September 8, 2020

IGrain’s Rahul Chauhan provides information on pricing and current inventories, as well as import figures and news from domestic and international markets.

Highlights from this week:

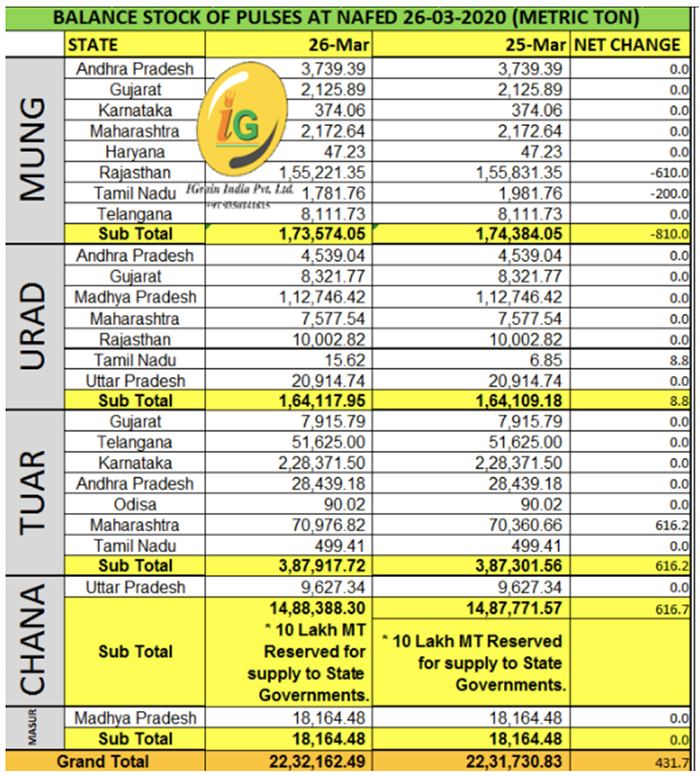

India’s pulse prices have been trending upward over the past month. The main factor behind this uptrend is the elevated price at which NAFED is selling off its inventories. Reports of crop damage due to excess rains have also contributed. Demand for pulses, however, remains weak.

It appears the government is interested in maintaining prices at high levels in order to benefit farmers. The more farmers earn, the less the government will have to procure.

India’s Supreme Court recently ruled in favor of DGFT and against a group of importers who challenged its authority to place quantitative restrictions on pulses. The DGFT wrote a letter to the Customs Department not to clear shipments of peas, black matpe, pigeon pea and other pulses that were sitting in ports pending this Supreme Court verdict.

