March 17, 2020

High corn prices and adverse weather have kept Brazil from expanding its bean area.

At Pulses 2019 in Rio de Janeiro, Eduardo Sampaio Marques, Policy Secretary at Brazil's Ministry of Agriculture, spoke about the government’s plans to boost Brazil’s dry bean production. The government’s ultimate aim, he said, is to transform the world’s top dry bean consuming nation from a traditional importer to a major exporter.

Brazil had already been exporting some dry beans, but these exports were limited to mainly brown-eyed beans. The government plan envisioned diversifying its bean export portfolio, and today, the country also exports a number of other bean types, including mung, adzuki, dark red kidney, black-eye beans and others. Even so, brown-eyed beans still account for the bulk of Brazil’s dry bean exports.

In 2019, the country exported 165,653 MT of dry beans. That’s a record high, Eduardo Balestreri of Arbaza tells GPC. He attributes the increase to the success of the government’s and exporter’s efforts to diversify bean production.

But because of high prices for the major commodity crops, the pulse sector has struggled to gain hectares for these bean types in 2019/20. Consequently, it looks like exports will remain stagnant this campaign.

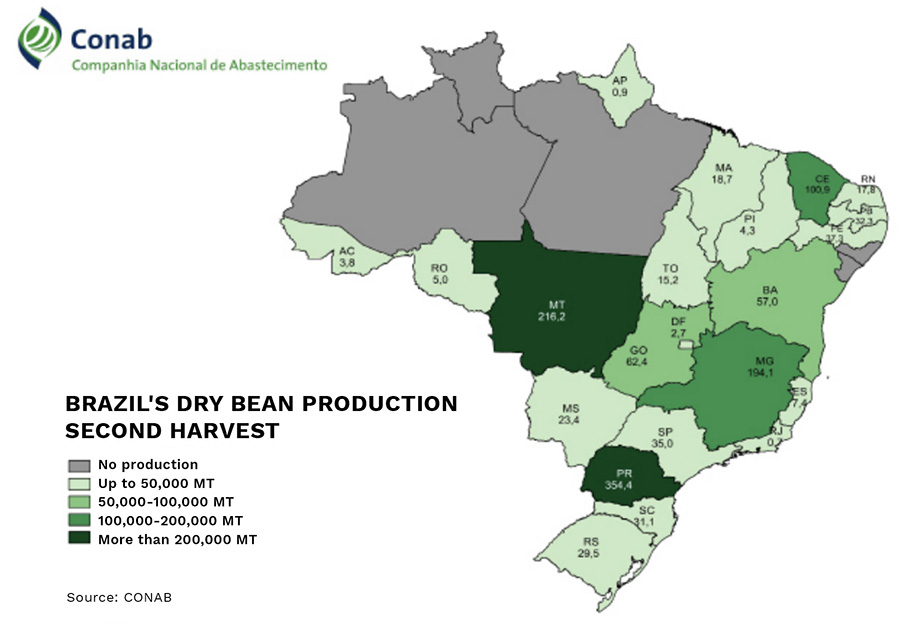

Brazil’s annual dry bean consumption is estimated at 3,050,000 MT. The carioca bean is the preferred bean of Brazilian consumers and local carioca bean production supplies the domestic market. It should be noted that carioca beans are endemic to Brazil and no other origin produces this bean type in significant volumes; therefore, external supplies are unavailable in the event of a short local crop. Brazil’s black bean production is also destined for the domestic market but must be supplemented with imports to meet local demand. Brown-eye and other bean types are destined primarily for export markets, mainly India and Pakistan.

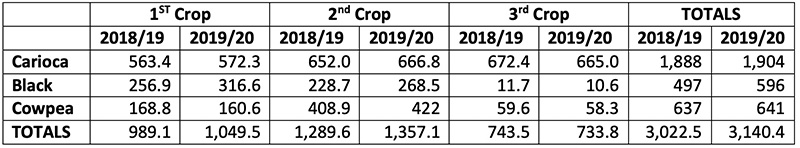

Brazil harvests three dry bean crops a year. The last of the first crop was harvested in January and CONAB, Brazil’s national supply company, pegs production at just over 1 million MT, a 6% increase over the previous first crop, which had about the same planted area but lower yields due to adverse weather conditions.

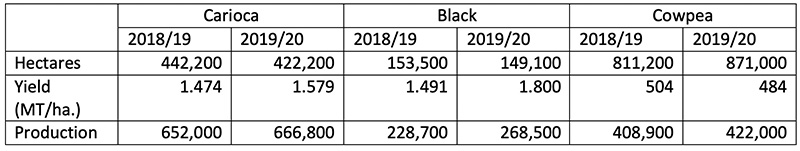

The first crop used to be the largest of the three, but in recent years dry beans have been losing planted area to better priced corn and soybeans, and growers have been discouraged by harvest rains. Consequently, the second crop, harvested mainly in May and June, is now the largest of the three. This cycle, 1,442,300 hectares were seeded to dry beans, a 2.5% increase over the previous second crop. The seeding of the third crop will also take place in the coming months and is projected at 597,800 hectares, the same as in the previous cycle. Third crop beans are seeded on irrigated lands and have seen their seeded area expand in recent years.

