January 23, 2020

Fewer hectares were seeded to pulses due to reduced export opportunities.

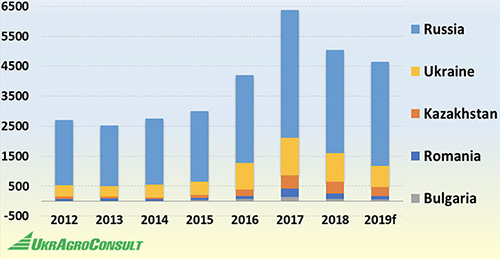

This marketing year was the second consecutive cycle to see a drop off in Black Sea pulse production since the region’s record crop of 2017. The decrease is due mainly to India’s restrictions on pulse imports.

At the same time, however, the Black Sea region maintains its competitive advantage (low production costs) in global pulse markets. Experts estimate the costs of producing one metric ton of pulses in the region are $30 to $40 lower than in the EU, North America and Australia. However, the pace of market growth is limited by marketing issues and the lack of diversity.

Below, we take a closer look at the region’s major pulse-producing countries.

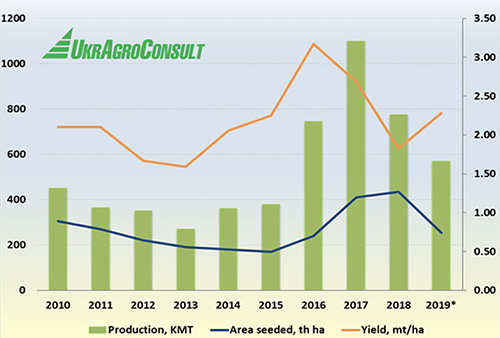

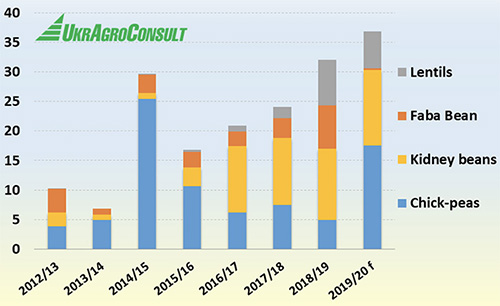

In 2019, the planted area and the production of pulses in Ukraine fell by 38.1% and 25.9%, respectively from the prior year. The biggest decreases were in the major pulse crops, namely chickpeas, lentils and yellow peas.

UkrAgroConsult estimation

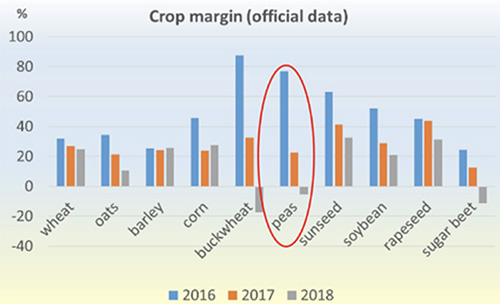

In 2017/18, the profitability of pulse crops decreased. For example, according to the State Statistics Service of Ukraine, the profitability of pea cultivation (the main pulse crop in the country) was negative in 2018.

This phenomenon can be attributed to such short-term factors like the spike in seed prices, plant protection products and fuel, which are mainly imported. Moreover, the foreign currency exchange rate had a negative impact.

Since 2018, pea production has been declining. The export potential of the record harvest in 2017 was never fully realized and the share of the crop that remained in the country at the end of the campaign was excessively high: 63% remained for domestic consumption.

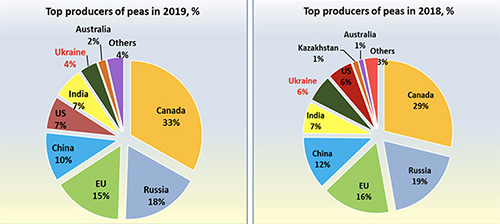

In 2019, Ukraine's share of world pea production fell to 4% compared to 6% in 2018. Together with Russia and Kazakhstan, the region’s total share decreased from 26% to 22%.

On January 1, 2017, the Association Agreement between the Ukraine and the EU went into force and resulted in increased exports of Ukrainian peas into Europe. But this only partially offset the decrease in exports to India.

