May 5, 2020

The CEO of a leading brokerage firm dealing in pulses from the Black Sea region weighs in on what to expect in 2020-21.

The highly contagious coronavirus has spread quickly across the continents and thrown supply chains out of whack. On the seas, the pandemic has led to an increase in blank sailings, thereby disrupting container rotations and causing cargoes to back up at ports. On land, truckers are encountering closed depots and delays at border crossings and checkpoints as countries implement national lockdowns. Farmers and processing plants are experiencing labor shortages. And some policymakers are banning exports to ensure food security at home.

In a warning delivered before the UN Security Council, World Food Programme Executive Director David Beasley said that supply chain breakdowns could see the number of people on the brink of starvation nearly double to 265 million. Similarly, the World Trade Organization’s Committee on Agriculture issued a statement in favor of keeping supply chains flowing and opposing any restrictions on trade, declaring that the world food supply is “more than adequate to meet the anticipated demand.”

With demand for pulses spiking in several markets as people stock up on nutritious, non-perishable foods for extended lockdowns, those in the trade look around the globe with hopeful expectation for harvests yet to come. The countries of the Black Sea region are presently planting their pulse crops and their harvests in July and August will be among the next big influx of new crop into the export pipeline.

To discuss pulse production in the Black Sea region and the impact of the pandemic on supply chains, the GPC reached out to Denis Plenkin of Agropa Trading, a leading brokerage company specializing in food commodities, especially pulses, from the Black Sea region. As a regular contributor of market research to Thompson Reuters, Agropa Trading is also a trusted source for agricultural information.

Denis: Since my childhood, I was always thinking about how to help people all over the world tackle one of the biggest problems that we face, and that is world hunger. When I graduated with a degree in economic and mathematics, I knew that I wanted an office job that would allow me to interact with people and travel all over the world. Then, the more I learned about pulses, including, but not limited to, how they support the sustainable use of land, water and natural resources, as well as their contributions to the preservation of the environment, the more I became interested in working with them. This led me to discover that there are only a limited number of pulse professionals, and that these professionals will be increasingly valuable in the future.

Denis: The thing I enjoy most is interacting with people and feeling that sense of accomplishment that comes from brokering a successful trade deal. Nothing makes me happier than receiving positive comments from my suppliers and buyers.

Honestly, I love what I do. I am happy when I’m in the office, working alongside employees who have the same goals and ideas, all of us striving together for the company’s success.

And as a market forecaster, there is the special feeling of seeing things turn out like you predicted they would.

Denis: Agropa Trading is an independent brokerage company specializing in agricultural commodities. We cover a broad range of agricultural raw materials and by-products. With our highly experienced staff, we work with all the major agricultural markets.

Our main focus is the commodity origination in the Black Sea region and exports into Türkiye, the Mediterranean Sea, the Caspian Sea, Europe, the Persian Gulf and Asia. We deal with cereals, oilseeds, oils, pulses, feedstuff, coriander and sugar. Agropa Trading is a leading brokerage company for pulses from the Black Sea.

Additionally, we contribute market research to Thompson Reuters. We cover both bulk and container markets.

Denis: Pulses are exceptional crops that can significantly contribute to more sustainable agriculture in a variety of ways. For example, pulses use water efficiently, which is beneficial for subsequent crops grown in the rotation in the same field. The water used to produce one kilogram of animal-sourced protein-rich food is hundreds of times higher than the water necessary to produce one kilogram of pulses. Many pulses are drought-resistant and are suitable for arid climates and drought-vulnerable areas.

Pulses also have a favorable impact on soil organisms, increasing their number, diversity, and activity while minimizing weeds, pests and disease agents. Another feature relevant to sustainable agriculture is the biological capacity of most pulse species to fix nitrogen. Some of them also help to increase the availability of phosphorus in soils for companion crops grown in the same field and at the same time (inter-cropping) or for subsequent crops grown in rotation, thus naturally providing two fertilizers.

By producing a smaller carbon footprint and by reducing the need for fertilizers in subsequent and/or companion crops, pulses are an important factor in climate-change mitigation and their importance is likely to further increase.

Additionally, pulses provide income for farm families and nutrition for the hungry and malnourished. Greater integration of pulse crops into farming systems can contribute to food and nutritional security and natural resource integrity. Besides, there is greater stress on vegetable proteins nowadays.

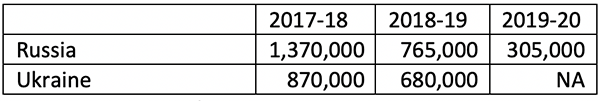

Denis: There is a significant decline in yellow pea exports from Russia and Ukraine. This decline is caused by decrease in the seeded area, as farmers are replacing peas with other crops, such as soybeans and wheat. At the same time, the domestic demand is growing. The feed market is taking more and more yellow peas because of their high protein content and low price. In Russia, the feed market consumes about 150,000 MT of pulses per month.

