August 19, 2019

Harvest of second crop is wrapping up; third and final crop is in the ground.

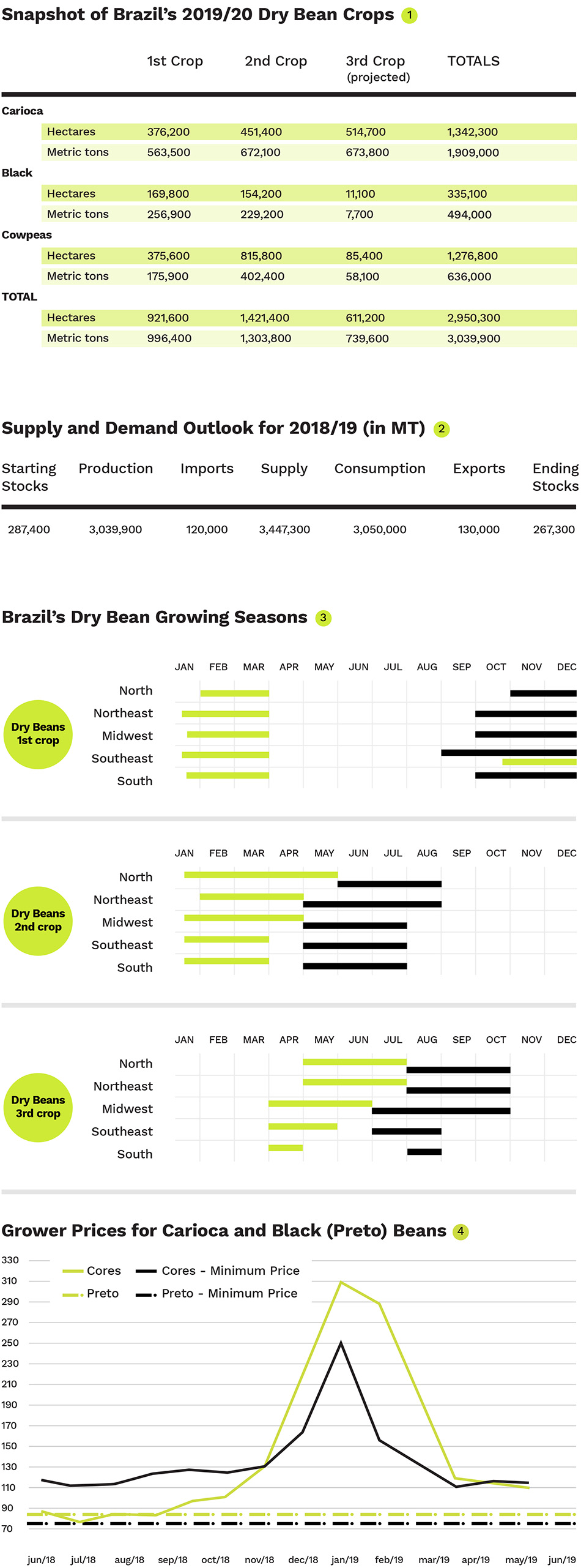

In its August crop report, CONAB (Brazil’s National Supply Company) reports that Brazil’s second dry bean crop is wrapping up and estimates production at 1.3 million MT, a 7% increase over the second crop of 2017/18. The third and last crop was planted in mid-July and is projected to produce an additional 739,600 MT of dry beans, a 22% increase over last year’s third crop. The greater production of these two crops will offset the crop losses of the first dry bean crop, which was harvested in March and was 23% smaller than the first crop of the previous year due to weather issues.

Compared to last cycle, Brazil’s overall dry bean production is down 2% in 2018/19. The decrease is due to a 19% drop off in cowpea production. Carioca bean production is up 4% and black bean production is up 1% from 2017/18.

Second dry bean crop production is estimated to be 7% greater than last year, with a 41% increase in carioca bean production, a 27% increase in black bean production and a 28% decrease in cowpea production.

Third crop plantings are estimated to be up 6% compared to last year. The biggest increase is in cowpeas, up 9%. The carioca bean area is estimated to be up 4%. Black bean plantings are estimated to be down 35%.

It should be noted that IBRAFE, Brazil’s pulse industry association, takes issue with CONAB’s overall seeded area estimate for carioca beans. The feeling in the industry is that fewer cariocas were planted, especially in Bahia.

Brazil’s carioca and black bean crops are destined almost exclusively for internal markets. About 35% of the cowpea crop is typically exported. This year, however, due to reduced production, IBRAFE projects 30% of the crop will be exported.

CONAB forecasts Brazil’s total dry bean supply for 2018/19 at 3.4 million MT. Dry bean consumption is estimated at 3,050,000 MT. Its August production projection is 3,039,900 MT, revised upward from its July projection by nearly 20,000 MT. Consequently, the August carryout projection increased by the same amount to 267,300 MT. Imports are estimated at 120,000 MT. Black beans comprise most of Brazil’s dry bean imports.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.