November 4, 2020

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

DGFT extended the 10% import duty for lentils through 31 December 2020. This extension caused a disturbance in the domestic market. Domestic traders are displeased with the extension. The domestic market may not surge in the future and has started moving downwards. Millers are purchasing as per their needs. Trader interest is also down.

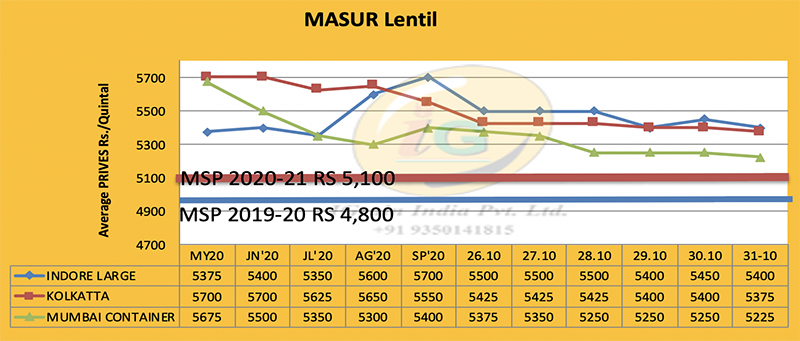

Lentil seeding is in full swing. As of Friday, approximately 80-85% of the crop has been seeded. The demand for desi variety seed was up, but with the import duty cut extension, momentum collapsed. Last week, lentil prices at port fell by Rs. 25 per quintal and by the weekend, Mumbai vessel charges declined to Rs. 5175 per quintal, container Rs. 5251, Australia nugget Rs. 5350, Mundra Rs. 5171 and Hazira port Rs. 5281 per quintal. At Kolkata port, lentil vessel traded at Rs. 5325 and container Rs. 5400 a quintal.

Due to normal demand from millers, stockists were unable to sell at good prices or with a high margin. Due to normal purchase/demand of millers, lentil prices in Delhi rose marginally by Rs. 25-50 by the weekend. Large lentils traded at Rs. 5800, small lentils at Rs. 6300-7000 and imported lentils at Rs. 5350 per quintal.

In domestic market yards, the supply of small red lentils is very short. Small lentil demand is good. Last week, an up-down fluctuation of Rs. 25-50 was reported in the main markets. Over the weekend, lentils were trading at Rs. 5450 in Indore, Rs. 5800-5875 in Kanti, Rs. 5800 in Kanpur and Rs. 5600 in Badh (Bihar). In Bareilly, large lentils traded at Rs. 5850-5875 and small lentils at Rs. 7100.

Chhattisgarh, Raipur market yard price declined by Rs. 50 and by the end of the week settled at Rs. 5450 a quintal.

Masur dal demand is normal. Millers are buying as needed and are not in hurry to maintain stocks. Prices are stable on normal demand. Over the weekend, masur dal traded at Rs. 6,500-6,700.

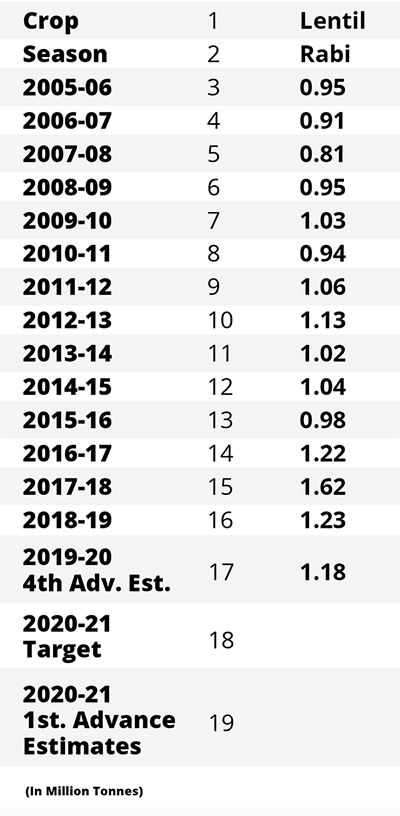

Lentil future depends on sowing. Farmers may reduce sowing because they did not fetch good prices last season. Also, the extension in the import duty cut may see large farmers reduce sowing.