Denis: Dry conditions in Russia and Ukraine could affect the size of the crop and its quality. To give you a sense of how severe the situation is, rainfall in Krasnodar, the top wheat growing area in Russia, amounted to only 1 mm during the first three weeks of April. The norm is 50 mm. But even before then, Russia didn’t get enough snow this winter. Snow accounts for about 40% of annual moisture for crops.

Denis: Russia’s entry ban on foreigners and restrictions on movement within the country might result in a labor shortage for seasonal agricultural work.

This is not only an issue for Russia and Ukraine. In the U.S., many farmers depend on migrant laborers from Mexico, and in Western Europe, there are concerns that workers from Eastern Europe will not be able to cross over come harvest time.

Besides the labor shortage, we have heard about problems trucking cargo and inputs, like fertilizer and seeds, between the regions of Russia. The difficulties are caused by the requirement of a permit to leave one’s home and enter the public space, of which roads are a part. A newspaper quoted a source from a large agricultural holding in Krasnodar explaining that legal entities are only given a limited number of permits, meaning that only a limited number of employees are authorized to work.

Denis: Well, first of all there is the currency exchange rate. The pandemic and crude oil war between Saudi Arabia and Russia pushed prices to historical lows. The May contract price for a barrel of crude oil dropped to an unprecedented negative $37.63. The Russian ruble and the Ukrainian hryvnia have lost value to the U.S. dollar, and this allowed suppliers to conclude plenty of sales contracts with buyers abroad. Now the challenge is the execution. The currency of the buyers lost value to the U.S. dollar, too, which may result in defaults.

Secondly, there is the issue of container shortages, as reported by many of our suppliers in Russia and Ukraine. This was caused by the logistics issues in China, the subsequent increase in freight costs and some vessel cancelations, mainly because of the container shortage. We don’t expect this situation to improve as long as the COVID-19 pandemic persists.

Let me just say that every year brings new challenges for market players. This year the biggest challenge is COVID-19. The next biggest challenge is India, with consignments of peas stuck in ports. There are 250,000 MT of green and yellow peas, imported mainly from Australia and Russia, sitting in Indian ports without custom clearance since last November. Will the buyers receive permission to release the goods? Will the shipping lines give them a discount on demurrage and detention? Will port storage give them a discount for its services? Or will all these expenses exceed the cost of the cargo?

The same questions apply to sellers who haven’t received payment from their buyers. It wouldn’t surprise me if we see many importers and exporters go bankrupt.

Denis: Smithfield Foods, the world’s biggest pork processor, said on April 12 that it is shutting down a U.S. plant indefinitely due to a rash of coronavirus cases among employees, and warned that the country was moving “perilously close to the edge” in terms of supplies for grocers.

Slaughterhouse shutdowns are disrupting the U.S. food supply chain, crimping availability of meat at retail stores and leaving farmers without outlets for their livestock.

Other major U.S. meat and poultry processors, including Tyson Foods and Cargill have already idled plants in other states. JBS USA said on April 20 that it was indefinitely shutting down a hog slaughterhouse that produces about 5% of all U.S. pork.

These shutdowns are resulting in meat shortages at markets, and we could see prices rise in the near future. It is not surprising, then, that people are taking a fresh look at pulses.

Denis: The UN forecasts that by 2050, the world’s population will exceed 9 billion people. Demographers are predicting hunger. For a significant part of the world’s rural population, pulses have become an affordable source of protein and minerals. More and more, we see people cutting back on meat consumption for a variety of reasons, including environmental, health and animal welfare concerns.

At the same time, there are these startups looking to completely remake meat production, and they are attracting millions of dollars from well-known investors.

I’m confident that pulses are the future of a healthy human diet.

Denis: Be open minded, flexible and don’t be afraid to take risks. For example, when I was offered a position in a Dubai brokerage company that I had worked for previously, I didn’t dwell on it for more than a second. I packed up and moved to Dubai. I was 24 years old at the time.

Source: Agropa Trading

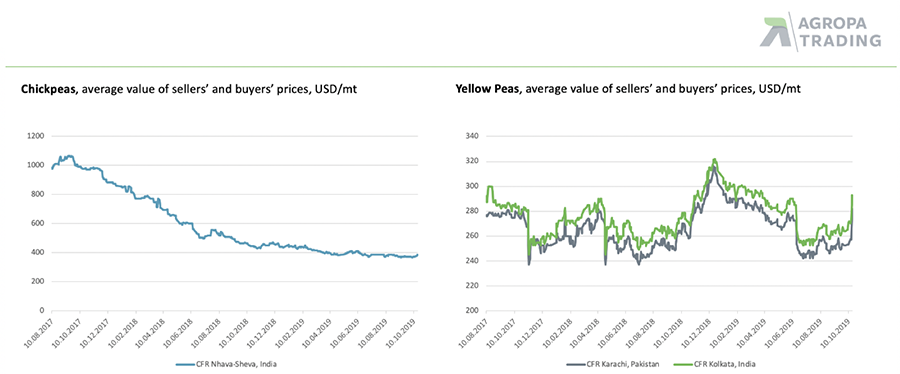

Caption: Prices are valid for the payment against copies of documents

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.