August 9, 2023

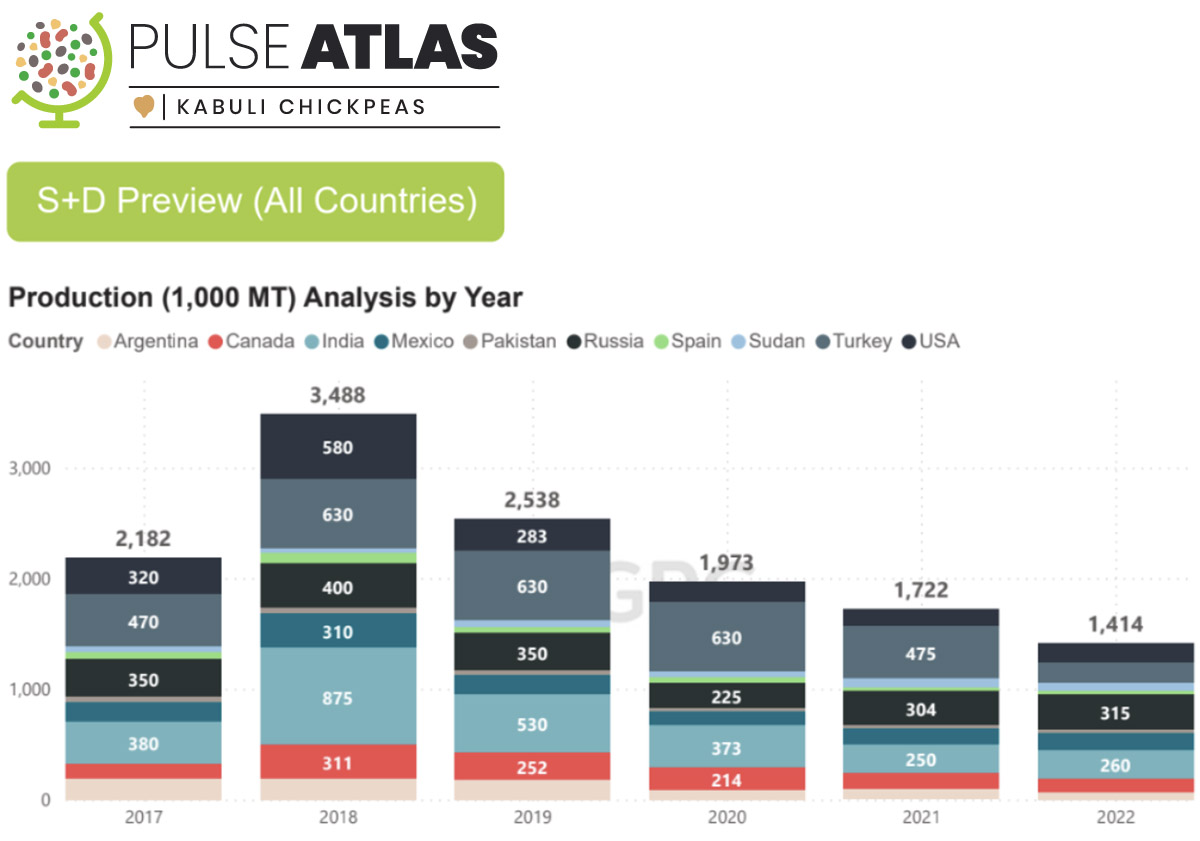

Data from the Pulse Atlas shows a decrease in global kabuli production since 2018, causing prices to stay firm for a few years. Data suggests a reversal in this trend for 2023 - we look at the numbers.

Kabuli chickpea global production 2017-2022

Exclusive Pulse Atlas data maps a steady decline in global kabuli chickpea production since 2018, which showed production hit 5-year highs. Threats of a shortage since the outbreak of war in Ukraine have been well documented both on the Pulse Pod and in mainstream media due to intense competition from other commodities such as wheat and sunflower. Low carry-in stocks have played a significant role in kabuli trade at many origins and continue to be a factor. This year, however, it seems that global supplies will start trending up due to boosted production in many of the main producing regions.

While Mexico is predicted to see production down 25% with scarce carry-in putting further pressure on export potential, the USA, Canada, Türkiye, India and Argentina are all looking at an increase in production year-on-year with Russia’s kabuli volumes expected to hit record highs.

Navneet Chhabra, Global Garbanzo

“Now in the market, there is a big difference in price between bigger & smaller sizes. Algeria tenders increased the market in Mexico and India and have made the market for bigger calibers very firm. If more Algeria tenders come in the next few days, the price will increase more. Because of high prices for big calibers, people will opt for 8 or 9mm; Algeria’s recent tender requested a quotation for 9mm for the first time because prices are so high for bigger sizes.”

“We need to see how the Turkish harvest ended - we’re expecting around 280-300K MT. They’ll be the cheapest this year but the export quota will impact the market. If the US and Canada come with good production, prices will maybe soften a little but not much because the carry-in is so small. Production volumes are not large enough to make a big impact on the market.”

“We also need to look at yields in Canada and the US. In Türkiye also, last week it was reported in Anatolia that the big sizes (9 mm) are not getting in normal percentages, but we need to see what happens when the the harvest completes in the coming days. Everything is mixed now. Huge prices might make India and Mexico increase their seeded area in Oct/Nov, but I doubt it as the last two years we’ve had high prices but not much change in areas; other commodities are still too competitive.”

“Now in the market, there is a big difference in price between sizes. Algeria tenders increased the market in Mexico and India and have made the market for bigger calibers very firm. If more Algeria tenders come in the next days, the price will increase more. Because of high prices for big calibers, people will opt for 8 or 9mm; Algeria imported 9mm for the first time because prices are so high.”

Kabuli chickpea / chickpea production / chickpea shortage / Navneet Chhabra / Global Garbanzo / Russia chickpeas / USA chickpeas / Canada chickpeas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.