June 28, 2022

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Less rains reported in some of the largest pulses producing states.

Rains in Rajasthan are above normal.

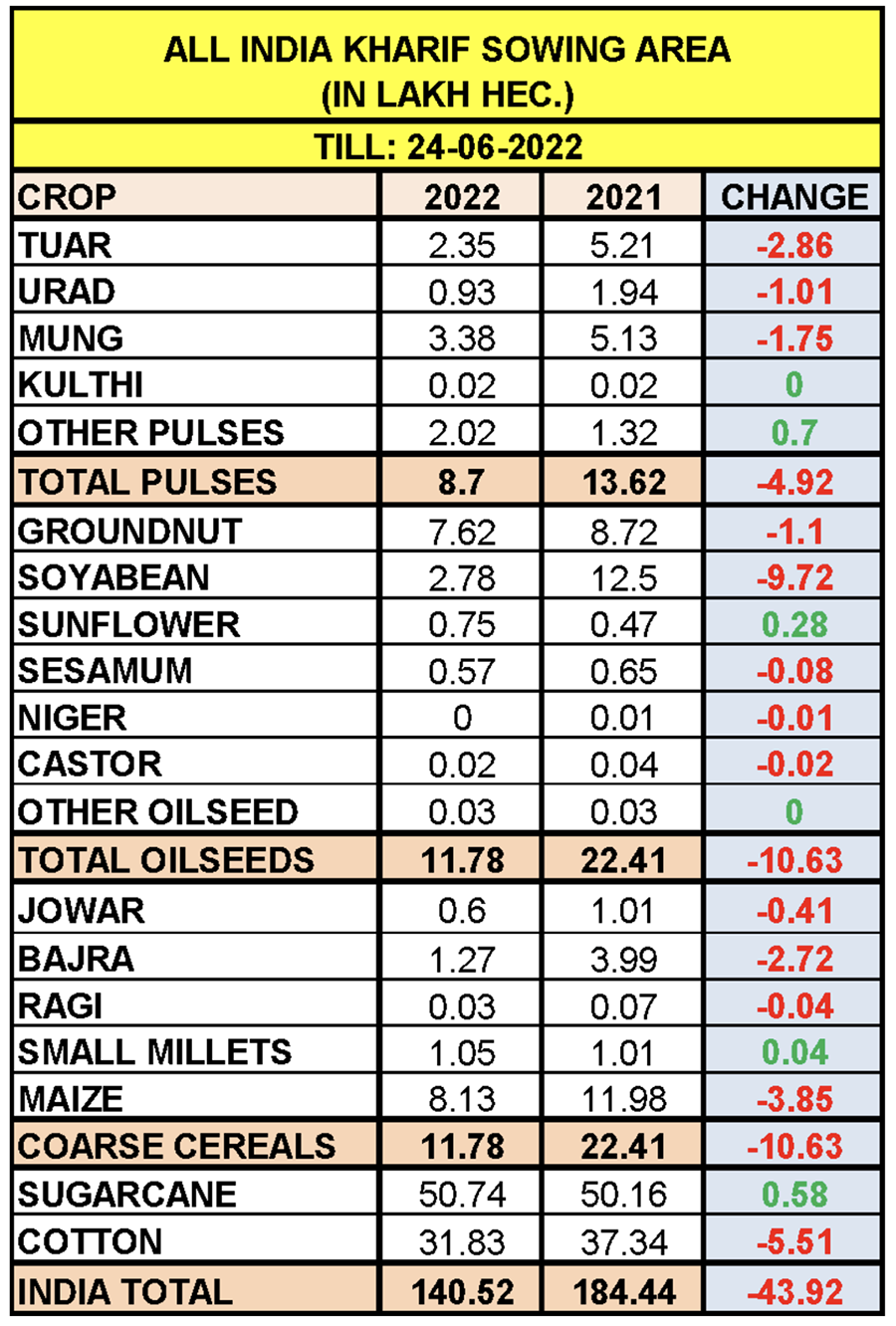

Pulses sowing is down 38.65% from last year.

