July 22, 2025

The Managing Director of Nanjing Bonagro expects kidney bean acreage to grow in 2025 as strong prices and government support align—but also signals China may gradually open to South American black beans, driven by cost and supply dynamics.

David Chen expects kidney beans to remain top performers, as climate, demand, and policy shifts reshape China’s bean landscape.

In 2024, China’s total bean planting area was about 1.46 million hectares, marking a decrease of approximately 13,330 hectares compared to the previous year. For 2025, the total area is expected to rise to around 1.5 million hectares due to increased planting of kidney beans and other related crops.

The expansion of kidney bean planting in 2025 is driven by a combination of policy leverage and market pull. Government policies have reduced production risks through credit support, technical assistance, and supply chain interventions. Meanwhile, higher consumer demand and strong prices have directly encouraged farmers to increase the planted area.

This season is characterized by flooding in the north and drought in the south, along with spells of extreme heat. These conditions have impacted bean production: in the north, effective drainage is essential to manage flooding, while in the south, water conservation and soil moisture replenishment are priorities. Across all growing regions, protecting crops from pests and diseases triggered by high temperatures remains a key challenge.

Kidney bean planting has expanded most noticeably in Heilongjiang, Inner Mongolia, and Shanxi. This is mainly due to rising market prices, which have incentivized local farmers to devote more land to kidney beans.

Overall, the supply of pulse seeds in 2025 is manageable and quality supervision continues to improve. However, smaller or specialty varieties still face challenges regarding technical support and adequate reserves. Farmers are encouraged to purchase seeds through proper channels, match technologies to local conditions, and take full advantage of supporting government policies to minimize risks and stabilize income.

Dark red kidney beans and light speckled kidney beans have experienced the most significant acreage growth. This trend is driven by the unique qualities of certain Chinese kidney beans, which are highly valued in export markets. As output has increased, prices have become more competitive, further enhancing China’s presence in the global market.

Chinese specialty bean varieties—such as dark red kidney beans, light speckled kidney beans, and internationally certified organic black beans—are expected to maintain stable planting areas and continue supplying the international market. However, for beans that can be readily substituted by imports, China may increasingly rely on imported beans due to domestic cost and price disadvantages. With South America’s strong agricultural base, it’s expected that China may gradually open up to more bean imports, while using domestic policy measures to guide and protect its industry according to market needs.

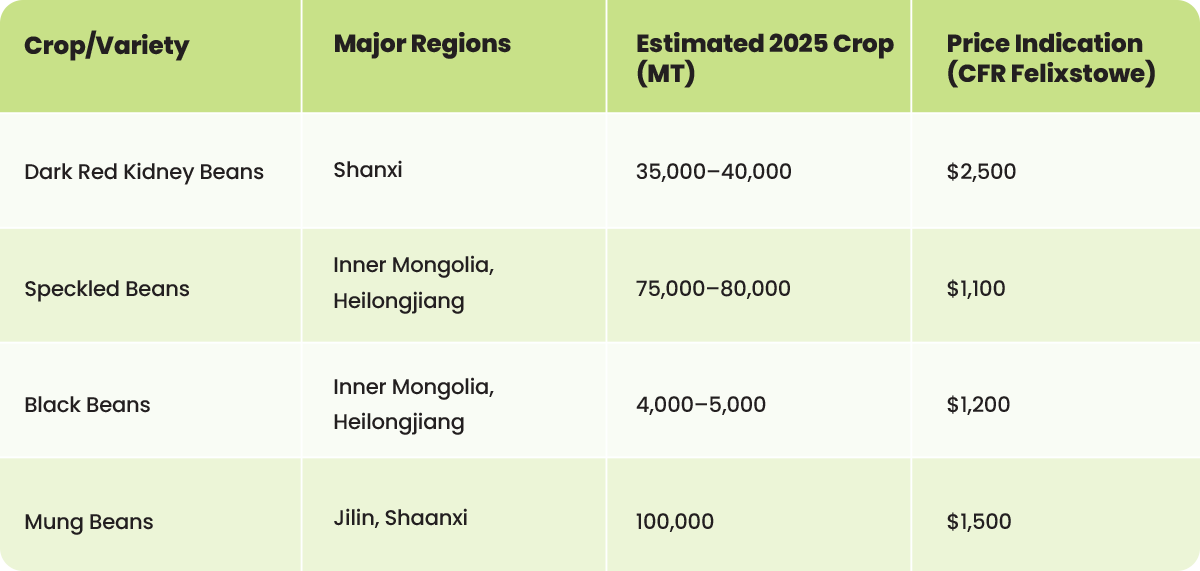

Nanjing Bonagro - Chinese key growing regions and estimated 2025 crop sizes.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.