August 4, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Burma

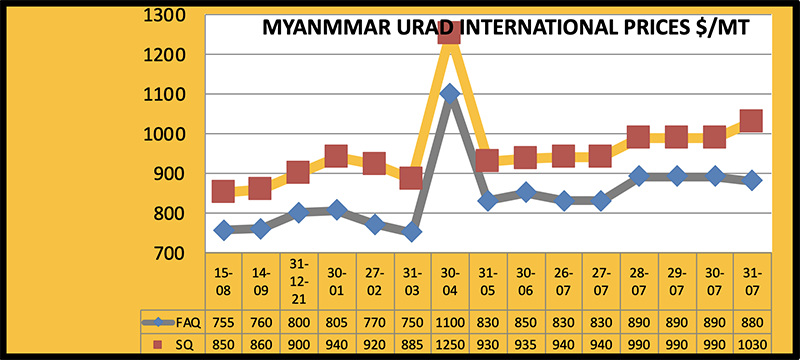

Burma urad FAQs rose by $60 and SQ by $50 a tonne on increased demand from Indian importers, and traded at $890/ton and $990/ton, respectively.

Mumbai

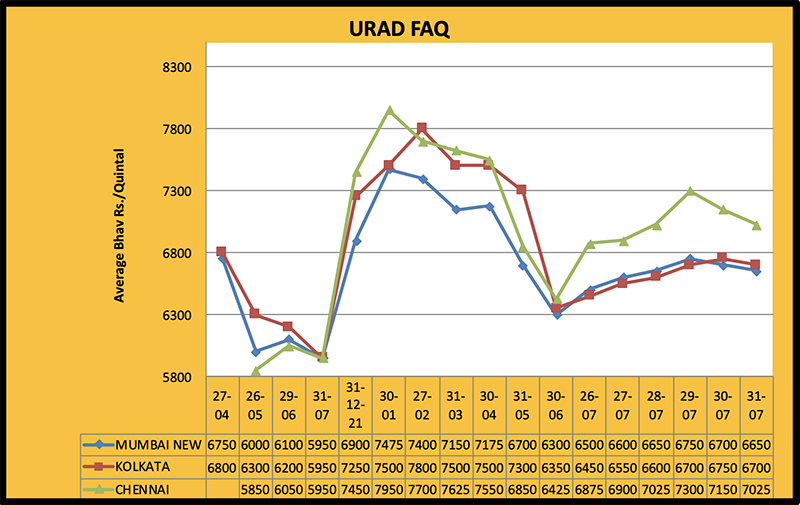

Urad remained bullish during the week due to continued demand from stockists. Due to increased domestic demand, Mumbai urad prices increased by Rs. 300-325 per quintal and Chennai urad FAQ by Rs. 300 and SQ by Rs. 400-450 per quintal. With this increase, Mumbai urad traded at Rs. 6,650-6,750 and Chennai FAQ Rs. 6,600 and SQ touched Rs. 7,700 per quintal. Similarly, Kolkata urad surged by Rs. 350 per quintal to Rs. 6,750 per quintal.

