October 17, 2022

Luke Wilkinson follows the progression of the Canadian harvest and speaks with industry experts in the pulse growing regions to get a more detailed look into the extent of this year's improvements.

Source: Canada: Outlook for Principal Field Crops - Agriculture and Agri-Food Canada (Sep ‘22)

After the disappointment of the poor pulse crops of 2021, there has been much hope for a comeback for Canadian pulses in 2022. While this year's crop certainly appears to be an improvement on last year, this report will dive into the details of whether the improvement fully matches up to the industry’s hopes and expectations.

Jeff English of Pulse Canada gives a brief summary of where the Canadian harvest stands right now compared to last year: “Last year we obviously had the challenges of drought across Western Canada. This year we haven't seen that; depending on who you talk to, [production] estimates can be around 50% greater this year. Things are looking good. We're starting to trickle into some frost now in certain areas, but broadly in Southern Alberta and Southern Saskatchewan many folks have finished up the harvest. Overall, generally positive, and certainly much, much further ahead than 2021/22.”

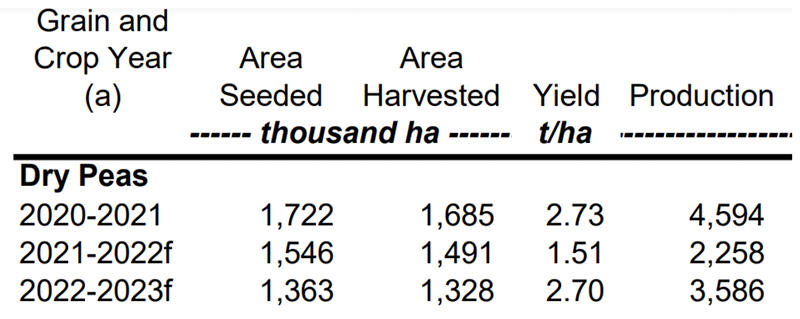

In terms of area seeded, dry peas, dry beans, and chickpeas have all seen a cut in acreage from 2021; dry peas went down 12% to 1,722,000 ha, dry beans down 32% to 120,000 ha, and chickpeas down 4% to 72,000 ha.

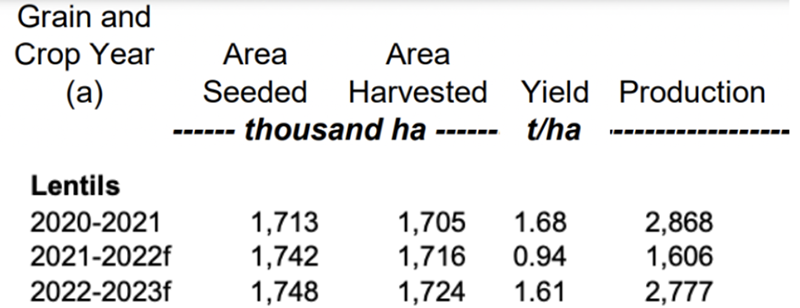

Lentil acreage barely changed at all, growing by less than 0.4%, up to 1,748,000 ha. These cuts can all be interpreted partly as aftershocks from last year, says Carl Potts, executive director of Saskatchewan Pulse Growers:

“As a result of the drought last year and market conditions, we've had strong prices for other crops that farmers can grow, like wheat, canola, oats, and flaxseed. Heading into this spring, other crop prices were attractive for growers; this led to the decrease in the seeded area for peas and a more or less unchanged acreage for lentils, even though the prices for peas and lentils were historically high.”

The question of whether these acreage changes will stick is as yet uncertain and will depend on how pea and lentil prices rally before the next seedings are decided, explains Potts:

“I think prices for peas and lentils are going to need to be stronger in order to maintain or increase their seeded area. Especially if we continue to have strong wheat and canola prices, as farmers know how to grow these crops really well and they may be less risky than pulses.”

Expectations for this year's harvest were that yields would be much higher and crop quality would be greatly improved due to drastically improved weather conditions during the growing season. Carl Potts is pleased with the way the harvest has progressed:

“This year went fairly well from a harvest perspective, with warm dry weather throughout the harvest, which has resulted in average to better than average quality for those crops. In the western side of Saskatchewan, we had drought last year and continued drought this year – this is where most of the pulses are planted. The eastern side of the province had winter snow and then spring precipitation, which led to a later start for planting.”

