Crop damage due to rains, prices improved

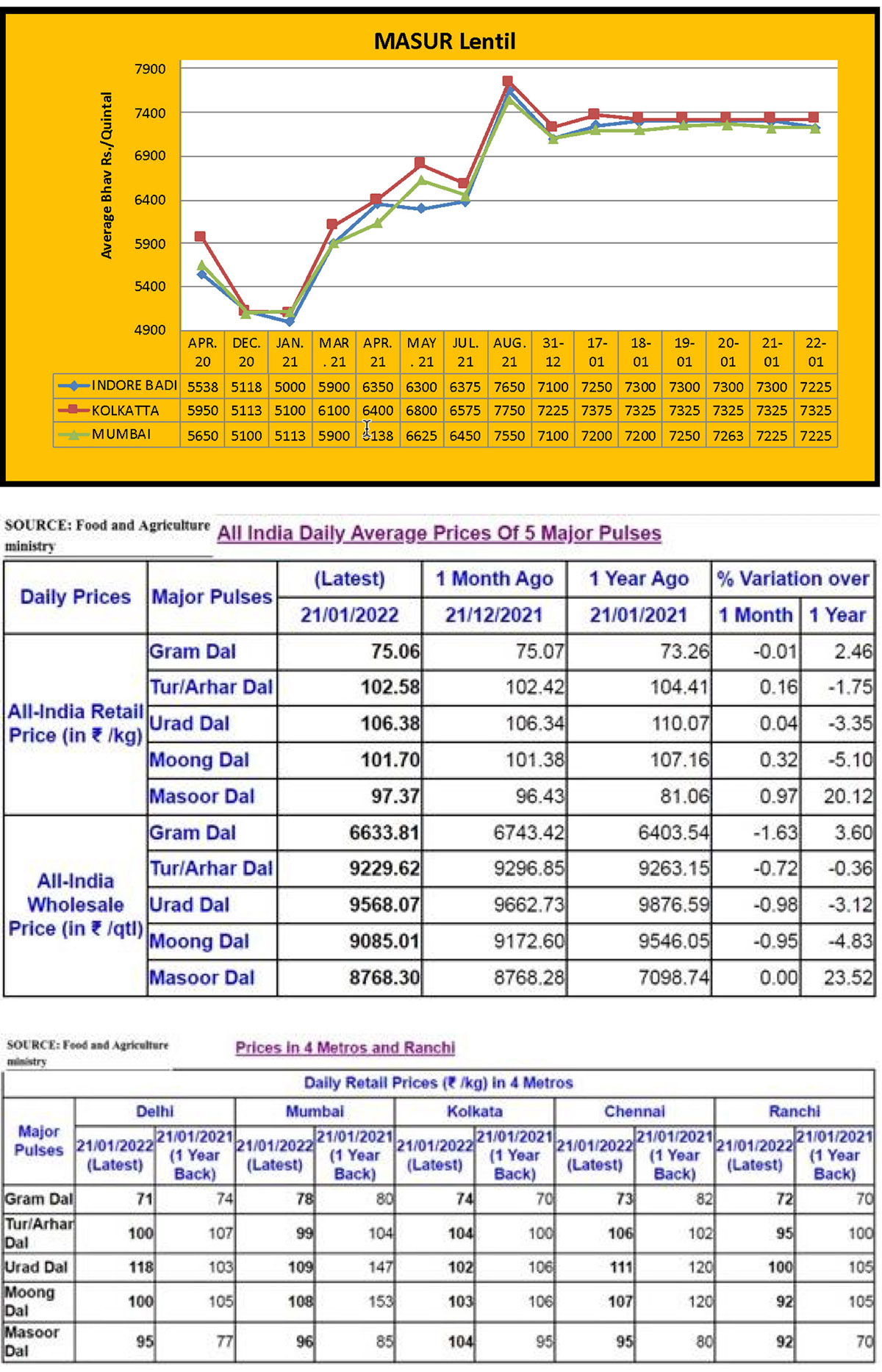

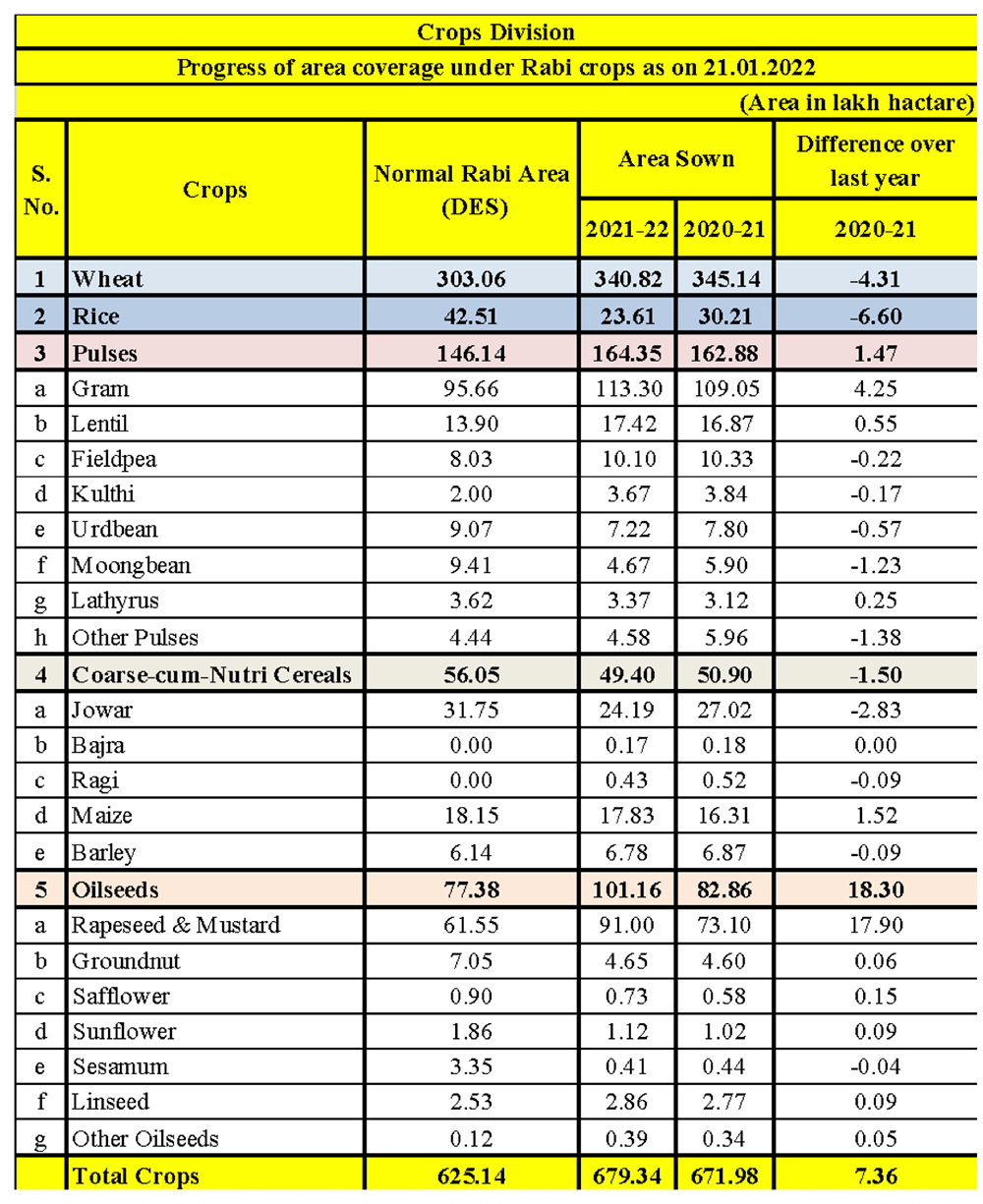

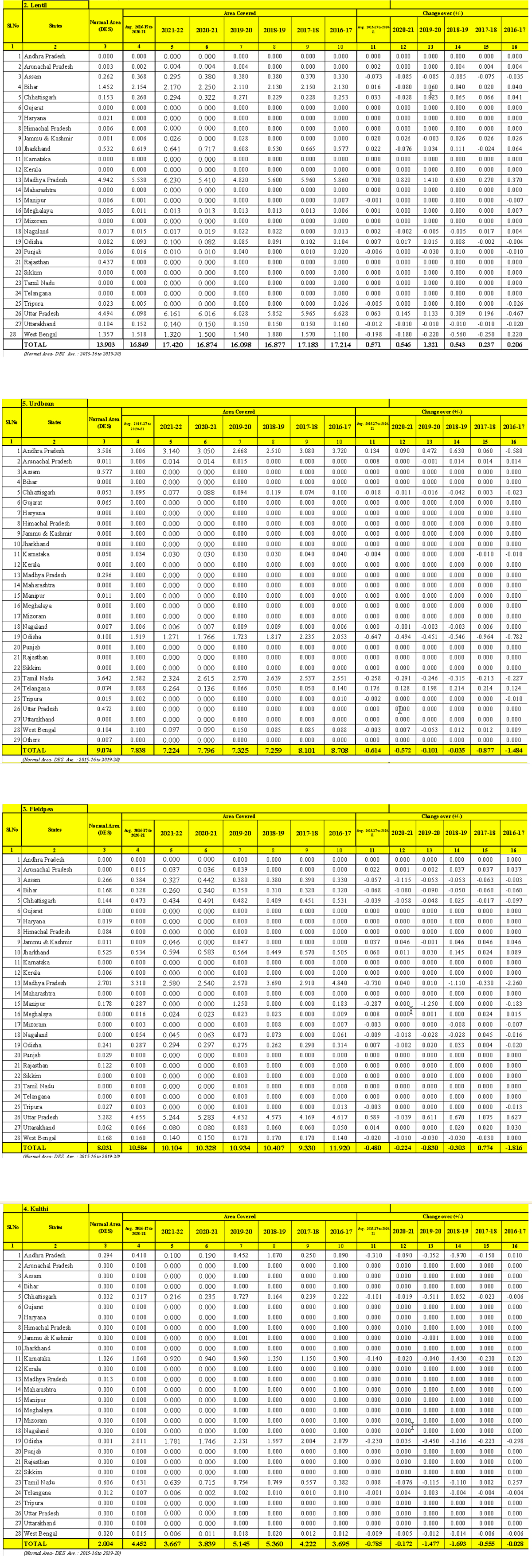

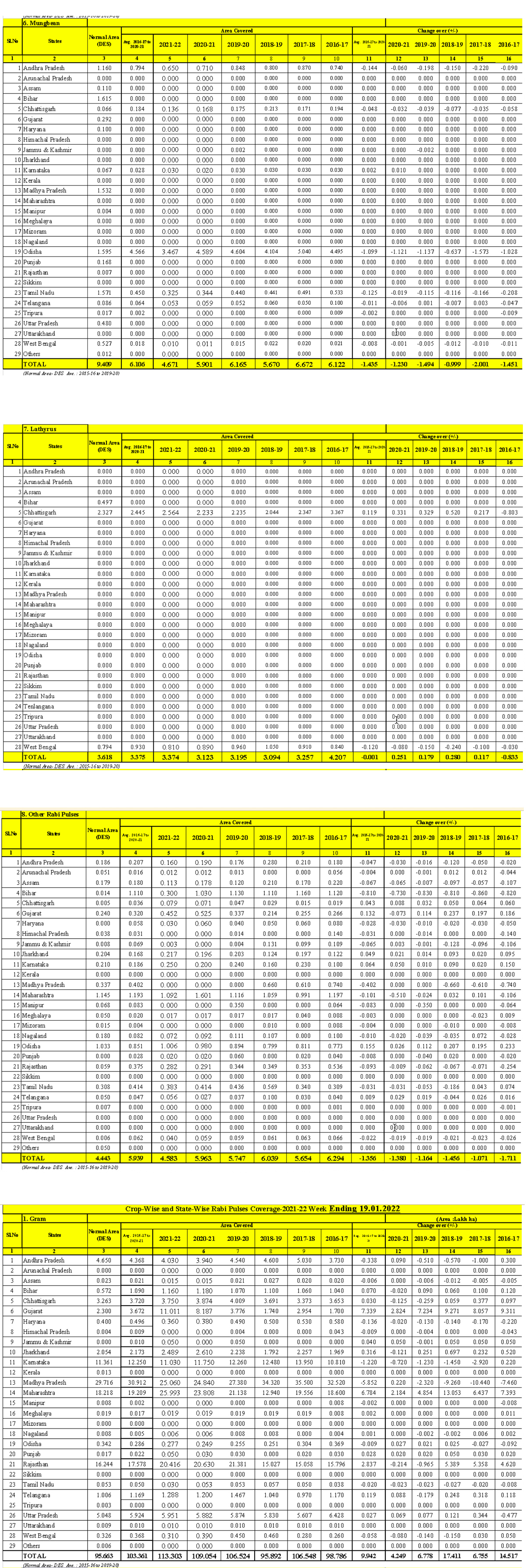

Lentil crops may be affected due to poor weather and intermittent rains in the main growing areas. Damage in late sown crops was reported. The sown area of lentils increased this year in Madhya Pradesh and Uttar Pradesh but decreased in other states. This year, the sown area reached 17.42 lakh hectares, compared to 16.87 lakh hectares in the same period last year. Sowing is almost finished.

