February 25, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Ports

Mumbai

Due to rains and hailstorms in the lentil producing states, importers have stopped selling their stocks. The reduced selling has seen prices increase in most states. The major lentil growing states of Uttar Pradesh, Bihar and Madhya Pradesh received heavy rains and this may cause harvest delays, increase the moisture content and reduce the size of the crop. The rains, however, were reported through Saturday and Sunday brought clear skies. Due to the rise in prices, demand improved.

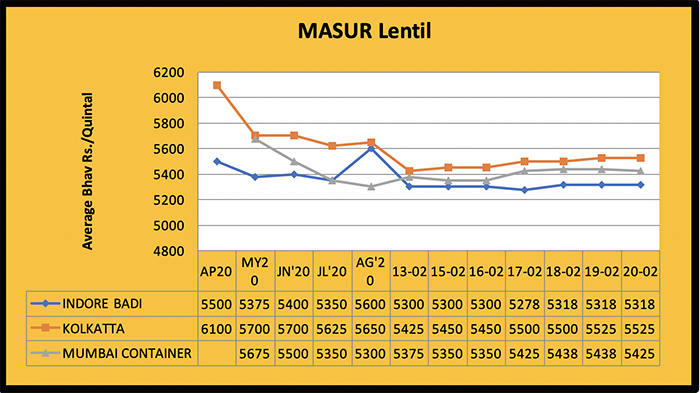

Mumbai Port

Last week, Mumbai port prices saw a surge of Rs. 75-100 and by the weekend vessel prices were at Rs. 5,350-5,375, container prices were at Rs. 5,500 and Australian lentil prices increased to Rs. 5,600. Lentils traded at Rs. 5,350 in Mundra port, Rs. 5,375 in Hazira port, Rs. 5,321 in Kandla port and Rs. 5,475-5,525 in Kolkata. The import parity is on the high side as from 1 January lentil import again rose to 30%.

New crop may hit the market in 15 days and may reach peak level from last week of March.

The increased import availability and domestic crop may pressure the market for a month or two.

New Delhi

Due to increased prices at port Delhi, the lentil market rose by Rs. 50-75. Initially, at the start of the week, the price fell by Rs. 100. Delhi large-sized lentils traded at Rs. 5,600, small lentils at Rs. 5800-6300 and imported lentils at Rs. 5550.

Uttar Pradesh

In Uttar Pradesh, the demand for lentils was normal and by the weekend prices increased by Rs. 50-75 and traded at Rs. 5575 in Kanpur. In Bareilly, small lentils traded at Rs. 6550-6600 and large sizes at Rs. 5,650. In Jhansi, prices ranged from Rs. 4,000 – 5,000. In Lalitpur, large lentil prices were reported at Rs. 4800-4900 and small lentils at Rs. 5,200-5,400.

Madhya Pradesh

In Madhya Pradesh, decreased demand saw prices fall by Rs. 100. Lentils traded at Rs. 5000-5200 in Ashoknagar, Rs. 4900 – 5200 in Ganjbasoda, Rs. 5300-5325 in Indore, Rs. 5000-5200 in Sagar and Rs. 5575-5600 in Katni.

Others

In Barh, prices dropped by Rs. 100 and traded at Rs. 5300. Raipur market yard lentils traded at Rs. 5,300. Trading was slow in other market yards.

Processed Lentils Dall

Due to decreased demand for processed dall, the market remained unchanged, with no significant ups or downs.

By the weekend, processed lentil prices were at Rs. 6,000-6,400.

The Department of Food, Consumer Affairs appointed Nafed to procure lentils from Bihar state. Bihar is one of India’s largest lentil producing states. Due to some glitches between the Central and state governments, farmers were unable to sell lentils at MSP for the past nine years. When procurement begins, it may widen the gap between supply and consumption.

In 2019, Nafed and other government agencies procured 56,226.52 MT (56075.02 from Madhya Pradesh, 151.5 MT from Uttar Pradesh). In 2020, only 1,433.88 MT were procured (1,433.68 MT from Madhya Pradesh and 0.2 from Uttar Pradesh).

This year, Nafed’s procurement target is 79,300 MT from Madhya Pradesh and 113200 MT from Uttar Pradesh.

The MSP for lentils is Rs. 5100/100 kg. As of this writing, market prices for lentils are equivalent to MSP. When prices are lower than MSP, government procurement is higher, and when government procurement is higher, it may affect future market sentiment if the crop is sold at lower prices.

If prices are above MSP, there is less procurement.