To check surging domestic prices and due to ongoing elections, the government felt pressure to control inflation by increasing lentil availability ahead of new crop arrivals. This was the third time the DGFT extended the deadline. Importers may now import lentils at 10% duty till 31 December. Originally importers had till August and then that was extended to 31 October. Last week, it was extended till the end of December. From June to August, approximately 4.5 lakh MT of lentils entered India at 10% duty. The normal import duty is 30%. At that time, Canada’s new crop lentils had not yet been harvested. Now the crop is in the bins. Additionally, Australia’s lentil harvest will commence soon, which will further increase international availability and competition.

It should be noted that, unlike for pigeon peas, black matpe and moong, there is no quantitative restriction on lentil imports. Another 4 lakh MT of lentils may arrive in India by 31 December.

The import deadline for pigeon peas is also 31 December. For black matpe, the deadline is 31 March.

Presently, movement of lentils, pigeon peas and black matpe can be observed at ports. Due to the extension of the import deadlines, the interest of stockists/bulk buyers and large farmers has faded.

The extensions may see international prices surge at first, but competition between Canada and Australia may see them become competitive.

In Rajasthan, one of India’s largest gram producing states, the seeding of the rabi crop hit 2.17 million hectares, up from 1.27 million hectares at this time last year. The rabi season sowing target is 9.88 million hectares, down from last year’s target of 11.3 million hectares. The five-year average is 9.245 million hectares.

According to the Agri Department, wheat sowing increased 400 hectares to 12,000 hectares. Barley sowing improved by 1,000 hectares to 6,000 hectares.

The sowing of pulses increased by 0.26 million hectares to 0.59 million hectares through Friday. Gram sowing jumped by 0.26 million hectares to 0.58 million hectares. The sowing of other pulses improved by 200 hectares to 6,000 hectares.

Oilseed sowing also improved and reached 1.4 million hectares.

The Food Ministry has authorized the procurement of 4.5 million MT of pulses and oilseed at minimum support prices for this past kharif season. In many states, like Gujrat, Maharashtra, Rajasthan, Andhra Pradesh, Tamilnadu, Telangana, Haryana, Odisha and Utter Pradesh, government procurement is in process. Through 1 November, 10,571.140 MT of moong, urad, groundnut pods and soybean have been procured.

Based on the proposals or requests received from various states, the Central Government has so far authorized the purchase of 45.10 lakh tonnes of pulses and oilseeds at MSP and the procurement process has started in many states.

The Central Government has started resorting to imports to check the rise in domestic pulse prices.

To achieve this goal, import permits/licenses are being issued to millers-processors to import 4 lakh MT of arhar and 1.50 lakh MT of urad. Approval has been granted to import arhar by 31 December 2020 and Urad by 31 March 2021. Further, the cut in import duties for lentils has also been extended from 31 October to 31 December 2020. There is on quantitative restriction on lentil imports.

Pulse imports typically increase the availability in the domestic market and soften prices. But this time the situation is somewhat different. The market price for imported pulses, such as arhar, mung, urad, lentils and gram, is still above the government support price. The government has deliberately allowed the import of pulses to create psychological pressure on the market.

It is known that natural calamities have caused extensive damage to major pulse crops this kharif season. Production is therefore likely to not only end up below the government’s estimates but also below normal expectations. Moong and urad crops have suffered heavy losses and there have been reduced arrivals in market yards. In states including Maharashtra, Karnataka, Madhya Pradesh and Gujarat, provincial government data indicates the pigeon pea (tuar) crop has also been impacted. In Karnataka, pigeon pea production is estimated to have fallen to about 7.65 lakh MT, down 34% from last year’s 11 lakh MT.

It should be noted that this season, pulse markets will not receive strong support from domestic production nor carry-in stocks. Import volumes are also much lower compared to domestic demand. Arhar and urad prices have spiked considerably in Myanmar and Indian millers have not shown interest. Pigeon pea imports from African countries may continue at regular intervals, but stocks there are limited. Only lentil imports are likely to increase drastically.

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter @igrain_india

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.