The Community of Pulse Producers and Customers of Ukraine hosted its annual conference “The Future of Pulses” on November 29 at the Premier Palace Hotel in Kyiv, Ukraine. The event attracted 259 delegates from 27 countries.

Antonina Sklyarenko, President of the Community of Pulse Producers and Customers of Ukraine, welcomed delegates and thanked the conference’s sponsors, including the Global Pulse Confederation (GPC), which was a Support Sponsor at the event.

Antonina Sklyarenko, President of the Community of Pulse Producers and Customers of Ukraine, welcomes delegates.

Sklyarenko’s remarks were followed by a welcome from Inna Meteleva, Deputy Minister of Economic Development, Trade and Agriculture, who highlighted Ukraine’s potential to increase pulse exports and the positive impact that rising production has had for small- and mid-scale farmers in the country.

GPC Executive Committee member Mr. Michael Kemperdick took the stage next and underscored the strengthening ties between the GPC and the Community of Pulse Producers and Customers of Ukraine during the past few years. He also invited delegates to participate in the “the main event for the pulse industry in terms of networking opportunities and market information access,” referring of course to the upcoming GPC Pulses 2020 Conference in Dubai, April 16-19, 2020.

GPC Executive Committee member Mr. Michael Kemperdick underscored the strengthening ties between the GPC and the Community of Pulse Producers and Customers of Ukraine.

These opening remarks preceded an extensive program that covered several topics, including minimizing harvest losses, access to pulse seeds, storage and logistics, and investments in new technologies. But the most highly anticipated sessions were the two market outlook panels summarized below.

How to Stay on Global Track: Market Outlook for Canada, Australia and USA

The first panel session was moderated by former GPC President Huseyin Arslan and featured GPC Executive Committee members Farhan Adam and Peter Wilson. Liu Jun, advisor on trade and economic issues at the Embassy of the People's Republic of China in Ukraine, and U.S.-based international trader Samuel Peck were also on the panel.

The first panel session was moderated by former GPC President Huseyin Arslan.

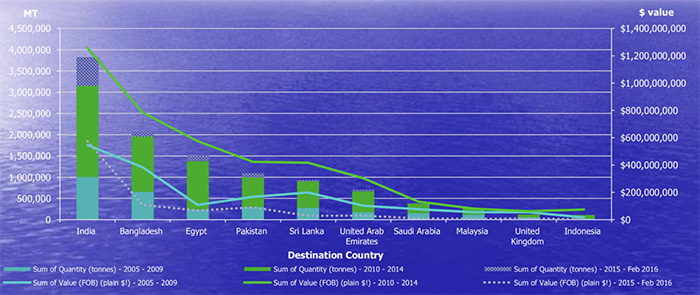

Adam began by noting how Ukraine’s growing presence as a pulse exporter in the international market affected the Canadian industry, which currently accounts for roughly one-third of the global international pulse trade.

Adam confirmed what the GPC had anticipated in earlier reports on the North American pulse crop: it hasn’t been a very good year for some Canadian pulse products due to untimely rains during the current campaign. With harvest already wrapped up, Adam anticipated quality issues, especially in the case of red lentils.

In terms of market access, he stressed that one of Canada’s main importers, Türkiye, had been increasingly buying from Kazakhstan, but cast a shadow of doubt over the 2019 Kazakh red lentil crop.

On the pea side of things, he reported higher-than-average yields. Despite the greater production, he forecast favorable prices for sellers due to strong buying interest from China, a result of the Trump administration’s trade tensions with the Asian giant.

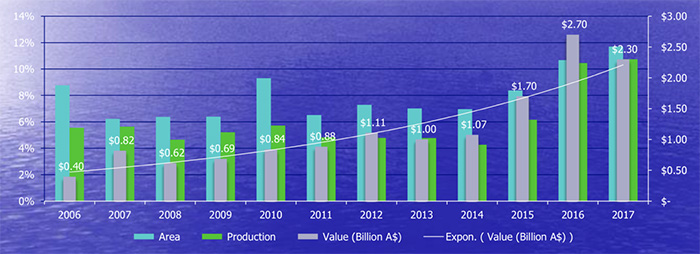

GPC executive committee member Peter Wilson pointed out that dry weather conditions in Australia have been crippling production over the past few years. For 2019, he provided the following production estimates by pulse crop:

Australia’s pulse industry, noted Wilson, is fully dependent on export markets. Market access issues, therefore, are a top priority. In this regard, he mentioned the importance of bilateral trade agreements, such as with China, and the damage caused by tariff and non-tariff issues into key markets like India.

