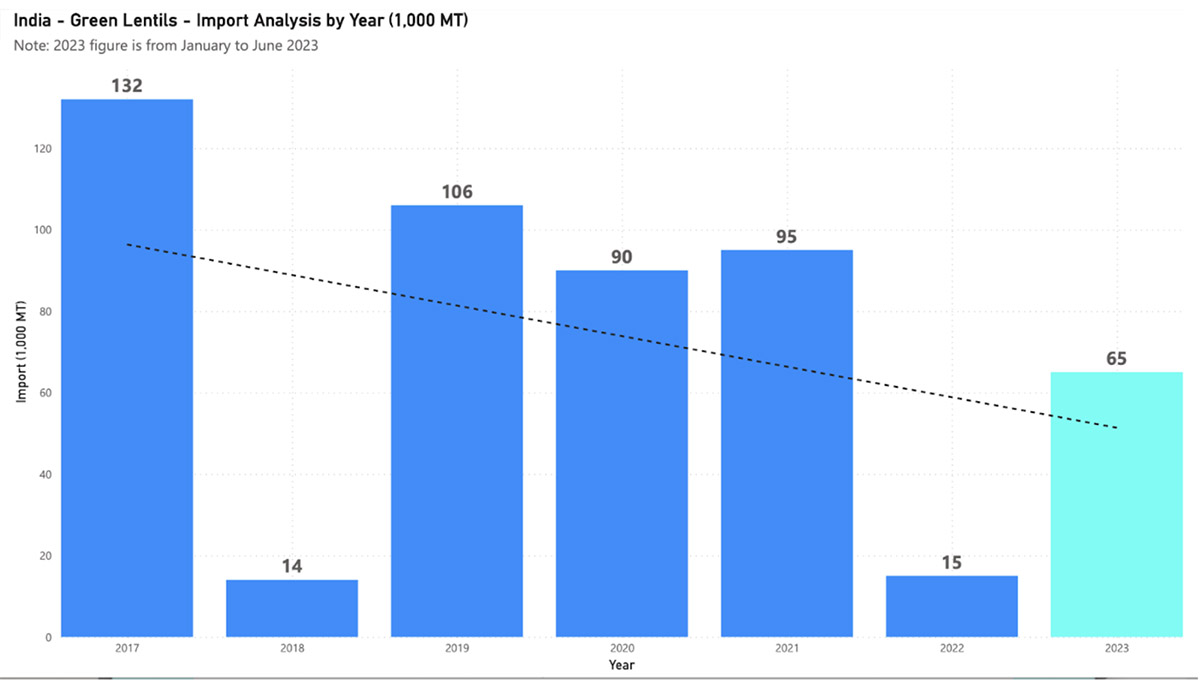

Exclusive Pulse Atlas data shows significant fluctuations in India’s green lentil imports over the past 6 years. Largely pegged to the supply and pricing of pigeon peas, India’s green lentil imports are an interesting one to watch. In 2023, prices of pigeon have been tracking high and lower acreages and below average weather for the kharif crop mean yields will likely not boost supplies in the near future. India’s green lentil imports usually come from Canada, which has had a below-average lentil crop in 2023, meaning prices are staying high and volumes on the market are low. So far this year (January to June), green lentil imports stand at 65 thousand tonnes and it seems volumes for the rest of the year are dependent on the supply of pigeon peas out of Africa and Myanmar. Looking at the data and talking to experts, we explore how imports will pan out in the next quarter.

- India’s imports were 15 thousand tonnes in 2022, compared to 95, 90 and 106 thousand in the three years previous. From Jan-June 2023, imports sit at 65 thousand tonnes.

- Total global production of green lentils so far in 2023 is 795 thousand tonnes, a modest increase from the past two years but far below the five-year average.

- India’s 2023 pigeon pea crop is estimated at around 3.2 million tonnes from 4.3 million hectares, by far the lowest volume seen in the past six years.

Insider insights

Harsha Rai, Mayur Global

- “There was no civil supply support in 2022, it only started in Oct/Nov and that's how the market started picking up into 2023. Also pigeon pea prices were not as high as they have been in 2023 because of the shorter supplies and lower acreages. African prices have not gone down much. Mozambique is not shipping cargo as there is a phyto issue so we’re not seeing the normal arrivals but the government has put a stock limit on pigeon and black matpe to control prices.”

- “One thing that helped this year was green lentil imports from Russia. This has never happened before. Even with the tariff removal in the USA, prices are so high that US lentils are trading close to Canadian prices but volume seems to be limited. In the last few months, Russian prices have been almost 100 USD below Canada. But we cannot supply only Russian lentils in the tender, there’s a quality difference compared to Canada. Also logistics are not great from Russia, there are some phyto issues plus the export duty brought some volatility.”

- “In November, the market expects that the Tamil Nadu government will be releasing another buying tender for civil supplies. This has sparked a surge in activity in the market, as buyers rush to secure their supplies. With imports open with zero duty and production looking smaller in India, other origins are waiting for more demand before dropping prices. This cautious approach is keeping the prices stable and preventing any aggressive selling at lower prices. The recent buying tender by Algeria for green lentils has added to the high price scenario. As a result, we expect green lentil prices to remain strong in the near future.”