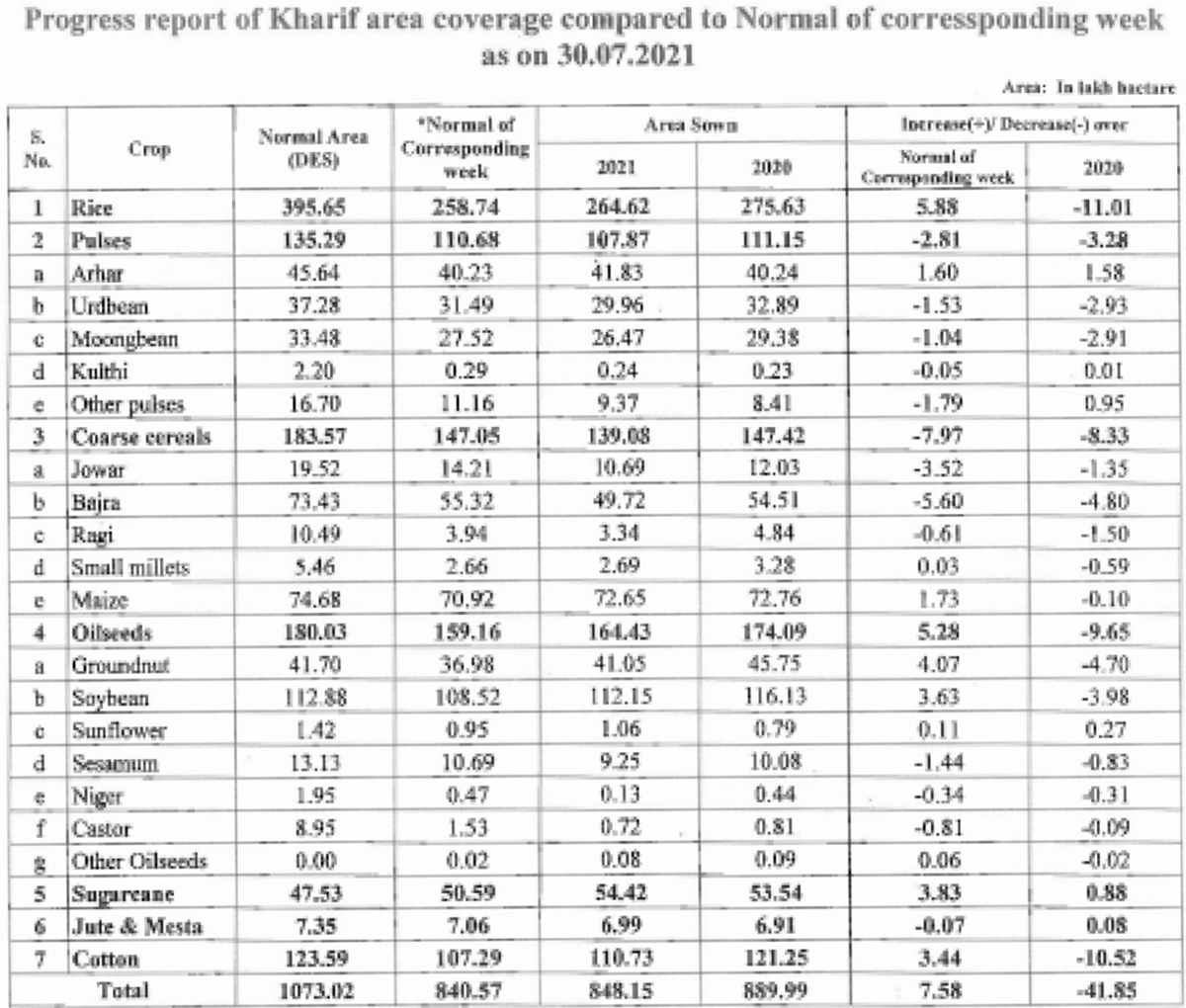

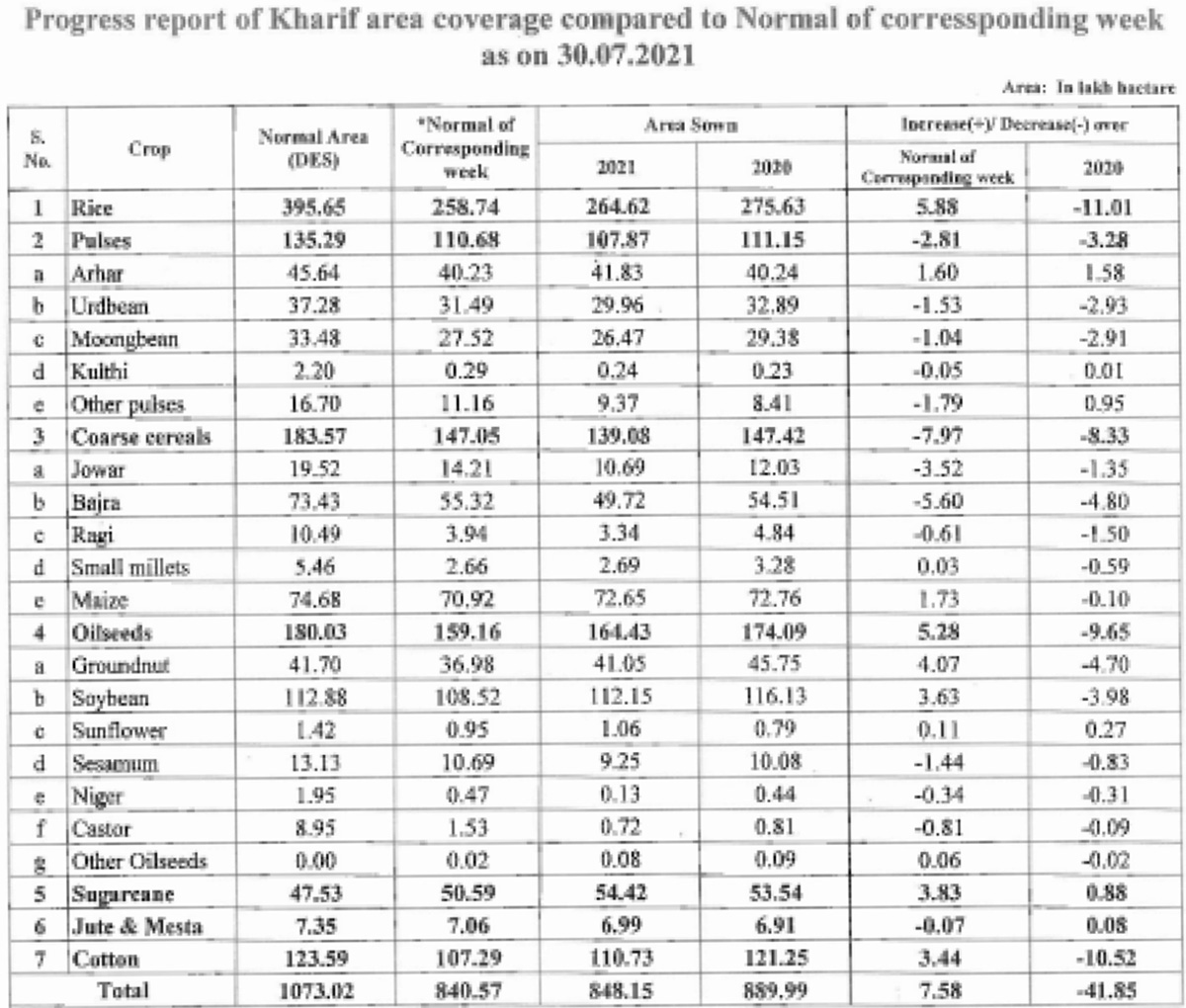

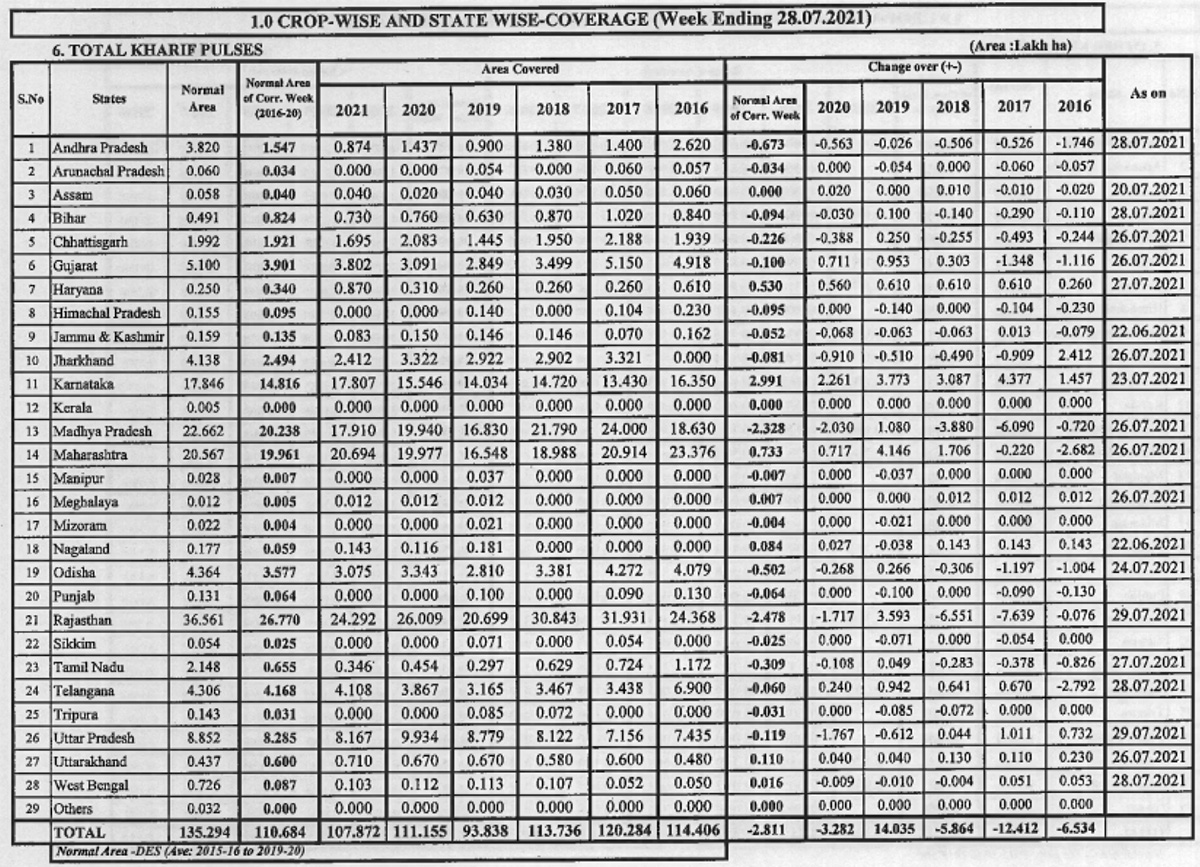

Through July 28, India seeded 29.96 lakh ha. to urad, down from 32.89 lakh ha. over the same period last year.

Delhi

This week, Delhi urad FAQ registered an increase of Rs. 350 and SQ Rs. 450 per quintal due to the port's support and increased demand. With this increase, prices reached Rs. 6,950 per quintal and SQ 7,950 per quintal.

Maharashtra

Due to weak arrivals and increased demand, the price of urad rose by Rs. 300-400 per quintal over the course of the week at mandis in Maharashtra and Akola urad traded at Rs. 6,900, Vashi Rs. 3,500-6,700, Jalgaon Rs. 6,700-7,151 and Ahmednagar Rs. 6,700-6,800 per quintal.

Uttar Pradesh

Urad prices continued to rise during the week at the mandis of Uttar Pradesh due to continuous demand. In Lalitpur urad, this week the price increased by Rs. 400 per quintal to Rs. 5,000-6,600 per quintal. Similarly, with an improvement of Rs. 150 per quintal, Bareilly urad sold up to Rs. 7,250-7,300 per quintal.

Rajasthan

