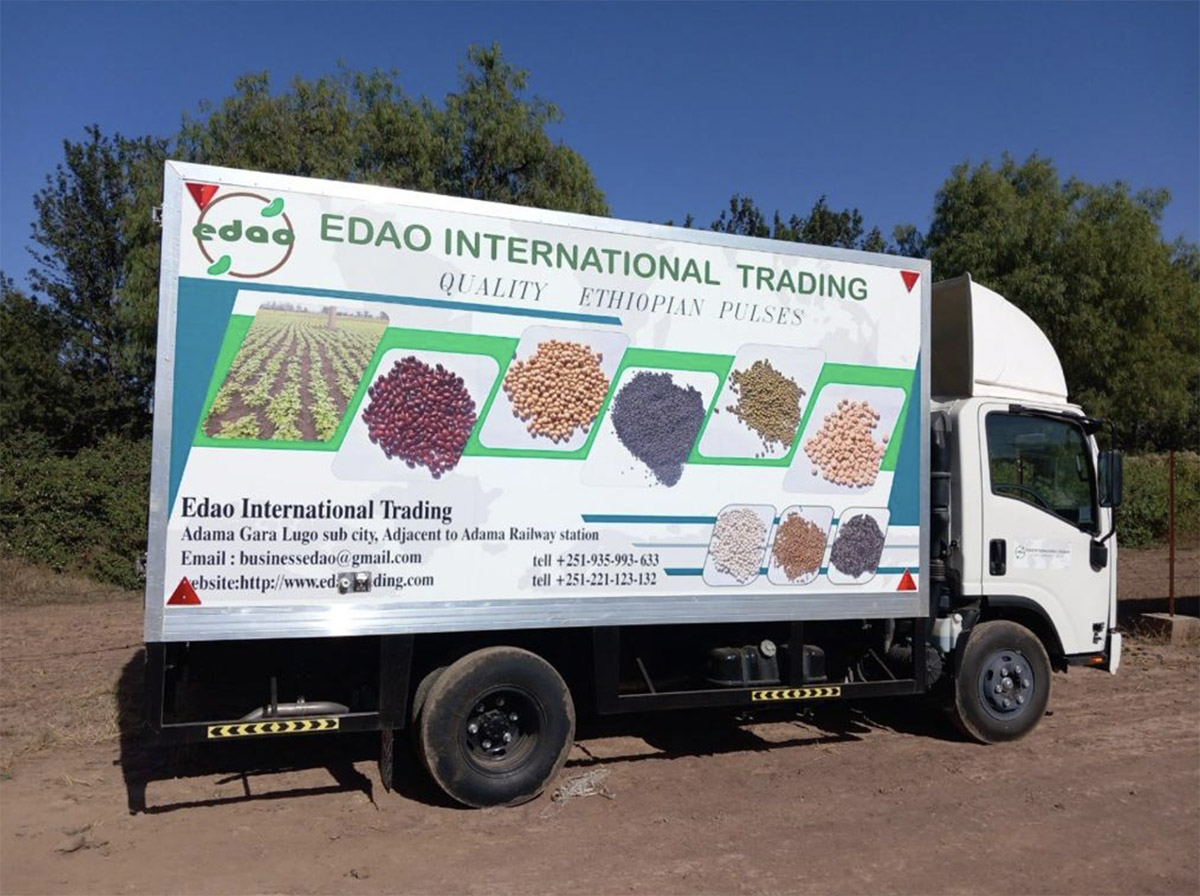

In 2022 we shipped to fifteen countries around the world and made over $8.3 million worth of shipments – over 10,000 metric tons of pulses. We now have 52 permanent employees and over 46 temporary employees, and have our own seed cleaning technology that is ISO certified.

The pulses we shipped the most of last year were small red kidney beans and white pea beans. The red kidneys go mostly to Russia, India and Pakistan, and the white pea beans are sold mostly into the European market. We also sell chickpeas and other varieties of pulses like pinto and cranberry beans. Because of the dramatic volume of mung bean production in Ethiopia this year, we also started exporting mung to Vietnam and China.

Most production comes from smallholder farmers and there are two lines of the value chain. The first is run through a contact farming scheme put in place by the Ministry of Agriculture. Over the last two years, farmers have been put into clusters to improve productivity then brought together with exporters via contracts that stipulate that exporters provide farmers with resources like better seed varieties, fertilizers, pesticides, fungicides, and agronomists to help monitor the crops. Farmers in Ethiopia are always dealing with a scarcity of resources, so farmers here have accepted the help with inputs very positively and are happy to work with us.

The farmers then produce beans for our facilities without any involvement of brokers. The system has two main benefits: it ensures sustainability, and also ensures the quality of the beans, protecting crops from pests like weevils, foreign matter, or diseases like aflatoxin.