New Delhi

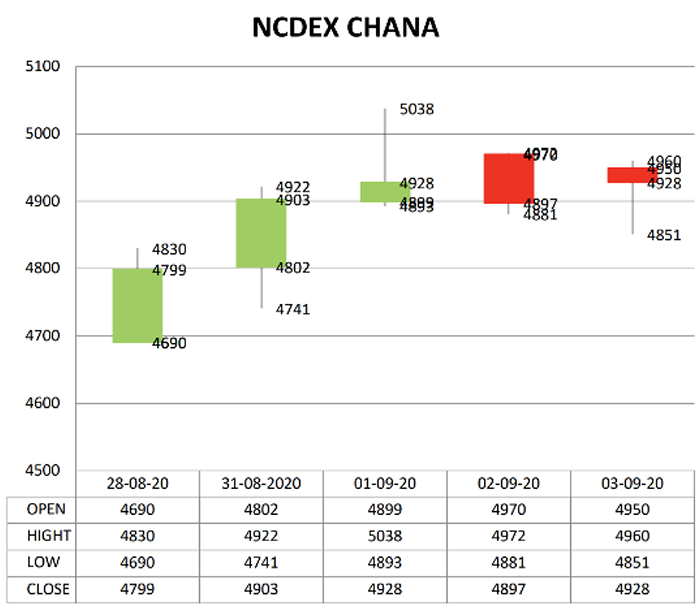

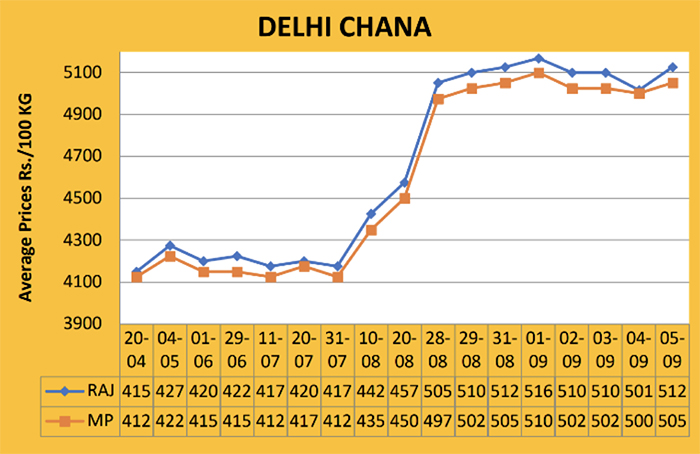

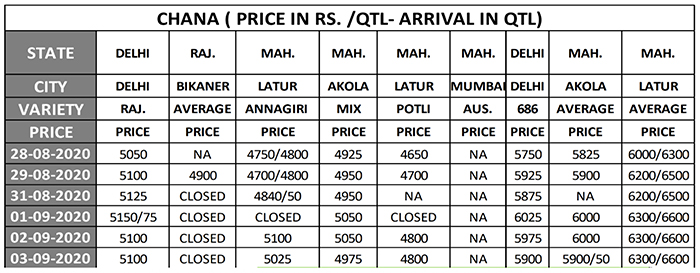

Arrivals of gram at local market yards is decreasing. NAFED continues to sell at high prices. Tenders below Rs 5,000/100 Kg are not accepted in Rajasthan. The NCDEX future market is on a strong note, which further impacts the spot market. NAFED has allotted almost all old crop (1.5 million MT) under the Prime Minister's scheme. NAFED wants to sell the new crop at a slow pace on higher prices. Prices rose by Rs 50 to Rs 5025/5100 per quintal in Delhi by the weekend. Demand is expected to improve with the festive. The lockdown has been relaxed for restaurants, wedding, local market bazars and religious gatherings.

Rajasthan

Prices up Rs. 100-300 this week. This weekend, prices in Jodhpur stood at Rs. 4900/5000 per quintal, in Jaipur Rs. 5050, in Bikaner Rs. 4900 and in Sumerpur Rs. 4700/4725. Demand is expected to improve.

Madhya Pradesh

Arrivals and demand remain normal in the market yards of Madhya Pradesh, India’s biggest producer of gram. Due to the ups and downs of the futures market, spot prices rose Rs. 150-250/quintal over the weekend. Most of the markets closed due to the strike against the government’s New Agri Ordinance. Arrivals dropped off and demand increased, supporting the rise in prices.

Maharashtra

There are fewer gram inventories in Maharashtra. Millers rely on the gram auctioned by NAFED and also buy gram from Rajasthan. Gram prices were up Rs. 125-250 in market yards. This weekend, prices in Solapur stood at Rs. 4700-5100 per quintal, in Amravati Rs. 4400-4900, in Jalna Rs. 4000-4500, in Latur Rs. 4950-5000, in Akola Rs. 5050-5100 and in Nagpur Rs. 5150-5200. Prices are expected to remain strong in Maharashtra.

Other States

In Kolkata (West Bengal), gram prices rose Rs. 200 and stood at Rs. 5150 per quintal by the weekend. In Raipur (Chhattisgarh), prices rose by Rs. 200 and stood at Rs. 5,100 per quintal by the weekend. In Kanpur (Uttar Pradesh), the price of gram rose by Rs. 75 to Rs. 5100 per quintal. There were price increases at other mandis as well.

Gram Flour & Chana Daal

Demand remains normal. As gram prices rose, flour prices were also supported. Chana daal prices rose Rs. 125-300 over the course of the week and stood at Rs. 5900-6600 by the weekend. The market sentiment is expected to strengthen further.

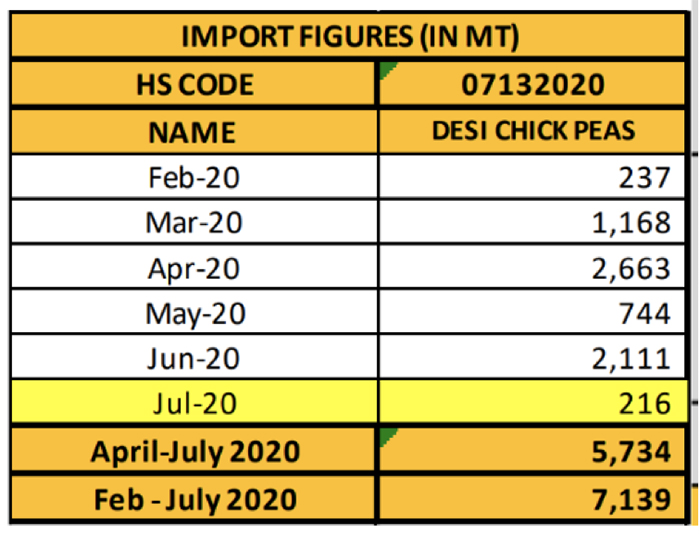

The import of gram was negligible due to high import taxes. From February to July, imports amounted to 7,139 MT and came mostly from Australia.

