September 1, 2023

Facing another year of severe drought in 2023, Ethiopian agriculture looks for a crop that can bring good yields despite low rainfall. Pulse Atlas data shows that mung beans may be providing the answer.

Prolonged droughts over recent years in Ethiopia have had a huge hugely detrimental effect on crops, leading to poor harvests and a drastic reduction of available food for many of the population. Since 2015, humanitarian needs have gone up by 300%.

Staple foods such as pulses, maize, sorghum, and wheat have suffered hugely from the reduced rainfall, pressuring food systems and the communities that rely on them. According to the World Food Programme (WFP), local prices for these foods have risen dramatically in drought-hit regions, but there are some prospects for good 2023 harvests.

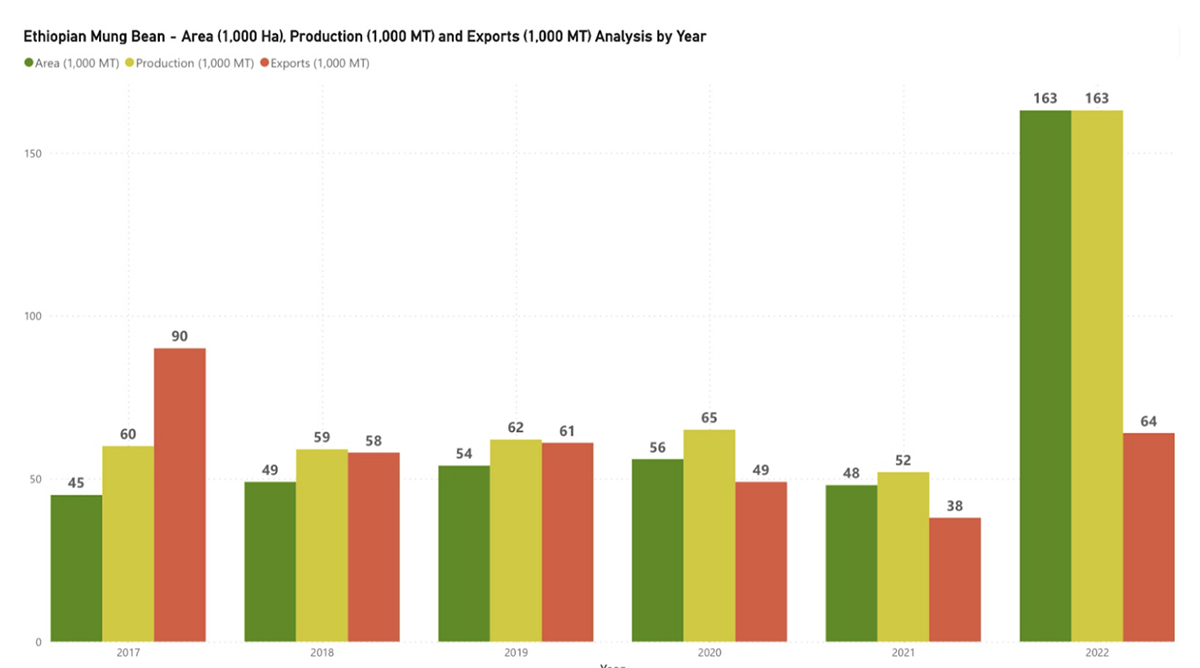

An outlier amongst the common Ethiopian crops is the mung bean, which has proven to be more drought-resistant than other pulse crops and grains. Exclusive Pulse Atlas data suggest that mung bean acreage has ramped up as a result.

Caption: Ethiopia Mung Bean Area, Production and Exports 2017-2022

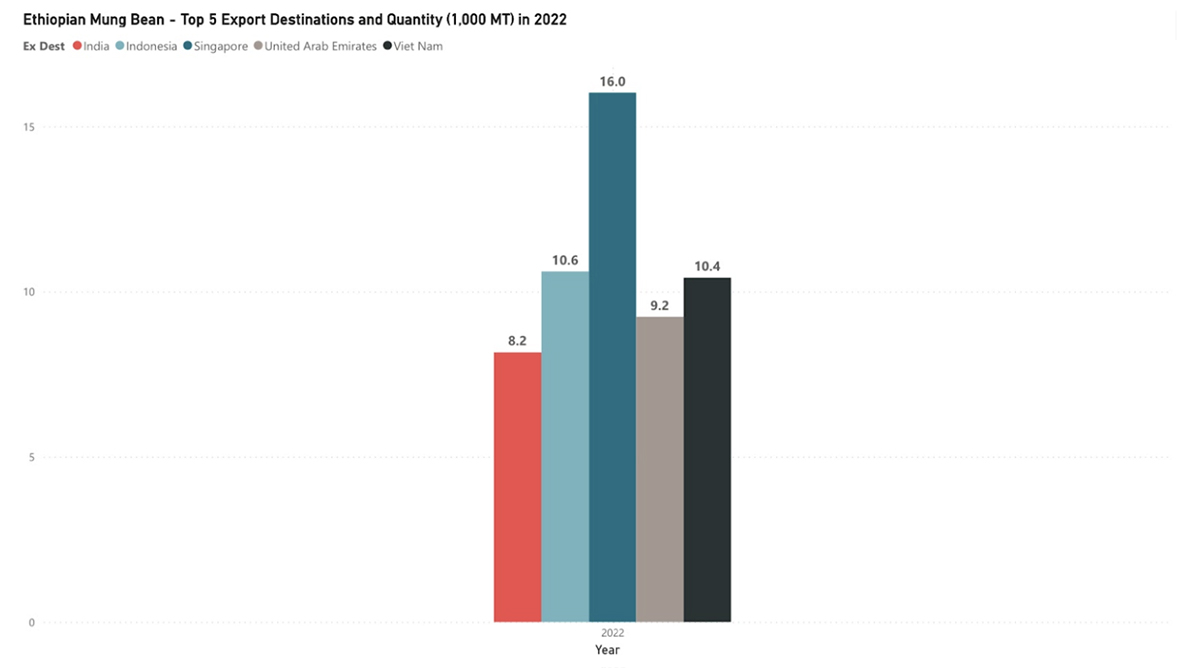

"Production was in one zone of Ethiopia named Shewa Robit — Chinese and Asian demand has been growing and the domestic price has responded in the same fashion over the last three years.”

"Farmers started to share information, and immediately most regions started to harvest mung beans which meant that eventually acreage and production moved up significantly."

“In terms of price what affects mung most is that India remains closed. This year the problem of Vietnam was added, with which the most important countries for mass consumption were out of the market.

“I am very optimistic about (mung) next year – I think there will be a lack of product and the plant-based food market in Europe has seen record growth, reaching a value of €3.6 billion in 2020. This is a 28% increase from 2019 and 49% from 2018. With regards to production, many farmers in Venezuela, Argentina and Brazil have been unmotivated to plant mung, so there will be few players.”

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.