December 13, 2021

Madaline Dunn spoke to Nick Goddard, CEO of Pulse Australia, to learn more about the upcoming Australian harvest, the industry's resiliency and his projections for pulses looking forward.

I'm the CEO of Pulse Australia, which represents the whole value chain, supporting growers at one end, all the way through to traders, exports and processors on the other end. I've been in the food industry for most of my life, working in food marketing, corporate relations and government relations, largely with Unilever. I feel like that's given me a good appreciation for the importance of the value chain and the way the consumer influences the supply chain. For example, if we look at sustainability as a theme that's been driven by consumers, you can see how that's been passed down the value chain, from food manufacturers and processors, all the way down back to the farm gate.

Consumers really rule the roost when it comes to food. Pulses are a great example of that. If a pulse product doesn't come up to scratch in the Indian marketplace because of appearance, or taste, it's completely rejected by consumers. That's then fed back to the breeders pretty quickly. Pulses are one of the few foods that are eaten pretty much as they are coming off the farm. So whether that's daal, where the lentils are cooked, eaten as is, or lightly processed pulses, which are turned into a flour - it's all pretty direct from farm to plate - other agricultural products go through quite a lot of processing before they become a food product.

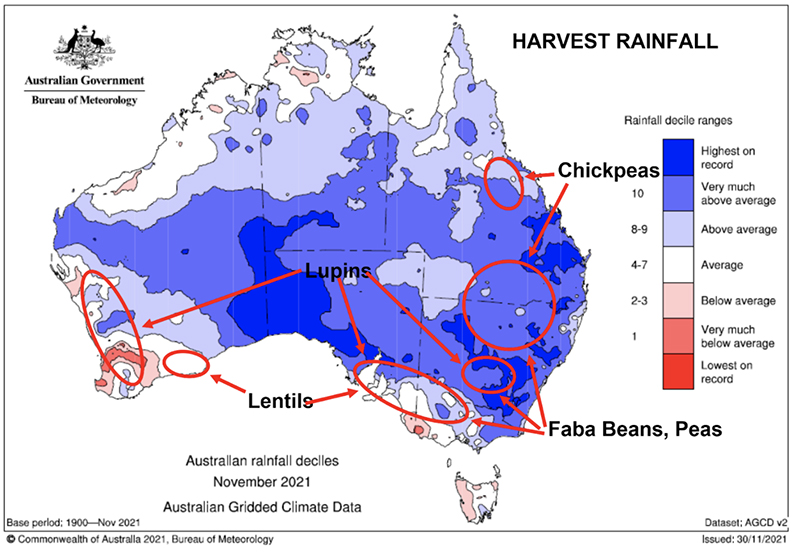

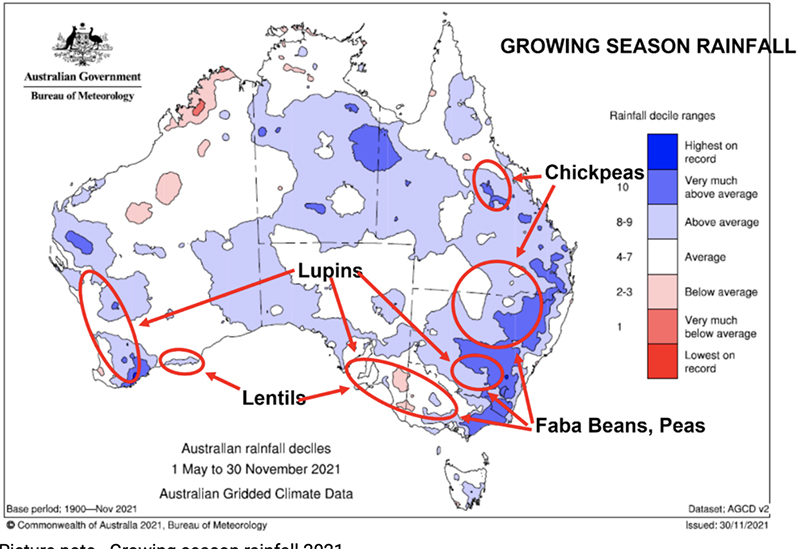

Yes, in recent years, we've been hit by droughts, which has been really tough for Australian growers because the majority of the winter crop is not irrigated, so we rely heavily on rainfall, and there's also been a huge increase in the number of mice. So, dealing with the mice plague over the last 12-18 months has really put a strain on things. There were absolute plague proportions. Fortunately, this season has been much wetter and cooler, which has helped deal with the problem. The mice situation has pretty much disappeared now, and the crops have come through very well.

Certainly, there have been some areas in states like New South Wales that have had a lot of rainfall - to the extent that there's been some flooding. Some crops have been lost, but by and large, the majority of the pulses have come through pretty well.

