Fundamentals of bullishness in chana

Fundamentals of recession in gram

Decreased buying kept Chana on low side

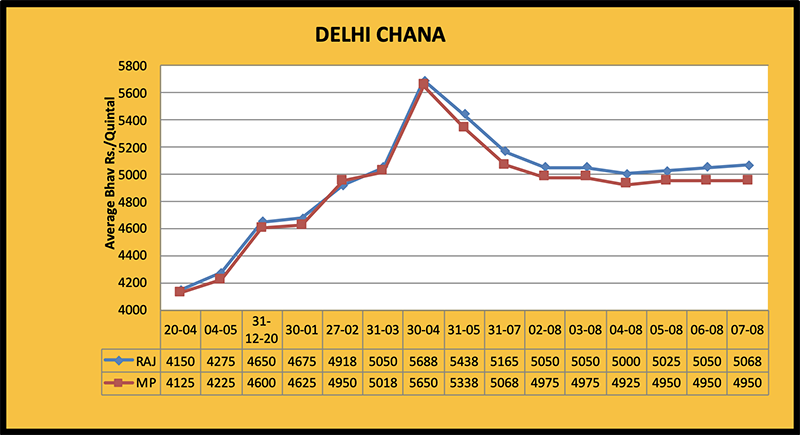

Chana had a declining trend during the week due to reduced buying on increased prices. NCDEX Future Chana also reduced impacting spot. Daily chana arrivals on Delhi Lawrence Road were 20-25 motor, but by the weekend, the volume fell to 10-15 motor. Due to weak buying, Delhi chana prices dropped by Rs. 150 per quintal. By the weekend, Madhya Pradesh line traded at Rs. 4,950 per quintal and Rajasthan line Rs. 5,050 per quintal.

Port

There was limited buying of imported chana. As a result, chana prices at Mumbai Port remained low at Rs. 100-125 per quintal. Tanzania chana traded at Rs. 4,750 and Sudan old Rs. 5,200 and new Rs. 5,400 per quintal. Similarly, Kolkata chana fell by Rs. 50 to Rs. 5,050 per quintal by the weekend.

Rajasthan

Due to the fall in futures and weak demand, the price of a quintal of gram decreased by Rs. 150-200 and by the weekend the quintal traded at Rs. 5,000 in Jaipur, Rs. 4,850 in Bikaner, Rs. 4,300-4,630 in Kishangarh and Rs. 4,550 in Kekri.

Maharashtra

As in other markets, there was less demand from mills and stockists in Maharashtra. Consequently, prices per quintal declined by Rs. 100-250. Gram traded at Rs. 4,950-5,100 in Latur, Rs. 4,500-4,700 in Amravati, and Rs. 4,950-5,025 in Akola. Nagpur chana sold for Rs 4,950-5,050 and Jalgaon Rs. 4,875-5,100 per quintal.

Madhya Pradesh

The price of a quintal of chana declined by Rs. 150-250 in the market yards of Madhya Pradesh due to sluggish buying. With this decrease, prices per quintal were Rs. 5,100 in Indore, Rs. 5,000-5,050 in Katni, Rs. 4,200-4,675 in Pipariya and Rs. 4,700 in Bina.

Karnataka

Due to weak offtake in chana dal, Karnataka chana prices fell by Rs. 100-200 per quintal. Per quintal prices were Rs. 4,800-5,100 in Gulbarga and Rs. 4,319-5,085 in Bidar.

Other

Due to sluggish demand, Raipur recorded a fall of Rs. 150 per quintal and chana traded at Rs. 5,100-5,150 per quintal. The quintal of Kanpur gram also fell by Rs. 125 to Rs. 5,125. In Gujrat State, the price of a quintal of gram declined by Rs. 100-150 to Rs. 4,800-4,850 in Dahod and Rs. 4,500-5,000 in Rajkot.

Chana Dall

Prices for a quintal of chana dal fell by Rs. 150-250 during the week due to a decline in raw chana as well as chana dall. With this decrease, the price per quintal was Rs. 5,775-5,975 in Delhi, Rs. 6,050 in Katni, Rs. 6,200 in Indore, Rs. 6,100-6,300 in Gulbarga and Rs. 5,600-5,650 in Kanpur.

