Rundown of Indian Markets- Market slashed due to increase in imports and stock limits

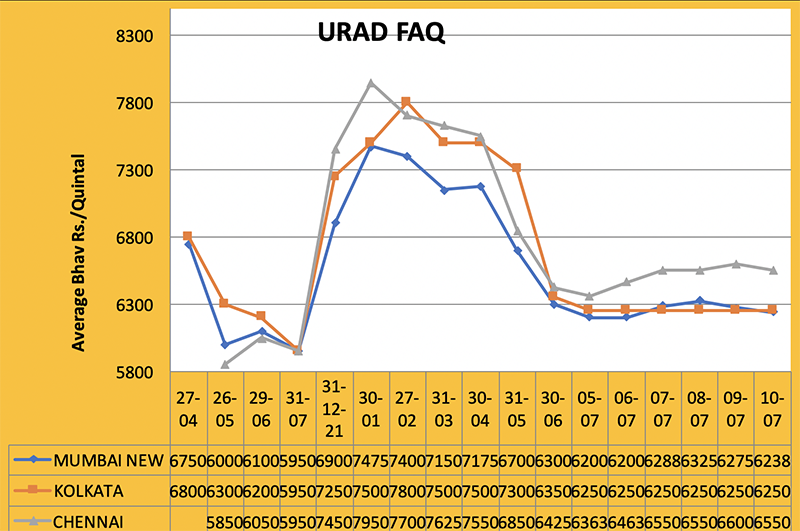

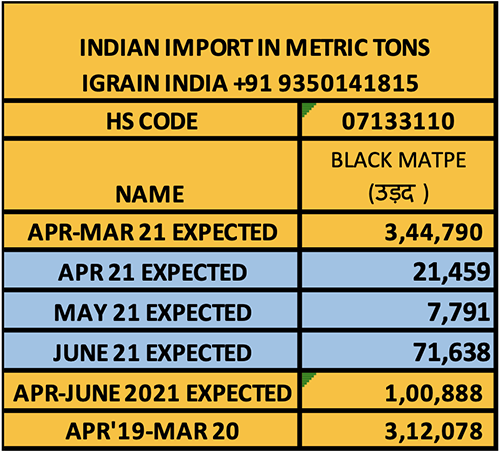

Consignments of imported urad started arriving at ports. At the same time, the government has imposed stock limits on the domestic market, which is increasing the pressure in the market. Sellers are ready to sell but there are no purchasers. As per information available from sources, during the month of June, 71,638 MT of urad landed at various ports.

Port

FAQ Urad at Mumbai Port traded at $ 850 and SQ $ 950 per MT CIF. At Mumbai Port, prices declined by Rs. 25 to Rs. 6,325, the old Rs. 6,225. Chennai Port FAQ traded prices were Rs. 6250, SQ was Rs. 6950.

In Kolkata, the price remained steady at Rs 6,250. Demand is expected to remain normal.

Delhi

Due to variations in urad prices at port, the Delhi market has shown a downtrend. No ups and down in Delhi recorded. Urad traded at Rs. 6,500 per quintal in FAQ and Rs.7,200 per quintal over the weekend. Demand is expected to increase.

Maharashtra

Selling pressure was seen on urad in Maharashtra. Due to lack of buying in pulses, millers reduced urad purchases and as a result prices fell by Rs. 100-200 by the weekend. With this decrease, the price per quintal over the weekend stood at Rs. 3,500-6,500 in Jalna, Rs. 6,600 in Akola, and Rs. 6,250-6,600 in Jalgaon.

Uttar Pradesh

Urad registered a price drop of Rs. 200-400 due to panicked selling by stockists. With this drop, the price per quintal over the weekend fell to Rs. 6,600 in Bareilly, Rs. 4,200-6,200 in Lalitpur, Rs. 5,000-5,800 in Jhansi and Rs. 6,600 in Bahjoi.

Rajasthan

Due to lack of business, urad prices slipped by Rs. 100-300 in Rajasthan. Over the weekend, trading took place at Rs. 6,300-6,400, Sumerpur Rs. 6,000-7,000.

Madhya Pradesh

In Madhya Pradesh, as well, prices fell to Rs. 2,500-5,500 in Ganjbasoda and Rs. 5,000-5,400 in Ashoknagar. Demand is expected to increase.

Other

In Dahod, the price of urad fell by Rs. 500 to Rs. 5,500-6,000. In Vijayawada, the price rose by Rs. 100 to Rs. 6,800-7,000 per quintal.

The urad crop is being sown. Through Friday, urad had been sown on about 12.75 lakh ha. That compares to 12.53 lakh ha. at this time last year.

