July 17, 2019

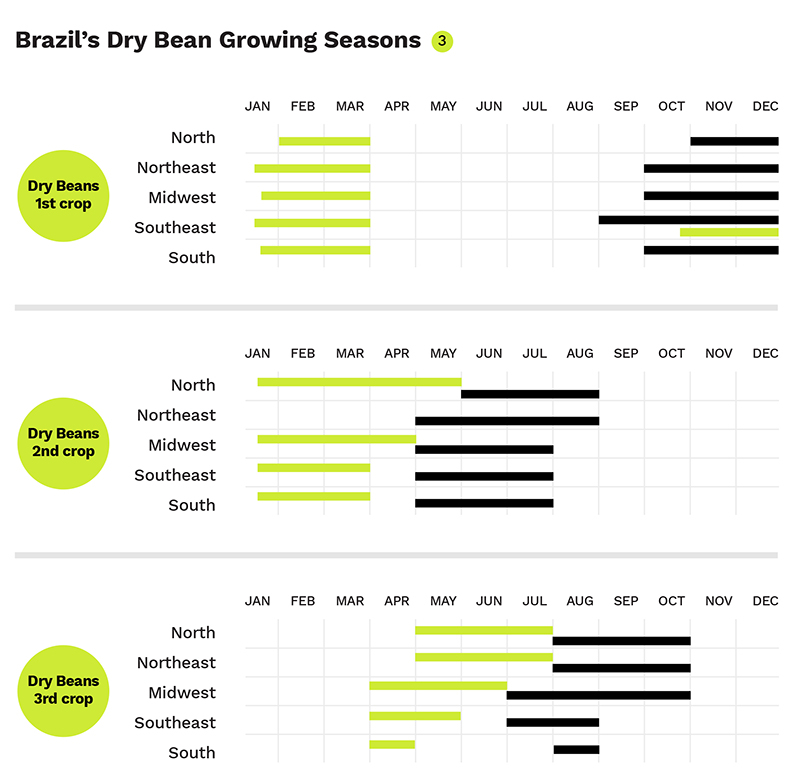

Planting of the third and final crop of the 2018/19 cycle wrapped up in mid-July.