The latest government production estimates from the Agriculture and Agri-Food Canada (AAFC) demonstrate a rise in almost all pulse production, which we will see as we work through each pulse type.

Source: Canada: Outlook for Principal Field Crops - Agriculture and Agri-Food Canada (Sep ‘22)

Marlene Boersch, Canadian crop market analyst and owner of Mercantile Consulting Venture, expects a much higher dry pea supply: “People have said that production may actually be close to 3.6 million tonnes and with carry out from last year at around 250 kilotonnes (kt), that means our supply has certainly improved – it will be somewhere between 3.8 and 4.1 million tonnes."

Official figures from the AAFC corroborate Boersch’s estimates for dry peas: production is thought to have risen to 3,586 kt. Likely total supply will be 4051 kt - a 42% rise from 2021. This big jump in production can be attributed to much higher yields, which have risen from 1.51 t/ha to 2.70t t/ha.

Saskatchewan is estimated to account for 51% of dry pea production, 41% will be from Alberta, and the remainder will come from different regions across the country.

AAFC figures predict carry out to be 650 kt, a significant rise that is set to put a downward pressure on pea prices.

Domestic demand for peas goes to seed, pet food (for the United States), and fractionation for pea protein, says Marlene Boersch: “You can probably use about 1 million tons all-in for those purposes. That's actually giving a little bit of extra competition at the farmers' side.”

“As for export demand, I anticipate that it will rekindle a little bit from last year up to about 2.6 million tonnes. When we talk about exports, the big question mark is whether China is going to include feed into their demand or not – that could be an up to 1.3 million tonne question. It's a very, very big swing factor. I would expect them to take between 1.3 and 1.5 million in edible/fracturing demand. Anything on top of that will mean they’re going into the feed market.”

Carl Potts agrees that Chinese demand will be important: “Something like 80% of our yellow pea exports have been going to China. The USA has been another important market, as well as Bangladesh.”

Boersch also believes that Bangladesh’s involvement as a buyer will depend on Russian exports: “I think last year's lack of sales to Bangladesh was related to purchases made by Bangladesh from Russia. We hear that Russia has a good crop, but can they ship? Will they have farming capacity and vessels? With the ongoing war, we can't anticipate what shipping capacity is.”

The AAFC expects the average dry pea price to drop significantly to $440 per tonne down from $590 per tonne on average during 2021/2022, citing higher supply around the world and the rise in Canadian carry out stock as the main reasons.

Canadian yellow pea prices as reflected in bids in September 2022 are selling at a record high price of just under $470 per tonne, whereas green peas will be selling at a price closer to $450 per tonne.

Source: Canada: Outlook for Principal Field Crops - Agriculture and Agri-Food Canada (Sep ‘22)

Predictions on final lentil production are extremely promising compared to last year. It is believed that production will be over 73% higher than 2021 at 2777 kt, with a predicted total supply of 3076 kt. Lentil yields have reportedly risen from 0.94 t/ha to 1.61t/ha.

Saskatchewan will likely represent 84% of total lentil production, with 16% coming from Alberta.

Red lentils are set to make up the large majority of lentils planted in Canada, says Marlene Boersch, "We think red lentils represent about 69% of the acreage - they’ve become quite predominant. You probably have 70 to 75% of the production in red lentils, which have found favor with the farmers because they yield a bit better than greens.”

In total, carry out stocks for lentils are estimated to be 400 kt - a 78% increase from last year but a 9% drop from 2020/21.

"About 85% of our lentil exports go to just four or five markets,” Says Carl Potts, “India, Türkiye, and the UAE would be three of our largest markets overall. Sri Lanka would be in there as well. It's really a demand from south Asia primarily for red lentils, and with green lentils there is lots of demand from India, but also Latin American countries and the Middle East.”

Marlene Boersch explains that red lentils are mostly bought in larger quantities: “The bulk markets - that tends to be the red lentil market. India and Türkiye combined will make up roughly 50% of our red lentil demand. If you want to know how our exports are going, you have to look at those two first.