An increase of Rs. 300 per quintal was registered in Jaipur urad and Kekri urad by Rs. 100 per quintal. With this increase, the price of Jaipur urad rose to Rs. 6,800-7,300 and Kekri Rs. 6,000-6,800 per quintal.

Madhya Pradesh

In Jabalpur market, the daily arrival of summer urad was 5,000-7,000 bags and the price increased by Rs. 200 per quintal to Rs. 5,500-6,200 per quintal. In the market of Ashoknagar and Ganjbasoda, the daily arrival of urad was 50-100 bags and over the weekend prices at Ganjbasoda were Rs. 3,000-6,000 and Ashok Nagar Rs. 5,000-5,500 per quintal.

Other

The price of Gulbarga urad in Karnataka rose by Rs. 200 per quintal to Rs. 4,500-6,400 per quintal over the course of the week. Similarly, in Vijayawada urad prices rose by Rs. 400 per quintal and traded at Rs. 7,250 and Polish reached Rs. 7,450 per quintal.

Urad dal

Urad dal registered an increase of Rs. 200-300 per quintal over the course of the week due to increased demand. With this increase, the price was Delhi Rs. 8,600-9,700, Bhatpara Rs. 8,250-8,600, Jalgaon Rs. 9,200, Meerut Rs. 7,100-8,200 and Vijayawada Rs. 8,500-9,500 per quintal.

Pulse prices expected to increase due to reduced sowing and more rains.