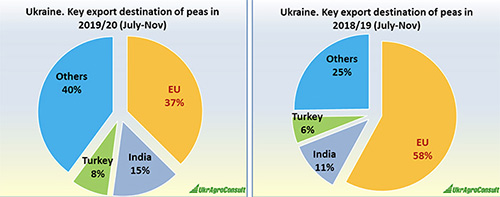

To date, the EU remains the main importer of peas and other pulses from Ukraine. In MY 2018/19, the EU’s share of Ukrainian pea exports hit 60%. However, from July to November, the volume for MY 2019/20 dropped to 37% from 58% for the same period the previous cycle.

At the same time, despite the import restrictions, shipments to India intensified again. In MY 2019/20, India’s share of Ukrainian pea exports grew slowly to 15%, up from 11% in MY 2018/19.

Overall, in MY 2019/20 (July through November), Ukraine’s total pea exports fell by 23% to 283,220 MT compared to the same period the previous MY. Even so, despite lower production, exports of lentils, chickpeas and kidney beans will end up higher in 2019/20.

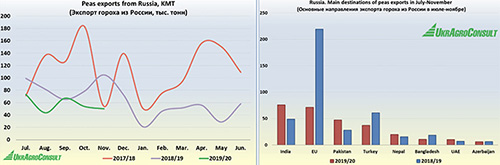

In Russia, the pace of pea exports is the slowest it has been in the past six years. For MY 2019/20 (July through November), Russia exported 288,500 MT of peas, down 33% from the same period the previous MY (430,000 MT).

In the current campaign, exports to the EU have declined drastically. The EU’s share of Russia’s pea exports decreased from 51% to 25%, and the export volume fell by 68% to 71,200 MT.

In November, India became the top importer of Russian peas. Exports to this destination grew by 55% year-on-year to 75,600 MT. Other destinations that saw significantly increased shipments were the UAE (10,200 MT, up 46%), Pakistan (47,100 MT, up 69%) and Nepal (19,800 MT, up 29%).

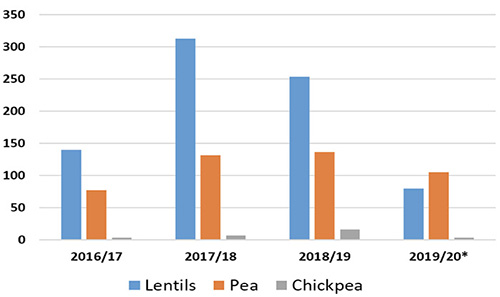

Having had a strong showing in Black Sea pulse markets from 2016 to 2018, Kazakhstan reduced production of its top pulse export crops, lentils and peas, in 2019/20.

UkrAgroConsult estimation

Just like Russia and Ukraine, Kazakhstan cut back on pulse plantings in 2019 under the assumption of reduced export opportunities. Lentil seedings fell by 68.7% and pea plantings by 21% compared to 2018.

Export opportunities were severely curtailed due to:

In 2017, 74% of the lentil crop was exported. In 2018, 62% of the pea crop was exported. In 2019, export share of the crop was more balanced, at 53-55% of production.

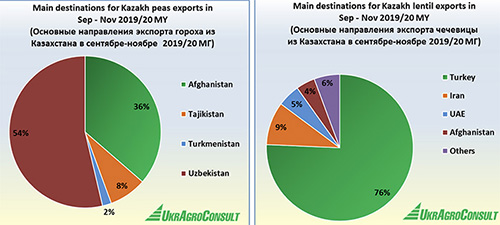

In MY 2019/20 (September through November), pea exports fell by 12% year-on-year to 17,800 MT. The only visible improvement was seen in Uzbekistan, the main buyer, which increased its take by 20% year-on-year to 9,500 MT.

Lentil exports in 2019/20 grew by 21% year-on-year to 40,260 MT, with more active demand from the major importer, Türkiye (30,500 MT, up 25% compared to MY 2018/19 (September through November)).

To sum up, in MY 2019/20, the Black Sea pulse sector is seeing:

Sergey Feofilov / UkrAgroConsult / Ukraine / Russia / Kazakhstan / peas / lentils / chickpeas / lupins

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.