September 8, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

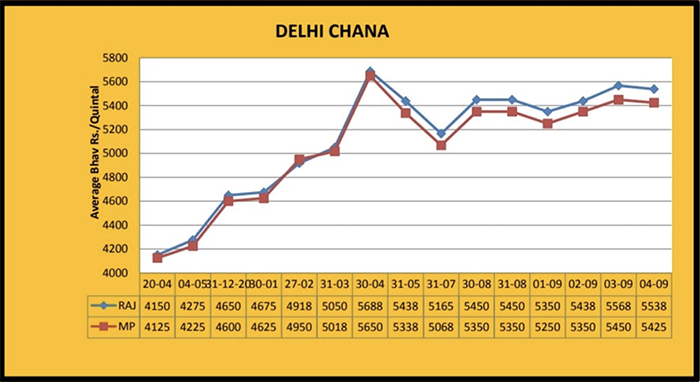

Market initally down due to subdued demand but improved by the weekend

The demand for desi chickpeas was weak at the beginning of last week, which caused a downward trend in prices, but by the weekend demand improved slightly on account of the lower prices. In Delhi, prices remained stable in the Madhya Pradesh line, at Rs. 5,450, and in the Rajasthan line chana traded at Rs. 5,550/5,575 per quintal.

Port

Demand for imported desi chickpeas remained sluggish. At the Port of Mumbai, prices softened by Rs. 50 per quintal. Tanzania old traded at Rs. 5,100 and new at Rs. 5,550 while Sudan old traded at Rs. 5,850 and new at Rs. 6,050 per quintal. In Kolkata, prices remained stable at Rs. 5650 per quintal over the weekend.

Rajasthan

In Rajasthan's mandis this week, prices decreased by Rs. 50/100 per quintal to Rs. 5,000/5,050. In Kishangarh, the price was Rs. 5,000/5,100, in Bikaner Rs. 5,350 and in Jaipur Rs. 5,500 per quintal.

Madhya Pradesh

In Madhya Pradesh, prices did not see much change due to weak demand from local mills. In Indore, prices fell by Rs. 25 to Rs. 5,550/5,575 per quintal this week while in Katni, prices remained stable at Rs. 5,450/5,500 per quintal over the weekend.

Maharashtra

During the current week, demand remained weak and prices showed a declining trend. In Solapur, prices fell by Rs. 100 per quintal, in Amravati by Rs. 150, Rs. 50 in Latur and Rs. 50 per quintal in Nagpur. With this decrease, the prices were Rs. 5,000/5,600, Rs. 4,800/5,100, Rs. 5,400/5,600 and 5,500/5,550 per quintal in Solapur, Amravati, Latur and Nagpur respectively. In Akola, however, prices improved by Rs. 50 per quintal to Rs. 5,500/5,575 per quintal over the weekend.

Uttar Pradesh

Last week, demand was normal in Kanpur and the price remained stable at Rs. 5,650 per quintal. In Lalitpur, prices softened by Rs. 50 per quintal and sold at Rs. 5,000/5,150 per quintal. In Orai, prices fell by Rs. 150 per quintal to Rs. 5,152 per quintal at the weekend.

Other

Last week, in Raipur prices registered an improvement of Rs. 50 per quintal, reaching Rs. 5,500/5,600. In Gulbarga, prices remained stable at Rs. 5,100/5,500.

Chana Dal

An overall downward trend was seen in chana dal due to the fall in prices of whole chana as well as weak demand. Prices fell by Rs. 125 in Delhi, Rs. 800 in Katni, Rs. 50 in Jalgaon and Rs. 200 in Kanpur, bring them to Rs. 6,300/6,525, 6,500, Rs. 6,550 and Rs. 6,250/6,300 per quintal, respectively.

Huge drop in production of pulses due to severe drought in Canada

The first production estimates released by StatsCan show that there has been a sharp decline in the yield of pulse crops in Canada during the current year as compared to last year. Harvesting has reached the final stage and is likely to be over by mid-September. In Canada, pulses are mainly produced in the western part and Saskatchewan, Alberta and Manitoba are the top three producing states. In some other provinces, including Quebec, there is a small amount of pulses production. Notably, for the first time in Canada, the August StatsCan crop report was not based on surveys of farmers. Instead, the agency used a model-based approach in which the overall condition and progress of crops are closely monitored under satellite images, from which production is depicted. The production figure has been estimated on the basis of the crop condition until July 31, 2021. In August, however weather conditions was very poor.

On September 14, the production estimate will be re-evaluated, and will include a review of the condition of the crop until August 31. The final yield report for the whole year will be published in December, which will be based on farmer surveys. Canada is the largest producer and exporter of lentils and peas in the world and this year there has been a sharp decline in the production of both of these pulses. After extended period of severe drought, it started raining and temperatures fell at the time of harvesting, which is a concern for farmers. In Saskatchewan, the most prominent pulse-producing province, 76 percent of lentils and 81 percent of peas had been harvested by August 23, while chana harvesting was done in less than 20 percent of the area.