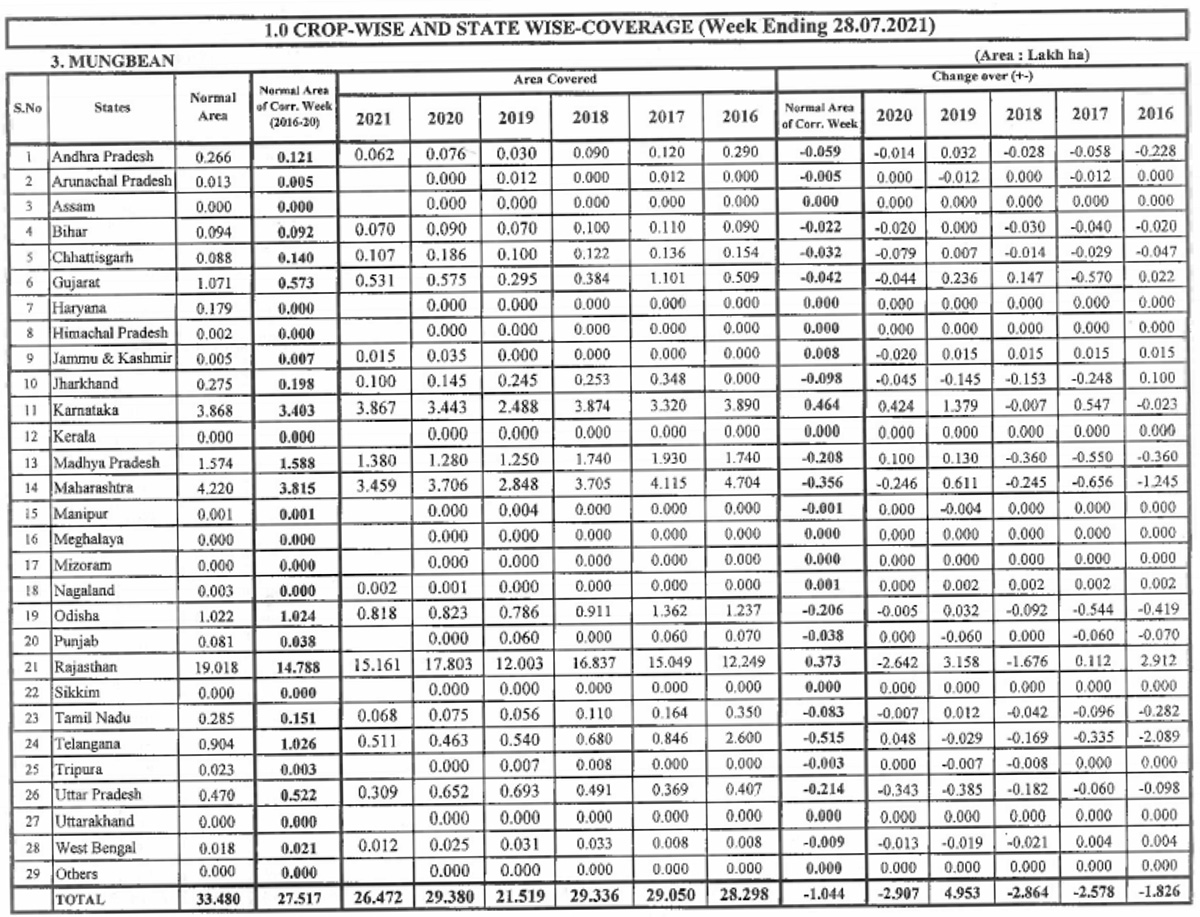

The area sown to kharif pulse crops—mainly urad and mung—declined sharply. During the first three weeks of July, many states experienced concerning differences in temperatures between the day and nighttime. In the last week of July, abundant rains raised concerns about crops in waterlogged fields. The sowing of urad and moong was also affected in many areas.

As a result, pulse prices may increase significantly by November-December. Domestic lentil prices are very high despite the government’s announcement of a reduction in the customs duty to incentivize imports. New crop from African nations has started to arrive. Imports may increase while India sows its domestic crops. New crop will arrive in December-January. Meanwhile, the price of urad and mung may increase. In order to control prices, the Central Government has imposed stock limits on tuar, urad, gram and masoor through October 31.

In June 2020, when the government implemented three new agricultural laws, it also amended the Essential Commodities Act and assured that stock limits would not be implemented under normal circumstances. But by implementing these limits in less than a year, the government lost the confidence of the industry-business sector. Traders fear that if domestic pulse prices increase in November-December, then the government may extend the stock limits. This is contrary to the government’s free trade policy stance. If traders do not have the opportunity to do business, then pulse growers will suffer huge losses and the government’s goal of achieving pulse self-sufficiency by increasing production will be undermined. This may actually increase dependence on imports.

If the seeded area for moong in Rajasthan and urad in Madhya Pradesh does not reach last year’s level, then total national production may decline drastically. Additionally, the weather and monsoon will have an effect on crops. This kharif season, the total area sown under pulses was about 10% behind last year’s pace. The pace of sowing is expected to increase with the onset of the monsoon, but if the major growing states receive heavy rains, the pace of sowing and the condition of crops may be affected. The weighted holding of pulses is 0.64% in the Wholesale Price Index and 2.95% in the Retail Price Index. Inflation of pulses in the Wholesale Price Index was 12.09% in May, which came down slightly to 11.49% in June. The retail price index also rose to 10.01% in June from 9.39% in May.

The pulse area decreased by 30% in Rajasthan and 23% percent in Madhya Pradesh this kharif season as compared to last year. Although Maharashtra and Karnataka saw an increase in the area under pulses, heavy rains and severe floods are expected to cause heavy crop damage there. According to government data, as of July 23, the area sown to pulses at the national level has fallen from 97.20 lakh ha. at this time last year to 87.30 lakh ha. The government’s kharif season pulse production target is 98.20 lakh tons. Last kharif season, a total of 131.80 lakh ha. were seeded to pulses and production was estimated at 85 lakh tons.

Heavy damage of Kharif crops due to torrential rains and severe floods in Maharashtra

In Maharashtra, an important agricultural producing state, the initial estimate is that 2 lakh ha. of kharif crops were badly damaged due to torrential rains and devastating floods over the past few days. As the rainy season continues, the extent of the damage is expected to increase further. The government is assessing the damage to crops and property. Farmers say that insurance companies have been requested to assess the damage, but there has been no response there.

Maharashtra’s Kolhapur district has been badly affected by rain and floods. According to rough estimates, 63,000 ha. of standing crops in the district were lost to floods.

