May 5, 2021

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Rundown of Indian Markets- Second wave of COVID-19 severely impacts pulse demand and supply chain.

Pigeon pea stocks are limited at ports. Because of the aggressive spread of COVID-19, state-wide lockdowns have been declared and many market yards, stockists and shops are closed. Demand and the supply chain have been disrupted. Weddings, religious functions and similar gatherings have been banned. Hotel, restaurant and catering services are doing minimal business. Consumers are not eating out. Labor shortages are being felt as people have returned to their homes. Consequently, the pulse industry is going through a difficult time. Several states, including Madhya Pradesh, Delhi, Karnataka, Maharashtra, Rajasthan, Kerala, Jharkhand, Chhattisgarh, Bihar, Tamil Nadu, Telangana and Andhra Pradesh have imposed lockdowns and nighttime curfews.

Mumbai Port

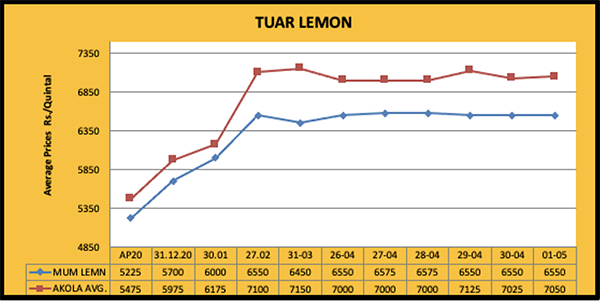

Last week, due to decreased demand, pigeon pea lemon prices at Mumbai port fell by $30-35 to $770 per MT and Linke to $785/MT. Spot prices at port slipped by Rs. 100-150 and by the weekend Lemon traded at Rs. 6,550, Arsuh 6,200 ????, Gajri 6100 and Sudan Rs. 6,600/ 100 Kg. Prices at Chennai port also fell to Rs. 6550-6600.

Maharashtra

Half of the market yards with few traders opened shop. Processed dall demand is negligible. Traders buying as per their needs. Prices fell by Rs. 100-150 and traded at Rs. 6700-6950 in Solapur, Rs. 6200-6800 in Jalna, Rs. 6300-6850 in Latur and Rs. 7000-7050 in Akola.

Karnataka

Processed pigeon pea demand fell off. Weekend prices were Rs. 6400-6850 in Gulbarga, Rs. 6162-6683 in Raichur and Rs. 6541-6766 in Talikot.

Uttar Pradesh

Prices dropped on decreased demand from processors. On Friday, pigeon peas traded at Rs. 6600-6700 in Bareilly and were reported at Rs. 6600/100kg in Kanpur.

Others

In Dahod market, pigeon pea prices fell by Rs. 100 and sold at Rs. 5800-6100 by the weekend.

Processed Pigeon Peas / Tuar Dall

Demand was severely affected by the lockdowns and processed pigeon pea prices fell by Rs. 100-300 pan India. Fatka Daal traded at Rs. 9500-10,500 and sawa no. 9000-9500.

GRAM RABI 2021 (as of April 14)

State- QTY MT

Andhra Pradesh 5,481.30

Telangana 15,100.90

Maharashtra 85,475

Karnataka 18,720.86

Gujrat 84,961.80

Madhya Pradesh 35,723.76

Rajasthan 3,527.40

Total 2,48,990.97

Masur Lentil Rabi 2021 Procurement till 14.04.21

State-Qty (MT)

Madhya Pradesh 2.6

Total 2.6

Pigeon Pea Procurement by agencies as of April 14

State- Qty (MT)

Karnataka 8,969.05

Maharashtra 1,246.76

Gujrat 554.95

Tamil Nadu 31.95

Andhra Pradesh 184.55

Total 10,987.26

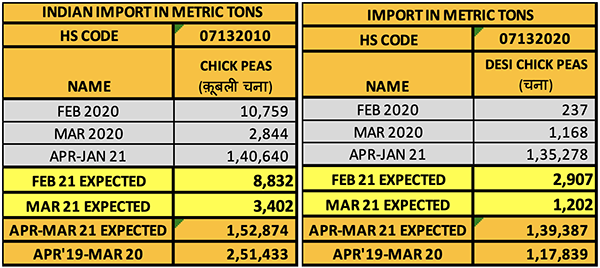

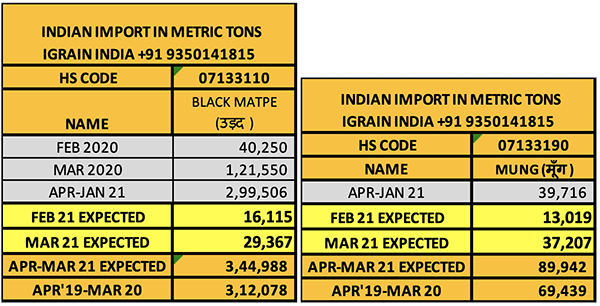

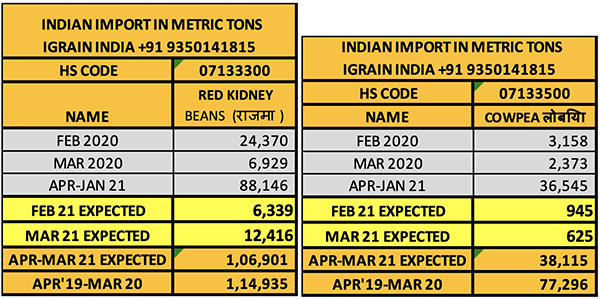

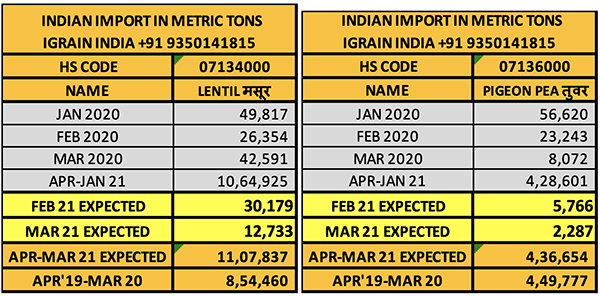

PULSES IMPORT FIGURES

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$= Rs 73.84)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india

Rahul Chauhan / India / Andhra Pradesh / Telangana / Maharashtra / Karnataka / Gujrat / Madhya Pradesh / Rajasthan

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.