Just looking at it state by state, regarding chickpeas, for example, northern and central Queensland has been quite dry, even though the drought has broken, it's not back to its usual sort of levels. Yet, the chickpea harvest there has been pretty good. As we move further south, there has also been a good harvest for chickpeas. But, as we cross the border into New South Wales, that's when the rain started to hit, affecting fava bean and chickpea production. We'd expect a bit of loss of chickpea crops, but they're still coming pretty well. So, overall the total chickpea production before we started to have the impact of the rain was probably around 750-800,000 tons, but it could be coming back to around 700,000 tons this year.

As we move further south through New South Wales, we start to pick up some of the other pulses, so peas, lupins and fava beans continue. For fava beans, we're looking at production of around 400,000-450,000 tons. The price of fava beans is fairly depressed but, nonetheless, there's a good market for them. We've got a pulse fractionation plant in Australia that takes fava beans; the Middle East is obviously a key market for us, too and increasingly, the aquafeed market is a good, strong market for fava beans. The production has held up pretty well, especially in those southern states.

Moving into Victoria and South Australia, we get into lentil country. In those states, we're talking lentils and fava beans. They've had an excellent year, the 'goldilocks' kind of rainfall - so, not too heavy, not too light, it's just been right, with great temperatures throughout the growing season. As a result, we're expecting some good numbers for lentils out of those states, and production numbers could be as high as 600,000 tons. That said, regarding overall pulse production, the reason why it's not any greater, despite it being a great season, is because a lot of the winter growing area has been given to canola (or rapeseed) this year because of the higher prices canola attracts. So, we've seen a shift from wheat, barley and pulses. Overall, it's been a very good year for Australian farmers.

The seasonal conditions have certainly been challenging, but it's in the growers' mindset to be able to deal with that. I think they would probably agree that they'd rather have more rain than less because even if they can't get the ideal crop this year, the moisture will stay in the soil for next year. Or, in certain parts of the country, when they have a summer cropping program, they can use the moisture for that. There's a saying we have here, "there's money in mud," so, as devastating as floods are, they do recharge soil moisture and can carry crops through for almost two years sometimes. It's definitely been a challenging time for Australian farmers, but they are made tough.

So, although we're seeing great production, the one challenge is being able to export the pulses. Australia is a net exporter of all its grains, and pulses in particular dominate through the container trade but the challenges with container trade at the moment have deadened enthusiasm. It's made it very difficult to execute deals. Growers have a lot of stock coming off the fields but traders are reluctant to commit to large volumes because of the uncertainty around securing sufficient export containers.

We've seen more and more bulk shipments of pulses go out from last year's harvest - more than we've ever seen, and we expect to see the same this year.

We're starting to see more bulk lentils and bulk fava beans because the bulk shipments are providing more assurance than waiting and hoping that containers will come through.

The container bottleneck is a real challenge for us, and we're starting to see the impact. We expect to see Australian production held in storage this year and bled out in the coming 12 months as shipping becomes more available.

I would say at least a year. The indications are that vessels are actually being removed out of service and, with that, huge amounts of containers have been removed. So, if supply is restricted, that's a great opportunity to put the price up, and that's what the shipping companies are realizing: that by restricting the supply of vessels and containers, they can charge more and make more money. Of course, the unfortunate part of this for commodities like pulses is that the value equation means that they tend to get relegated to the bottom of the pecking order.

The Australian government has launched an inquiry into this and identified that the grains industry is one of the industries that is suffering because grains often get bumped off the shipping schedule in favour of higher-value goods, which is very disappointing.

As we look down the track, the future is certainly very bright. We've got our core markets in the Indian subcontinent and the Middle East for the pulses we grow - but when we look at the global trend in plant protein consumption, we are well placed to capitalize on that. We're seeing increased investment by Australian processors into fractionation plants, and we're seeing new investment in this area by other players. You can definitely see the opportunity and potential.

One of the things that differentiates Australia on the world market is the clean, green aspect of Australian production. We provide a sustainability certification. So, our pulses can be traded under the International Sustainability and Carbon Certification (ISCC), meaning farmers who grow pulses can elect to have their farms certified and that enables those pulses to be traded as certified sustainable agricultural inputs to those large multinationals that are starting to change their sourcing arrangements.

One of the initiatives that the Australian grains industry created is Sustainable Grain Australia, and that's how the ISCC certification scheme is implemented at a farm level. It provides a common certification scheme across all farms. It's integrated with the majority of traders, so we're seeing canola, wheat, barley, oats, and pulses being traded under the Sustainable Grain Australia banner, which I think is a great move forward. It puts Australian farmers at the top of the global rankings regarding sustainability credentials.

The plant-based protein market is growing strong. We have a large meat analogue producer supplying some of the burger chains with these products but, at the moment, a lot of that is based on soy, and there's an opportunity for pulses to really step in there. Fortunately, the company I mentioned is exploring the opportunity for pulses there, and we're well-placed with the peas and fava beans we grow as sources for protein in this market. So, consumers are both increasing their consumption of whole grains, eg. lentils in bolognese or chickpeas in salads, but there's also the shift to plant protein and the value-adding that we're seeing from that.

Harvest rainfall 2021

Growing season rainfall 2021

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.