Next 15 days are crucial for sowing; one bad season in India will disturb balance in supply and demand.

Stockist and millers are active in buying of pulses, causing prices to increase.

During sowing, urad, tuar and mung prices have all been below the MSP

Last week, impressive demand from stockist and millers was reported. The import parity is higher than local market prices but, due to low stocks and delayed rains, selling and purchasing increased. As a result, prices increased across the board.

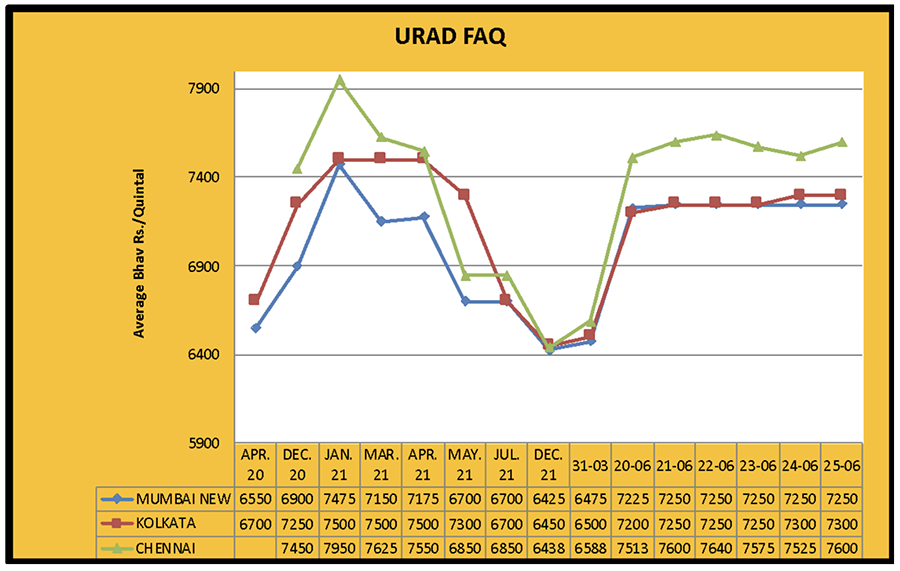

Chennai: FAQ 7,250, SQ 7,950

Mumbai: FAQ 7,250

Kolkata: Rs. 7,300

Delhi: FAQ 7,500, SQ 8,175/8,200

Jabalpur 6,000/7,000

Akola 7,300

Barshi 4,500/7,100

Ahmednagar 4,000/7,000

Vijayawada 7,300/7,500

Gulbarga 4,500/6,700

Urad dal: 8,300/10,000

Delhi. So far, monsoon rains have been below normal in most of the main pulse-producing states but the meteorological department expects more rains next month. Farmers are losing hope as early sown crops have been damaged due to excessive heat and low soil moisture, leaving them with only one option: to sow their crops again if the rains come. As a result, kharif sowing is almost 4 million hectares behind last year’s area. Due to attractive prices, cotton and soy are the preferred crops for farmers this season. Meanwhile, urad, mung and tuar prices are all below the MSP.

Chandigarh: The Haryana government has announced a scheme to incentivise pulses and oilseed production in the 7 biggest millet-producing districts. The government plans to increase the areas of the two crops to 0.01 million acres - particularly tuar, mung and urad - by offering Rs. 4,000 / acre to participating farmers.

The scheme is motivated by decreasing domestic production of pulses and oilseeds in India. According to the Directorate General of Commercial Vigilance and Statistics (DGCIS), the import expenditure of pulses has increased by around 39% compared to last year. According to trade analysts, since the free import of pulses (except mung bean) has been allowed to continue until March 2023, total imports in the current financial year are expected to reach 2.5-2.6 million tons.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.