September 17, 2019

LeftField Commodity Research’s founder shares his expert analysis on the production and market prospects for this year’s crop.

Trade tensions with China, import restrictions in India and significant global surplus supplies. With the harvest of Canada’s pulse crops at about the mid-point, GPC checked in with Chuck Penner to cover all the bases and keep readers from getting hit with something out of leftfield.

Chuck is a trusted and well-known name in pulse industry circles. Following a career as a consultant and market analyst, he founded LeftField Commodity Research in 2010. Since then, he has been a featured speaker at major pulse industry events, including Pulses 2017 in Vancouver and the 2019 Pulse and Special Crops Convention held last month in Montreal. Every week, he prepares a series of newsletters for his clients, covering 16 crops, from specialty crops to canola and soybeans to small grains. His clients include the leading pulse industry companies in Western Canada, as well as a myriad of pulse buyers and exporters from Canada, the U.S., Australia, the Ukraine, the United Kingdom and elsewhere. His expertise extends beyond his native Canada.

“With agriculture, to really understand what is going on, you need to look at things globally,” he says. “On chickpeas, for example, you need to know what’s happening in Mexico, India, Argentina and Russia. I provide coverage of what is going on in markets across the world.”

Earlier this week, GPC reached Chuck by telephone at his home in Winnipeg, Manitoba, where recent rains in the area had slowed the pulse harvest and raised some concerns as to Canada’s pulse production this year.

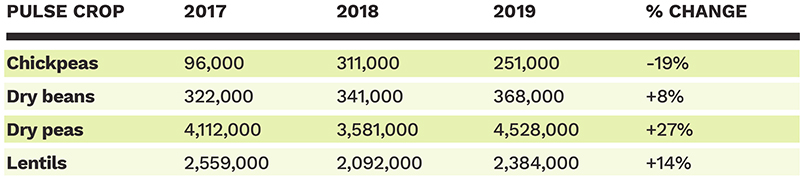

Source: StatsCan, Production of Principal Field Crops, July 2019, released August 28, 2019.

Chuck: I grew up on a farm not far from here. My brother and my nephews are taking it over now and it’s nice to have it stay in the family. My brother, in fact, is the chair of the Manitoba Pulses and Soybean Growers Association.

So I’ve been interested in agriculture from an early age. I earned degrees in agriculture and agricultural economics from the University of Manitoba, and then went to work for United Grain Growers (UGG), and that’s where I gained a lot of professional experience. I moved around the company a lot, gaining experience in different areas, and got to travel and see a good bit of Western Canada. That was at the time when there were a lot of mergers taking place in the industry, and I left UGG after one of those and went to work for a market research company that was called Informa Economics back then; today it’s called IEG Vantage. I spent five years there learning the consulting and market analysis business, and while I was there, I developed a special crops report, and after some time I decided I’d really like to do it on my own.

That’s when, in 2010, I started LeftField Commodity Research. We started basically focusing on special crops and since then have added analysis in small grains and oilseeds. Today, I prepare weekly newsletters covering 16 crops grown in Western Canada. The way I like to think of LeftField and what we do is that we provide the analytical support, or research department, that grain companies and other market participants need to make better marketing decisions. And now, after nine years, I’ve just added a second analyst, Jonathon Driedger, so I doubled my workforce!

Chuck: I’m generally in agreement with what StatsCan projected for pea and lentil yields in late August. Chickpeas are a bit of a different story. I think they’ve underestimated that crop.

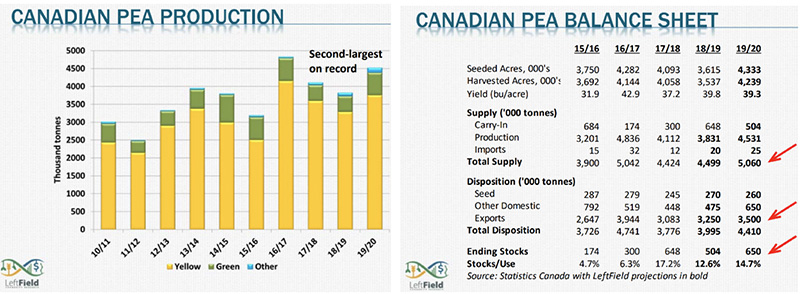

On peas, even before that report came out, I was looking at a 4.5 million MT crop, up 18% over last year. That includes 3.75 million MT of yellow peas, 600,000 MT of green peas and 150,000 MT of other pea types. I think on green peas we are up 40% from last year, and that’s because we came off a year where we had these extreme highs in green pea prices and farmers responded to that.

