September 23, 2020

A recap of last week’s Pulse and Special Crops virtual sessions on beans, chickpeas, peas and lentils.

With the COVID-19 pandemic still keeping us socially distant, the Canadian Special Crops Association (CSCA) moved its Pulses and Special Crops convention online. Held on September 15 and 16, the event featured sessions on plant-based protein and the global economic outlook, as well as market outlook panels on Canada’s major special crops, including beans (moderated by GPC President Cindy Brown), chickpeas, peas, lentils and sunflower, mustard and canary seed.

The first day of the conference was emceed by Pulse Canada CEO Gordon Bacon, who welcomed attendees to the 34th edition of the Pulses and Special Crops convention, and the first one conducted entirely online.

“For 30 years, this convention has been the place to discuss what the special crops industry is and what will drive the industry forward,” he said. “COVID-19 doesn’t change that.”

The pandemic also didn’t shutdown the convention’s social component. At one point, Bacon introduced Pulse Canada’s Director of Events and Programs Denise Hawryluk, who appeared behind him tidying up from the previous evening’s socially distant welcome cocktail reception.

Before introducing the first session, Bacon thanked everyone for tuning in and reported that the CSCA’s first virtual convention was being watched by more than 420 attendees from 30 countries.

The convention kicked off with a panel on the plant-based protein sector, moderated by Bacon and featuring the participation of Chris Shields from Lovingly Made Ingredients, Andrea Pierce-Ghafoor from Summer Fresh, Paul Wong from Daiya Foods and Ken Toong from the University of Massachusetts.

Over the course of the discussion, a number of interesting points were made. Wong started out by noting that the plant-based space is the fastest growing food segment, and that the COVID-19 pandemic has only accelerated that growth. About 46% of consumers, he said, are “plant-based curious” and companies like his have one chance to convert them into regular customers.

“So, make sure the product looks and tastes good,” he advised.

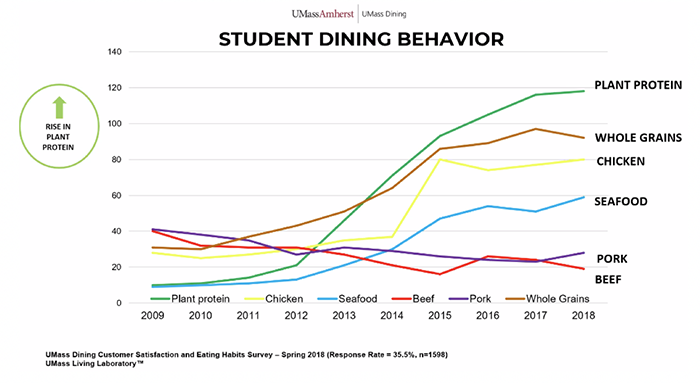

Picking up on this theme, Pierce spoke about how the pandemic accelerated consumption of plant-based products in the home, and spotlighted the importance of Generation Z; although they don’t presently have much purchasing power, they are very influential in the home, she said. Toong, who heads the food service at the University of Massachusetts, also made this point. As Generation Z goes to college, the number of plant-protein food items at university dining halls has risen sharply. Gen Z-ers, he noted, are “ethical diners” who are looking for healthy and sustainable foods that are also socially responsible. Messaging and storytelling are important, said Toong, but so is the look and taste of the product.

Dovetailing into the importance of social messaging, Shields, whose UK-based parent company decided to build a plant in Saskatchewan in order “to be in the heart of pulse production”, spoke about the importance of sourcing locally to “take the miles off” and using crops which use less water and promote sustainable farming.

Distributors are interested in sustainability as well. At first, the focus was on packaging, but now they are looking at the product itself.

“Never underestimate the intelligence of consumers,” said Wong. “They want to make an impact with their purchasing power.”

