October 27, 2020

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Highlights from this past week:

Rundown of Indian Markets

Chana prices decline on weak purchasing and panicked selling

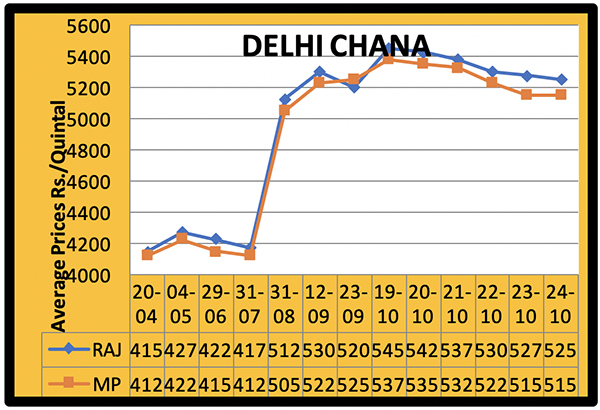

There was a lack of demand for gram throughout the week. After a downturn in future prices, domestic spot prices fell as well, resulting in a downward market trend. The slowdown is temporary as the availability of gram is low and festive consumption is expected to increase further. During the past week, chana prices in Delhi fell by Rs. 200/250 and sold at Rs. 5,150/5,275 per quintal over the weekend. Demand is expected to increase.

Madhya Pradesh (India’s top gram producer)

In Madhya Pradesh, a drop in the futures market saw stockists trying to sell gram, but as there wasn’t any demand, prices declined. Gram prices have fallen by Rs 400 in the last fortnight. During the past week, prices fell by Rs 150/250 in Madhya Pradesh. By the weekend, prices at Indore fell to Rs 5,200 per quintal, Ashok Nagar prices fell to Rs. 4800/4850, and Katni prices fell to Rs. 5100/5150 per quintal. Prices at other mandis also declined.

Rajasthan (second biggest gram producer)

New arrivals of gram are decreasing in Rajasthan market yards. Due to fewer queries, prices fell by 100/200 rupees through the weekend. With this decline, weekend prices in Jaipur closed at Rs. 5,375/5,400, Jodhpur Rs. 4,800/4,900, Bikaner Rs. 5,150 and Kishangarh Rs. 4,700/4,900 per quintal. Demand is expected to rise.

Maharashtra (third biggest gram producer)

In Maharashtra, prices also fell on reduced demand. There was less interest from gram millers (besan millers) because of the decline in prices. The prior week, prices fell by Rs. 150/200 and at the major markets, like Solapur, they leveled off at Rs. 5,000/5,800 per quintal. Other market prices: Amravati Rs. 4,800/5,500, Latur Rs. 5,400/5500, Akola Rs 5300/5400, Nagpur Rs 5300/5500. Demand is expected to increase.

Others

Bhatapara gram prices fell by Rs. 200 and stood at Rs. 4,600/4,700 by the weekend. Raipur chana fell by Rs. 100 and stood at Rs. 5,200/5,300 by the weekend. In Kanpur, the price fell by Rs. 200 to Rs. 5,225/5,250.

Chana Dal

Dal prices also declined. Due to low demand, prices fell by Rs. 150/250 over the course of the week to Rs. 6,000/7,000 per quintal. No further decline is foreseen as the demand for gram dal from gram flour plants is expected to increase.

Views

To check the decline in prices, NAFED stopped selling Chana through tenders. But prices fell instead of increasing as there is no demand from consumers, millers and wholesalers. The decline illustrates the simple fundamentals of supply and demand. Without demand, prices cannot be sustained.

Government approves purchase of 45.10 lakh MT of pulses and oilseeds

Based on proposals received from various states, the central government has so far approved the purchase of 45.10 lakh MT of pulses and oilseeds for the procurement marketing season of 2020-21. This includes pigeon peas, moong, urad, groundnuts, soybeans, sesame and sunflower etc. The government of India has slowed the pace of pulses-oilseeds procurement as wholesale market prices are higher than the minimum support price. In Gujarat, procurement was announced from October 21. After the announcement, prices rose. In many areas, oil millers are buying from farmers at high prices.

Proposals from several states have been accepted for procurement of pulses and oilseeds, including Tamil Nadu, Karnataka, Maharashtra, Telangana, Gujarat, Haryana, Uttar Pradesh, Odisha, Rajasthan and Andhra Pradesh etc. NAFED has been designated as the nodal agency for procurement of pulses, oilseeds and copra.

According to official data, as of October 24, the procurement of moong and urad valued at Rs 6.43 crore in Tamil Nadu, Maharashtra and Haryana by the government agency benefited 871 farmers. Similarly, 5089 MT of copra valued at Rs 52.40 crore were purchased from 3961 producers in Karnataka and Tamil Nadu. As the prices of pulses and copra have now risen above the minimum support price, the activity of government agencies has decreased.

Telangana First Advance Production estimate: Pulses, Rice, Oilseeds are up, Maize and Sugarcane are down

The Agriculture Department of Telangana, one of the most important agricultural states in southern India, released its first advance production estimates for the state.

As per the department, the production of maize, sugarcane and turmeric is expected to decline drastically in the Kharif season of 2020-21 as compared to 2019-20, while the production of the remaining crops is projected to surge.

Rice production is estimated at 83.66 lakh MT, up 40% or 23.81 lakh MT from the previous kharif season (59.85 lakh MT).

Pigeon pea (Arhar/ Tuar) production is projected at 8.44 lakh MT, a huge increase from the previous kharif season’s 2.66 lakh MT.

