Rundown of Indian Markets- Markets improved as court did not allow confiscated peas to be imported

Following the order to re-export imported peas that had been confiscated at the port, it became clear that these goods would not enter India. The government has no plans to import peas. Consequently, demand for domestic peas on the part of traders has begun to grow. Arrivals at mandis had increased the past few days but have started slowing down. There was a bullish trend in gram. Its effect is also being seen on peas.

This week, a price increase of Rs. 175 for peas was recorded in Kanpur, bringing the price to Rs. 5,050-5,100. The daily arrival of peas at Lalitpur mandi has fallen to 1,500-2,000 bags. Due to demand, the price per quintal for unpolished product increased by Rs. 250-300 to Rs. 4,500-4,550; polished product was priced at Rs. 4,800-4,950 per quintal.

A price increase of Rs. 100 was recorded in Orai Matar, bringing prices to Rs. 4,550-4,900. Orai received 500-6000 bags of peas daily. In Jhansi, daily arrivals of peas fell to 200-250 bags. With demand normalizing, prices per quintal remained at Rs. 4,000-4,600. Rath peas traded at Rs. 4,800-4,900 for white and Rs. 9,000 for green.

Pea prices in Jalaun stood at Rs. 4,650-4,940 per quintal on normal demand. Daily market arrivals amount to 150-200 sacks. In Konch, the price per quintal was Rs. 4,600-4,700. Normal demand is expected for now. There is little chance of a further downturn. Indian traders will have only domestic product to depend on.

New crop will come next year. There will be no imports and prices of domestic peas are likely to remain high in the future. Pea stocks are high in the world’s major pea-producing country.

Canada’s business has been affected deeply by India’s decision on imports. Peas in Canada are priced at $9/bushel. The coming harvest is also good. With good pea production, there will be pressure on the global market. India was a major importer of Canadian peas.

Processed Pea

Due to normal demand, there was no uptick or downturn in peas. Prices stood at Rs. 5,200-5,250 per quintal over the weekend. Selling by millers was done based on demand, and as a result business remained normal at previous price levels.

Order to re-export imported pulses and peas after recovery of necessary redemption fine

The Supreme Court, while ordering complete confiscation of the stock of peas and pulses imported without a license and held at ports (warehouses), has directed the Customs Department to allow their re-export only after recovery of necessary redemption penalty. In fact, the matter has become quite complicated. The Bombay High Court had issued an order which upset the Customs Department. The High Court had said that the order originally issued by the Additional Commissioner of Customs, Group-I, Mumbai should be complied with, and the confiscated products accordingly imported by private traders. On the other hand, the Customs Department argued that these imported pulses should be confiscated. Challenging the order of the High Court, the Customs Department filed a petition in the Supreme Court and the Supreme Court has ruled in its favour. The matter is very old and has gone through the courts many times. The Directorate General of Foreign Trade (DGFT), a body subordinate to the Union Ministry of Commerce, issues notification and trade notices from time to time, prescribing rules and regulations for the import of pulses. In this case, after a notification was issued banning the import of peas and other pulses, some traders attempted to import them without a license. Officials from the Customs Department halted the cargoes at the ports. The matter was then taken to court. When it reached the Supreme Court through the High Court, the judges there ordered the confiscation of the pulse shipments. In its decision, the Supreme Court also said importers may re-export the pulses to a third country after paying the redemption penalty.

Government procurement this season on low note

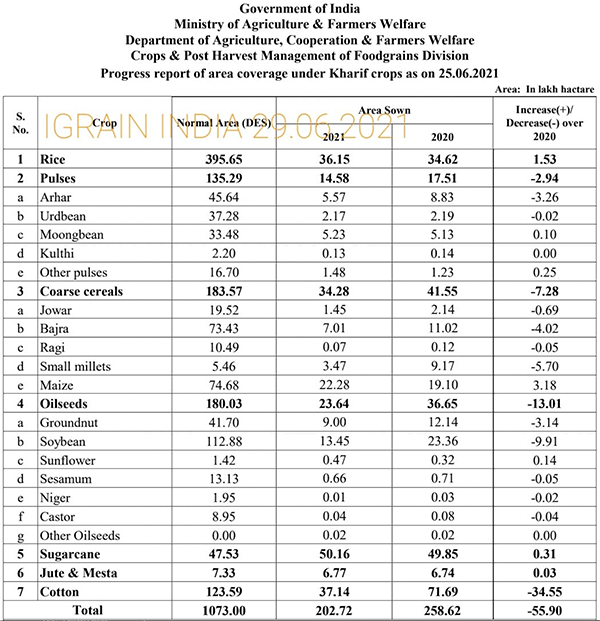

Although the Union Agriculture Ministry approved the purchase of a large quantity of kharif and rabi season pulses at MSP in 2020-21, in response to requests and proposals received from various major pulse-producing states, the wholesale market price of most pulses is supported. Government agencies have not had much success procuring kharif crops due to high prices. The same is happening with the procurement of rabi season pulses.