“Our green lentil markets are Colombia, Peru, Chile, and the Mediterranean. We have Spain, Italy and also Algeria and Morocco. The two lentil markets are really quite separate, because Bangladesh, Türkiye, and India take mostly red, and that's in volume.

For all grades of lentils, the AAFC foresees a significantly lower price for lentils at $750 per tonne. As with dry peas, this is based on an expected uptick in carry out stock and increased world supply in general.

“In terms of the balance sheet internationally,” says Boersch, “there is tightness in green lentils, but red lentils will certainly be less tight – that is also going to be influenced by a potentially very, very good crop in Australia.”

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) reports that the lentil crop in Australia this year is set to be strong, at an estimated 924 kt - a 7.6% rise in production from last year, and 47% up on the five year average for production. This suggests that red lentil supply may be ample, leading to potential downward pressure on price.

Source: Canada: Outlook for Principal Field Crops - Agriculture and Agri-Food Canada (Sep ‘22)

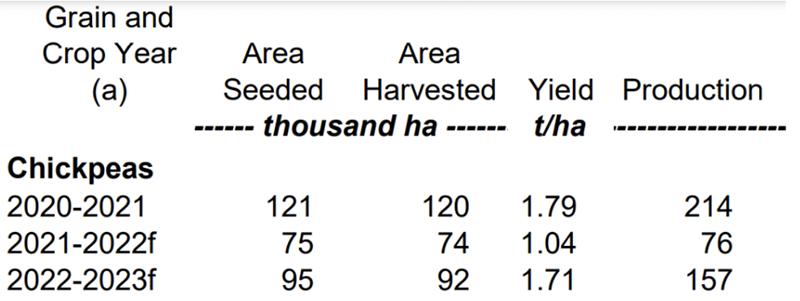

Chickpea production is thought to have more than doubled from last year’s levels, up to 157 kt. Total supply is set to be 349 kt - a 9% drop from the previous year, with a carry out of 140 kt. Despite the rise in production, the marketing year 2022/23 will be the third consecutive year where carry out has decreased. Overall yields for chickpeas have risen from 1.04 t/ha to 1.71 t/ha.

Due to an anticipated decrease in world chickpea supply, the average price for chickpeas is set to be around $900 per tonne according to the AAFC.

“Our biggest chickpea buyer is the US, who uses them mainly for hummus,” says Marlene Boersch, “we would expect to sell them around 45 kt, then around 45/50 kt to Pakistan as well. We have some other buyers like Türkiye, the UAE, and then Lebanon, which has become a little bit bigger as a buyer - around 10-12 kt will go to them.”

Canadian Kabuli chickpea prices as reflected in bids are currently strong, hovering at roughly $920 per tonne, but not as strong as the record high prices of 2016/17.

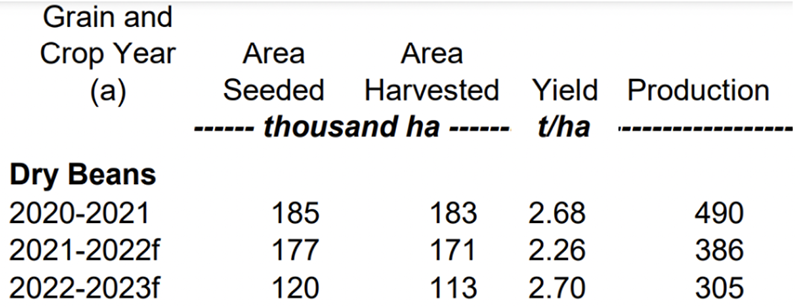

This year, dry bean acreage is thought to have dropped significantly, causing a 21% drop in overall production from 386 kt to 305 kt.

Overall yield looks to have improved on both last year’s poorer yields and the more average yields of 2020, moving up to 2.70 t/ha.

2022 Canadian bean production is spread across Ontario (38%), Manitoba (40%), and Alberta (22%) and consists of pinto beans and navy beans in the majority. Great Northern beans, black beans, cranberry beans, and kidney beans are also grown in varying quantities.

Canadian dry bean price is forecast to be $1250 per tonne on average. This is reportedly as a result of lower supply in North America.

Canadian dry beans are in large part directly contracted through companies, meaning deals will be struck with farmers and crops earmarked before the beans even go into production. This means there is less movement in the Canadian dry bean market relative to other global pulse markets.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.