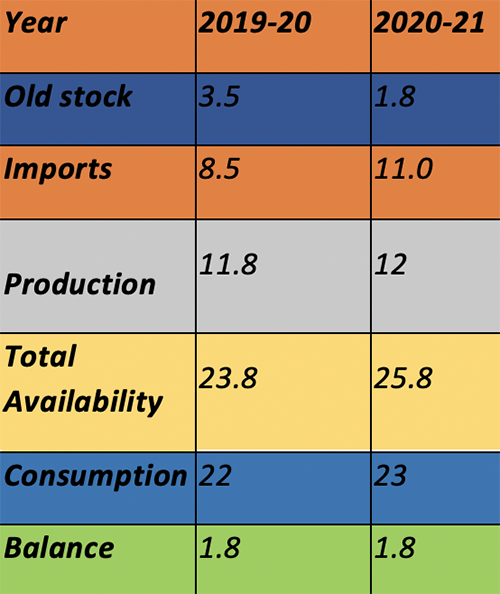

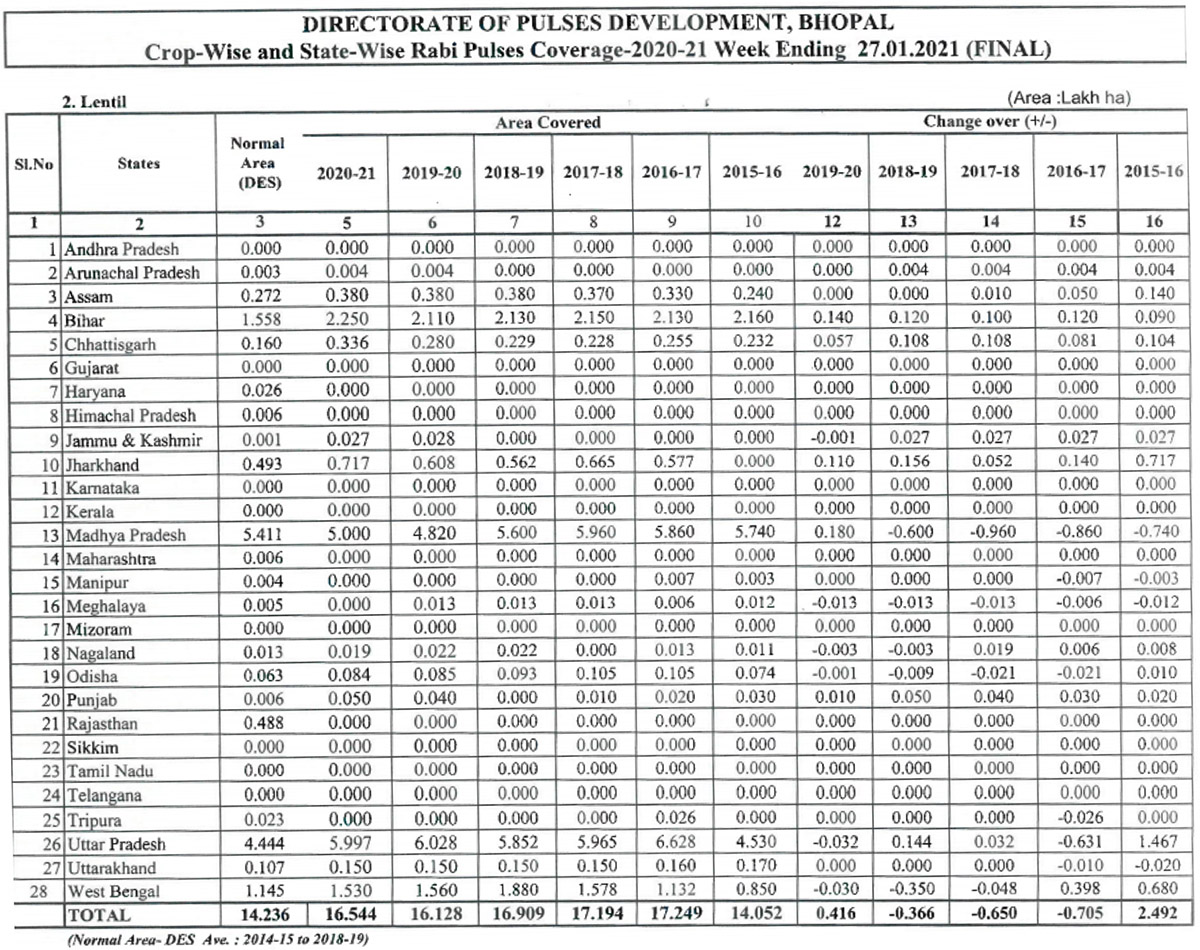

Lentil consumption is about 2.2. million MT. From April to January, approximately 1.041 million MT of lentils were imported. By the end of the financial year, imports may hit 1.1 million MT.

Assuming production of 1.2 million MT, the balance stock through the year may be recorded at 0.18-million-ton equivalent to last year.

For the next financial year, the government may have to amend lentil import policies to cover consumption.

Based on the situation described above, I-Grain India feels that in June lentil import policies will be relaxed, either by reducing the custom duty or via another method. Should this occur, it may cause a surge in the market again, as Canada does not have stocks and new crop will not be available till the third quarter. Aggressive buying from India this year and constant buying from Türkiye will drive up international prices.

I-Grain India feels that during the second quarter of the next financial year (April-September), prices may remain well above MSP for a considerable amount of time.

STATEWISE RABI SEASON 2019 LENTIL PROCUREMENT (IN METRIC TONS) STATE- QUANTITY

Madhya Pradesh 56,075.02

Uttar Pradesh 151.5

Total 56,226.52

STATEWISE RABI SEASON 2020 LENTIL PROCUREMENT (IN METRIC TONS) STATE- QUANTITY

Uttar 0.2

Madhya Pradesh 1,433.68

Total- 1,433.88

Government procurement to be less than last season

The Central government announced the procurement of 2 million MT for the 2020-21 marketing season. These crops will be procured from different states so that farmers receive good prices. A good amount of the budget is allocated for pulses and oilseed procurement. If we compare the previous and current market scenarios, the situation has changed dramatically. Most of the pulses are selling above MSP. Moong and Urad (Black Matpe) crops were severely affected by irregular rains. Tuar (Pigeon Pea) crop also affected due to climate conditions in different parts of India. Due to crop damage and restricted imports during arrivals, the prices of most of the kharif pulses was above MSP.