Mumbai

Domestic lentils witnessed a bullish trend last week due to increased demand and buying. Despite the prices in other markets improving, Mumbai prices registered a fall of Rs 25/50 per quintal last week due to increase in selling and weak buying and Mundra sold at Rs. 7,150/7,200, Hazira Rs. 7,175, Container Canada Rs. 7,200 and Australia at Rs. 7,300 per quintal.

Delhi

Delhi lentils trended upwards due to improved buying. Desi prices improved by Rs. 175/250 and prices of imported stock increased by Rs. 50 per quintal. In Delhi, the Kota line sold at Rs. 7,775, the Bundi line at Rs. 8,250, the Uttarakhand line at Rs. 8,300, domestic large variety at Rs. 7,775 and imported stocks at Rs. 7400 per quintal.

Madhya Pradesh

Due to better buying, Madhya Pradesh prices increased by Rs. 50 in Indore, Rs. 100 in Bina, Rs. 300 in Ganjbasoda, Rs. 100 in Damoh and Rs. 200 per quintal in Sagar. With this increase, Katni traded at Rs. 7,750, Indore Rs. 7,300, Bina Rs. 6,600/7,300, Ganjbasoda Rs. 6,600/7,050, Damoh Rs. 6,500/7,000 and Sagar at Rs. 6,600/7,000 per quintal over the weekend.

Uttar Pradesh

Last week, demand improved in Uttar Pradesh and prices increased by Rs. 100/200 per quintal. Lalitpur Bold prices reached Rs. 6,900/6,950 and stocks of the small variety sold at Rs. 7,200 a quintal.

Other

In Bihar,prices were up and down in the range of Rs. 100 per quintal but by the weekend, prices stabilized at Rs. 7,700. Khushrupur sold at Rs. 7,600 and Mokama at Rs. 7,700 per quintal. Similarly, Raipur prices remained stable and sold at Rs. 7,300 per quintal.

Processed Lentil Daal

Although the prices of whole lentils improved, demand for daal remained sluggish. At the weekend, prices remained stable at Rs. 8,500/9,000 per quintal.

Demand to abolish GST on branded pulses and cereals

New Delhi. Since its implementation in 2017, the 5% Goods and Services Tax (GST) on branded pulses and cereals has been causing problems in the trade sector as well as at the consumer level, causing many traders to exit the branded market. Since non-branded products of these commodities are free from the GST, manufacturers and traders of branded products are not able to trade competitively.

Because of the GST, retailers charge a higher price for branded goods to consumers, which they feel has increased the price of pulses.

In their pre-budget memorandum, grains and pulses traders have demanded the Union Finance Minister to remove the GST on branded products. Branded grains subject to the 5% GST include rice and wheat flour.

Both trade organizations and traders have been pushing the government to remove the GST for a long time, without success. Since the implementation of the GST, the business of branded food products has been continuously shrinking. For many consumers, branded products give an assurance of the quality of the product. The demand will most likely be considered this year as the government wants to discourage bulk and open form trading the reduce the risk of adulteration

The trade sector is arguing that these essential products should be kept out of the purview of tax. After the implementation of the GST, the export of branded pulses from the country was blocked and it is felt that the government should immediately reinstate this subsidy. It was also highlighted in the memorandum that, due to frequent changes on the import policy of pulses, there is an atmosphere of uncertainty in the market. Traders are urging the government to make a permanent policy for at least one year, even if a minimum import duty has to be imposed.

Between September andNovember, Australian lentil exports reached 1.34 lakh tons

Brisbane. Recent data from the Australian Bureau of Statistics (ABS) shows that around 1.34 lakh tons of lentils were exported from Australia to India and many other countries between September and November, 2021.

Total shipments were 34,000 tons in September, 53,000 tons in October and 47,000 tons in November.

India was the major buyer in the quarter, importing a total of 29,016 tons, comprising 11,392 tons in September, 7,650 in October and 9,974 in November.