Asked what role the government and industry can play, Shields stated that public investment in the sector would accelerate its growth. Wong suggested companies like his partner with processors to get the right ingredients for their products. Pierce underscored the need to connect farmers to consumers, similar to what the dairy industry has done in Canada. In this respect, she made the point that consumers are not all that familiar with the term pulses, and that the use of more familiar language (chickpeas, pea, lentils, beans) would help the industry connect better with food shoppers. Toong recommended funding projects to educate consumers on how to cook with pulses and suggested organizing a plant-based festival.

The Bean Market Outlook session was moderated by GPC President Cindy Brown and featured the participation of analyst Chuck Penner of LeftField Commodity Research and panelists Marcos Mosnaim of Globeways, Dan Sturt of DW Sturt & Co. and Keven Sawchuk of Viterra.

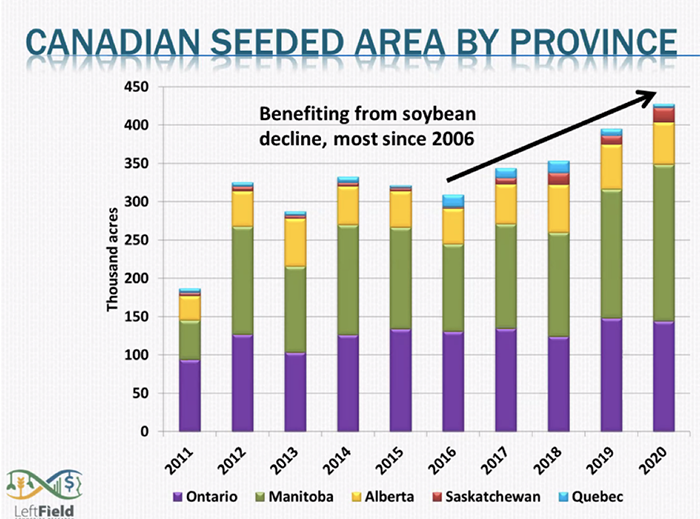

Penner began his presentation by looking at the area seeded to beans in both the U.S. and Canada. With soybean prices in decline, bean plantings are rebounding in 2020. Last year, North America had a small crop, and, except for black beans, exports were limited due to tight supplies.

StatsCan pegs Canada’s dry bean area at 420,000 acres, the highest level since 2006. Taking a closer look at the top three bean classes produced in Canada, Penner noted pinto beans saw the biggest area increase, up 53% from 2019. The navy bean area also expanded, but to a lesser degree. The black bean area, however, fell off slightly “because the price signals weren’t there.”

In the U.S., the USDA estimated the bean area at 1,571,000 acres back in August, and is projecting record production of 1.49 million MT. The area seeded under pinto beans increased from 495,000 acres last year to 640,000 acres this year.

In Mexico, bean plantings are also rebounding following a difficult 2019. In Argentina, meanwhile, bids have risen due to production problems, and this may create opportunities for North American bean exports into South America.

During the panel discussion that followed, Sturt commented on the supply and demand situation for pinto beans and black beans in Mexico. Back in June, he said, pinto bean seed was hard to come by in Mexico and the bean industry there knew at that time that production would fall short of demand. Severe drought then hit Chihuahua, a key pinto bean growing state, causing the loss of 60% of the bean crop there. Consequently, Sturt is expecting that Mexico’s demand for North American pinto beans will be three times what it was last year. Prices there, he said, are presently high, at $58/cwt for pinto beans and $45-50/cwt for black beans. Therefore, Sturt anticipates there will be strong demand from Mexico for North American pinto beans at least through November, when Mexico harvests its next crop.

Sawchuk updated the panel on the harvest progress in North America. At that time, about a third of Canada’s bean crop and a quarter of U.S. beans had been harvested. In Canada’s western prairies, growers were reporting above average yields. There was optimism, therefore, that North America was poised to be a major supplier of dry beans in 2020/21.

