The world’s one and only Chana (desi chickpea) futures contracts are traded in India on National Commodity and Derivatives Exchange (NCDEX).

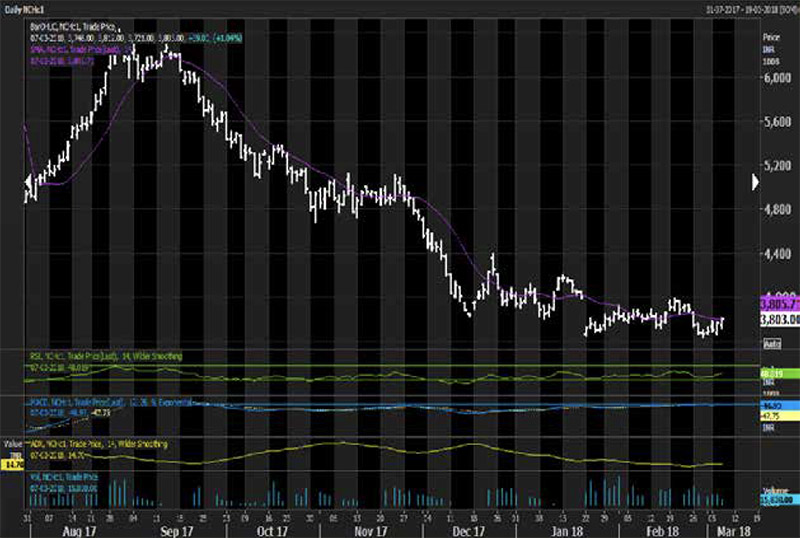

The NCDEX Chana futures are struggling to find any momentum at all. For the past couple of months it has been moving in a broad range from 3600-4000 levels. Though, there was indication of a possible bottom around 3654 in the month of January 2018, at present there are no clear signs of the same. A decisive close above 3900 could be the trigger for the expected upside towards 4400 in the coming weeks. Unexpected fall below 3600 could cause doubts on our bullish view.

Technical Outlook for Indian Rupee

THE USD-INR

The Indian rupee was little changed against the dollar in afternoon trade, as greenback sales by state-run lenders amid broad weakness in the U.S. currency offset losses triggered by weak local and regional shares on renewed concerns over trade war. US President Donald Trump’s decision to impose tariffs, in what according to him was necessary to address the unfair trade situation, has kindled fears of a trade war between the U.S. and other major economies.

The major implications of the tariffs imposed by President Donald Trump as part of his election agenda that many in the markets feared are:

1. Risk of a trade war and retaliatory measures from other countries

2. Inflationary - as metal prices rise (US domestic firms unlikely to ramp-up production rapidly)

3. USD negative, if other countries retaliate (likely)

4. China could be less hurt than thought (high domestic absorption rate)

We expect weakness in the Rupee to continue with bouts of appreciation on and off. Global dollar strength on the back of rate hikes could bolster the dollar and with falling equity markets, lack of substantial inflows chasing emerging markets could add to Rupee woes.

A potential upside to 65.95/66.05 is on the cards in the coming months. Any corrective dips to 64.50 is expected to hold now. It is hard to say if prices can follow-through higher from there. But, with present variables, it might look difficult.

Conclusion: We see the Rupee weakening, in line with a stronger dollar overseas. Technically, we expect some shortterm strength initially followed by a rebound higher again.

The author Gnanasekar Thiagarajan is Director, Commtrendz Research, India. He can be reached at gnanasekar.t@gmail.com or on +919943148092.

Viewer Disclaimer: The content in this analysis compiled from various sources, is not a recommendation to buy/sell commodities and currencies. The author is not liable for any loss or damage, including without limitations, any profit or loss which may arise directly or indirectly from the use of above information.