So we are looking at a large crop, but the concern now is if it is all going to get harvested, and if it does, what the quality will end up being. Right now, Saskatchewan is reporting pea harvest progress at 47% complete. Last year, we were at 86% complete and the 10-year average for the date is 80% complete. So we’re well behind. It’s not as much of a concern for yellow peas, but for greens, where visual quality is so important for canners and packagers, we could see some real downgrading because of staining and bleaching. The forecast doesn’t look great for the next couple of weeks, so I think we’ll continue to see delays. We’ll probably get the crop off at some point, but the big concern is quality.

To sum up, the outlook is for a large crop, but we may have quality issues and that means green pea supplies for canners and packagers could be compromised.

Chuck: Mid-September is a normal frost date, so we are right around that point now, but it largely depends on whether the peas are mature or not. If it’s matured, then frost isn’t a problem. There were some delays at planting, so it is possible that a quarter of the crop has yet to mature and is at risk for frost.

Chuck: Again, I don’t take issue with StatsCan’s yield projection, which is a little over 1,400 pounds per acre. That would be the highest yield we’ve seen in five years. With lentils, the biggest impact on yields is disease more so than dryness, and given the dry conditions we had early on, disease was not a factor this year, and so it’s quite possible that we’ll have those yields. That would give us a crop that’s just under 2.4 million MT.

A lot of acres shifted to reds from greens, so I have the red lentil crop at about 1.5 million MT, which is up about 27% from last year. On large and small greens, I see production dropping off slightly. Last year, the area really went up, but prices have come down this year. With green lentils, it’s the same as with green peas versus yellow peas. There needs to be a premium on green lentils because the quality risk is higher than with red lentils. This year, the premium was minimal. It wasn’t enough to sway farmers. That’s why there was a drop in green lentil acreage and an increase in red lentil acres. So total green lentil production will probably be around 850,000 MT, down about 4% from last year.

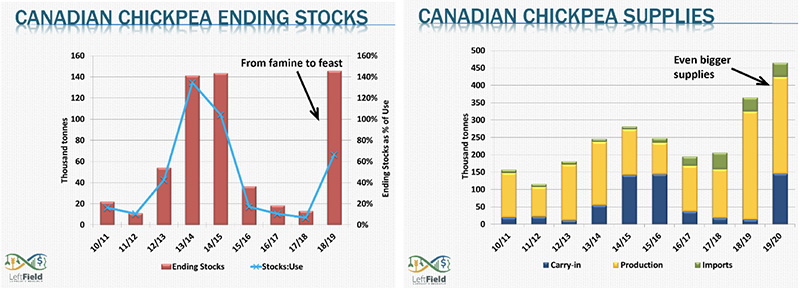

Chuck: Yes, that to me was the most surprising. I think StatsCan estimated yields at 1,450 pounds per acre. That would be the lowest yield in more than 10 years. I know there were some disease concerns, but I don’t think conditions were so bad that we have a 10-year low. StatsCan is projecting 250,000 MT of chickpea production, down from 311,000 MT last year. I think we’re going to be closer to 300,000 MT this year.

The problem with chickpeas is that a lot of countries, Canada included, are going to be carrying over large supplies. In our case, it’s at least 100,000 MT, maybe closer to 150,000 MT of old crop carryover. Because of that, this year’s supplies, despite the lower production, is actually going to be up considerably from last year.

Chuck: StatsCan actually bumped up production from last year. They have it at 370,000 MT, which is about an 8% increase. But I think the yield they are using is too high. I would say we are the same or smaller than last year.

In terms of the different classes, there is a decline in acres for a number of them this year. Pintos held up not too badly. On white beans, though, the area is lower for great northerns but higher for navies. What I see happening there is that because of EU tariffs on U.S. beans, European buyers are increasingly turning to Canada for navy beans, and that encouraged Canadian growers to plant more of them this year.

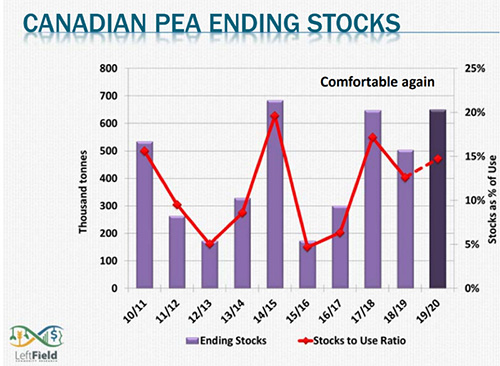

Chuck: StatsCan’s ending stock number for peas is a little bit smaller than what I was expecting. I was looking at about a 500,000 MT carryout, but they came in at a little over 300,000 MT. In my opinion, they are underestimating last year’s crop, but whatever their thinking is, I honestly don’t believe supplies are quite that tight simply because yellow pea prices have been under pressure, and especially so later in the year. If supplies were at 300,000 MT, it just doesn’t make sense that prices would fade like that.