Amendments to chana selling tenders- NAFED

The National Agricultural Cooperative Marketing Federation of India (NAFED), a subordinate agency of the Union Ministry of Agriculture, has made changes in the notes of contracts related to the sale of gram. From July 31, there will be no sale of gram with PSS (Price Support Scheme). August 1 fell on a Sunday and therefore the sale of gram started on Monday, August 2. Meanwhile, the government agency made changes in the contract rules related to the sale of gram, under which the advance deposit amount (earnest amount) is to be 5.5%; further, within two days of receipt of the tender, buyers will have to pay 95% of the value. Additionally, buyers are to offload gram stocks within the stipulated timeframe.

NAFED procures pulses, including gram, from farmers every year at the Minimum Support Price (MSP) announced by the Center. Tur, urad and moong are procured during the kharif season and gram and lentil during the rabi season as the government fixes the support price for these five pulses. This year, the support price of gram was increased from Rs 4,875 per quintal to Rs 5,100 per quintal. In the initial phase of the rabi marketing season, the price of gram was running a little above the government support price and therefore NAFED did not manage to purchase large volumes. Later, with the imposition of stock limits, the market softened and NAFED’s purchases increased.

Registration of pulse traders in Uttar Pradesh- an exercise to curb inflation

The government of Uttar Pradesh started the process of registering pulses traders/processors in order to obtain their stock details on a weekly basis. This information will be used to enforce the rules on stock limits and thus control market prices. Registered dealers are to submit information on their pulse stocks on the government portal and to send same to the competent government authority. This will allow administrators to know the availability of pulse stocks and to use this information to control prices. The central government fixed the maximum stock limit of pulses at 500 MT for wholesalers, 5 MT for retailers, and six months’ average production or equivalent to 50% of the total accumulated processing capacity for pulses millers-processors. Importers who provide details of their stocks are exempted from pulse stock limits. The government has taken this measure to increase the supply and availability of pulses and to control prices. In other districts of the state, the pulses business is expected to continue normally after the registration of traders. Traders are to provide details of stocks of pulses such as tur, urad, gram and masoor on a weekly basis. This will make it easier to assess the district-wide stock, although prices for all pulses (except lentils) have already fallen drastically.

Kharif crops in many states damaged by heavy rains and floods

Floods impacted crops in vast areas of Bihar and Maharashtra, and more recently in Madhya Pradesh, Chhattisgarh, Jharkhand, Punjab, Himachal States, Rajasthan, Uttarakhand and Jammu and Kashmir etc. Karnataka and Telangana did not experience severe floods, but excessive rainfall left fields waterlogged in many areas, damaging crops, especially pulses and oilseeds. In the Konkan and Vidarbha divisions of Maharashtra, there are preliminary reports of heavy damage to various crops in an area of at least 3 lakh hectares due to severe floods. A survey is also being conducted there for a detailed assessment of the damage. The monsoon is gaining momentum in other states as well. The Meteorological Department has predicted heavy rains for the next three to four days in five states. This poses a serious threat to Kharif crops and may also affect further sowing. As of July 30, India seeded 848.10 lakh hectare to kharif crops, which is about 42 lakh hectares less than the area sown as of that date last year. Heavy monsoon rains may disrupt further sowing, making it difficult for this year’s seeded area to match last year’s level.