NAFED Gram Procurement During the 2020 Season by State

Pulse Crops in Vidarbha Impacted by Rain and Pests

Pulse crops in Vidarbha were impacted by torrential monsoon rains and an outbreak of disease and pests. Moong and black matpe crops were hard hit. Pigeon pea crop was affected to a lesser extent. Gram is sown starting in October. Vidarbha is in eastern Maharashtra and borders Madhya Pradesh in the north and Chhattisgarh in the east. In the Akola district, 22,000 ha. of moong had been planted and 90% was destroyed. Barring further devastation, farmers anticipate yields of 300-500 kg/ha. Additionally, 40% of the district’s 15,000 ha. of urad were also destroyed.

Canada Expecting Second Largest Crop in History

In Canada, the largest producer and exporter of peas and lentils in the world, the gross production of pulse crops during the current year has been projected to hit 8.33 million MT, which is 17% above the previous year's production and 19% above the five-year average (7.01 million MT). The gross production of pulses crops in Canada hit a record high of 8.386 million MT in 2016. In Canada, besides peas and lentils, chickpea and various types of beans are produced on a large scale. According to Statscan, good yields are expected for all pulses. Lentil production is projected to increase by 22% from 2.295 million MT in 2019 to 2.805 million MT in 2020. Pea production is forecast to increase from last year’s 4.285 million MT to 4.995 million MT in 2020. Canada’s pulse crops are currently being harvested.

India Sees Higher Pulse Prices on Reports of Production Issues

In August, torrential monsoon rains and outbreaks of insects and disease impacted crops in India’s major pulse-growing states. The news set off an increase in prices. According to the president of the All India Dal Mill Association, urad and moong prices rose about 10% following news of heavy rains in the key growing states of Maharashtra, Madhya Pradesh and Karnataka. This also pulled up prices for other pulses. New crop has begun to arrive in Karnataka, but the rain has interfered with harvest progress. If the government were to extend the deadline for urad imports to December, domestic prices could soften, but the government has not extended import deadlines so far. The import deadline for urad expired on August 31.

Australia’s Gram Production Expected to Increase by 64%

Pulse Australia forecasts the country’s 2020 gram production at 773,000 MT, a 64% increase over the prior year. The area seeded to gram is up and improved yields are expected thanks to favorable weather. In New South Wales, yields of at least 1,500 kg/ha. are expected. In other parts of the country, yields have the potential to hit 2,000 kg/ha. But India, the top export market for Australian gram, is practically closed due to high tariffs. Traders will rely on demand from Pakistan and Bangladesh instead, but even so it seems Australia may not be able to export half of its gram production during 2020/21.

India’s Gram Prices Up

The Union Agriculture Ministry projected India’s gram production to increase from 9.94 million MT in 2018/19 to a record 11.35 million MT in 2019/20. It is estimated that NAFED accounted for 20% of purchases at MSP of Rs. 4,875 per quintal (100 kg). In the first week of March, the country went into a national lockdown to fend off the spread of COVID-19. Hotels, restaurants and other venues closed down. Even post-lockdown, there is a lack of demand in the market. Even so, gram prices are on the rise. Due to the futures market, the price of gram has increased to nearly Rs. 5000 per quintal. The increase in demand for gram flour during the festive season may lift gram prices. Demand for gram flour is also expected to increase in the food manufacturing sector.

India Modifies Crop Insurance Scheme to Attract States

Starting next year, the Prime Minister's crop insurance scheme is expected to be more attractive to states. This year, because of the huge burden that the premium represented, many states decided to start their own insurance schemes instead of participating in the Central Government’s much-publicized Pradhan Mantri Fasal Bima Yojana. The Central Government responded by modifying the scheme so as to appeal to states and farmers. The changes aim to provide convenience to the states and encourage them to maintain the Prime Minister's Crop Insurance Scheme. According to sources, a real and practical premium will be determined every year by mixing Kharif and Rabi crops and some discounts will also be given.

Karnataka’s Kharif Crop Sowing Benefits from Good Rains

Despite a severe outbreak of COVID-19 in Karnataka, an important agricultural producing state in southern India, there were no issues seeding kharif crops this year. Thanks to good monsoon rains and government support, 100% of the area was seeded (730,000 ha. as of Aug. 31). Although there is the possibility of some damage to crops due to torrential rains, yields should improve.

DISCLAIMER: The information contained herein is provided by third parties and is for general information purposes only. GPC is not responsible for the accuracy of third party information or opinions contained herein. This information shall not constitute any advice or recommendation. You should independently verify information and not rely upon any information or materials herein to make or refrain from making any specific business decisions.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.