Mosnaim reported on bean production in Brazil. This year, there were production problems across all bean classes. In the case of black beans, Argentine prices were at $860-880/MT at the border. Argentina, Brazil’s traditional black bean supplier, had production issues, as well. Carioca bean prices are also high in the domestic market. Prices are also high for browneye beans, Brazil’s most exported bean. In conclusion, with production problems in both Brazil and Argentina, there will be opportunities for North American bean exports to the region.

Brown then segued out of her moderator role to report on the U.S. kidney and navy bean crops. A large kidney bean crop is expected this year but given that consumption has increased 30% since the International Year of Pulses in 2016, the increased volume is not a concern, she said. On navy beans, the European canning industry is the main buyer of U.S. export supplies. Usually, the U.S. faces competition from Ethiopia into that market, but the African nation has limited supplies this marketing year. Additionally, limited supplies of larger sized white beans, including alubia beans from Argentina and great northern beans in the U.S., may see buyers of those bean classes turn to smaller-sized alternatives, creating navy bean demand from new markets.

The Chickpea Market Outlook was moderated by Brad Grabham of BroadGrain and featured the participation of Chuck Penner of LeftField Commodity Research as analyst and Ali Siddiqui of the Northern Chickpeas Alliance and Colin Young of Midwest Grain as panelists.

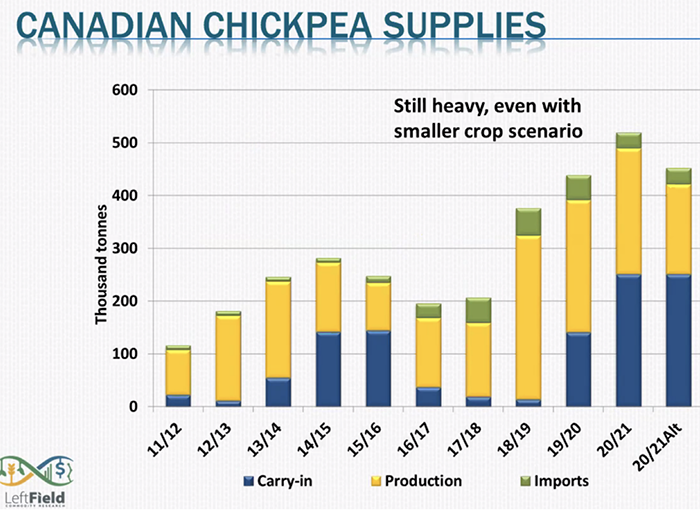

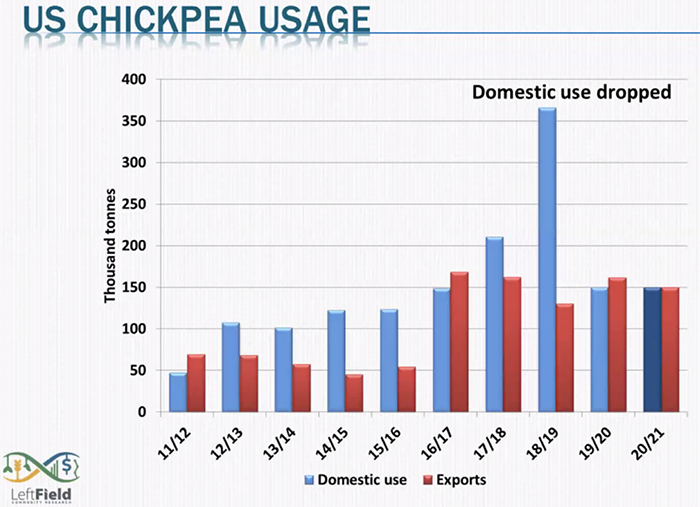

Penner began his presentation by noting that North American chickpea yields rebounded from last year’s challenging harvest in both Canada and the U.S. In Canada, production estimates vary, with StatsCan estimating production at 240,000 MT and the Saskatchewan Crop Insurance Corporation at 175,000 MT. In either event, with a carry-in of 250,000 MT, Penner described Canada’s chickpea supply situation as “very comfortable”. In the U.S., the USDA is estimating production at 176,400 MT. Farmers there had cut back seeding chickpeas because of burdensome old crop inventories, but the good yields this year will offset some of the reduction in area.

