September 9, 2020

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Highlights from this week:

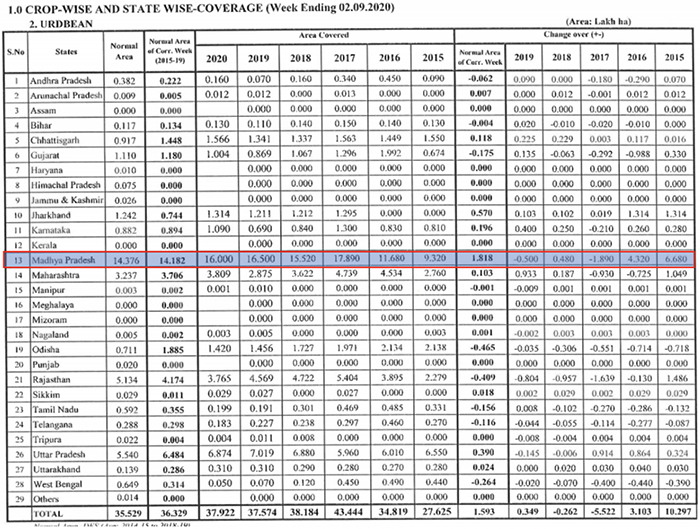

This week, 611,000 ha. of pulses were seeded, bringing the total area under pulses to 17,680,000 ha., well above the average of 12,888,000 ha. What’s more, seeding was above the five-year average for all pulse crops. Through this past Saturday, 379,200 ha. had been seeded to black matpe.

Growers preferred to seed moong over pigeon peas and black matpe. In Madhya Pradesh, the top black matpe growing state, 1.6 million ha. were seeded to black matpe, down 48,000 ha. from last year but above the five-year average of 1.412 million ha. In other states, black matpe seeding stood at 370,000 ha. in Rajasthan, 680,000 ha. in Uttar Pradesh and 380,000 ha. in Maharashtra. Excessive rains damaged some black matpe crops in Maharashtra and Karnataka, but overall, the crop conditions are satisfactory to good. In Akola district, the crop was impacted by disease and pests.

The Rajasthan Department of Agriculture estimates the state’s kharif pulse production at 2.093 million MT, down from 2.311 million MT last year. Black matpe production is estimated at 283,000 MT, down from 381,000 MT the previous kharif season. The Gujarat Department of Agriculture estimates total pulse production at 397,000 MT and black matpe production at 62,000 MT.

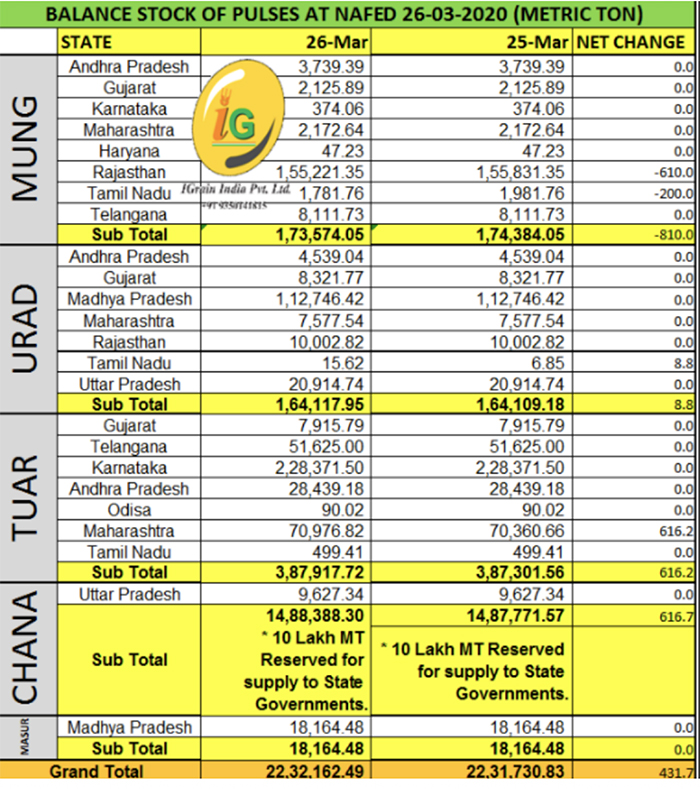

Overall, due to crop losses this kharif season, negligible remaining old crop inventories and import restrictions, the market will be on the high side. It appears the government is interested in maintaining prices at high levels in order to benefit farmers. The more farmers earn, the less the government will have to procure.