Pigeon pea procurement was very low compared to last year. Gram and lentil MSPs are both at Rs. 5100. Lentil prices are above MSP and gram prices also appear to improve.

During the kharif season, the government procured only 0.31 million MT of Urad, Mung and Pigeon pea, as well as groundnuts and soybeans.

This procurement came from Maharashtra, Karnataka, Rajasthan, Orissa, Andhra Pradesh and Tamil Nadu. Procurement in Bihar and Jharkhand will start soon.

Last season, 0.48 million MT of pigeon peas were procured by May 14, 2019, which is 0.2 million MT more than in the 2018 season.

This season, as of February 4, 2021, a total of 10,504.21 MT of pigeon peas were procured.

In kharif 2020-21, only 150 MT of mung was procured, compared to 25,965 MT in 2019. During the 2018 season, the government procured 295,406 MT.

Analyzing the above procurement patterns, we can see that if the crop is good, government procurement increases, and vice versa.

Except for gram, other pulse prices are above MSP. Due to the drastic decrease in the domestic kharif season and restricted imports, especially of peas, there was a price surge for most pulses. Prices for pigeon peas, moong, urad, lentils are above MSP.

Imports of Urad, Moong, Lentils and Gram are open. Gram and lentils import parity is higher, moong international prices are well above domestic prices and, due to reduced availability of urad, imports are affected. Pigeon pea imports were restricted from 1 Jan 2021. Pea imports over the past two years are negligible.

Presently, pigeon peas are arriving at market yards. Slowly, rabi lentils and gram will soon hit the market. Rabi Urad and moong arrivals are down from last year. As the government has removed the essential commodity act, big firms/companies/stockist may procure pulses at any level.

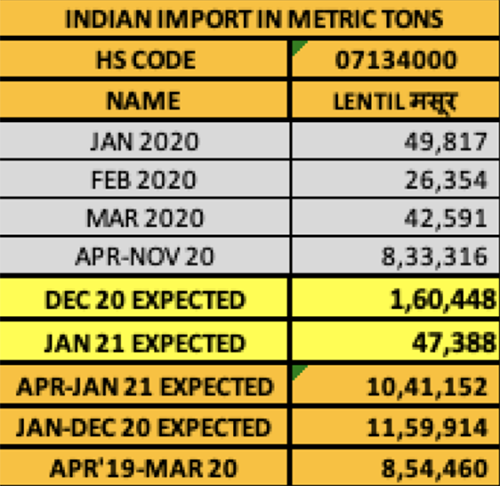

Lentil imports hit 1.041 million MT

The import of lentils under the discounted tariff increased drastically from April to January 2021, the first ten months of the current financial year. Lentil imports may hit 1.15 million MT. As per the data given by the commercial department, from April to November India imported more than 0.833 million MT. In December, imports were above 0.161 and in January 2021, 00.47 million MT arrived at ports.

In January 2020, imports amounted to 15,000 MT, and in February 2020, they totaled 26,000 MT. In March, 43,000 MT were imported. In calendar year 2020, India imported 1.160 million MT.

Last financial year (April-March), 0.855 lakh MT of lentils were imported. From February to March of this year, imports will be lower due to higher import tariffs.

Last year, because of lower production, the government of India lowered the import duty from 30% to 10% and extended the import deadline twice.