On domestic usage, Penner singled out the 2018/19 marketing year, where internal consumption spiked only to return to historic levels in the marketing years that followed. He believes the drop off from 2018/19 may be due to the petfood controversy.

On exports, Penner pointed to the dip in Canada’s export volume in 2019/20, a reflection of the difficulty Canada had competing against Russian chickpea exports. For MY 2020/21, he expects a return to export volumes in excess of 140,000 MT.

In terms of the global supply-demand situation for kabuli chickpeas, Penner said production is down at all origins, but supplies remain high. In India, both desi and kabuli chickpea prices are starting to trend upward, a sign that the market is beginning to turnaround.

In summary, the high chickpea prices of the prior two years motivated growers to seed chickpeas and caused a surplus to accumulate, and it is taking a long time to chew through the inventories that have piled up. It didn’t help that Canadian exports were week in 2019/20 because of competition with Russia. But looking ahead, most origins reduced the area seeded to chickpeas in 2020. Even so, it may take another year to work through the accumulated burdensome inventories. All things considered, Penner anticipates a moderate recovery later in 2020/21.

Siddiqui of the Northern Chickpeas Alliance then spoke about the Pakistani market. Kabuli chickpea demand there, he explained, is driven by the HORECA sector. When the pandemic broke out, the sector was forced to close, and kabuli chickpea inventories subsequently piled up. He expects to see a moderate recovery in 2020/21 as the sector reopens.

Young of Midwest Grain provided an update on Canada’s kabuli chickpea harvest progress. He reported 60% of the crop had been harvested. The yields have been in the 30-40 bu/acre range for the most part. About 35% of the growing area, however, was experiencing disease pressure from a new pathogen that emerged last year; yields there were in the 20-25 bu/acre range.

Young described the quality of the crop thus far as excellent, though the sizes of the chickpeas tended to be on the smaller side. He offered the following breakdown by caliber: 20% of the chickpeas are 9 mm in size, 60% are 8 mm and 20% are 7 mm. The 40% of the crop that remained in the fields had been hit by frost, and this could adversely impact the quality of the chickpeas that had still to be harvested.

In closing, Siddiqui noted that Türkiye and Argentina are also having issues with the caliber sizes of their crops. There are two factors to keep an eye on this marketing year, he said. The first is if India drops its tariffs and the second is if Türkiye becomes a buyer of 9 mm kabuli chickpeas. Should either one of those occur, it could drastically move the market, he said.

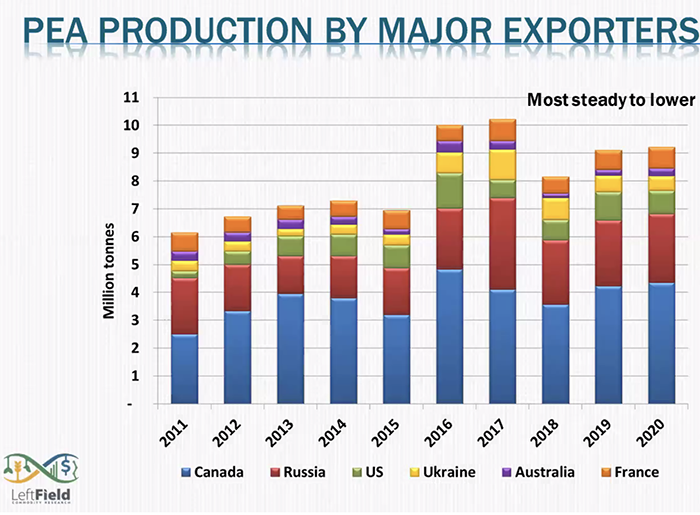

The Pea Market Outlook was moderated by Quinton Stewart of Viterra and featured a panel that included Rav Kapoor of ETG Commodities, Jeff Vipond of Scoular Canada and Kevin Price of Parrish and Heimbecker. Chuck Penner of LeftField Commodity Research reprised his role as analyst.

