July 11, 2023

The Statistics Canada numbers released at the end of June predicted lentil acreages 15% down on 2022. Taking data from the Pulse Atlas, we look at the details of the green/red split and what it means for markets.

Canadian red and green lentil acreages 2020-2023

The June 30 Stats Can numbers estimates a 15% decrease in total lentil planting but does not discriminate between lentil types. Exclusive Pulse Atlas Data confirms the 15% drop as well as providing key insight into the split between reds and greens. Although green hectares are up on 2022, the 23% decrease in red lentil hectares is making up the majority of the decline.

Elsewhere in the Stats Can numbers, chickpea planting saw a projected 35% increase to 127,000 hectares and dry beans a 6.8% increase to 129,000 hectares while dry peas are expected to drop 10% to 1.2 million hectares. With Canada’s wheat area hitting the highest levels in decades, it’s not difficult to understand where else the lost red lentil acres are being made up, especially taking into account modest increases across soy, corn and canola.

With the country already facing tight red lentil supplies, the data raises questions around how export potential will be impacted. In the shorter term, however, the pressing issue remains what the weather over the next few weeks will look like and the subsequent effect on yields.

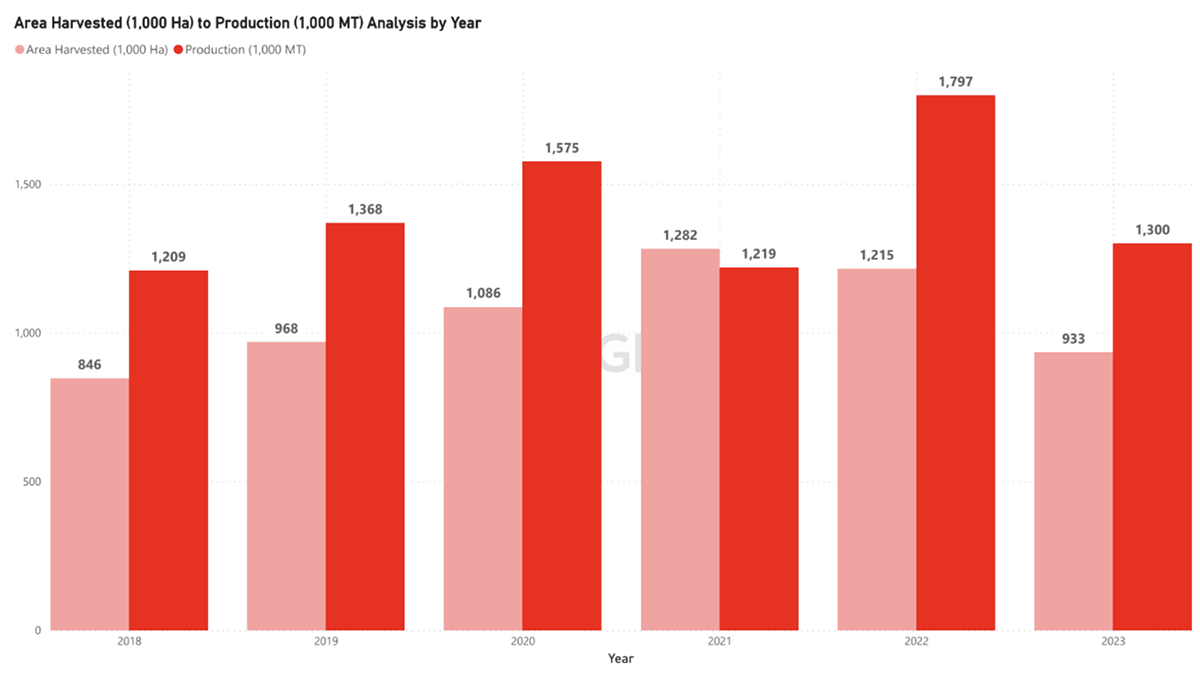

Canadian red lentils area harvested to production (2018-2022)

Will Watchorn, Global Head of Pulses, Viterra

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.