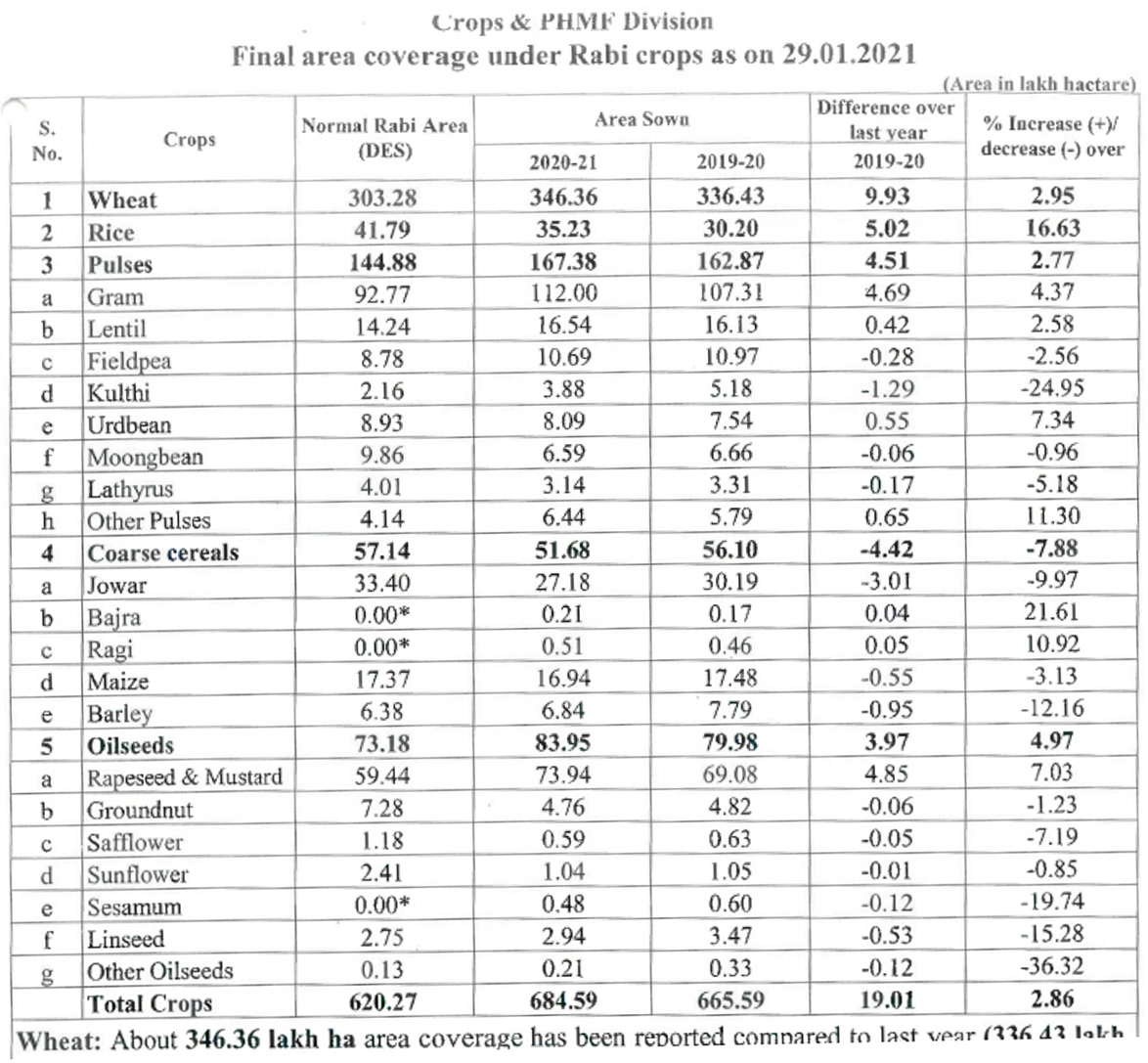

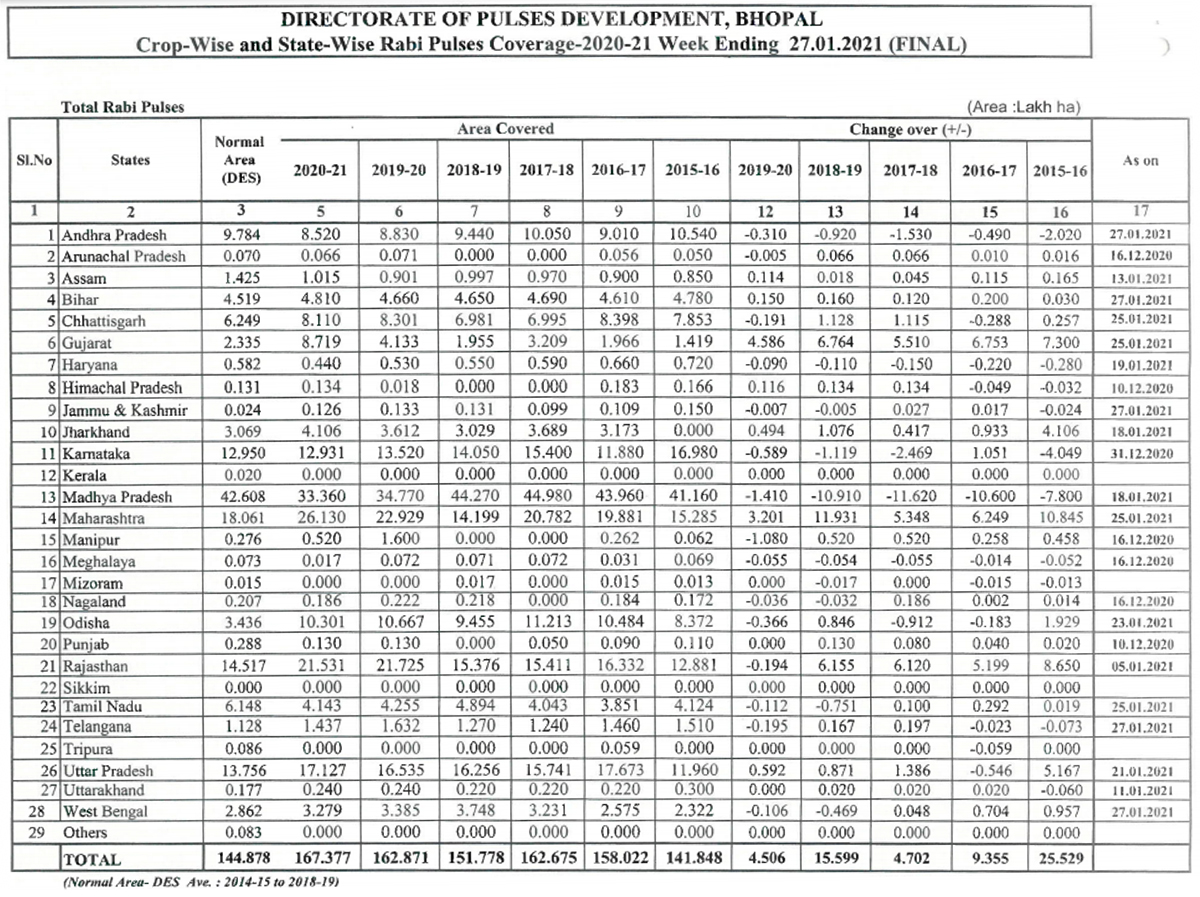

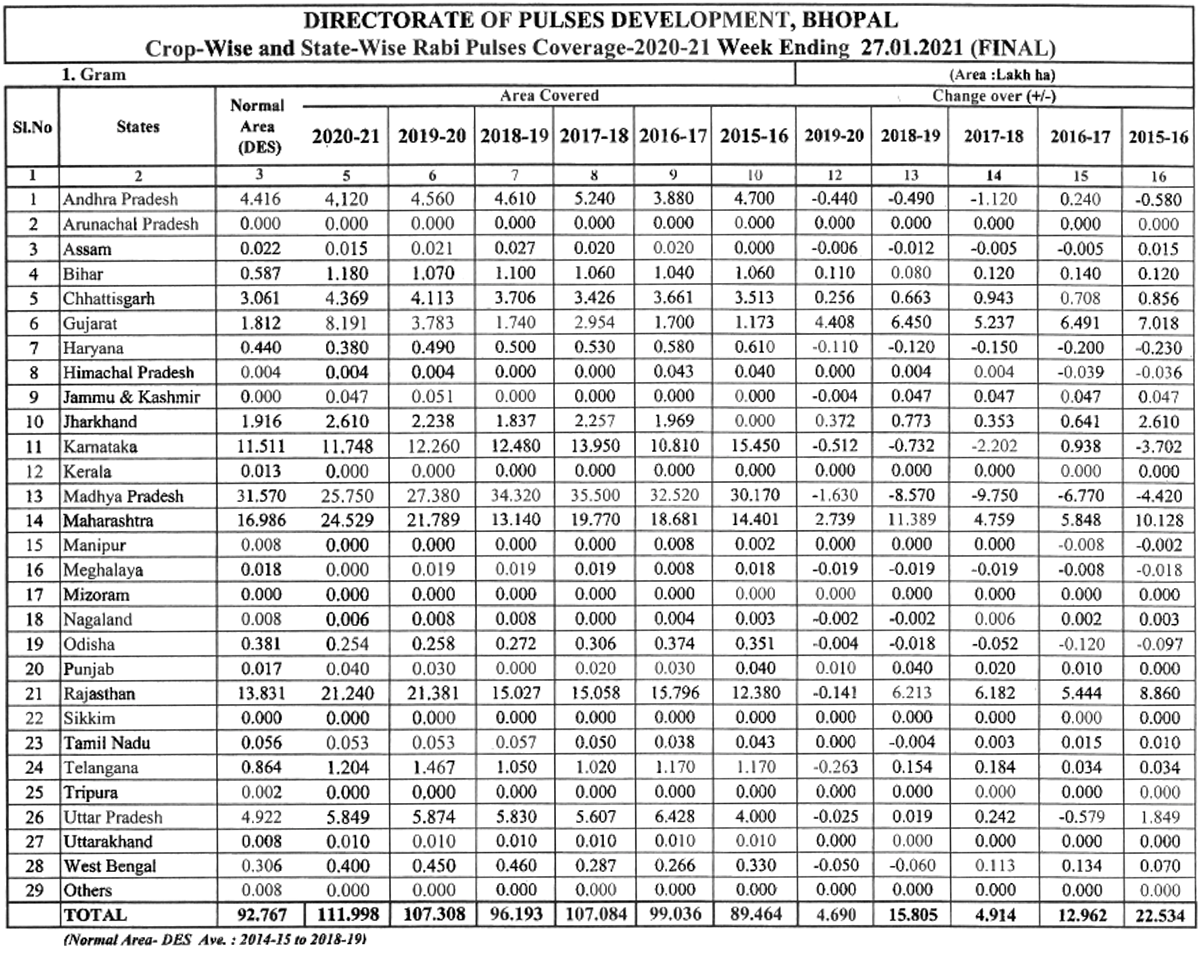