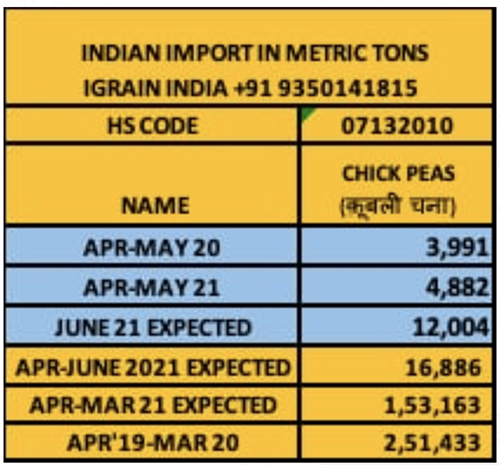

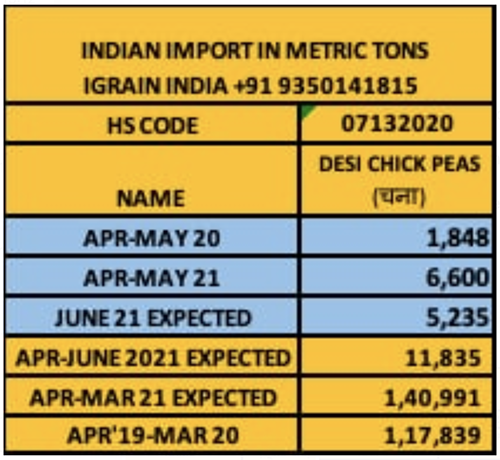

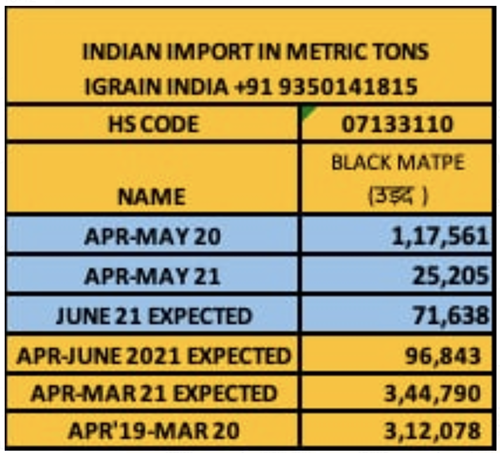

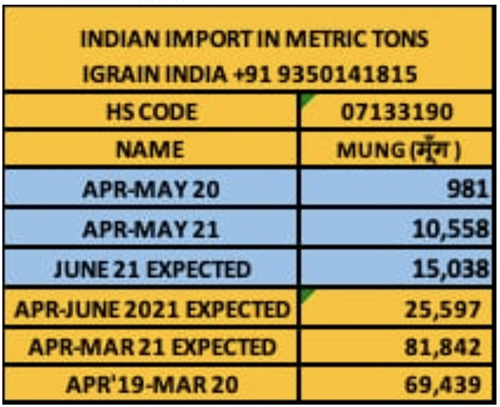

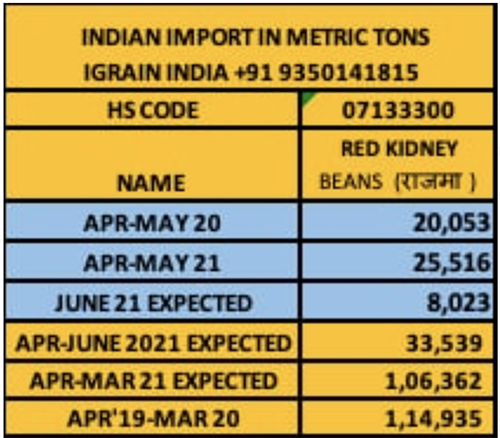

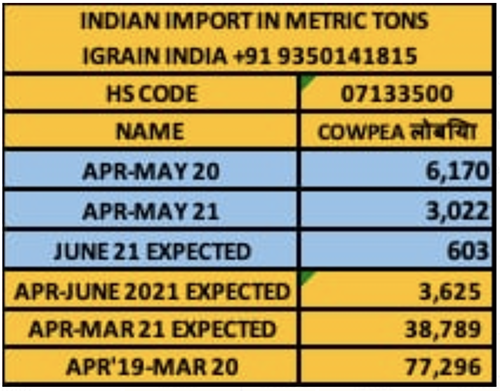

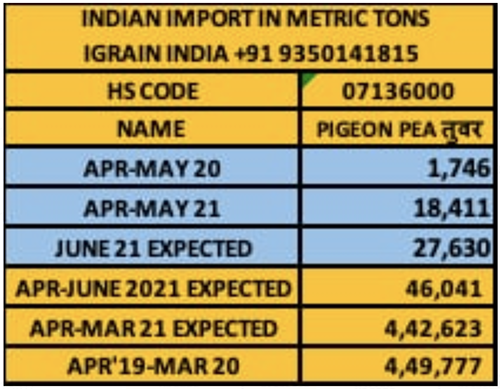

PULSES IMPORT FIGURES

India / Rahul Chauhan / IGrain / Rajasthan / Maharashtra / Madhya Pradesh / Karnataka / Chana Dall / Chana

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.