August 20, 2019

Soon after he established his brokerage firm in 2010, Navneet decided he would focus on just one commodity: kabuli chickpeas.

Two short years ago, the global pulse trade was riding high on kabuli chickpeas, with prices soaring even as the seeded area at major origins expanded by leaps and bounds.It seemed as if the sky were the limit. But that all changed in 2018. As of last year, the trade is contending with burdensome surplus stocks and deflated prices. At key origins, including India, Mexico, the U.S., Canada, Argentina and Russia, plantings are down by at least 30% in 2018-2019 as a severe market correction takes place.

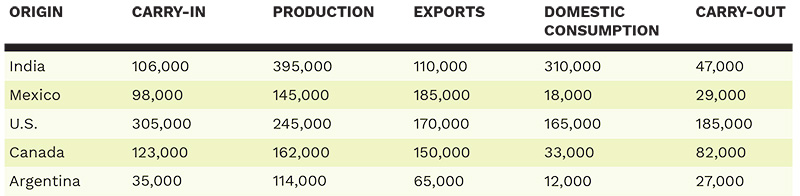

The dramatic turnaround was triggered by government interventions in two key origins: Türkiye and India. In 2018, Türkiye harvested its largest kabuli chickpea crop in a decade, putting downward pressure on prices and leading farmers to push for government intervention. The government reacted by setting an attractive Minimum Support Price and reinstating import duties on kabuli chickpea imports. Thus, Türkiye transformed itself from one of the top importers of kabuli chickpeas into a major exporter in its own right. In India, farmers responded to the government’s push for pulse self-sufficiency with record pulse production in 2016 and 2017. The ensuing glut caused prices to plummet and inventories to pile up at all origins. The U.S. was the worst hit, with a carry-in of 305,000 MT reported for 2019/20.

For Navneet Chhabra, founder of Shree Sheela International, this is precisely the sort of market volatility that led him to make a fateful decision back in 2014. Back then, he determined that it was better to know everything about one commodity than to know a little about several.

Source: Pulses 2019 Kabuli Chickpea panel presentation

Navneet: I have been in the business since I was 17. I started out working in the family business in Indore. It supplies agricultural goods, mainly grains and pulses, for the domestic market here in India. I procured crops from farmers while I completed my university studies.

When I earned my MBA in international business, I told my father I wanted to try to do something on my own. That’s when I founded Shree Sheela International in 2009/10. The company is named in honor of my grandmother, who passed away 12 days before I was born.

Navneet: At Shree Sheela, we work exclusively with kabuli chickpeas. Our slogan is: Single Product, All Origins. We deal in chickpeas from all the exporting nations, including the U.S., Canada, Mexico, Türkiye, Africa, the Black Sea region and India. We ship from these countries to the major markets: Türkiye, Iraq, Algeria, the Middle East, Dubai, Pakistan and some European markets.

We started with a little bit of business in Iraq and then Iran, and went from there. Today, we trade about 15,000 MT of kabuli chickpeas annually, working with all origins and all export destinations.

Navneet: Up till 2014, we were also working with some lentils and other pulses from Canada and the U.S., as well as other origins. But I came to understand that although the buyers and sellers are the same, lentils, beans, chickpeas, etc. are entirely different products. And if you don’t know a product very well, you can run into major problems due to the nature of price fluctuations in the pulses business, and you won’t be able to guide your clients with complete information.

With lentils, there were big market fluctuations from 2014 through 2016, as there was with other pulses from time to time. I realized that I did not have full knowledge of either lentils or chickpeas. I was adrift like a boat in the middle of the sea.

So I decided I had to pick one and to learn everything about it. Kabuli chickpeas are the only pulse product that is authorized for export in India, so I chose to focus on that commodity. I have come to know the product very well. I know what is happening at all the origins and markets, and I understand the requirements of the end user. It is essential to understand that each chickpea variety has its own application and end use. India, Pakistan and Jordan all import Russian chickpeas, but for different applications.