Myanmar’s Black Matpe Stocks Expected to Be Normal

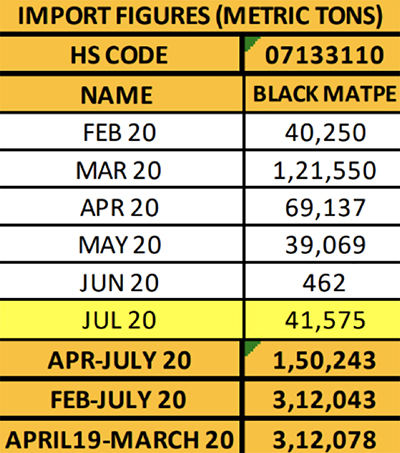

Presently, there are about 300,000 MT of black matpe inventories in Myanmar. India had set an import deadline of August 31 and a quota of 400,000 MT for the financial year that just ended.

Myanmar’s black matpe stocks, however, will not remain at a burdensome level. Of the 300,000 MT that remain, 50,000 MT of whole urad can be easily exported to Nepal, the UAE, Bangladesh and Pakistan. Additionally, Myanmar is expected to export 30,000 MT of urad daal to various destinations.

Consequently, Myanmar is likely to remain with black matpe inventories of 150-200,000 MT, which is considered normal. New crop will enter the pipeline in March 2021.

India Sees Higher Pulse Prices on Reports of Production Issues

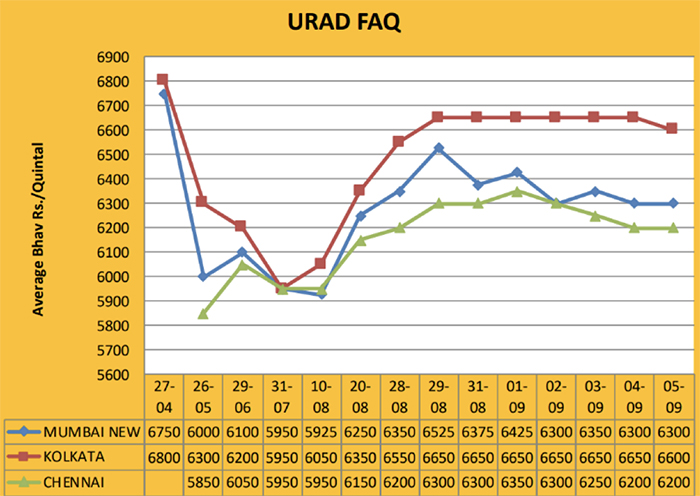

In August, torrential monsoon rains and outbreaks of insects and disease impacted crops in India’s major pulse-growing states. The news set off an increase in prices. According to the president of the All India Dal Mill Association, urad and moong prices rose about 10% following news of heavy rains in the key growing states of Maharashtra, Madhya Pradesh and Karnataka. This also pulled up prices for other pulses. New crop has begun to arrive in Karnataka, but the rain has interfered with harvest progress. Trade analysts expect the uptrend in pulse prices to continue in the near future. If the government were to extend the deadline for urad imports to December, domestic prices could soften, but the government has not extended import deadlines so far. The import deadline for urad expired on August 31.

Phytosanitary Exemption Made for 123 Containers of Black Matpe from Myanmar

India’s Ministry of Agriculture granted a conditional exemption from plant quarantine rules for 123 containers of black matpe from Myanmar that were imported from February-April 2020. The exemption is conditioned on importers following specific instructions.

