A lack of demand for masoor dal was observed last week. The arrival of lentils in the market yards (mandis) is improving following the lifting of the COVID-19 lockdown. Stockists are not buying much and markets are declining as a result. Further, falling prices for other pulses is also contributing to an atmosphere of panic in the lentil market.

Delhi

Delhi lentil prices declined by Rs. 100-125 last week. Prices per quintal for large lentils fell to Rs. 6,450, small size lentils to Rs. 6,250-6,700 and imported lentils to Rs. 6,500. Demand is expected to remain normal.

Port

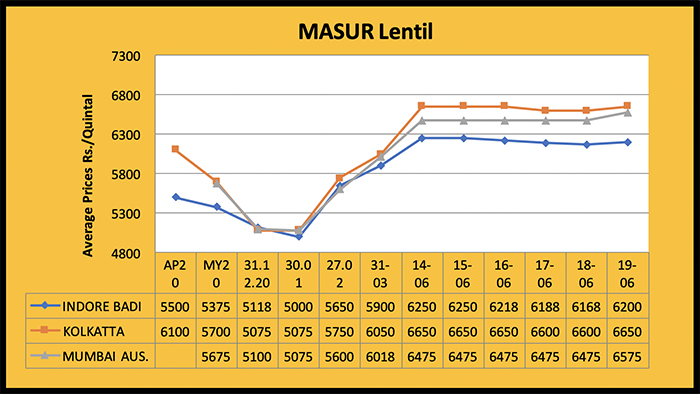

The availability of imported lentils at the ports is gradually decreasing. Importers were seen selling lentils with clenched hands. The prices for imported lentils is lower than that of domestic lentils; consequently, the consumption of imported lentils is on the rise. Over the course of the week, lentil prices at the port registered a correction of Rs. 50-100. Over the weekend, Mumbai vessel reached Rs. 6,450-6,500, Australia container Rs. 6,550-6,600, Mundra Rs. 6,400, Hazira Rs. 6,450 and Kolkata Rs. 6,550-6,600 per quintal. Demand is expected to increase.

Madhya Pradesh

Lentil arrivals were better at the mandis of Madhya Pradesh, but weak buying saw prices fall by Rs. 80-150 over the course of the week. By the weekend, a quintal of lentils traded at Rs. 5,500-6,000 in Ganjbasoda, Rs. 6,600 in Katni, Rs. 6,150-6,175 in Indore, Rs. 5,600-5,850 in Sagar, and Rs. 5,250-6,031 in Kareli.

Uttar Pradesh

Lentil prices fell by Rs. 100-200 over the course of the week on slow buying by mills and selling by stockists. By the weekend, a quintal of Bareilly small lentils sold for Rs. 7,000, large lentils for Rs. 6,500, Kanpur Rs. 6,450, Jhansi Rs. 5,500-6,000 and Lalitpur small lentils for Rs. 6,200, large lentils for Rs. 5,800-5,850.

Other States

In Bihar’s Barh Mandi, lentil prices fell by Rs. 100 to Rs. 6,700. In Raipur, the price fell by Rs. 100 to Rs. 6,100. In other mandis as well, trading took place at lower prices.

Processed Lentil (Daal)

Due to lack of demand for masoor dal, prices slipped by Rs. 100-150 over the course of the week. By the weekend, the price had fallen to Rs 7,300-7,650 per quintal.

Logistical challenges- A big threat to India

Freight rates for tanker and dry bulk shipping into and out of India have increased significantly due to the continuing severe outbreak of COVID-19.

India is among the world’s top importers of coal, vegetable (edible) oil and crude mineral oil, etc., and is a large-scale exporter of iron ore, pellets, steel, salt, rice and many other items.

Several countries are not allowing ships to enter their ports if they have been in Indian ports during the prior two to four weeks. As a result, ship owners have started demanding higher fares for loading and unloading goods in India. This is a double-edged sword for India. It is delaying both the shipment of exports and the arrival of imported goods, and also significantly increasing the cost of ordering and shipping goods. Many countries fear that there may be a risk of the spread of new COVID-19 variants. Surprisingly, serious outbreaks of COVID-19 are still present in many other countries, including the U.S., Brazil, Mexico and Argentina, but similar rules do not apply to ships visiting ports in those countries. There is also confusion caused by frequent changes in quarantine rules at ports of some countries.