The second line of the value chain goes through the Ethiopian Commodity Exchange – what we call the ECX. Farmers provide the suppliers with the beans, and the suppliers pass them over to the ECX. The exporters then buy them from the ECX warehouse.

For the last decade, we have been challenging the government's use of the ECX as it doesn't ensure quality or support farmers in any way, and has led to a deterioration of Ethiopian beans’ reputation internationally.

Previously, pulse farmers were forced by the government to bring their products to the ECX warehouse – the farmers had no choice to sell in any other markets, even if they would be paid better. Naturally, the farmers didn't like being forced to sell their products at the ECX, so they shifted their crops to other commercially viable ones such as onion or garlic.

When the new mechanisms of the contract farming scheme came into the picture, farmers started to see the potential of producing white pea beans again, so have switched back. This is part of the reason for the sharp rise.

Usually Europe – the biggest buyers are usually Belgium, Germany, Italy, Bulgaria and Romania. Due to the old trading methods at the ECX, the quality of white pea beans had dropped and complaints had come from our buyers. Most complaints were in relation to the minimum residual level, quality, and color. With our large crop this year, European buyers are now more interested in our white pea beans.

We are advancing – our cleaning technology has been modernized, we have better standardized food safety, and we use our new contract system, which is proving to be key. There is a huge opportunity for us to get into a broader European market, and I expect the price for white pea beans to be around $820-850 per metric ton at the beginning of the new season.

“We are advancing – our cleaning technology has been modernized, we have better standardized food safety, and we use our new contract system, which is proving to be key.”

That is exactly what is happening in Ethiopia at the moment. When people start to improve their income, they begin to look for imported items like processed foodstuffs from the supermarket and meat.

People in rural areas who may have a low income tend to just stick to the traditional way of eating, which is actually making them healthier and stronger than people in urban areas!

It's an interesting question. No, up to now there hasn’t been a government initiative to push the consumption of pulses. The Prime Minister of Ethiopia himself is taking pictures advocating a bumper production of wheat – this is so we can avoid using huge amounts of foreign currency by importing wheat from the Balkan region. I have explained to the Ministry of Trade and the Ministry of Agriculture that having a bumper production of wheat will never secure our nutritional issues.

In some cases the government is forcing farmers to produce wheat instead of pulses, but pulses are better nutritionally, cheap to process, and affordable to the poorer local community.

Both countries are looking to Africa as an alternative source of food and are providing special trade references – quota free imports, no taxation, and the removal of tariff issues.

They are both already buying large volumes of pulses from Ethiopia and demand is big, but we are not always able to provide them with what they need in terms of quality and on-time delivery. As a result, there's been a shift of the Indian and Chinese markets over the last 2-3 years to other producers like Tanzania, Mozambique, and some Latin American countries.

“They are both already buying large volumes of pulses from Ethiopia and demand is big, but we are not always able to provide them with what they need in terms of quality and on-time delivery.”

National figures show that Ethiopia is utilizing only 30% of its arable land. This means 60-70% more land is suitable for agriculture – the agroecology, environment, and rainfall are all conducive to intensifying production and increasing the acreage of pulses.

One of the major things for increasing productivity is peace and security. Then, agricultural research centers must be supported with strong budgets so they can continually develop new seeds for distribution. The government has to look into its existing policies and encourage farmers with new policies, commercializing farming around the country.

These are the major bottlenecks of Ethiopian agriculture. Our farming depends on the import of fertilizers. The government subsidizes farmers with billions of dollars to buy them, but over the last couple of years, the war in Ukraine tripled the cost of fertilizers and farmers couldn’t afford them. The government also wasn't secure in its foreign currency, so couldn't always import them in time.

The cost of fuel has also tripled in the last two years for Ethiopians, it is very costly for farmers to pay for their tractors and prepare production and harvest. The Ministry of Finance has lifted taxes on agricultural equipment and machinery imports, but we still need the foreign currency in order to import them, and this is often hard to obtain.

From what I can observe, there is no improvement. The major source of foreign currency in Ethiopia is first exports, then foreign aid – loans from the World Bank or IMF or lending countries around the world. The remittances and grants are not coming in from those countries because of the disparity between the black market and the National Bank of Ethiopia exchange rate, which is almost double.

I want us to improve our export capacity and quality by adopting new technologies to improve volume and reach a better paying market – this will help us support the livelihood of our farmers.

The second thing is that we want to continue with the government-approved project for creating half kilogram and one kilogram consumer packaging of pulses, cleaned to the highest possible quality and then supplied to the European market. We are going to specialize in pulses, branding our products as being grown and produced in Ethiopia.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.