According to official data, through June 17, the government agency has procured a total of about 5.46 lakh MT of chana at MSP during the 2021 rabi marketing season. This amount includes 1.94 lakh MT from Madhya Pradesh, 1.68 lakh MT from Maharashtra, 1.29 lakh MT from Gujarat, 22,000 MT from Karnataka, 17,000 MT from Telangana, 10,000 MT from Andhra Pradesh and about 6,400 MT from Rajasthan.

The MSP for gram increased from Rs. 4,875 per quintal in 2019-20 to Rs. 5,100 for the 2020-21 rabi season. The procurement of lentils, another major rabi season pulse crop, has been nominal. Only 18.35 MT of lentils could be procured in Madhya Pradesh. The MSP for lentils increased by Rs. 300 per quintal from Rs. 4,800 last year to Rs. 5,100. In major producing states like Uttar Pradesh, Madhya Pradesh and Bihar, the price of lentils rose to near or above the MSP even before the new crop was harvested and remained high even after the arrival of the crop.

Government procurement of rabi season moong was slightly better than that of lentils. The MSP is Rs. 7,196 per quintal. The government procured a total of 4,528 MT of rabi season moong, including 4,419 MT from Tamil Nadu and 109 MT from Orissa. Mung procurement from Madhya Pradesh started on June 15.

Lentil prices are moving higher than MSP. The procurement of rabi pulses is much less than it was last year and hence government stocks may be unable to play an effective role in balancing the supply and demand of pulses and controlling domestic market prices.

MSP increase doesn’t guarantee production

Although the central government generously increased the MSPs for groundnuts, sesame, sunflower, tur and urad, and also provided a general increase in the MSP for soybeans and moong, agricultural experts and farmers’ organizations believe that the demand for pulses and oilseeds has increased over the last few years. The MSPs did not increase as much relative to the costs and risks of production, and farmers will unlikely be as enthusiastic about growing pulses as they are about growing paddy and wheat. Another problem is procurement at MSP. The government does not impose quantitative limits on the purchase of wheat and paddy, but procurement of pulses and oilseeds is limited to 25% of production for each state. Farmers depend on the open market to sell the remaining 75% of their production, and prices there tend to be below MSP. Consequently, farmers generally receive less income.

From 2014-15 to 2020-21, the MSP for a quintal of tuar increased from Rs. 4,350 to Rs. 6,000. The MSP for a quintal of soybeans increased from Rs. 2,560 to Rs. 3,880. The MSP for a quintal of chana increased from Rs. 3,175 to 5,100. Like paddy and wheat, the MSP for tuar and urad increased by less than 40% over this period. The maximum increase was in the MSP for mustard, gram, moong and soybeans. According to official data, during this period paddy production increased from 914 lakh MT to 1,038 lakh MT, tuar production from 28.10 lakh MT to 38.80 lakh MT, moong production from 15.00 lakh MT to 26.20 lakh MT, urad production from 19.60 lakh MT to 23.80 lakh MT, soybean production from 103.70 lakh MT to 134.10 lakh MT, wheat production from 865.30 lakh MT to 1087.50 lakh MT, mustard production from 62.80 lakh MT to 99.80 lakh MT and gram production from 95.30 lakh MT to 126.10 lakh MT. There was an increase of about 75% in the production of moong and 57% in the production of mustard, while the production of other crops increased by less than 50%. In marketing season 2020-21, the wholesale price of kharif and rabi pulses and oilseeds was higher than MSP and this led to a sharp decline in government procurement. The previous season saw large-scale procurement of gram, groundnuts and mustard. But this time, there has been very little. The government will have to take concrete and practical steps to motivate farmers to grow pulses and oilseeds.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs.: Indian Rupees (1$=Rs 72.9)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.