August 12, 2019

Climate conditions more so than market forces defined this year’s crop planting.

Drought conditions in the farm of GPC Board member Peter Wilson (eastern Darling Downs)

The major pulse crops grown in Australia are lupins, chickpeas, lentils, faba beans and field peas. The major chickpea growing regions are in New South Wales and Queensland. Most of the lupin crop is planted in Western Australia. Lentils are mainly produced in South Australia and Victoria. Field pea and faba bean production is spread more evenly across several states.

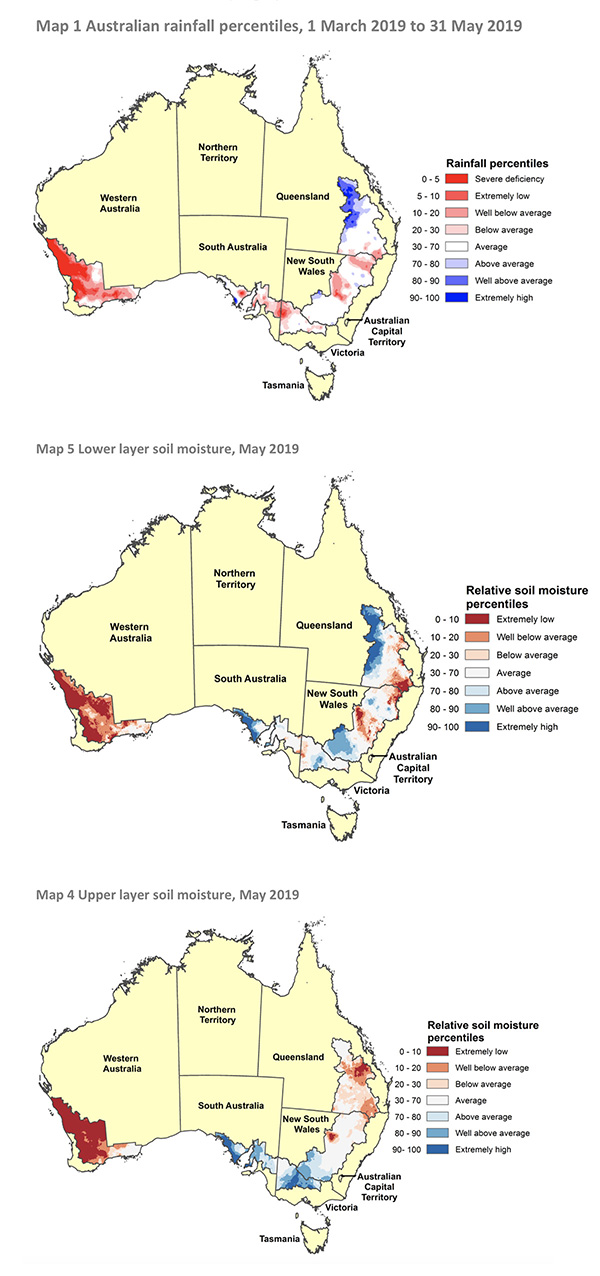

During the southern hemisphere’s autumn, when pulse crops were being seeded, dry conditions were a concern in much of Australia’s key growing areas. In the states of Western Australia, South Australia and Victoria, the months that followed brought favorable rains, and Peter Wilson of Wilson International Trade reports that the lentil, faba bean, field pea and kabuli chickpea crops there are progressing nicely.

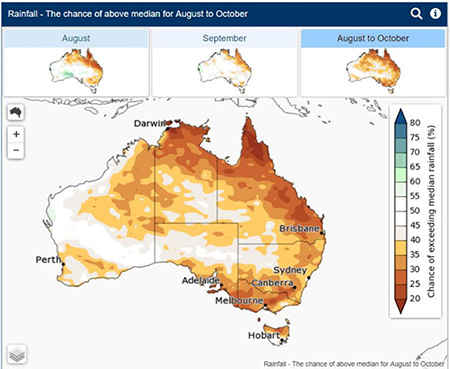

“It’s acknowledged that subsoil moisture is only considered ‘adequate’ and as a result, good rainfall will be required over the next two months to ensure the reproduction and grain filling phases can occur under sound conditions,” he cautions, adding that the forecast from Australia’s Bureau of Meteorology “does not inspire much confidence”. For now, he says, the yield potential is still intact for the pulse crops in those states.

In the northeastern states of New South Wales and Queensland, however, record dry conditions from 2018 have carried over and have persisted into this growing season. Drought over the past several years has depleted soil moisture levels in the region and many growers had no choice but to forego planting crops this year.

“Central Queensland is the only bright spot in the northeast, where ‘adequate’ moisture exists to sustain cereals and desi chickpeas,” says Wilson. “However, as temperatures rise in the north, the evaporation rate will as well, and with no rain in the forecast, for this region, we expect yield potential to be curtailed. Based on moisture received to date, Central Queensland is headed for average to slightly below average yields for desi chickpeas.”

Source: Australia Department of Agriculture, Australia Crop Report, June 2019

Source: Australia Bureau of Meteorology

For crop year 2019/20, Australia’s Department of Agriculture is estimating increased plantings for all pulses except lentils and lupins. Faba beans have the greatest estimated increase in area (up 28% from last year), followed by chickpeas (22%) and field peas (13%).

The Agriculture Department attributes the increase in pulse plantings at least in part to a grower shift away from canola, which is estimated to be 14% below the ten-year average. But as Wilson points out, pulse plantings were low in 2018 to begin with, due to exceptionally dry conditions; therefore, it is unsurprising that pulse plantings recovered somewhat in 2019. Even so, they remain historically on the low side.