In Vidarbha division, reports indicated 66,000 ha. of crops were damaged. In Satara district, 5,000 ha. of crops were damaged. In Sangli district, 33,000 ha. of crops have been damaged due to floods and 13,000 ha. of sugarcane crops are underwater. This is expected to reduce yields and the recovery rate of sugar. In the Konkan region’s Ratnagiri district, 1,000 ha. of rice paddies were flooded. Farmers in Nanded are troubled by the negligence and apathy of the insurance companies. There has been heavy damage to soybean, moong, urad and jowar crops. The Agriculture Department is conducting a survey of the damage in flooded areas.

The government's vigorous efforts to increase the availability of pulses during the festive season

Over the past two-and-a-half months, the Central Government has taken several steps to increase the supply and availability of pulses in the domestic market and to control prices. First, it deregulated tur, urad and moong imports by removing them from the annual quota system. Then, wholesale traders, pulse millers/processors and importers were asked to input information on their pulse stocks on the Department of Consumer Affairs’ portal on a weekly basis, and to have their physical inventories verified by competent government officials. Soon thereafter, stock limits on pulses were imposed.

This decision was unexpected and ran counter to the government’s assurances to the business sector. Traders and millers strongly opposed it, and this forced the government to provide some relief. Meanwhile, five-year agreements were signed for the import of pulses with countries including Myanmar, Malawi and Mozambique. The Department of Consumer Affairs, Ministry of Food is continuously monitoring the domestic market. These government policies pressured all pulse prices except lentils. The government has now drastically reduced the import duty on lentils to control prices by increasing supply and availability. The area sown to kharif pulse crops, especially urad, has declined and demand is being drastically curtailed, due to which production is expected to decrease and the market price is expected to increase. If this happens, the government might extend stock limits, which are supposed to expire on October 31, through November-December.

Heavy rains in Madhya Pradesh and Rajasthan

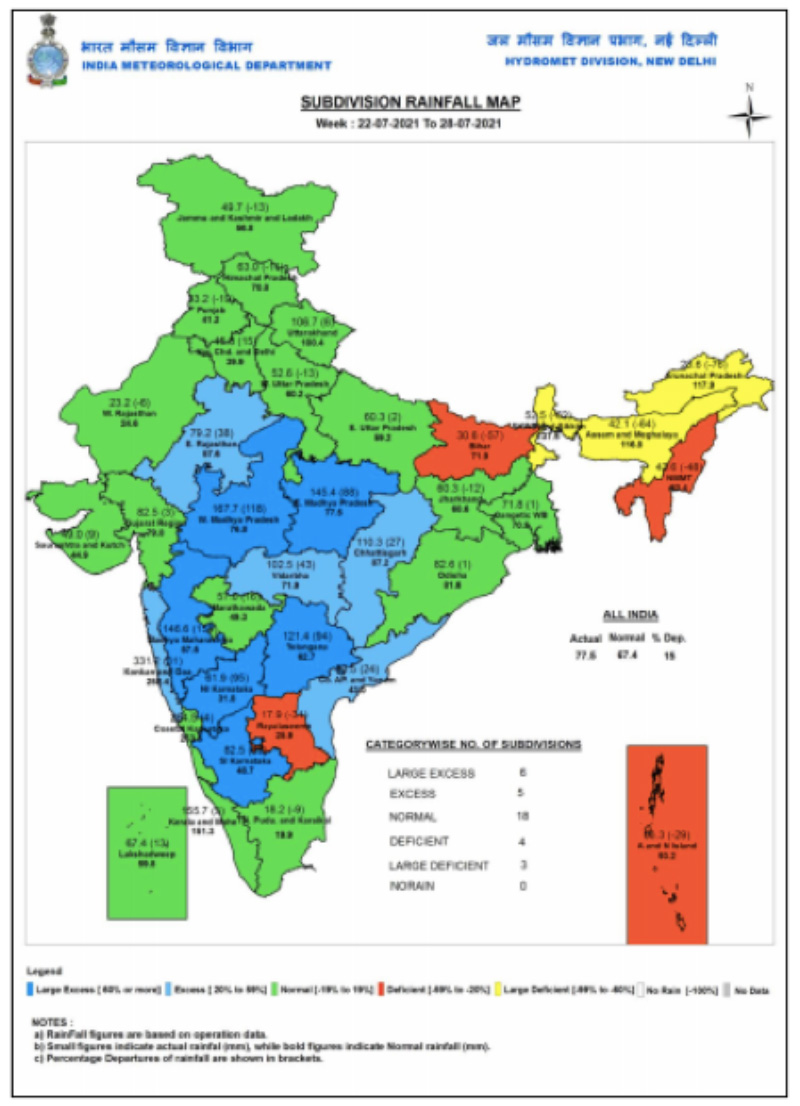

The southwest monsoon is moving with full intensity over many states of the country. On July 26-27, several districts of West Madhya Pradesh and East Rajasthan received torrential rains, while isolated heavy rains were recorded in East Gujarat, Bihar, Jharkhand and Punjab. Now the rains have moved on to western India and the northwestern states. Additionally, there has been heavy rainfall in Haryana, Chandigarh, Delhi, Saurashtra, Kutch, East Uttar Pradesh, West Rajasthan, Himachal Pradesh, Uttarakhand, Jammu and Kashmir, West Bengal, Sikkim, Madhya Maharashtra, Tamil Nadu and Pondicherry. Rains continued in many provinces and the Meteorological Department sees the possibility of the monsoon remaining active in some states through July 30. A low-pressure system is forming over the northern part of the Bay of Bengal. Consequently, a new round of rain is expected to begin July 30. Over the next three days, isolated scattered rains and isolated very heavy rains are likely in Konkan, Goa and Madhya Maharashtra. There is a possibility of some damage to Kharif crops due to heavy rains in some districts of Madhya Pradesh and Rajasthan. This monsoon rain will generally prove to be a boon for Kharif crops in such areas where till now there was a lack of rainfall. But in areas with heavy rainfall, if the water stagnates in the fields for days, then emerging pulse and oilseed crops may be damaged. Vigorous sowing of Kharif crops is still going on and the pace is expected to increase after the rains.