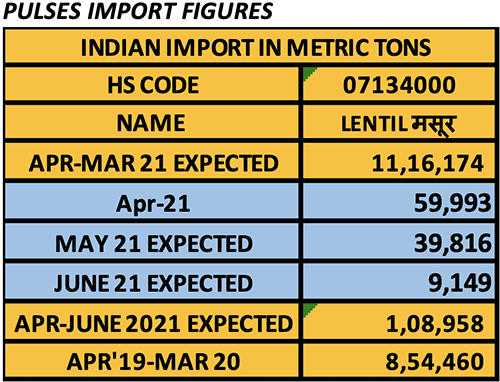

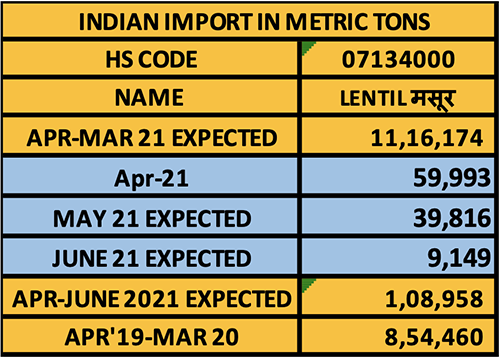

The major lentil-producing states of Uttar Pradesh and Madhya Pradesh are under lockdown due to COVID, and this has disrupted supply and demand chains. As movement came to a halt, stockists were active and reduced selling. Additionally, importers stopped selling stocks as supplies are tight throughout the world. Importers are facing issues with container shortages and elevated freight/container rates. With prices rising, inquiries about lentils from millers increased and this may see the market gain more support.

Ports

During the week, the domestic market remained dependent on imports, leading to a sharp rise in prices of Rs. 150-300 by the weekend. With this increase, prices in Kolkata reached Rs. 6450-6700 over the weekend. Similarly, with the above-mentioned price, Mumbai containers have reached Rs 6600-6650, Mundra Rs 6,300 and Hajira Rs 6,350-6,375 per quintal. The market sentiment may intensify. In May almost all states remained in lockdown. There is confusion about lentil production outside India and prices are therefore expected to remain high. Further, due to current duties, import parity is huge; even if India reduces the tariff to 10% like it did last year, import cost is still less than prevailing prices in India. Because of the unavailability of containers and high freight rates, the import cost is on the high side. There is no sign that container availability will return to normal in the near future. Due to COVID-19, ports and customs are busy clearing medical aid and equipment. The number of daily cases has the nation under a great deal of stress; all agri-product supply chains have been disrupted.

Delhi

Due to the lockdown, the pulse business is weak in Delhi. Millers are holding limited quantities. The arrival of lentils is decreasing. Lentil prices in Delhi rose by Rs. 250 by the weekend to Rs. 6,875-6,900. The market sentiment looks to remain strong as there is no possibility of opening mandis.

Others

All market yards producing lentil or other pulses are closed; only 15% of markets are open with limited business.

The price of lentils in Katni was Rs 6,850 per quintal. Meanwhile, the price in Indore mandi rose by Rs. 50 to Rs. 6,400. Prices reached Rs. 6,800 in Bihar's Badh market with a spurt of Rs. 300.

Processed Lentil/ Daal

The effect of lentil prices was seen on processed lentils. During the week, masoor dal recorded a gain of Rs. 50 and the price reached Rs. 7600-7650 per quintal. Presently, the possibility of increased demand is being expressed.

Sowing of kharif crops falls 21 % due to late monsoon

In most parts of the country, the sowing of kharif crops is being affected by the stalled progress of the southwest monsoon. Compared to this time last year, the area seeded to paddy and sugarcane is up. The area seeded to pulses, oilseeds, coarse cereals and cotton has declined. According to official figures, the area under coarse cereals declined to 34.28 lakh ha. from 41.55 lakh ha. last year. The area under maize, however, increased to 22.28 lakh ha. from 19.10 lakh ha. last year.

The area under paddy increased from 34.62 lakh ha. to 36.15 lakh ha. and the sugarcane area increased from 49.85 lakh ha. to 50.16 lakh ha. Through July 1, the total area seeded to kharif crops fell from 258 lakh ha. last year to 220 lakh ha. this year.

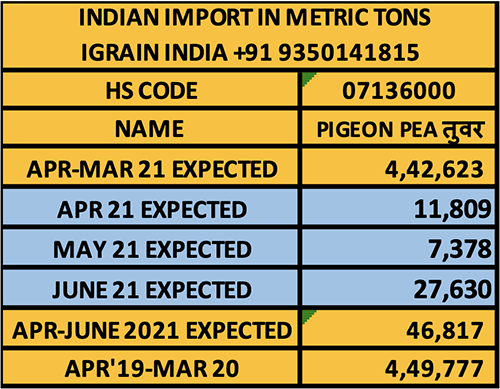

The area seeded to pulses fell from 17.51 lakh ha. to 14.58 lakh ha. The area seeded to tuar decreased from 8.53 lakh ha. to 5.57 lakh ha. The area seeded to urad slipped from 2.19 lakh ha. to 2.17 lakh ha., while the area seeded to moong increased from 5.13 lakh ha. to 5.23 lakh ha. The area sown to other pulses increased from 1.23 lakh ha. to 1.48 lakh ha.