No doubt India’s spate of recent protectionist measures weighed on the minds of growers as they evaluated their options this year, especially with respect to desi chickpeas, but Wilson says that in the end Mother Nature (in the form of elevated weather risk and poor soil moisture) was the one who made their seeding decisions for them.

And it is Mother Nature who will have the last word. Wilson reports that Australia’s pulse crops, where they got actually sown, are on track for average yields, but that the weather forecast indicates a greater chance of dry conditions and/or late frost.

“Either of those threats pose a significant challenge to production outcomes, and as a result Australian weather conditions bear watching over the next eight weeks or so as we move deep into spring,” he warns.

Australia Pulse Crop Seeded Area and Production

|

|

Area (in hectares) |

Production (in MT) |

||||

2017/18 |

2018/19 |

2019/20(f) |

2017/18 |

2018/19 |

2019/20(f) |

|

|

Chickpeas |

1,075,000

|

303,000

|

370,000

|

998,000

|

282,000

|

366,000

|

|

Faba beans |

313,000

|

178,000

|

227,000

|

416,000

|

217,000

|

326,000

|

|

Field peas |

291,000

|

179,000

|

202,000

|

317,000

|

152,000

|

249,000

|

|

Lentils |

418,000

|

303,000

|

285,000

|

543,000

|

323,000

|

384,000

|

|

Lupins |

612,000 |

500,000 |

483,000 |

714,000 |

693,000 |

678,000 |

Source: Australia Department of Agriculture, Australia Crop Report, June 2019

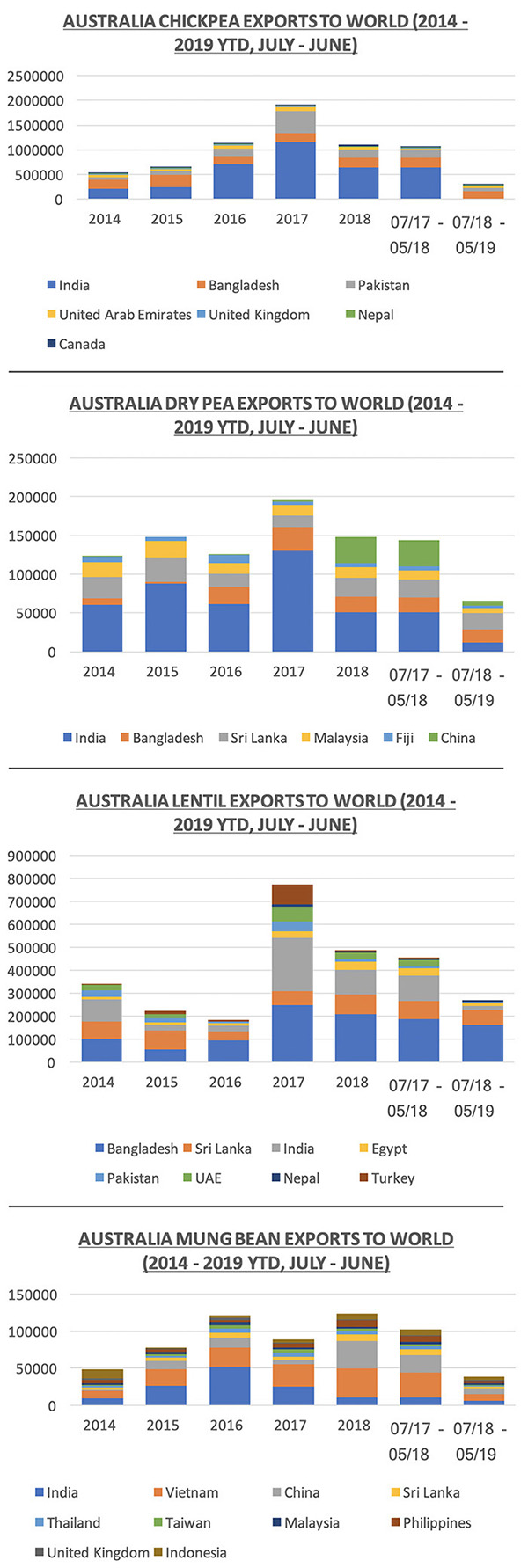

Australia is an important pulse exporter. In fact, it is the world’s leading desi chickpea and faba bean exporter.

The top market for Australian chickpeas is India, but with the Modi administration’s imposition of tariffs starting in December 2017, Australia’s chickpea exports fell off noticeably and its inventories stacked up. Carryover heading into the 2019/20 marketing year is estimated at more than 50,000MT.

Australia’s 2019 chickpea crop is projected at 366,000 MT, up from last year’s subpar harvest, but a far cry from the 2.3 million and 1 million MT crops of 2016 and 2017, respectively. Back then, short crops in India drove prices up and led to a worldwide boom in chickpea production. But the Modi administration’s push for price and production controls has seen India produce bumper crops of its own since then. Consequently, world supply has ballooned to the point where it exceeds demand, causing prices and liquidity to fall.

“Today, a large desi chickpea crop would represent a major risk to Australian farmers,”Wilson says.

For 2019/20, the pipeline seems likely to remain glutted as the world continues to work through surplus stocks and India continues to pursue market control.

The outlook for faba beans is variable. Egypt is the top export market for Australian faba beans. In Australia, faba bean production is rebounding from last year’s drought-stricken, subpar crop. Attractive prices heading into 2019 encouraged Australian growers to favor the seeding of this pulse crop. But there has been news of defaults and Wilson is wary about whether prices will remain high come harvest in November/December.

“It’s been reported that some market participants at destination have chosen to fail to honour commitments, thus creating some distress at destination,” he says. “Sellers everywhere need to take greater care with payment terms to ensure contracts are honoured as they are struck. The trade can ill afford to absorb balance-sheet damage because of unreliable counterparties.”

Source: Global Trade Atlas

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.