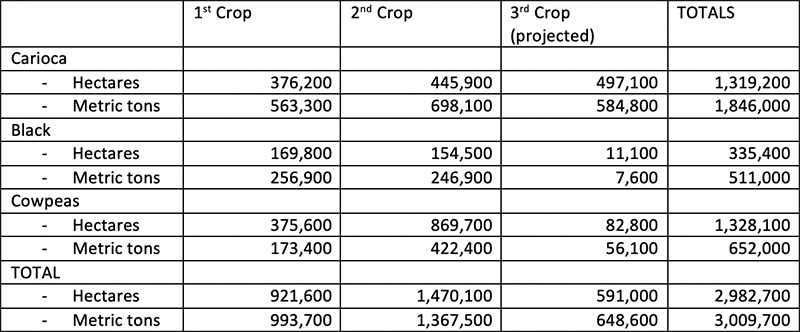

In its June crop report, CONAB (Brazil’s National Supply Company) projected Brazil’s total dry bean production for 2018/19 at 3,009,700 MT, down 3% from 2017/18. The projected breakdown by commercial class is as follows: carioca beans (1,846,00 MT, up 1% from last cycle); black beans (511,000 MT, up 4% from last cycle); and brown-eyed beans (652,000 MT, down 18% from last cycle). Most of Brazil’s carioca and black beans are consumed domestically, while most of its brown-eyed beans are exported.

Brazil’s dry bean imports are comprised mainly of black beans; therefore, domestic black bean production dictates how active Brazilian buyers will be in international markets. Brazil’s black bean production is locked in with the second crop, as third crop production is minimal, projected at 7,600 MT this year. CONAB is forecasting a normal level of dry bean imports this year (120,000 MT).

Supply and Demand

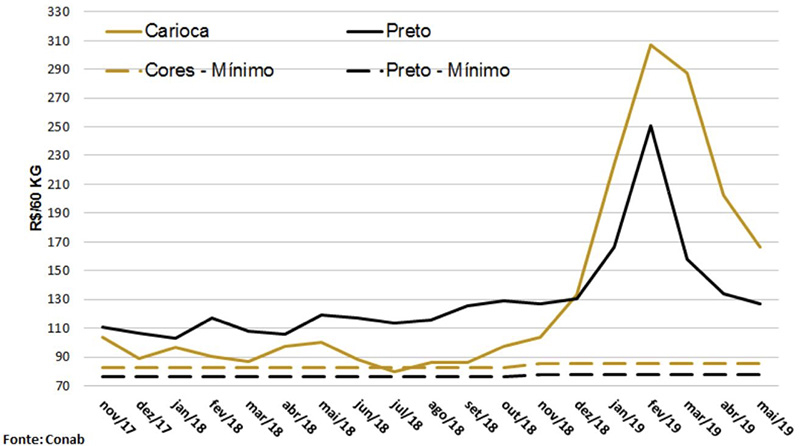

CONAB forecasts Brazil’s total dry bean supply for 2018/19 at 3.5 million MT, comprised of domestic production (3 million MT), imports (120,000 MT of mostly black beans) and carry-in (Brazil had ample supplies heading into the 2018/19 cycle). Brazil’s dry bean consumption has tended to vary between 3.3 and 3.6 million MT per year over the past decade. When prices are high, however, consumers turn away from beans. This occurred in 2016, when consumption fell to a historic low of 2.8 million MT. Earlier this year, bean prices spiked on news of first crop losses. But they have been trending downward since then.

Based on these consumption trends and anticipating exports of 130,000 MT (mostly brown eyed beans), CONAB calculates a carryout of 298,100 MT for 2018/19.

Snapshot of Brazil’s 2019/20 Dry Bean Crops

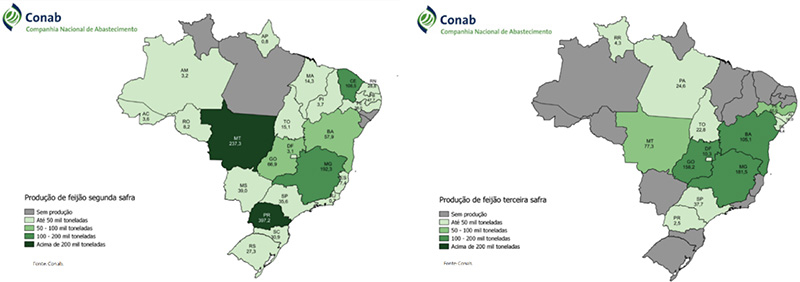

Brazil’s Dry Bean Growing Areas (2ndand 3rdcrops)

Grower Prices for Carioca and Black (Preto) Beans

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.