In terms of oilseed crops, the area sown to soybeans fell from 23.36 lakh ha. last year to 13.45 lakh ha. this year.

The arrival of monsoon rains is being eagerly awaited across the northwestern states, along with Maharashtra, Gujarat, Andhra Pradesh, Telangana and Madhya Pradesh. The area under patty is up in some states but is lagging far behind in many others. The sowing of pulses is up in Rajasthan and Madhya Pradesh, but down in Maharashtra and Telangana. Maharashtra is the major producing state. The area under oilseed crops is also down in the state. In terms of coarse cereals, the area under jawar and bajra has decreased, while the area under maize increased. The area under coarse cereals (grains) has increased by 4.32 lakh ha. in Madhya Pradesh and 1.43 lakh ha. in Karnataka. If monsoon rains are delayed further, then growers in many states will prioritize the seeding of coarse cereals over pulses and oilseeds. In this case, the area of maize especially is expected to increase greatly, as prices have improved recently.

Protests increasing against stock limits

Pulse traders and pulse millers in Madhya Pradesh have rallied against the central government's decision to impose stock limits on pulses and are meeting with leaders to apprise them of their problems. Traders strongly opposing this measure argue that imposing storage limits on pulses is not rational or practical.

The government first encouraged traders to buy pulses from farmers at higher prices and later forced them to sell at lower prices. This caused great resentment among traders and millers. Representatives from the Indore Grain Oilseeds Traders Association met with the National General Secretary of BJP and advocated for the removal of the stock limits on pulses.

Traders said that at present, with the exception of lentils, pulse prices are below MSP and therefore the imposition of stock limits is not justified. The BJP General Secretary spoke with the Union Food Minister about this matter, but perhaps it was not resolved. He therefore assured traders he would meet with the Food Minister directly and discuss the matter and that the interests of traders would be addressed. Efforts will be made to make suitable amendments to the stock limit rules.

Further, in a letter to traders the President of the Madhya Pradesh Gross Grain Pulses Oilseeds Traders Federation stated that the storage limits imposed by the government on all pulses except moong is improper and counter to prior assurances given to traders.

Traders and millers purchased pulses from farmers at higher prices and are being forced to sell at lower prices. The Speaker asked traders to meet with all the MPs, MLAs and public leaders to make them aware of the problem and express their concerns. These stock limits are against the interests of traders.

Pulse-oilseed crops are seriously threatened by dry weather

Not only is the sluggish pace of the southwest monsoon affecting the sowing of pulse and oilseed crops, but the lack of rain and scorching heat is also impacting crops that were sown earlier. After reaching the southern coast of the country on June 3, the monsoon progressed quickly and by June 15 had reached many parts of the country either on time or ahead of schedule. It appeared, therefore, that India would see heavy monsoon rains.

But since June 19, the monsoon has been stalled and its intensity and speed decreased drastically in most parts of the county except for the eastern and northeastern states. Meanwhile, temperatures continue to rise in the northwestern states, drying out soil moisture.

In most of the major producing states, the area sown to pulses and oilseeds is lagging behind last year’s pace. In Maharashtra and other states, farmers are being advised not to take on too much risk and to wait for rains. In Gujarat, the area sown to groundnuts has decreased.

The soybean area increased in Madhya Pradesh but the crop is facing severe drought. Farmers may be forced to re-seed soybeans in areas where seeds are not germinating or young plans are drying up. The condition of pulse crops is also not very good. Although the sowing pace of pulse crops, including arhar (tuar), was progressing normally thanks to good rains early on in Karnataka, the rain deficit is now being felt there, too.

The monsoon has not yet arrived in northwest India, while temperatures are soaring. As a result, farmers are finding it difficult to prepare their fields and sow pulse and oilseed crops. The situation is worse in Rajasthan, where soybean and castor, as well as moong, are grown on a large scale.

West Uttar Pradesh, Haryana, Punjab, Delhi, Uttarakhand and Himachal Pradesh are also in dire need of rain. The monsoon was expected to reach those areas by July 5, but now it is expected by July 10. There is a lack of rain in Maharashtra and Gujarat, which has increased the concern of farmers.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73.47)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Rahu Chauhan / India / urad / Maharashtra / Uttar Pradesh / Uttar Pradesh / Rajasthan / Madhya Pradesh

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.