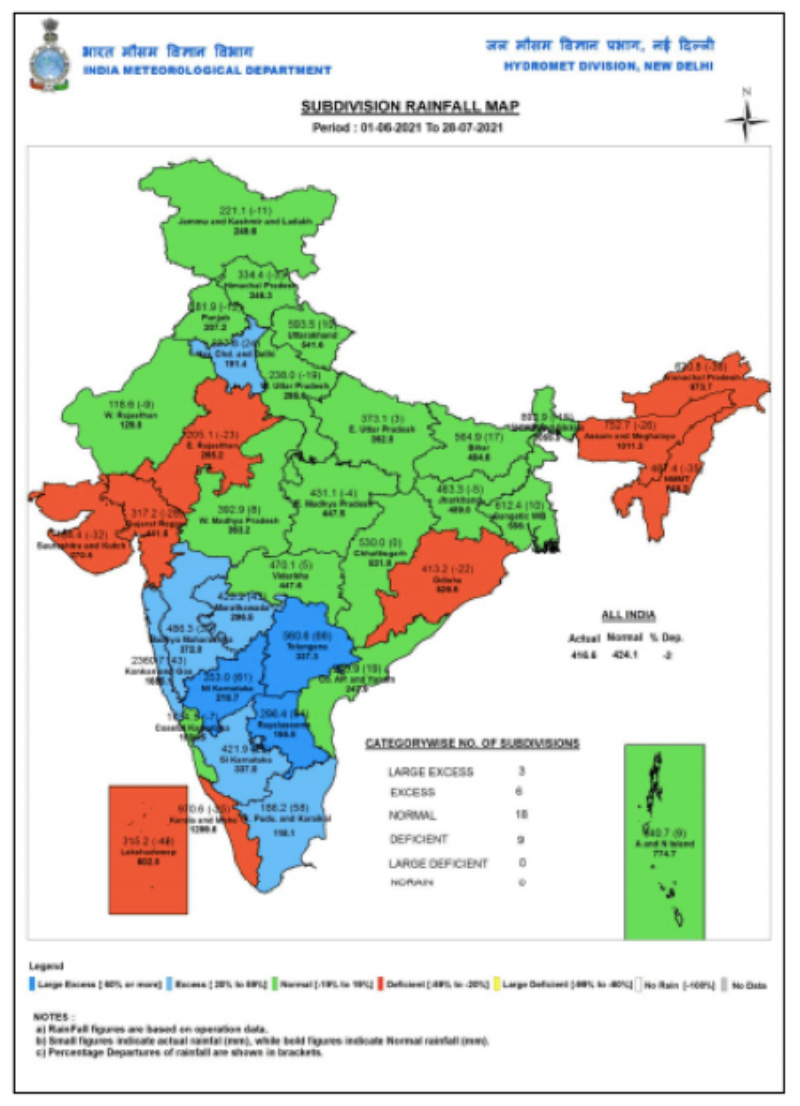

Rainfall 7% below normal in July

Although southwest monsoon activity increased significantly in the final days of July and many incidents of flooding, storms and landslides were reported across India, total rainfall for the month was 7% below average. However, in the first two months of the monsoon season (June-July), the national rainfall deficit was just 1%.

From June 20 to July 20, the intensity and dynamics of the monsoon decreased, with heavy rainfall before and after. According to the Meteorological Department, July rains amounted to 93% of the long-term average. Generally, rainfall between 96% to 104% is considered normal and between 90% and 96% is considered below normal. According to the Meteorological Department, during the month of July, very heavy rains lashed the coastal and central parts of Maharashtra, Goa and Karnataka, causing heavy damage to Kharif crops. Similarly, in the northwestern region, Jammu and Kashmir, Ladakh, Uttarakhand and Himachal Pradesh suffered losses due to heavy rains and cloudbursts. Delhi and adjoining areas also received good rains, but overall, it fell 7% below the national average. Monsoon conditions remained erratic over the western and northwestern parts of the country. The monsoon arrived in northwestern India with a delay of a fortnight. The eastern and northeastern region received 13% less rainfall. The northwestern part received 2% less rainfall while south India received 17% excess rainfall.