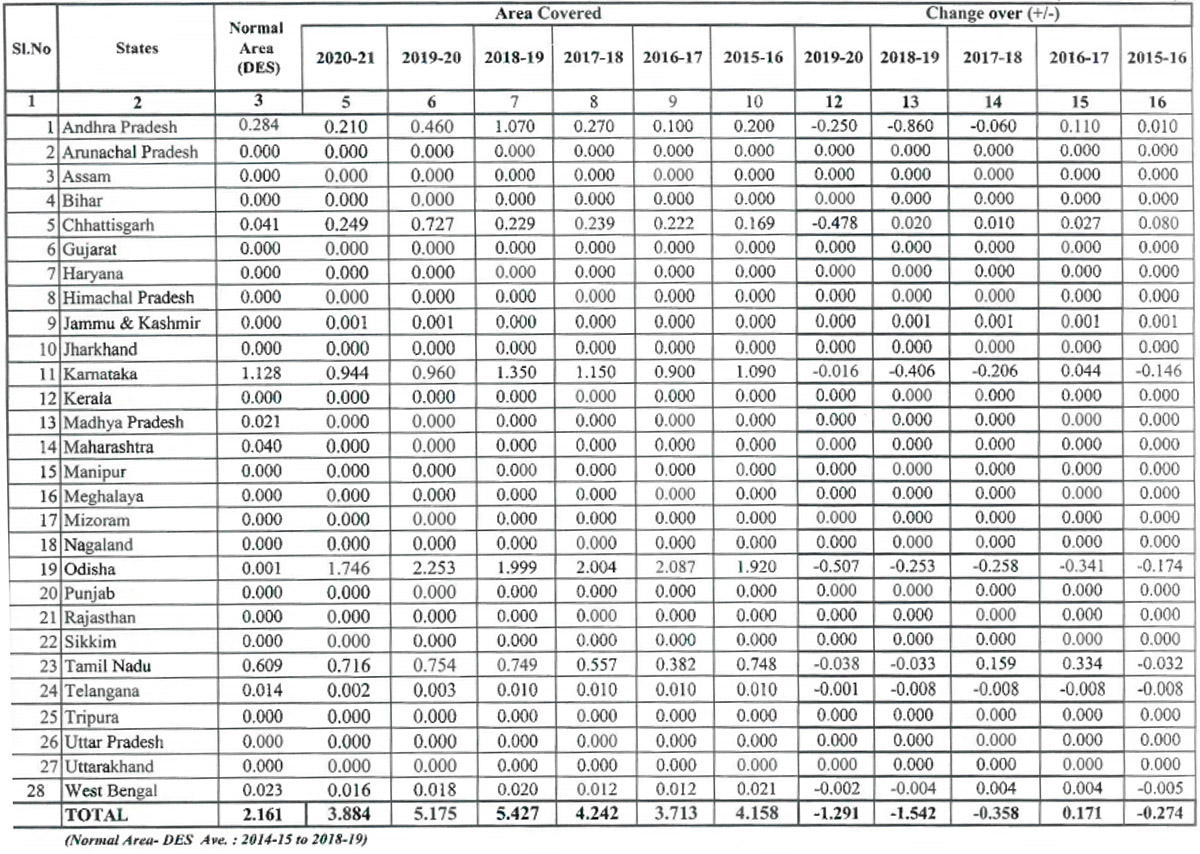

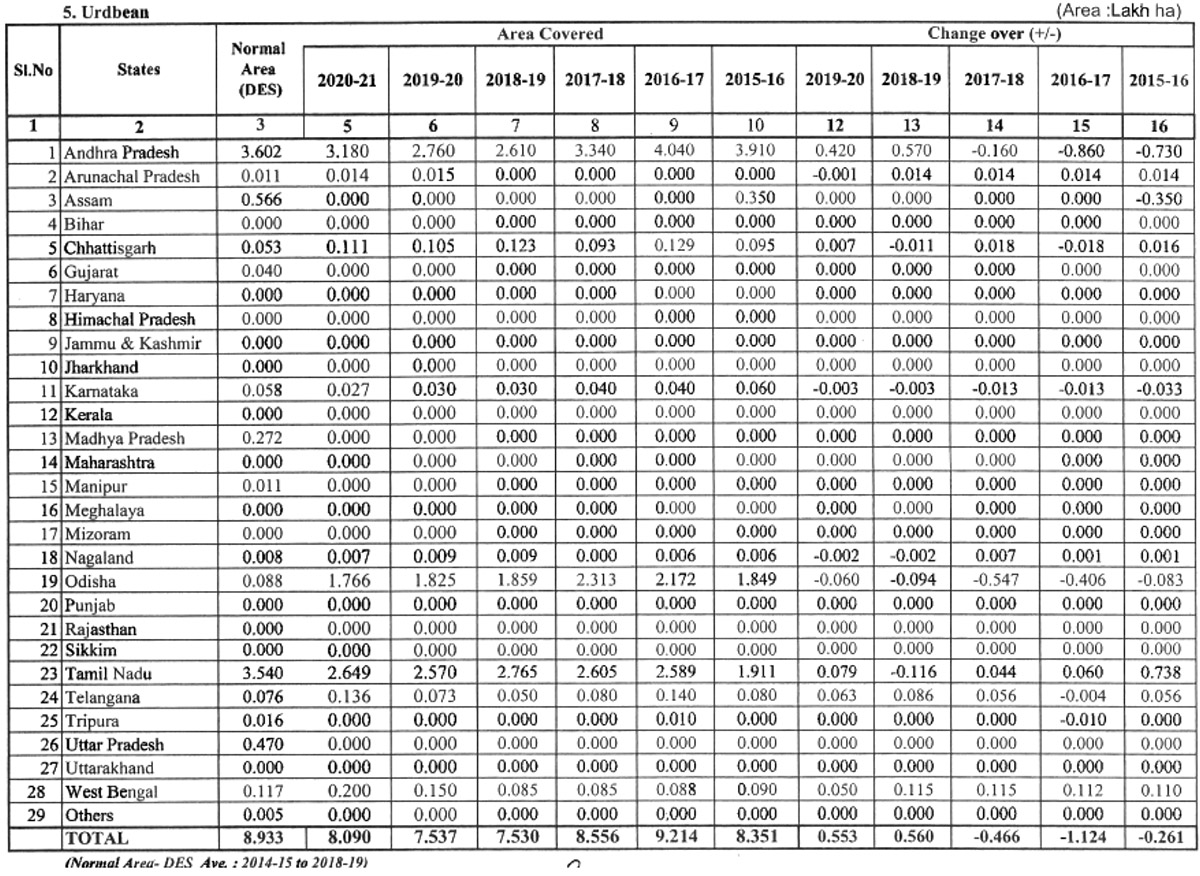

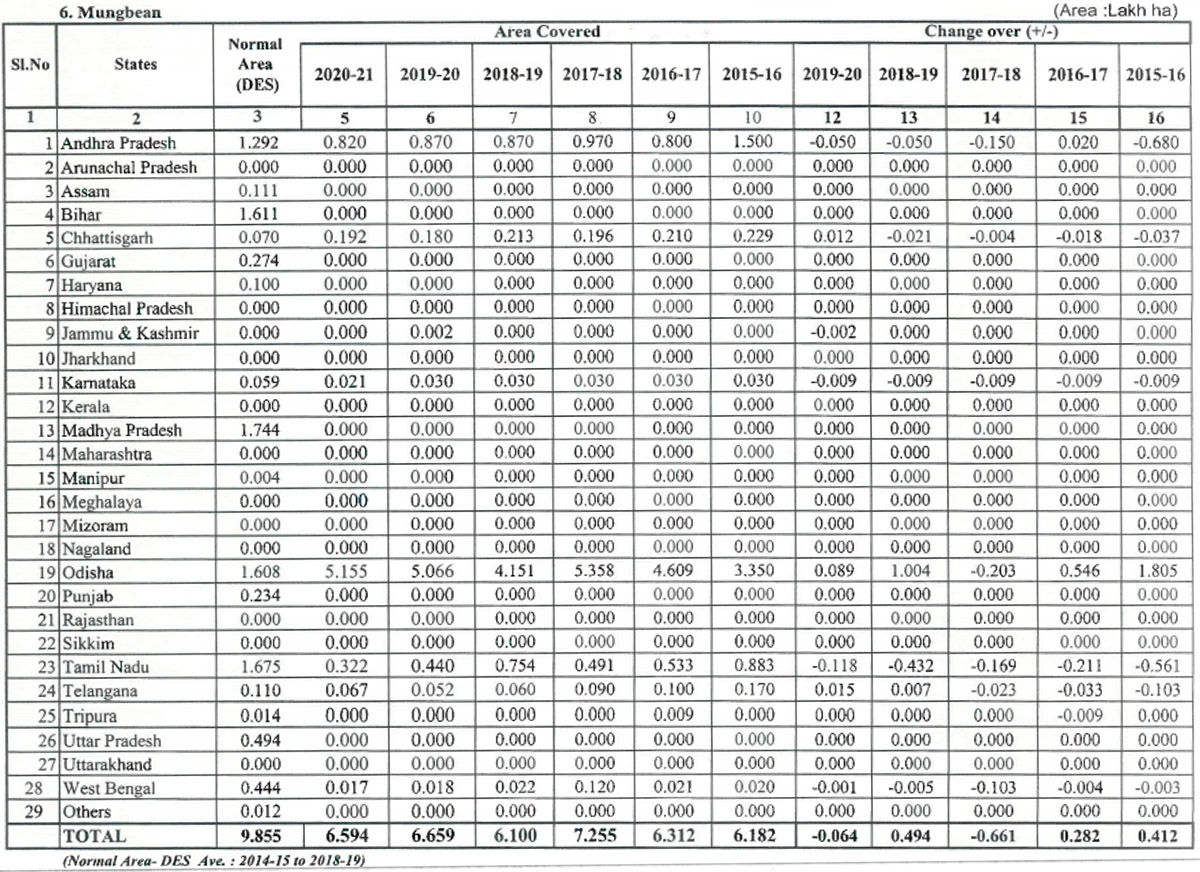

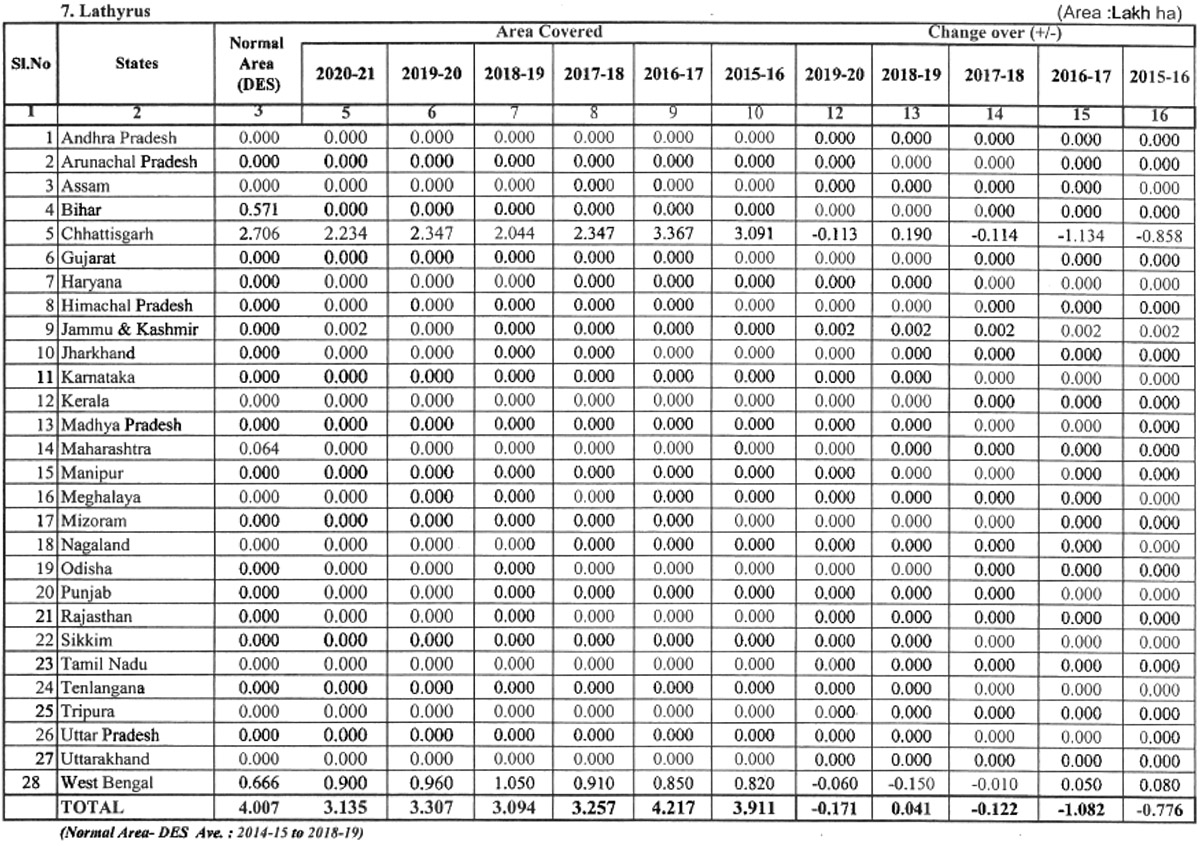