I believe in learning and I am still learning new aspects of the chickpea business every day. Right now I have a firm grasp of all aspects of it, and if one of my sellers or buyers has a question, I can give them complete information. No one can predict what prices will be in the future, but I must have good knowledge of the production, consumption, demand and carry-in at the different origins in order to guide my buyers and sellers properly. I believe pulse trades are made with a buy-sale gap of US$ 5-10/MT. Having the right information can help you save millions of dollars.

Navneet: That’s not really what we are doing. Yes, we are working with one commodity, but we are active in many markets. Let me give you an example. Normally, Türkiye and Algeria are our main buyers. This year, they both bought negligible quantities. So we turned to other markets, like Pakistan, Dubai and Colombo. Kabuli chickpeas are a food commodity, so someone will always be buying. There will always be opportunities to do business.

Navneet: I don’t see weather being much of a factor. In India, a good part of the production comes from traditional kabuli chickpea growers. They know that although the market is down this year, in a few years it will be back up. Their output is always between 250 – 300,000 MT. In Spain and Mexico, they also have traditional chickpea farmers that seed chickpea crops no matter what. So the weather is not much of a factor.

In my opinion, there are five origins to watch going forward. First, we need to see how the harvest turns out in the U.S. and Canada. Second, we need to see how Russia’s crop turned out; it was supposedly harvested in mid-August. And third, we need to see how much is seeded in India and Mexico in October and November.

So those are the origins to watch. Looking at other origins, we have Argentina, but its crop was already seeded. They are projecting a 25-30% decrease in the chickpea area. The harvest is in November/December.

Then there is Türkiye, which is the only origin that is estimated to have a significant expansion in the area seeded to kabuli chickpeas this year. This is because last year the government of Türkiye started offering growers there an attractive Minimum Support Price for chickpeas. I spoke to farmers there recently and they told me that, even though international prices are low, Türkiye is seeding 20% more chickpeas. They don’t expect that yields will be as high as last year, though, so production should be about the same as last year, perhaps 10% more.

Türkiye has traditionally been one of the biggest importers of kabuli chickpeas, but this will mark the second consecutive year that it has enough domestic production to cover internal demand. Türkiye has a 21% duty on chickpea imports. Back in 2017/18, when international prices were high, the government eliminated this duty, but now it’s been re-imposed.

So buying in Türkiye is slow for those reasons. Another market, Algeria, is also slow because of the political instability there.

Navneet: In 2016 and 2017, when chickpea prices were high, we saw many new origins enter the market. The impact on the trade was tremendous.

Türkiye, for instance, is an interesting case. In the ’90s, it was the biggest supplier of kabuli chickpeas to the entire Middle East, India and Pakistan. But then it started growing more lentils and other crops, and chickpea production declined. In 2018, responding to the high prices, it produced 350,000 MT of chickpeas, and it will produce a similar crop this year. So today Türkiye is a major exporter once again.

An important market for Türkiye is Pakistan. Pakistan used to be supplied by India, but India stopped shipments to Pakistan in 2018. Normally, Pakistan imported 60 – 70,000 MT of kabuli chickpeas from India, and 70,000 MT from other origins. Now, with India out of the picture, it gets its chickpeas from Türkiye, Argentina, the U.S. and Canada.

Another interesting case is Bulgaria. They used to produce no more than 10,000 MT, but in 2018, they entered the market with a crop of 100,000 MT. And the countries of the Black Sea region came with big numbers, too. I remember in 2017, the price to the grower in Russia was US$ 900-950/MT, and for cleaned and bagged cargo it was US $ 1,050-1,100/MT CFR to destinations. Today its US$ 400/MT CFR .

This is the nature of the kabuli chickpea market. We have two to three years of surplus production, and then two to three years of short production. What happens in the five origins I mentioned will determine if the market turns around this year.

Navneet Chhabra / India / Mexico / Russia / Shree Sheela / U.S. / Canada / Mexico / Türkiye / Africa / Black Sea / India / Iraq / Algeria / the Middle East / Dubai / Pakistan / Bulgaria

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.