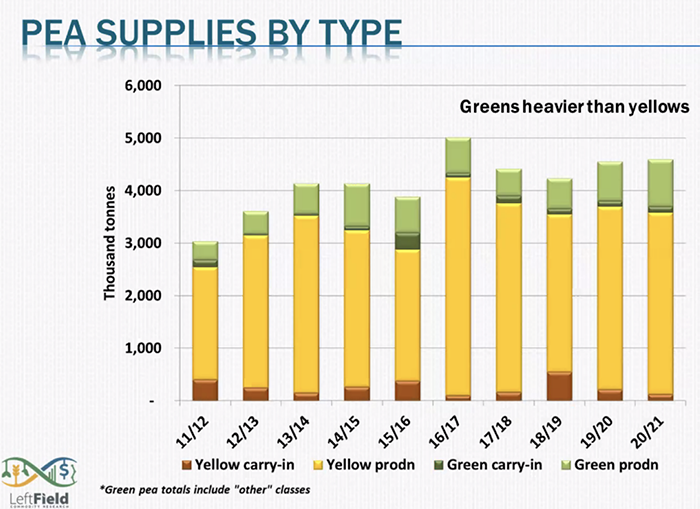

Penner began by reviewing production figures. StatsCan pegged Canada’s 2020 pea crop (yellow and green combined) at 4.4 million MT, a 3% increase over last year’s crop. Due to very low carry-in, however, the overall supply for 2020/21 is about the same as it was the previous marketing year.

This year’s slight increase in production is due to a 25% increase in green pea output. Yellow pea production, conversely, is down 1% from last year. Green peas also make up a larger than usual share of the carry-in for 2020/21.

On the export front, Canada shipped 3.7 million MT of dry peas overseas in 2019/20, a 13% increase over the previous marketing year. China was the major buyer, stepping in as India withdrew. For 2020/21, Penner believes that even with India continuing to sit out, export demand will exceed available supplies. China is having production problems, but even before then, imports were running at a record pace. Canadian product constituted 95% of the Asian Giant’s pea imports.

Smaller crops are also being projected at most other origins, with Australia being the sole exception. In the U.S., yellow pea production is down sharply from just more than 700,000 MT in 2019 to 500,000 MT in 2020.

Consequently, Penner sees ending stocks continuing to decline and to become heavier on greens.

In India, prices for both green and yellow peas have been on the rise, a signal that supplies there are dwindling and that import restrictions may be relaxed. With supplies tight, Penner sees yellow pea prices trending upward. On the other hand, he described green pea supplies as “comfortable”. As a result, he expects to see the price gap between green and yellow peas narrow.

Following Penner’s presentation, Jeff Vipond of Scoular Canada gave his opinion on Canada’s pea production. He said yield estimates were “all over the place” and described StatsCan’s numbers as “surprising”. Penner’s presentation, he said, contained the best numbers available. Given the current market conditions, growers in Saskatchewan are in a strong position, said Vipond, as they can hold onto their yellow pea crops and wait for their desired price. He estimated about a third of Canada’s 2020 dry pea crop had been sold to date.

Kevin Price of Parrish and Heimbecker shared his thoughts on demand from China. He identified two kinds of demand out of China—the traditional demand and new demand for compound feeders, which he described as basically bottomless but price sensitive. Presently, there is a lot of movement. He expects it to slow in 6-8 months and sees the possibility for exports of 2.3-2.4 million MT in 2020/21.

Rav Kapoor of ETG Commodities gave his thoughts on India. For the upcoming rabi season, he sees farmers seeding more desi chickpeas because of attractive prices. On the question of whether India were to reopen for November/December arrivals, he noted that even if it did, that business would likely go to Black Sea origins first. In any event, he pegs the chances of India reopening at only 5%.