Maize production is projected to fall drastically to 4.70 lakh MT, down 75.71% from the previous kharif season.

Oil seeds production is forecast at 3.97 lakh MT, up 4.75% from the previous kharif season.

The Telangana government projects the average yield for cotton will increase from 546 kg per hectare last year to 702 kg per hectare this year, and estimates a larger seeded area as well.

Pulses global production, trade, consumption on the rise

Over the past two decades, there has been a tremendous increase in awareness about the health benefits of pulse consumption. In 2000, world pulse production stood at 435.70 lakh MT, the global pulse trade stood at 80.20 lakh MT and worldwide consumption amounted to 402.40 lakh MT. In 2004, word production rose to 620.20 lakh MT, the global trade jumped to 181.50 lakh MT and consumption increased to 573.30 lakh MT.

During this period, pulse usage diversified, and this led to increased demand and consumption. Consumption of whole pulses as well as split pulses increased. Pulses started to be used to make various food items and their use as animal feed also increased. Additionally, demand for pulse ingredients, especially pea starch and protein, increased.

Pulses are being used in developed nations, including China, the U.S. and Canada, as well as in the European countries, and the demand for pulse flour and protein is on the rise and expected to see strong growth in the coming years. Pulses are regarded as excellent sources of protein.

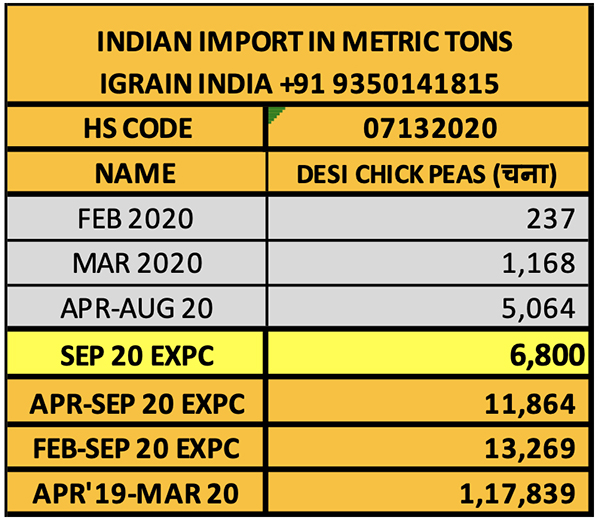

The major pulse producing countries include India, Canada, Australia, Myanmar, the U.S., Russia, Ukraine, Tanzania and France, etc. Additionally, there are smaller amounts produced in many African, European and South Asian countries. India is the world’s top pulse producer. Historically, India has also been the biggest importer of pulses, but China may surpass it. India has placed quantitative restrictions on the import of major pulses. Significant import duties have been imposed on lentils, kabuli chana and desi gram. The import of kidney beans and cowpeas is deregulated. Due to increased national production, India’s pulse imports have fallen off dramatically in recent years.

The government is continuously focused on controlling prices and maintaining stock levels, and import policies change frequently.

Urad imports expected to continue at regular pace

Domestic market prices remain on a good note despite the arrival of new kharif season crops. The government has allowed millers-processors of pulses to import 1.50 lakh MT of Urad by 31 March, but given current market conditions, importers are in no hurry to bring in cargoes. With high prices in Myanmar, importers are waiting for the market to cool. Nonetheless, urad imports are at a high level compared to last year. The next new crop will not hit the market before February-March.

This year, India imported 40,250 MT in February, 121,550 MT in March, 161,966 MT in April-July, 45,037 MT in August and 240 MT in September.

Therefore, during the fist half of the current fiscal year (April-September), India imported 207,243 MT of Urad. During fiscal year 2019/20 (April-March), India imported 312,078 MT of urad. Earlier this fiscal year, the government authorized urad imports from June to August, and suddenly authorized them again from October to March. Domestic urad production suffered heavy losses due to flooding and torrential rains. Carry-in from last year was very low.

NAFED to auction pulses and oilseeds in various states

The Central Government’s subordinate agency, the National Agricultural Cooperative Marketing Federation of India (NAFED), organized auctions of pulses, including Arhar (Pigeon Peas), Urad (Black Matpe), Moong, Masoor (Lentil) and Oilseeds, including Groundnuts and Sunflower procured from farmers. Participating states included Maharashtra, Uttar Pradesh, Madhya Pradesh, Gujarat, Orissa, Telangana, Andhra Pradesh, Karnataka and Tamil Nadu. Several auctions were held for the sale of pulses and oilseeds. In 36 of them, 115,270 MT of kharif 2019 crop tuar were put up for sale in Maharashtra. In Karnataka, 10 were held to sell 84,970 MT. Lentils were auctioned in MP and many auctions were also held to sell Urad. In terms of oilseeds, a sunflower auction was conducted in Orissa and peanut auctions were held in Andhra Pradesh, Orissa, Gujarat, Karnataka and Uttar Pradesh. Moong was auctioned in Orissa and Telangana, and Urad in Uttar Pradesh, Gujarat and Madhya Pradesh. Arhar was auctioned in Maharashtra, Tamil Nadu, Karnataka and Madhya Pradesh. At these auctions, pulses and oilseeds from marketing seasons extending from the 2017 kharif season to the 2020 rabi season were sold. Also, 81 auctions were held in Gujarat to sell 40,875 MT of groundnuts. Such auctions are frequently conducted by NAFED.

Abbreviations/ Hindi- English words

Tuar/ Arhar: Pigeon Peas

Mung: Green Mung

Urad: Black Matpe

Chana: Gram

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$ = Rs 73-74)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter rc_capricon

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.