First Advance Production Estimate - Gujarat

Gujarat received heavy monsoon rains this year. The area seeded to kharif crops was up 200,000 ha., but heavy rains and severe flooding resulted in crop losses in some areas. According to the first advance production estimate released by the state’s Ministry of Agriculture, the gross production of pulses is expected to amount to 397,000 MT, comprised of 265,000 MT of pigeon peas, 62,000 MT of black matpe, 61,000 MT of moong and 8,000 MT of moth.

MEIS Incentives Discontinued, Exports Likely to Be Affected

Starting on January 1, India is discontinuing the incentives on exports under the Merchandise Exports of India Scheme (MEIS). The move will make it harder for Indian exporters to compete in global export markets. Notice is being give four months in advance for exporters to adjust the price of their products or goods accordingly.

Karnataka’s Kharif Crop Sowing Benefits from Good Rains

Despite a severe outbreak of COVID-19 in Karnataka, an important agricultural producing state in southern India, there were no issues seeding kharif crops this year. Thanks to good monsoon rains and government support, 100% of the area was seeded (730,000 ha. as of Aug. 31). Although there is the possibility of some damage to crops due to torrential rains, yields should improve.

Mumbai Port

The DGFT ordered the release of black matpe cargoes that were being held at port due to fumigation issues. The release of these cargoes resulted in a short-term dip in prices. This week, Mumbai prices decreased by Rs. 50 and stood at Rs. 6300 for new crop and Rs. 6200 for old crop.

Chennai and Kolkata prices remained fairly stable. Chennai prices were at FAQ Rs. 6,250, SQ Rs. 7,300 and Kolkata Rs. 6,650 per quintal.

Delhi

The release of these cargoes also impacted the market in Delhi. Black matpe prices fell by Rs. 50-150 to Rs. 6,500, SQ Rs. 7525. Normal demand is expected in the coming days.

Maharashtra

Black matpe arrivals are negligible in the market years of Maharashtra. The new crop is almost ready for harvest. Due to adverse weather, there are reports of crop damage in some areas. The size of the crop should become clear within two weeks. Black matpe prices improved by Rs. 100 over the course of the week. Over the weekend, prices per quintal stood at Rs. 5,000-6,000 in Latur, Rs. 6,000-6,500 in Udgir and Rs. 6,500-6,900 in Jalgaon. Normal demand is expected.

Uttar Pradesh

Black matpe prices at mandis in Uttar Pradesh registered a correction of Rs. 100 due to reduced selling by stockists. Over the weekend, prices per quintal stood at Rs. 6,700 in Bareilly, Rs. 4,000-5,000 in Lalitpur, Rs. 4,500-5,000 in Jhansi, and Rs. 6,400 in Bahojoi. Prices were up in other mandis as well.

Other

In Rajasthan's Jaipur mandi, black matpe prices fell by Rs. 200 to Rs. 6,000. The price in Dahod was reported at Rs. 5,000-5,200. Demand is expected to increase. Gulbarga Urad recorded an improvement of Rs. 100. In Rajasthan's Jaipur mandi, Urad prices fell by Rs. 200 to Rs. 6,000. The price of Urad in Dahod was reported at Rs. 5,000-5,200. Demand is expected to increase. Gulbarga Urad recorded an improvement of Rs. 100.

Urad Dal

Millers have been selling greater quantities of Urad Dal as demand has increased. During the current week, Urad Dal recorded a jump of Rs. 100-300 to Rs. 6,500-9,300 per quintal. Normal demand is expected.

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter rc_capricon

DISCLAIMER: The information contained herein is provided by third parties and is for general information purposes only. GPC is not responsible for the accuracy of third party information or opinions contained herein. This information shall not constitute any advice or recommendation. You should independently verify information and not rely upon any information or materials herein to make or refrain from making any specific business decisions.

India / Rahul Chauhan / black matpe / urad / Gujarat / Myanmar / Karnataka / Delhi / Maharashtra / Uttar Pradesh / Urad Dal

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.