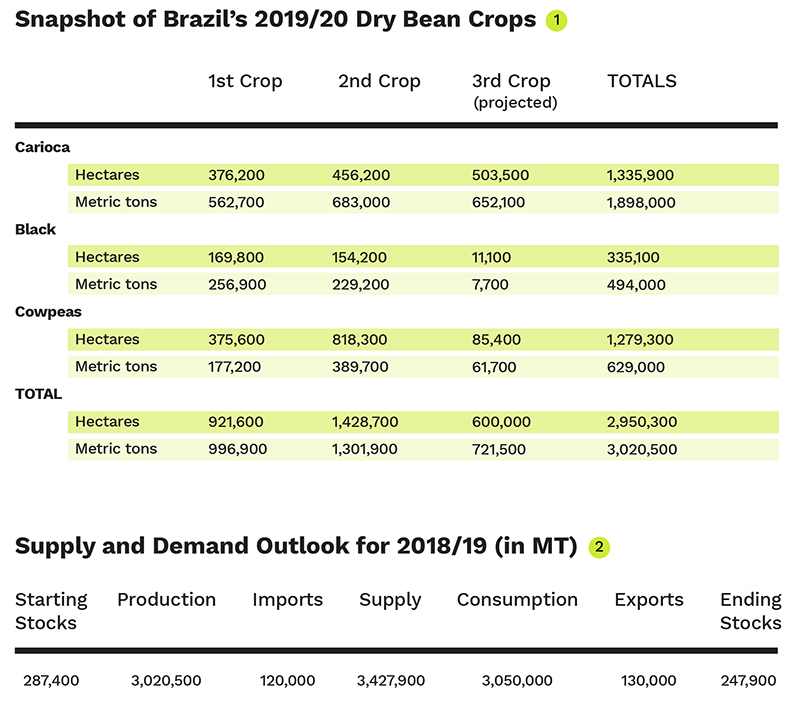

In its July crop report, CONAB (Brazil’s National Supply Company) reported that the planting of the country’s third dry bean crop, the last of the 2018/19 cycle, was completed by mid-month. The planted area is estimated at 600,000 hectares, up 4% from last year, with the following breakdown by class (with comparison to the third crop of 2017/18): 503,500 hectares of carioca beans (+2%); 11,100 hectares of black beans (-35%); and 85,400 hectares of cowpeas (+9%).

It should be noted, however, that IBRAFE, Brazil’s pulse industry association, takes issue with CONAB’s seeded area estimate for carioca beans. The feeling in the industry is that fewer cariocas were planted, especially in Bahia.

The harvest of the second crop, meanwhile, is wrapping up. Production is estimated at 721,500 MT, up 7% from last year, with the following breakdown by class (with comparison to the second crop of 2017/18): 683,000 MT of carioca beans (+43%); 229,200 MT of black beans (+27%); and 389,700 MT of cowpeas (-30%).

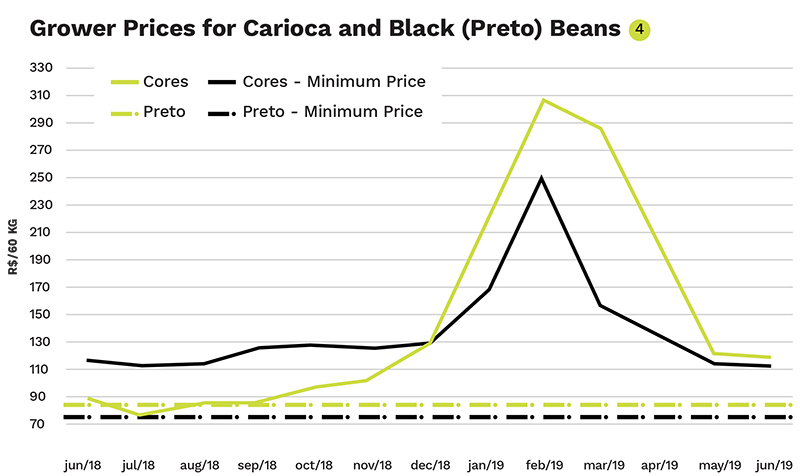

The first crop, harvested in the first quarter of the year, produced 23% fewer beans than last year due to losses from adverse weather. The carioca crop was especially hard hit, with production down 30% compared to the first bean harvest of 2017/18. The reduced supply of carioca beans led to a spike in prices in the early months of the year. Since then, prices have been trending downward and returning to previous levels.

With the second and third crops making up for the losses of the first crop, CONAB projects overall 2018/19 carioca bean production to be up 3% over the previous cycle. Overall black bean production is forecast to see a 1% increase. Cowpea production, on the other hand, is expected to drop off by 20%.

Brazil’s carioca and black bean crops are destined almost exclusively for internal markets. In the case of cowpeas, about 35% of the crop is typically exported. This year, however, due to reduced production, IBRAFE projects 30% of the crop will be exported.

Supply and Demand

CONAB forecasts Brazil’s total dry bean supply for 2018/19 at 3.4 million MT, comprised of domestic production (3 million MT), imports (120,000 MT of mostly black beans) and carry-in (Brazil had ample supplies heading into the 2018/19 cycle).

Brazil’s annual dry bean consumption has tended to vary between 3.3 and 3.6 million MT over the past decade. Based on these consumption trends and anticipating exports of 130,000 MT (mostly brown-eyed beans), CONAB calculates a carryout of 247,900 MT for 2018/19.

In mid-July, IBRAFE reported the following grower prices: carioca beans at US$ 640/MT; brown-eyed beans at US$ 480/MT; and cowpeas at US$ 510/MT.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.