September 7, 2021

On August 27 2021, the IPGA held their Kharif Sowing 2021 Knowledge Series, an online webinar featuring key speakers from India’s pulse industry who gave important insights into the 2021/22 kharif crop. The GPC attended the webinar and is providing full coverage for all members. Find the 2021 Sowing and Acreage outlook here.

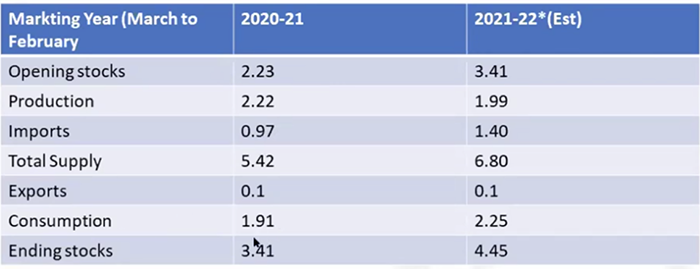

In the Urad session, Mr B Krishna Murthy, Managing Director at Four P International, gave important insights into the urad crop as well as stocks and consumption figures. He cited the Ministry of Agriculture and Farmers Welfare as his source for most of the numbers.

Consumption

In this session, Mr. Punit Bachhawat Managing Director Prakash Agro Mills, shared his insights into the mung bean scenario and consumption patterns in India and the sowing analysis for kharif 2021/22.

Source: IPGA Knowledge Series

In this session, Mr. Nitin Kalantri, CEO of Kalantri Food Products, shared his insights into the tur crop for kharif 2021/22.