The Lentil Market Outlook was moderated by Tanvir Zaidi of Globeways Canada and featured Marlene Boersch of Mercantile Consulting Venture as analyst. The panel included Elyce Simpson Fraser of Simpson Seeds and Farhan Adam of Marina Commodities.

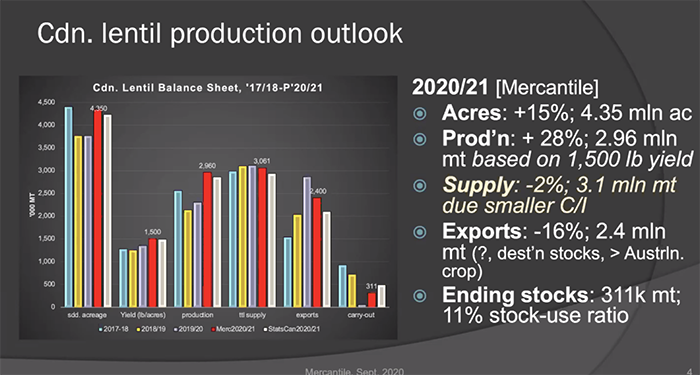

Boersch began her presentation by posing two key questions: Will lentil production hold up? And will usage remain at current levels?

On the production side, Mercantile Consulting estimates the area seeded to lentils in 2020 is up 15% from the previous year to 4.35 million acres. Based on a yield calculation of 1,500 pounds per acre, Boersch estimates production at 2.96 million MT, a 28% increase over last year’s output. However, with a smaller carry-in heading into 2020/21 (which Mercantile Consulting estimates at 51,000 MT), the overall supply amounts to 3.1 million MT, which is 2% less than what it was the previous marketing year. She projects a 16% decrease in exports to 2.4 million MT and ending stocks of 311,000 MT.

Red lentils comprise the bulk of Canada’s lentil production. Boersch offered the following breakdown by type for the 2020 crop:

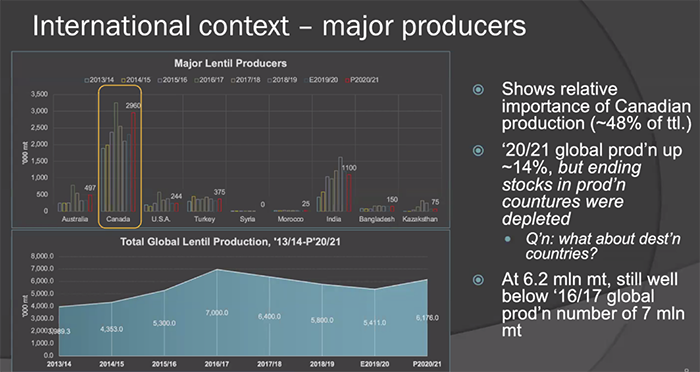

On the world stage, Canada is the dominant lentil producer, regularly accounting for about 48% of total global lentil production. For 2020/21, Boersch estimates world lentil production at 6.2 million MT, a 14% increase over the previous marketing year. But although production is up, carry-ins are low across all origins.

The biggest buyers of Canadian lentils are India, Türkiye, Bangladesh and the United Arab Emirates.

In India, attractive minimum support prices have encouraged farmers to seed pulses, but lentil stocks remain low and the next harvest is far off. At the convention, Boersch projected Canada’s 2020/21 exports to India at around 600,000 MT, down from 907,000 MT the previous marketing year. [EDITOR’S NOTE: It should be noted that Boersch delivered her presentation before India announced it was once again reducing its tariffs on lentil imports from 30% to 10%.]

In Türkiye, Canada has recovered the market it had lost to Kazakhstan. In 2019/20, Canada exported 423,000 MT of lentils to Türkiye compared to Kazakhstan’s 90,000 MT. The previous marketing year, 2018/19, competition from Kazakhstan had seen Canadian lentil exports drop to 122,000 MT. For 2020/21, Boersch projects Canada will export 400,000 MT into Türkiye. She also projected exports of 225,000 MT to the UAE and 200,000 MT to Bangladesh.