Wholesale and retail prices of most pulses softened in August

New Delhi. Official data shows that the average wholesale and retail prices of most pulses in India declined marginally in August compared to July. This includes chana dal, tuar dal, urad dal and moong dal. The price of masoor dal, however, increased slightly.

According to the data received, the retail price of chana dal decreased from Rs. 75.09 to Rs. 74.64 per kg in August as compared to July, tuar dal from Rs. 105.26 to Rs. 104.06 per kg, urad dal from Rs. 107.13 to Rs. 105.12 per kg and moong dal from Rs. 102.33 to Rs 100.77 per kg while the retail price of masoor dal increased from Rs. 87.55 to Rs. 89.76 per kg.

Similarly, at the national level, the wholesale market price of chana dal decreased from Rs. 6,678.01 to Rs. 6,596.01 per quintal, tuar dal from Rs. 9,580.72 to Rs. 9,468.67 per quintal, urad dal from Rs. 9,666.88 to Rs. 9,548.07 and moong dal from Rs. 9,191.51 to Rs. 8,065.26 per quintal. Masoor dal increased from Rs. 7,864.73 in July to Rs. 8,037.94 per quintal in August.

The data also showed that the wholesale and retail prices of various pulses in August 2020 were different from those of August 2021. As of August 30 2020, the retail price of chana dal was Rs. 66.69 per kg, tuar dal was Rs. 91.74 per kg, urad dal was Rs. 94.82 per kg, moong dal was Rs. 100.86 per kg and masoor dal was Rs. 76.50 per kg. Similarly, the wholesale market price of chana dal was Rs. 6,030.54 per quintal, tuar dal Rs. 8,465.42 per quintal, and urad dal Rs. 8,670.37 per quintal. All the above wholesale and retail prices are not of whole pulses but of split ones.

India- Pulse export business faded in the first quarter

New Delhi. Generally, India is considered to be a large importer of pulses but limited quantities of whole pulses, split/processed pulses and organic pulses are also exported from India. Export of pulses in consumer packs of up to 5 kg. have been permitted.

Data from the Agricultural and Processed Food Products Export Development Authority (APEDA), a subordinate body of the Ministry of Commerce, shows that in the first quarter of the current financial year i.e., during April-June 2021, only about 58,000 tones were exported.

Thes exports resulted in an income of Rs. 438 crore or $590 million. In comparison, in the April-June 2020 quarter, more than 1.10 lakh tones were exported, earning an income of Rs. 753 crore or $ 990 million.

The average unit export offer price increased from $900/ton last year to a high of $1,027/ton during the current fiscal year, so export earnings could reach a somewhat respectable level. However, export performance weakened due to high offer prices. In comparison to the year 2020, export earnings of pulses in 2021 registered a sharp decline of 41.90% in rupee terms and 40.40% in dollar terms. Exports declined due to the high prices of various pulses in the domestic division and complex supply and availability conditions.

NAFED's profit increased sharply with double growth in business

New Delhi. The total business of the National Agricultural Cooperative Marketing Federation of India (NAFED), a subordinate agency of the Union Ministry of Agriculture, increased sharply to Rs. 35,185.11 crore in the financial year 2020-21, which is more than double the total business of Rs. 16,280.98 crore in 2019-20. Similarly, the profit before tax of NAFED is estimated at Rs. 494.28 crore. The agency's profit during the financial year 2019-20 was estimated at Rs. 289.09 crore. This means that the profit before tax also almost doubled.

It is well known that the responsibility of NAFED is mainly to purchase pulses and oilseeds at the minimum support price and help curb prices by increasing the supply as per the requirement. NAFED's purchases also almost doubled. According to the availability data, the agency had procured agricultural products worth Rs. 18,612.92 crore in the financial year 2019-20, while the amount spent on procurement increased to Rs. 32,527.40 crore in 2020-21.

The Chairman of NAFED said that it is a happy result of the tireless efforts of the entire stock segment. NAFED has a strong team of skilled and unskilled personnel equipped with all the necessary facilities. According to the Chairman, it has been decided that a dividend of 12 percent will be given to all shareholders.

The scope of NAFED's work is expanding; they are also restoring apple orchards in Jammu and Kashmir and are engaged in creating a fortified rice bran oil equivalent.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 73.43)

Chana Dal: Split Chickpea Lentils

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Desi Chickpeas / Chana / IGrain / Rahul Chauhan / Mumbai / Rajasthan / Madhya Pradesh / Maharashtra / Uttar Pradesh / Chana Dal / New Delhi / NAFED / Chickpeas / Black Matpe / Mung / Red Kidney Bean / Cowpea / Lentil / Pigeon Pea

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.