Source: CONAB March 2020 Harvest Report Summary.

The bulk of Brazil’s second dry bean crop is typically harvested during the months of May and June. This year, however, excess rainfall in February slowed planting and, consequently, harvest delays are certain. Several industry sources also indicate that there were significant crop losses in areas where beans for export are grown, especially in the states of Mato Grosso, Minas Gerias and Goias, as well as in parts of Bahia and Sao Paulo.

“The second crop is very important for Brazil’s dry bean exports,” says Marcelo Lüders, president of IBRAFE, Brazil’s dry bean institute. In its March harvest report, CONAB estimated second crop bean plantings at 1,442,300 hectares. But Lüders believes the area seeded to beans will not be greater than 1.3 million hectares.

Julio Mariucci of Coperaguas reports that, because of all the rain, not much of the second crop had been planted in February. In the areas where beans for export are produced, the rains caused planting delays of nearly 15 days.

“Normally new crop from the second bean harvest hits the market in mid-May. This year, it won’t be till June,” he says.

He notes, though, that corn prices are attractive at the moment due to strong demand for feed from the meat industry, which is looking to supply China and other export markets. These high prices, Mariucci says, incentivized growers to seed more corn instead of beans.

“It is precisely for this reason that Brazil is unable to expand the bean area much this year,” he sums up. “Growers are still planting in mid-March and we expect the seeded area will be about the same as last year.”

Source: CONAB March 2020 Harvest Report Summary.

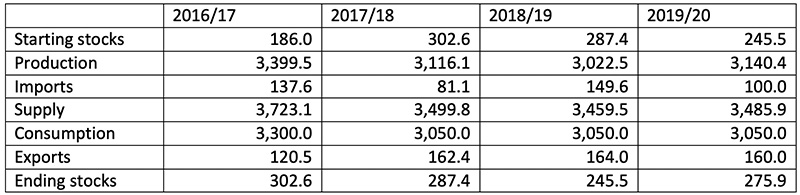

In its March crop report, CONAB projects Brazil’s overall dry bean supply at 3,485,900 MT. With consumption estimated at 3,050,000 MT, it would appear Brazil has more than enough to cover domestic demand. But timing is everything. At the moment, industry sources indicate the carioca bean market is tight.

