May 30, 2022

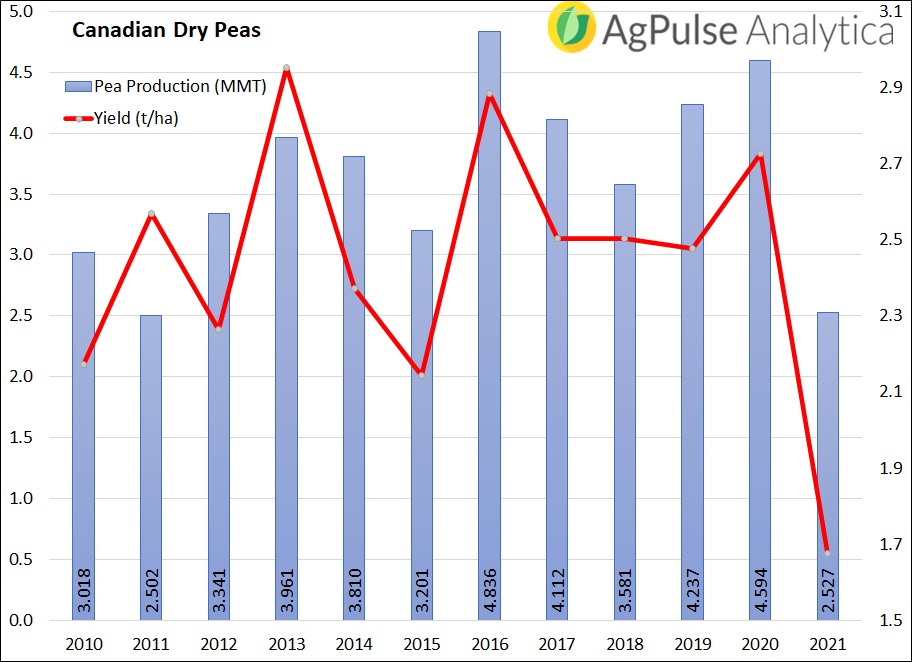

Last year’s drought wrought havoc on Canadian agriculture with the production of nearly all crops suffering the worst losses seen in more than a decade. Gaurav Jain comments on the outlook for peas this year.

Last year’s decreased production made prices escalate quickly and, as a result, Canadian growers and traders held onto their produce. China, the world’s largest pea importer, had to look elsewhere for supplies and imported from countries such as France, Australia and Argentina.

Now, at the end of the season, Canadian pea stocks are higher than previously anticipated and the accelerated pace of purchasing seen since March has failed to clear the pile. The arrival of a new crop in just a few months’ time will bring in ample supplies and bulk trade to China is expected to start again in earnest.

Old crop prices are quoted at nearly C$17/bushel, while the new crop is hovering around C$14/bushel. Farmers and traders should make the most of of this backwardation and clear their stocks before the prices converge to the lower levels.

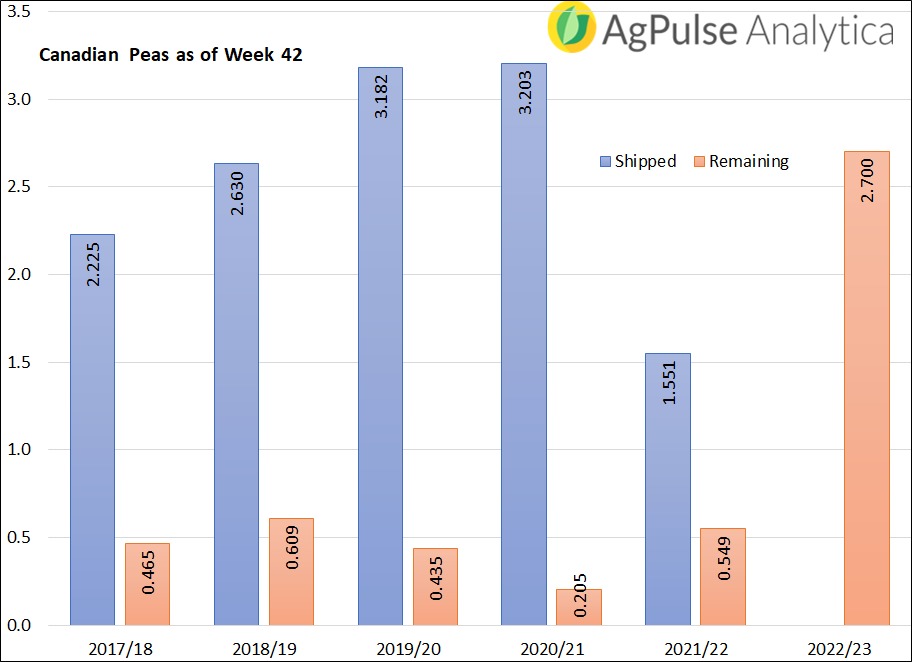

Canadian exporters accelerated their outflow in March, shipping 233,537 MT of peas, which is more than the past four months combined. Exports since then have kept up this high pace but, to meet the AAFC target of 2.1 MMT, another 549 KMT of peas must be shipped, the highest in three years.

With only 10 weeks to go before the marketing year ends, it is unlikely that the target will be met. Any shortfall in this figure will add to the beginning stocks for the MY 2022/23, boosting supplies therein.

If weather conditions do not deteriorate in the coming months, this carryover is likely to pressurize local prices and we may see a softening in international pea prices.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.