Turbulence, conflict and volatility are the “new normal,” he stated. For Wilson, the future opportunities for Australia’s pulse industry are further up the value chain, in retail food products and food ingredients, for instance.

Source: ABS/ABARE/Pulse Australia Limited/Wilson International Trade

Liu Jun’s brief presentation highlighted the potential for Ukraine’s pulses (and soybeans) in China’s domestic market due to the duty-free status that Ukraine’s agricultural products enjoy in China. “The time is now,” he urged.

In his presentation, US-based international trader Samuel Peck emphasized the challenges U.S. pulse growers faced in 2019. In the case of dry beans, he said it has been the worst campaign in the past 40 years. The growing season started out well enough, but heavy rains and a record-breaking snowstorm in October took a heavy toll on standing crops and caused harvest delays. Consequently, the pinto bean crop has discoloration issues and the white bean crop was decimated. Peck pegged losses at between 15 and 20%.

In closing, he provided an overview of value-added products produced in the U.S., particularly in the snack and pet food segments.

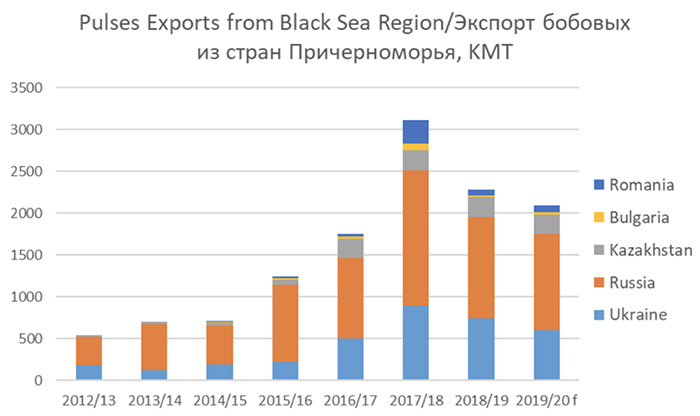

This panel discussed pulse production and exports from the Black Sea nations of Kazakhstan, Russia and Ukraine. Panelists included Kintal Islamov of Atameken-Agro, Nedim Sanli of Sodrugestvo, Sergey Feofilov of UkrAgroConsult and Denis Plenkin of Agropa Trading.

Plenkin gave a general overview of the pulse trade, looking at its past, present and future. In terms of world pulse exports, Canada and Australia have ranked first and second for the past several years, with Russia having risen from the fifth to the third spot over the past three campaigns. The top three importers have remained constant, with India in the number one spot followed by China and Pakistan. Plenkin sees the pulse trade expanding in the coming years as consumers shift to plant-based protein and the world embraces pulse crops as a means of reducing the environmental impact of food systems.