Lentils, on the other hand, came out a little larger than I was expecting. StatsCan reported ending stocks of 650,000 MT, which is down from the previous year, but I had it closer to 500,000 MT.

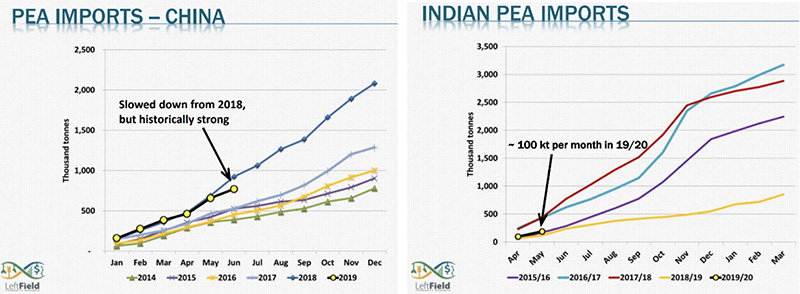

Chuck: Early on there was a lot of concern about China shutting off the tap on pea imports. So far, I honestly haven’t seen confirmation of that. We’ve had strong exports through July. In July, we exported just under 300,000 MT of peas, and 230,000 MT of that went to China. So they remain a large buyer of Canadian peas. Everybody has their fingers crossed. So far, diplomatic tensions haven’t spilled over into the pea market. If China continues to be a solid buyer, then we have a really nice outlook for pea exports.

In my S&D, I also have India penciled in for some small volumes, maybe around 300,000 MT. That’s more than their quantitative restriction of 150,000 MT of pea imports, but somehow peas are still managing to find their way into the country through various court orders. And, of course, Bangladesh has become a large buyer. The media reported on pea smuggling from Bangladesh into India. That may be part of it, but as long as pea prices remain low, these price sensitive markets are going to continue to be in the market.

So, I see a fairly strong outlook for pea exports. I have about 3.5 million MT penciled in for 2019/20, which is better than in 2018/19, which ended up with 3.2 million MT. So pea exports will be up over last year, but it will keep the market fairly well-balanced.

On lentils, it’s a little more concerning. India doesn’t have quantitative restrictions on lentil imports, so right now Canadian lentils, especially red lentils, are priced low enough that they are moving into India even with the 33% tariff. We will continue to move lentils in that direction, and I think we should be able to maintain overall lentil exports at the same level as in 2018/19. Of course, like I mentioned, quality is a concern with these harvest delays. But everything else being equal, I see lentil exports hitting 1.9 million MT, give or take, in 2019/20, which will be quite positive.

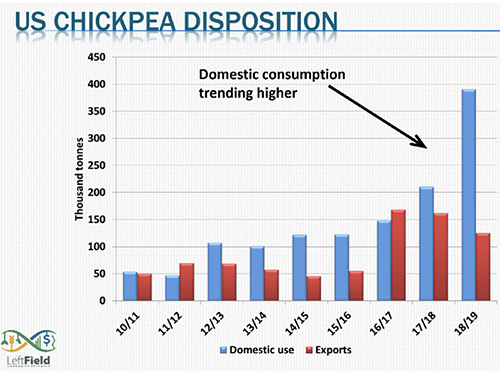

When it comes to chickpeas, that one is more difficult because even though crops are smaller, in a number of different origins there's still so much old crop carryover that competition is still going to be quite strong this year. And until recently the U.S. had been one of Canada's biggest buyers of chickpeas, but now they're producing more of their own as well. That means we now need to push more heavily on places like Middle East destinations and in other Asian destinations. Pakistan has become the largest buyer this past year. We'll need them to continue buying to keep export levels up. Otherwise the next year’s ending stocks are going to be even larger.

On dry beans, a lot of trading is done in advance. Generally, any increase in demand comes from Latin America, especially Mexico and Brazil. If there are short crops there, that could allow us to have a larger export program. This year, it looks like Mexico might be short. Hopefully we’ll have some solid exports there, because if StatsCan’s production number is right, we’re going to be sitting on some bigger supplies and we’ll need a bigger export program in 2019/20.