Area under pulses improved to nearly last year’s level

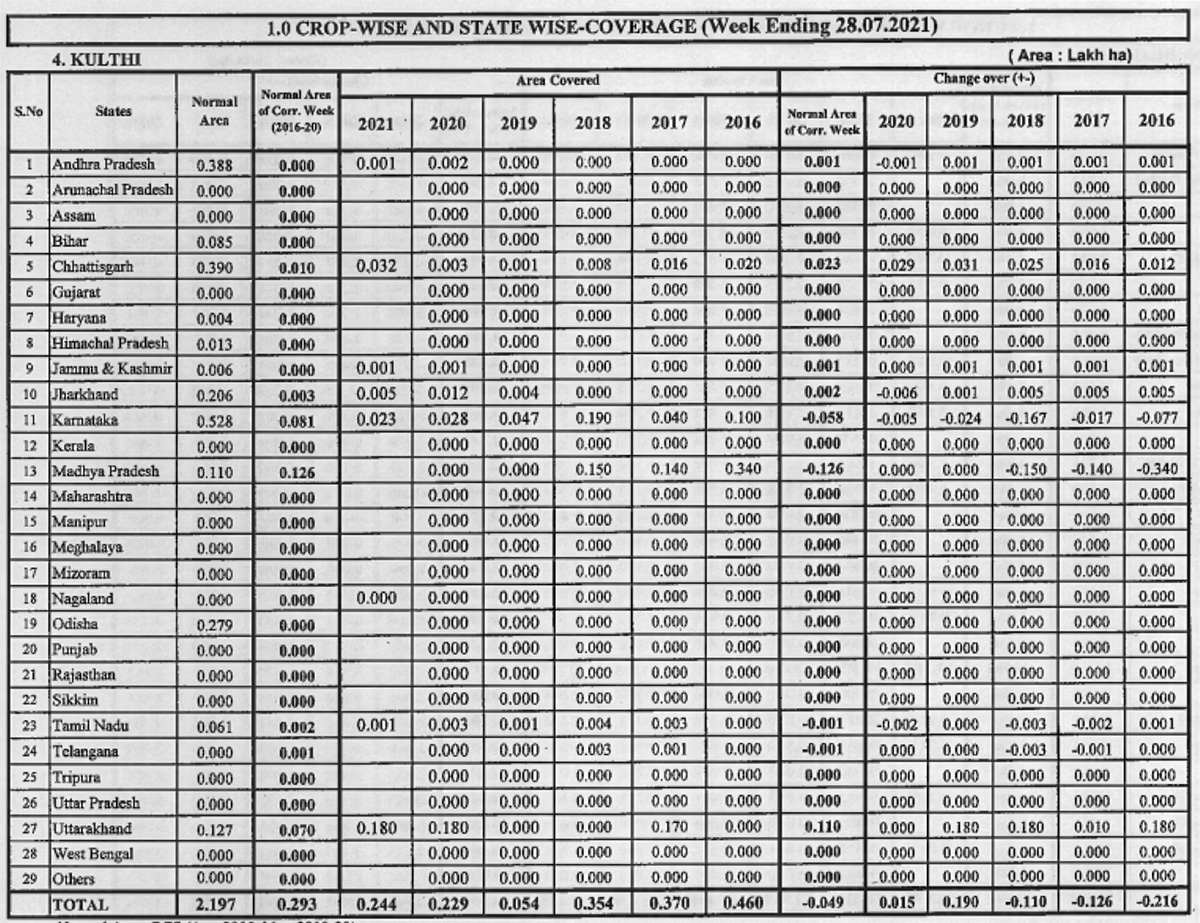

As expected, the sowing of Kharif crops, including pulses, picked up with the re-activation of the southwest monsoon. The area under Kharif pulses increased to 107.87 lakh ha., which is 3.28 lakh ha. less than the 111.15 lakh ha. seeded at this time last year. The area sown to tur was ahead of last year’s pace. Now the area sown to urad and moong is catching up to last year’s pace. As of July 30, the area under tuar amounted to 41.83 lakh ha., an increase over the 40.24 lakh ha. seeded at the same time last year. Two weeks ago, the seeding pace of urad and moong was lagging far behind last year’s pace, but now the gap has closed.

The area sown to mung is at 26.47 lakh ha., which is 2.91 lakh ha. less than the 29.38 lakh ha. seeded at this time last year. Similarly, the urad area is at 29.96 lakh ha., which is 2.93 lakh ha. less than the 32.89 lakh ha. seeded at this time last year. The kulthi area is the same as last year: 24,000 ha. An increase of 1.60 lakh ha. in the arhar area is a positive sign. With the government’s decision to move tur, moong and urad out of the quota system and into the Open General License (OGL), the imposition of stock limits and the five-year contracts with Malawi, Mozambique and Myanmar, it seemed the seeded area would decrease. Prices of these pulses have fallen significantly during the sowing window. But despite this, the enthusiasm of farmers was not diminished. It is only because of the sluggish monsoon that the pace of sowing of pulses, especially urad and moong, was down significantly in Madhya Pradesh and Rajasthan. Now with the monsoon reactivated, the sowing pace is improving.