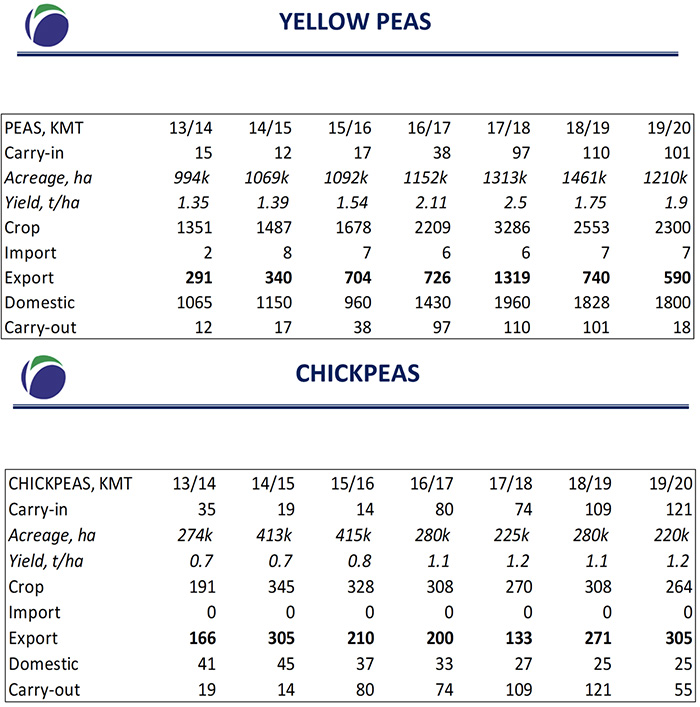

In his presentation, Feofilov focused on the Black Sea Region’s pulse production and exports in recent campaigns. After peaking in 2017/18, the region’s exports fell off in 2018/19 and are projected to slip further in 2019/20. Ukraine, however, is seeing interesting new developments. The country is primarily a dry pea exporter, and its recent drop off in overall pulse exports is due to decreased dry pea production. At the same time, however, it is seeing increased exports in other pulse products, namely kidney beans, chickpeas and lentils. In fact, Ukraine has emerged as the region’s top kidney bean exporter.

For his part, Sanli provided an analysis of Russia’s pulse exports. Russia’s lentil exports exploded from 1,100 MT in 2013/14 to 105,000 MT in 2018/19. For 2019/20, however, exports are projected to drop sharply to 29,000 MT. Similarly, Sanli projects Russia will export 590,000 MT of yellow peas in 2019/20, continuing a downward trend from its record high 1.3 million MT of yellow pea exports in 2017/18. In the case of chickpeas, however, Sanli expects 2019/20 exports will exceed the previous campaign’s 271,000 MT. He projects Russia will export 305,000 MT of chickpeas this campaign.

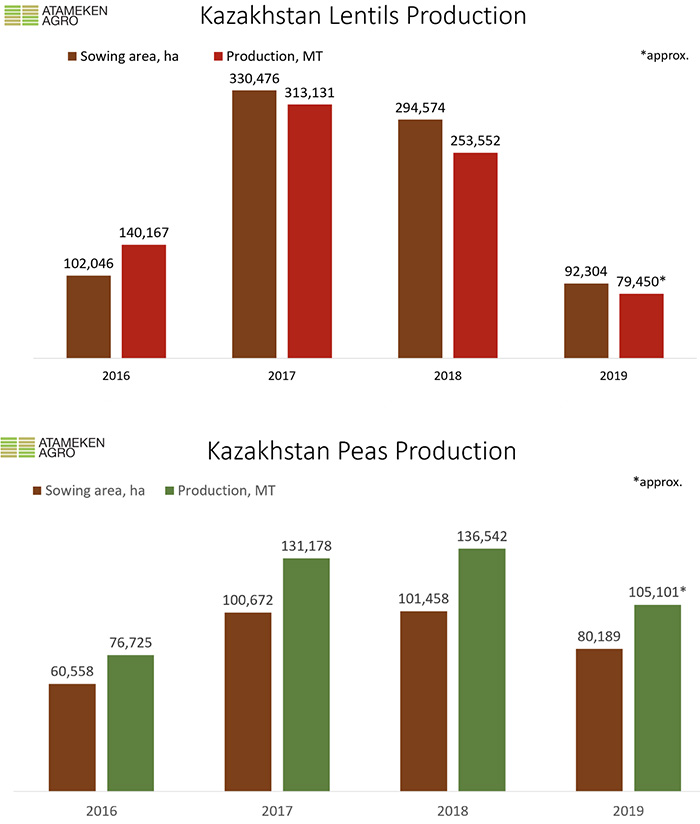

Lastly, Islamov provided the view from Kazakhstan. Lentils are by far the major pulse crop grown in Kazakhstan, with peas a distant second and chickpeas a far distant third. In fact, Kazakhstan ranks 10th in world lentil production, with a 2.2% share of global output, just behind China (2.3%). In 2019, however, Kazakhstan’s lentil production fell to a four-year low (79,450 MT) due to a drastically reduced seeded area and weather woes. The top destination for Kazakh lentils is Türkiye, which consistently takes upwards of 75% of Kazakhstan’s exportable supply. Turning to peas, production also dropped off notably in 2019, but to a less marked degree. Islamov estimates 2019 pea production at 105,101 MT, down from 136,542 MT in 2018. Last year, Spain emerged as the top destination of Kazakh peas, accounting for 52% of the total export volume. Other major destinations include Afghanistan and Uzbekistan.

Ukraine / Community of Pulse Producers and Customers of Ukraine / Antonina Sklyarenko / Michael Kemperdick / Huseyin Arslan / Farhan Adam / Peter Wilson / Liu Jun / Samuel Peck / Kintal Islamov / Nedim Sanli / Sergey Feofilov / and Denis Plenkin

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.