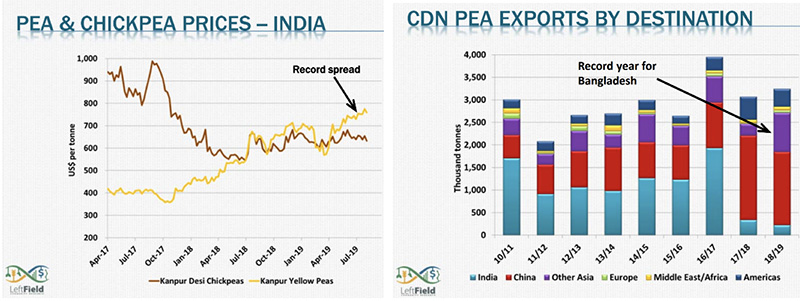

Chuck: Demand from India is going to be largely weather driven. Earlier, it looked like their kharif crop wouldn’t turn out, but late monsoon rains came through and it looks like they will get a good-sized crop. Those late monsoon rains are also recharging soil moisture for the rabi season, which is when India grows its lentil, chickpea and dry pea crops, and that has more of a direct impact on Canadian exports. So hopes for increased movement into India have faded.

But what is happening with yellow pea prices in India right now is interesting. They have this quantitative restriction of 150,000 MT per year on imports, and the assumption has always been that yellow peas and desi chickpeas are substitutable, that you would never get a premium on yellow peas over desi chickpeas because millers in India would just switch back to desi chickpeas. But yellow pea prices are running at a record premium right now, and that tells me there is some inelastic demand in India for yellow peas. So India has these high yellow prices. Meanwhile, you have very cheap prices in Western Canada. And so there is this incentive to try and get yellow peas into India somehow. And that’s where you see Bangladeshi buyers getting Canadian yellow peas on the cheap and re-selling them into India. Bangladesh has imported a lot of Canadian peas in the past, but this year itwas a record high by a significant margin. They bought 600,000 MT this past year, and the year before it was 160,000 MT. When Canadian prices are relatively low, they tend to buy more, and I think a chunk of that 600,000 MT is making its way across the border into India.

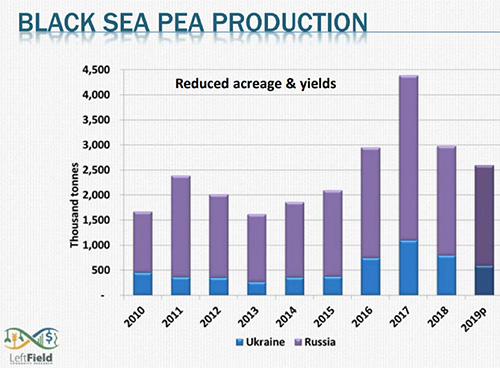

Chuck: I think we have smaller pea crops in Ukraine and Russia as farmers there reacted to lower prices and hot, dry weather probably affected production. In Ukraine, news reports indicate they produced 583,000 MT of peas. In Russia, I think they may have a little under 2 million MT of pea production this year, down from 2.2 million MT last year. So on the pea-side, I think Russia and Ukraine won’t go away completely, but they will be smaller competitors.

On lentils, I’m still waiting to hear what’s going on in Kazakhstan. Parts of the north of the country had some really hot, dry conditions as well, and that may translate into lower lentil yields. But I think they will remain a strong competitor again in 2019/20.

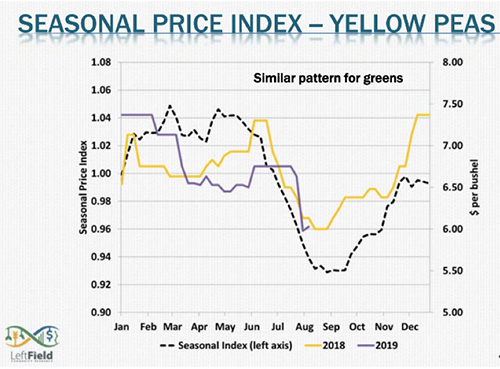

Chuck: Prices for peas, lentils and chickpeas have been declining in Western Canada for the past two months or so. That’s a seasonal matter. Especially when supplies are comfortable, you’ll have buyers backing off, waiting for new crop to come in. Within the next two months, I would expect to see a recovery as buyers become active again.

The difference between this year and last year is that we used to have these great big fall shipments of peas and lentils where we would move 50% of the crop in the first three to four months of the year. Buyers from India led that kind of heavy purchasing. But because of the trade restrictions there, our exports have spread out much more evenly across the year. Without that immediate demand, the price recovery from the seasonal lows won’t be as immediate. I expect in the next six or eight weeks we’ll see gradual movement on prices.

Now if the harvest continues to be delayed and we lose quality and maybe quantity, then there will be a little more urgency among buyers and that could push prices up faster. That remains a key risk in the price outlook.

Chuck Penner / Canada / LeftField / Red Lentils / Green Lentils / Yellow Peas / Green Peas / Dry Beans / Chickpeas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.