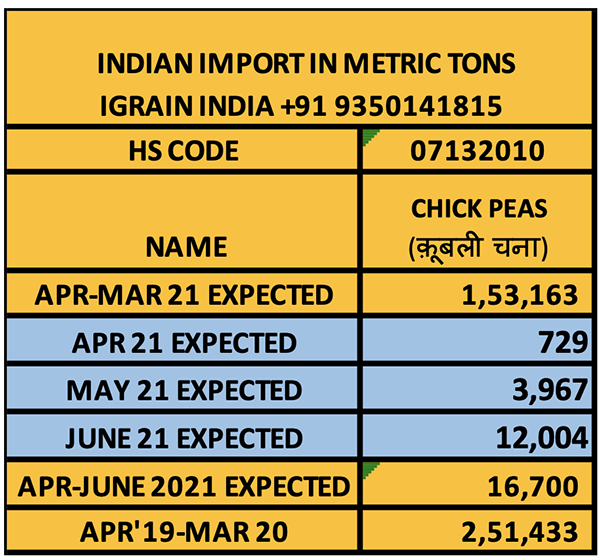

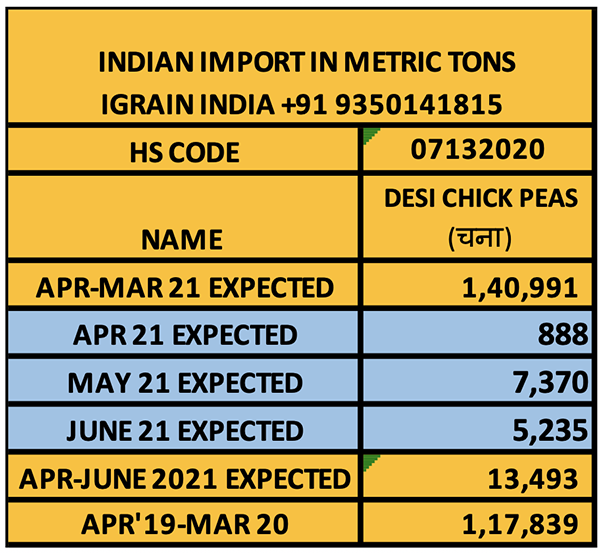

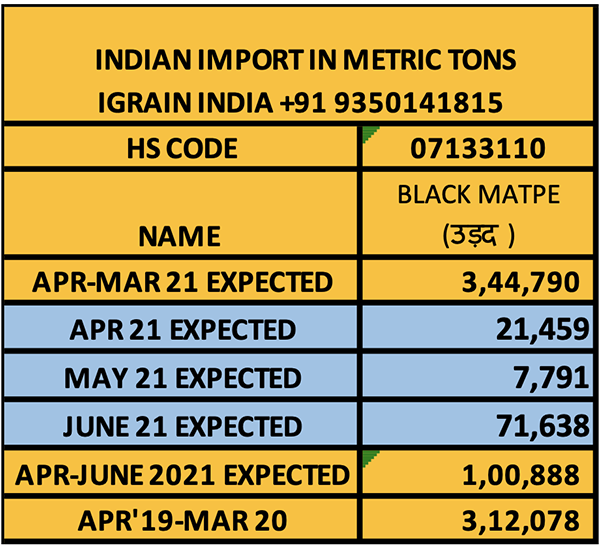

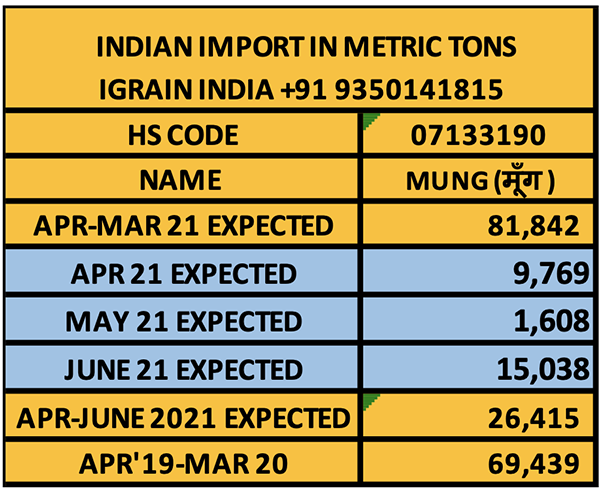

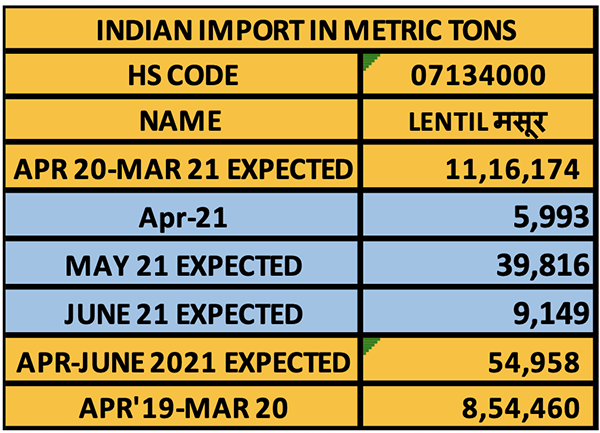

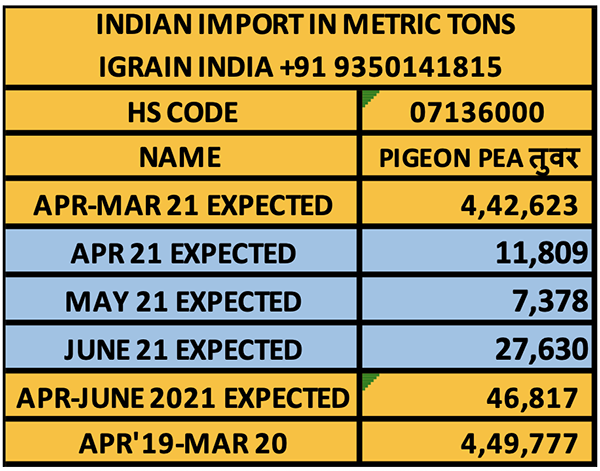

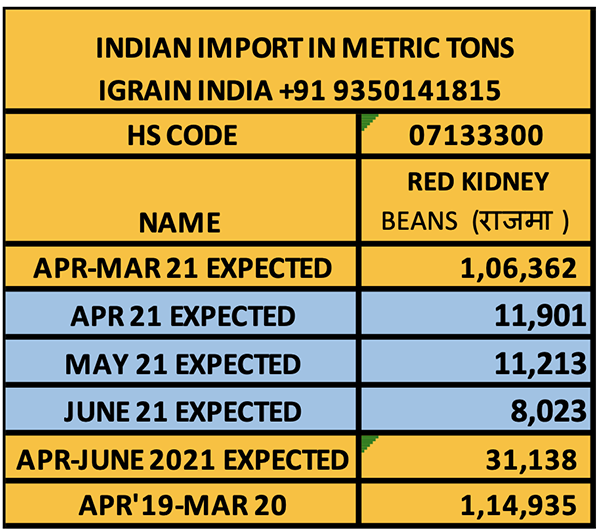

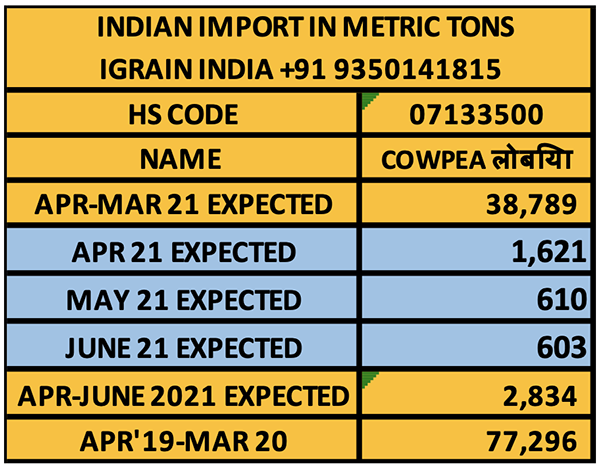

PULSES IMPORT FIGURES

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.51)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Rahul Chauhan / IGrain / Burma / Mumbai / Delhi / Maharashtra / Uttar Pradesh / Rajasthan / Madhya Pradesh / Urad dal

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.