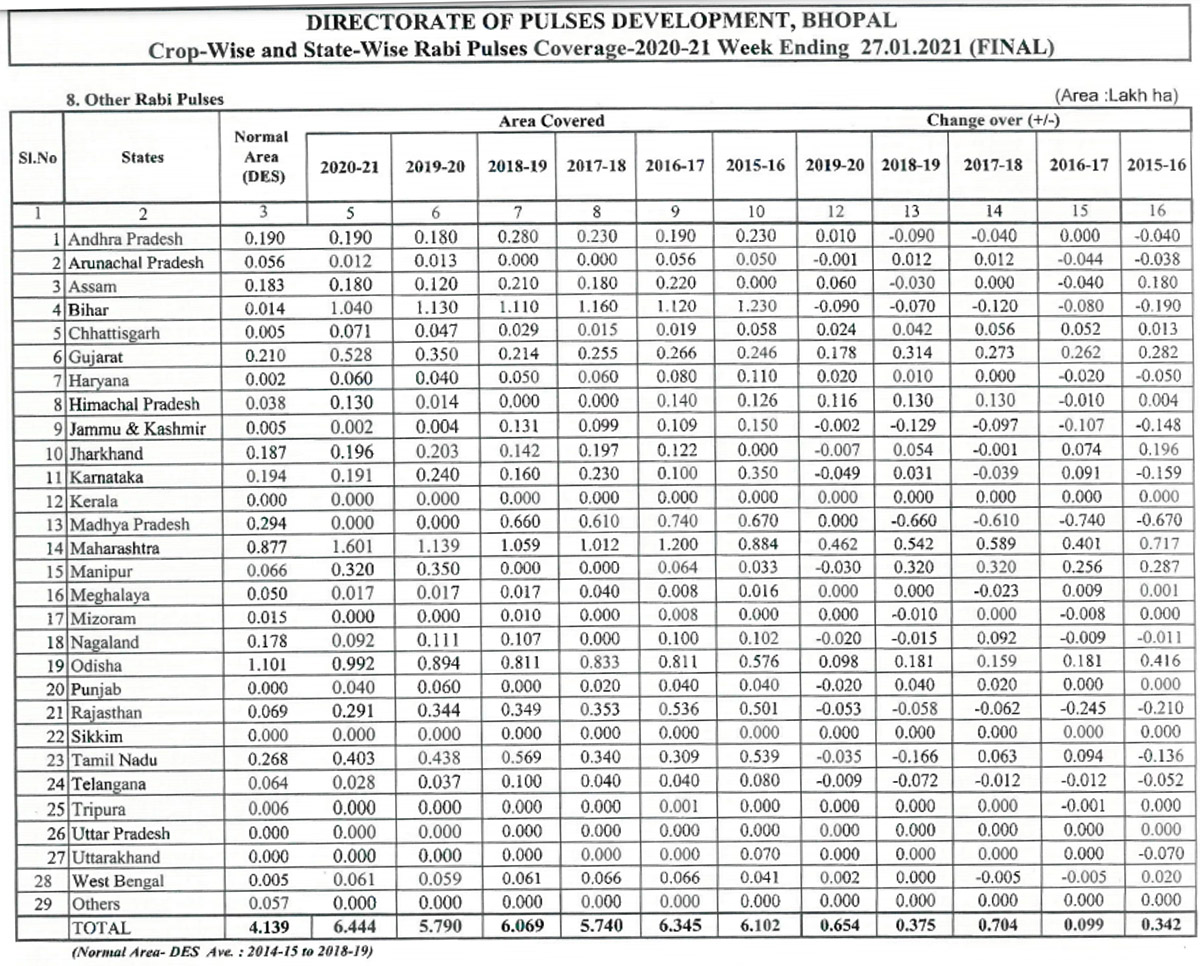

RABI SOWING: DEPARTMENT OF AGRICULTURE, COOPERATION & FAMERS WELFARE

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Mata: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 72.45)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Rahul Chauhan / NAFED / dal / India / Australia / Mumbai / Uttar Pradesh / Madhya Pradesh / Barh

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.