Elsewhere, 28,000 tons were exported to Sri Lanka, 27,000 to Egypt, 22,000 to Bangladesh, 12,000 to Nepal, 9,000 to the UAE and 6,000 to Türkiye. Exports of under 1,000 tons were also sent to other countries, including 505 tons to Pakistan, 299 to Malaysia, 99 to Mauritius, 74 to Lebanon, 50 to South Africa, 47 to South Korea, 46 to Taiwan, 24 to Fiji, 22 to Myanmar, 8 to Indonesia, 3 to New Zealand and 2 to Singapore

Harvesting of the new lentil crop started in Australia from October and the pace of supply increased in November. However, export shipments were hampered due to high shipping costs and the low availability of containers. Additionally, the global market price of lentils was very high in 2021, slowing down demand from importing countries. With the price of Canadian lentils jumping to a new record level, Australia also took the opportunity to increase prices. Lentils are heavily imported into India from these two countries.

Further Indian imports of lentil and chana are expected to increase in the coming months in the lead up to Ramadan in April.

Weather unfavourable in main growing areas for lentils and peas

Banda. In the Bundelkhand division of Uttar Pradesh and Madhya Pradesh, which is known for the cultivation of lentils and peas, sowing of the two pulses has been good and up to the week before last, weather conditions were favourable.

Last week, however, unseasonal rains and hailstorms were reported in some areas, causing damage to crops. The Madhya Pradesh government has asked collectors to get details of the damaged areas so they can provide financial assistance to farmers. This year, the sown area of lentils increased from 16.72 lakh hectares last year to 17.32 lakh hectares, comprising an increase from 5.41 lakh hectares to 6.19 lakh hectares in Madhya Pradesh and from 5.99 lakh hectares to 6.14 lakh hectares in Uttar Pradesh. In other lentil producing states, including Bihar and Bengal, the sown area of lentils has come down from a total of 5.32 lakh hectares last year to 4.99 lakh hectares. The market price of lentils has been running much higher than the minimum support price for a while and the sown area was expected to increase substantially as a result but this has not been the case.

Regarding peas, there is no minimum support price and prices are therefore driven by the market. Imports have also stopped due to the government imposing strict conditions and a heavy customs duty of 50 percent. Despite the shortage of stock, prices are fluctuating up and down within a certain range. According to government data, the sown area of peas has fallen from 10.27 lakh hectares in the 2020-21 season to 9.91 lakh hectares. The sown area decreased from 2.54 lakh hectares to 2.45 lakh hectares in Madhya Pradesh and 5.28 lakh hectares to 5.24 lakh hectares in Uttar Pradesh. In other producing states, the area has come down from 2.45 lakh hectares to 2.22 lakh hectares. The arrival of fresh peas has already started in the mandis and dry peas will start in the coming months.

Karnataka crop production low due to rain damage

According to the second advance production estimate released by the Karnataka Agriculture Department, the production of rice in the state is expected to reach 35 lakh tons, compared to 47 lakh tons last season. Maize production also decreased by 11 lakh tons to 53 lakh tonnes and tuar production decreased by 2 lakh tons to 1 million tons.

Oilseed production in the state is estimated to decrease by 10 lakh tons as compared to last year to 11 lakh tons. Likewise sugarcane production is predicted to fall to 407 lakh tons from 423 lakh tons and cotton to 17 lakh bales from 23 last year. Rainfall on standing crops and floods in many areas led to this decline in productivity per hectare. Tuar yields were reported at 637 kg/hectare compared to 759 kg/hectare last season. Soya production, however, is estimated to increase marginally, to 3.9 lakh tons from 3.77 lakh tons last year.