Huge decline in procurement

Although the Union Agriculture Ministry has approved the purchase of a large quantity of pulses at MSP for the 2020-21 kharif and rabi seasons on the basis of requests and proposals received from various major producing states, the wholesale market price of most pulses is supported. Government agencies have not had much success procuring kharif crops because of high prices. The same situation is being seen in the procurement of rabi pulses. According to official data, 2021 rabi marketing season procurement through June 17 totals about 5.46 lakh MT of chana (1.94 lakh MT in Madhya Pradesh, 1.68 lakh MT in Maharashtra, 1.29 lakh MT in Gujarat, 22,000 MT in Karnataka, 17,000 MT in Telangana, 10,000 MT in Andhra Pradesh and about 6,400 MT in Rajasthan).

The MSP for gram increased by Rs. 225 from Rs. 4,875 per quintal in 2019-20 to Rs. 5,100 for the 2020-21 rabi season. Lentil, another major rabi season pulse, has seen nominal procurement. Only 18.35 MT of lentils could be procured in Madhya Pradesh. The MSP for lentils increased by Rs. 300 per quintal from Rs. 4,800 last year to Rs. 5,100. In major producing states like Uttar Pradesh, Madhya Pradesh and Bihar, pulse prices were near or above MSP even before the harvesting of new crop and remained high even after the arrival of the new crop. Government procurement of rabi season moong was slightly better than lentils at an MSP of Rs. 7,196 per quintal. A total of 4,528 MT of rabi moong has been procured by the government agency, including 4,419 MT in Tamil Nadu and 109 MT in Orissa. Preparations are now being made in Madhya Pradesh to start procurement of summer or zaid season moong; this has already been approved by the Union Agriculture Ministry. Moong prices there have fallen far below MSP. Recently, the price of gram in Indore mandi has also dropped to Rs. 5,050 per quintal, which is less than the MSP of Rs. 5,100. Lentil prices are moving higher than MSP. The procurement of rabi pulses is much lower than last year and hence NAFED may not be able to play an effective role in balancing the supply and demand of pulses and controlling domestic market prices.

Government claims retail pulse prices have fallen

The government maintains that, as a result of its consolidated policies, the retail prices of tuar dal, moong dal and urad dal have started to soften. The Central and State Governments have taken some concrete steps to bring down the market price. A statement issued by the Union Ministry of Food and Consumer Affairs said that the bullish trend in the prices of the aforementioned pulses has put a brake on and this has stabilized market prices.

According to the ministry, from April 1 to June 16, 2021, the price of these three pulses registered an average increase of 0.95% as compared to 8.93% in the three months of the previous year (April-June 2020) and 4.13% over the same period in 2019. The growth for April-June 2021 is pegged relative to January-March 2021. Data from the ministry shows that between January 1 and June 18, the retail price of tuar and urad increased by Rs. 10 per kg during the current year. At present, the retail price of these two pulses is running at Rs. 110-110 per kg as against Rs. 100-100 per kg on January 1, 2021. The retail price of moong dal has remained stable at the previous level of Rs. 100 per kg. In order to control prices, the Centre took concerted steps with the states. The State Governments have made a successful attempt to control prices by requiring the declaration and physical verification of pulse stocks. Additionally, the deregulation of tuar, urad and moong imports has also had a psychological effect on the market. The Centre has asked the states to instruct traders, millers and importers to submit details of their stocks on a single portal. This has had positive results. Within a month of the portal’s launch, 28.66 lakh MT of pulse stocks were declared and 6,823 registrations were entered by various categories of partners. It currently accounts for about 20% of the total pulse stocks in the country.

According to the Food Ministry, procurement of gram, lentil and moong is still ongoing. NAFED is actively involved in the procurement of pulses on behalf of the Department of Food and Consumer Affairs, and is also obtaining the cooperation of provincial agencies. There is a regular supply of pulses to the states from the Centre.

Moong (Rabi-2021) Government Procurement Data

State Quantity (in Tons)

Tamil Nadu-4,419

Orissa-109.11

TOTAL-4,528.85

Lentil government procurement data

State Quantity (in Tons)

Madhya Pradesh-18.35

Gram government procurement data

(until June 17th)

State Quantity (in Tons)

Andhra Pradesh-10,083.8

Telangana-16,811.4

Maharashtra-1,68,379

Karnataka-22,030

Gujarat-1,28,589

Madhya Pradesh-1,93,706

Rajasthan-6,378

Total-5,45,980

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.15)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.