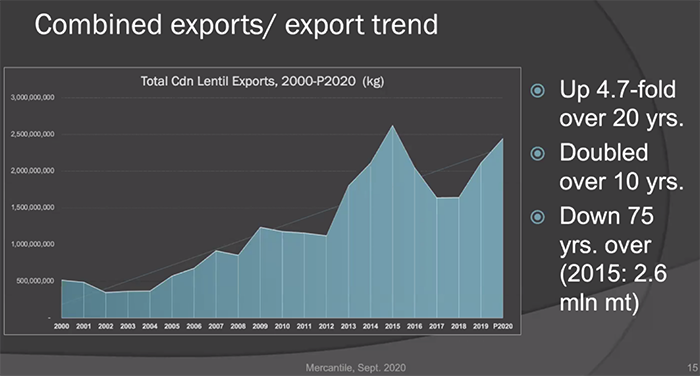

Overall, Boersch sees Canadian lentil exports continuing to trend upward. Over the past 20 years, they have increased 4.7-fold and doubled over the past decade.

She expects the 2020/21 marketing year will get off to a slow start because the importing countries may still have 2 to 4 months of inventories remaining.

In terms of the price outlook, Boersch sees green lentil prices firming up with stocks possibly running out by spring. Red lentil prices are more vulnerable and face competition from Australia’s new crop in the coming months.

During the discussion that followed, Farhan Adam of Marina Commodities gave an overview of the current export environment for red lentils. He indicated that India imported a good deal of new crop under the tariff reduction that expired August 31. Demand for lentils there has grown stronger due to rising tur prices. In Türkiye, domestic lentils prices are presently high. Kazakhstan is not a factor this marketing year and Canada should see good movement into that market.

On green lentils, Elyce Simpson Fraser of Simpson Seeds reported steady demand.

“We didn’t see harvest pressure on prices this year because stocks sold during the COVID-19 lockdowns,” she said.

At the moment, Canada’s growers are reluctant to part with their lentils, or any crop for that matter, for less than 30 cents a pound. They are cash rich and have the ability to store their lentils, said Simpson Fraser.

Additionally, COVID-19 has thrown off the normal buying patterns. Latin America overbought as the pandemic hit, but Simpson Fraser said as buyers re-enter the market, green lentil supplies will tighten and prices should hold. Further, competition from Russia is not expected to be significant in 2020/21.

The conversation then turned to Australia’s lentil harvest in November. Adam mentioned that production estimates range from 450-550,000 MT. Either way, he said, it won’t be a particularly large crop, and with the harvest still months away, weather can still play a significant role. Typically, Australian lentils command a quality premium over Canadian product, but Adam described the quality of Canadian lentils this year as “fabulous”. He does not believe there will be much of a price differential on quality this marketing year.

Picking up on the discussion of quality, Simpson Fraser touted the advances Canada has made in producing larger sized varieties of green lentils. Today, she said, Canadian green lentils are larger, rounder and more conducive to splitting, all attributes which should make them competitive with Australia’s product.

On pricing, Adam indicated red lentils were going for $500 C&F on the low end. If Australia has a good crop, he expects prices will remain in the $510-520 range. Simpson Fraser indicated that it will be difficult to push growers to lower their prices. Growers, she said, won’t go below $600 per MT on Estons and $680 on large greens.

“There is more of an upside to the market than downside,” she said.

Canada / Cindy Brown / Gordon Bacon / Chris Shields / Andrea Pierce-Ghafoor / Paul Wong / Ken Toong / Chuck Penner / Marcos Mosnaim / Dan Sturt / Keven Sawchuk / Brad Grabham / Ali Siddiqui / Colin Young / Quinton Stewart / Rav Kapoor / Jeff Vipond / Kevin Price / Tanvir Zaidi / Marlene Boersch / Elyce Simpson Fraser / Farhan Adam

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.