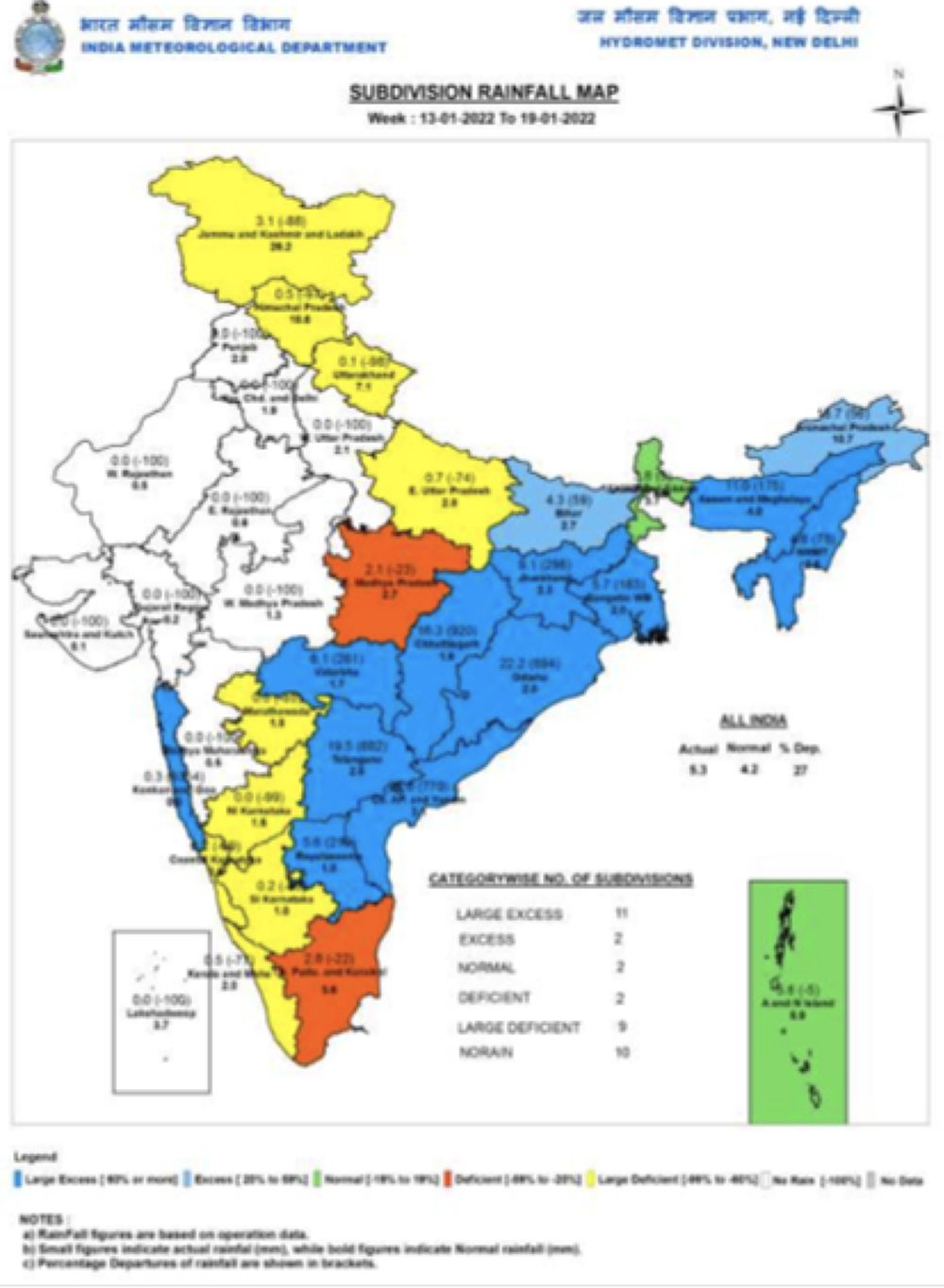

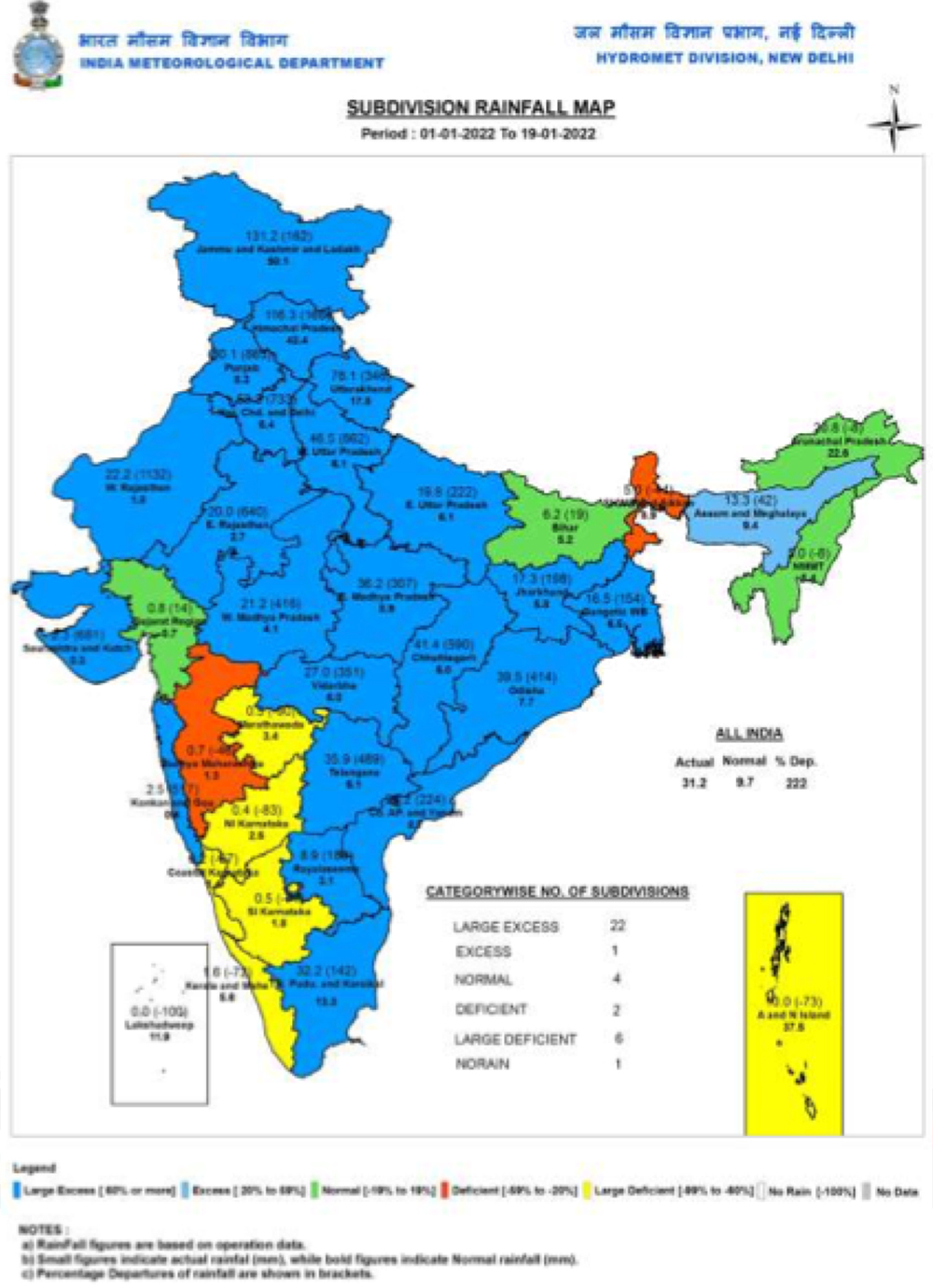

Rabi crops damaged in many states due to unseasonal rains and hailstorms

New Delhi. The Union Agriculture Ministry reports that although the recent rains have benefited the rabi crops in the major producing states, there has also been some damage due to heavy rains, hailstorms and strong winds. Data as of January 11 shows that, in the current Rabi season, about 49,000 hectares in Madhya Pradesh, 69,000 hectares in Rajasthan, 1.12 lakh hectares in Uttar Pradesh, 98,000 hectares in Haryana and more than 5,000 hectares in Maharashtra have been affected. There has also been damage to crops in Punjab and West Bengal but the damage has not yet been fully assessed.

The pulses sowing area target is likely to be achieved by the end of the month in most states. In the southern and eastern provinces, sowing of paddy is expected to continue until the first week of February while sowing of wheat is almost over. By the end of January, we will have a clear picture of the sown area of rabi crops and, from the first week of February, sowing data for summer crops will start coming in. With adequate water reserves in the dams and reservoirs, no irrigation problems are predicted.

Senior officials of the Ministry of Agriculture say that the third wave of the corona pandemic has not affected the sowing of Rabi crops. The progress of crops is encouraging although some places have been affected by adverse weather conditions. The next season will prove to be very important.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Besan: Gram Flour

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 74.72) 25 Jan, 22 at 12:56 PM IST

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

IGrain / Rahul Chauhan. India / Mumbai / Delhi / Madhya Pradesh / Uttar Pradesh / Lentil / Daal / Brisbane / Banda / Karnataka / Chick Peas / Desi / Black Matpe / Mung / Pigeon Pea / Red Kidney / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.