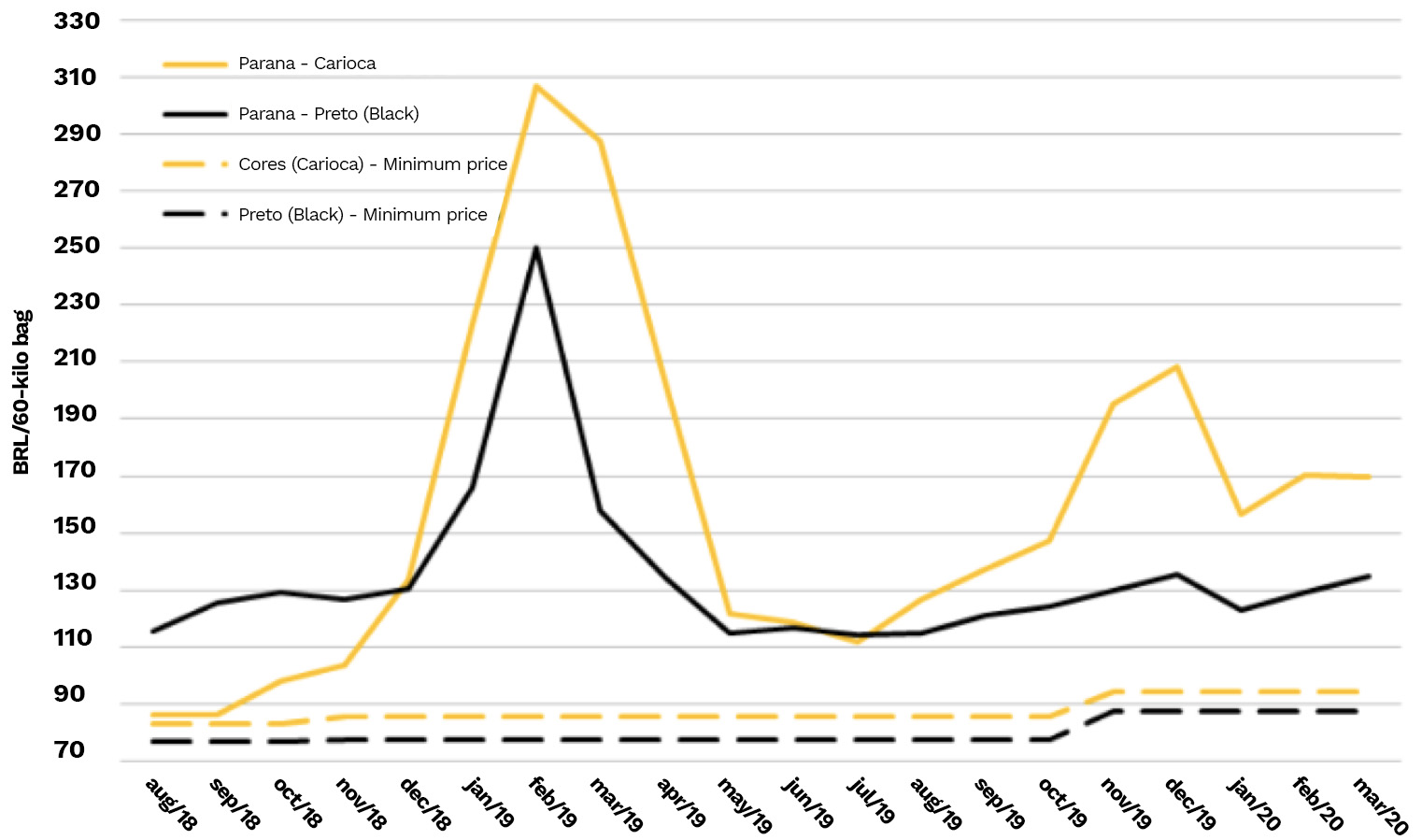

“Carioca bean prices have been trending upwards for weeks,” says Lüders. “If carioca prices are high, consumers will switch to black and other bean classes, and those prices will go up as well.”

Mariucci reports carioca prices are up 20% since the start of 2020. He attributes the increase to a smaller-than-expected first crop from Parana.

“The market will remain firm through May. Then we’ll get our second crop,” he says.

CONAB also forecasts dry bean imports of 100,000 MT. Most if not all of that will consist of black beans, mainly from Argentina.

“The black bean crop from Parana ought to keep us supplied through early June,” says Balestreri. He sees the bulk of Brazil’s black bean imports entering the country from July through August.

“The black bean area in Parana has been expanding and we now have better varieties with higher yields,” Balestreri says. “Every year we are importing less.”

“Part of the Agriculture Ministry’s dry bean plan is for Brazil to become self-sufficient in black beans by 2025,” adds Lüders. “The idea is for Brazil to eventually become a black bean exporter. Last year, the government signed a trade pact with Mexico and small quantities of Brazilian black beans were exported to Venezuela.”

In terms of bean exports, CONAB projects a slightly smaller volume than the previous campaign. As Mariucci sees it, the volume of brown-eye bean exports will be similar to last year, but plans to diversify bean exports will likely go unfulfilled because other bean types will be unable to compete against corn.

“Brazil will have beans to export, but prices will be firm,” he says. “Of course, there is the impact of the coronavirus pandemic, but we expect strong demand from China once the situation normalizes, and from India, too. We are already fielding inquiries about new crop, and buyers from India are interested in signing contracts now to lock in prices.”

Brazil may not see growth in bean exports this year, but the industry is optimistic about the future. Embrapa, a public company dedicated to agricultural research, is investing in new seed varieties that will boost yields and make bean crops more profitable to growers, says Balestreri.

“Brazil is competitive in other agricultural products and it can be in beans, too,” says Lüders. “When you consider the trend we are seeing with plant protein, it is only natural that Brazil should play a bigger role. On top of that, China is focusing on other commodities and seeding fewer and fewer beans. That leaves us with a lot of opportunities in the region.”

Source: CONAB March 2020 Harvest Report Summary.

Source: CONAB bean market report, March 6, 2020.

From June 17 to 19, IBRAFE is hosting the eighth Brazil Forum on Pulses and Special Crops in Cuiabá, Mato Grosso, the state that produces the most dry beans, sesame seeds and peanuts for export. Around 500 people from more than 60 industries are expected, including researchers, producers, exporters and packagers, making this the biggest event for the pulses and special crops industries in South America. For more information, visit IBRAFE’s website.

For more information, visit IBRAFE’s website. To register, visit: https://www.forumdofeijao.com.br/en/inscricao/.

Source: CONAB February 2020 Harvest Report.

Brazil / mung beans / adzuki beans / dark red kidney beans / black-eye beans / brown-eye beans / Eduardo Balestreri / Marcelo Lüders / Julio Mariucci

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.