June 27, 2023

The country marches towards a fourth consecutive year of more than 1.2 million hectares harvested, but a production drop is predicted. Bringing together industry insight and market data, we investigate.

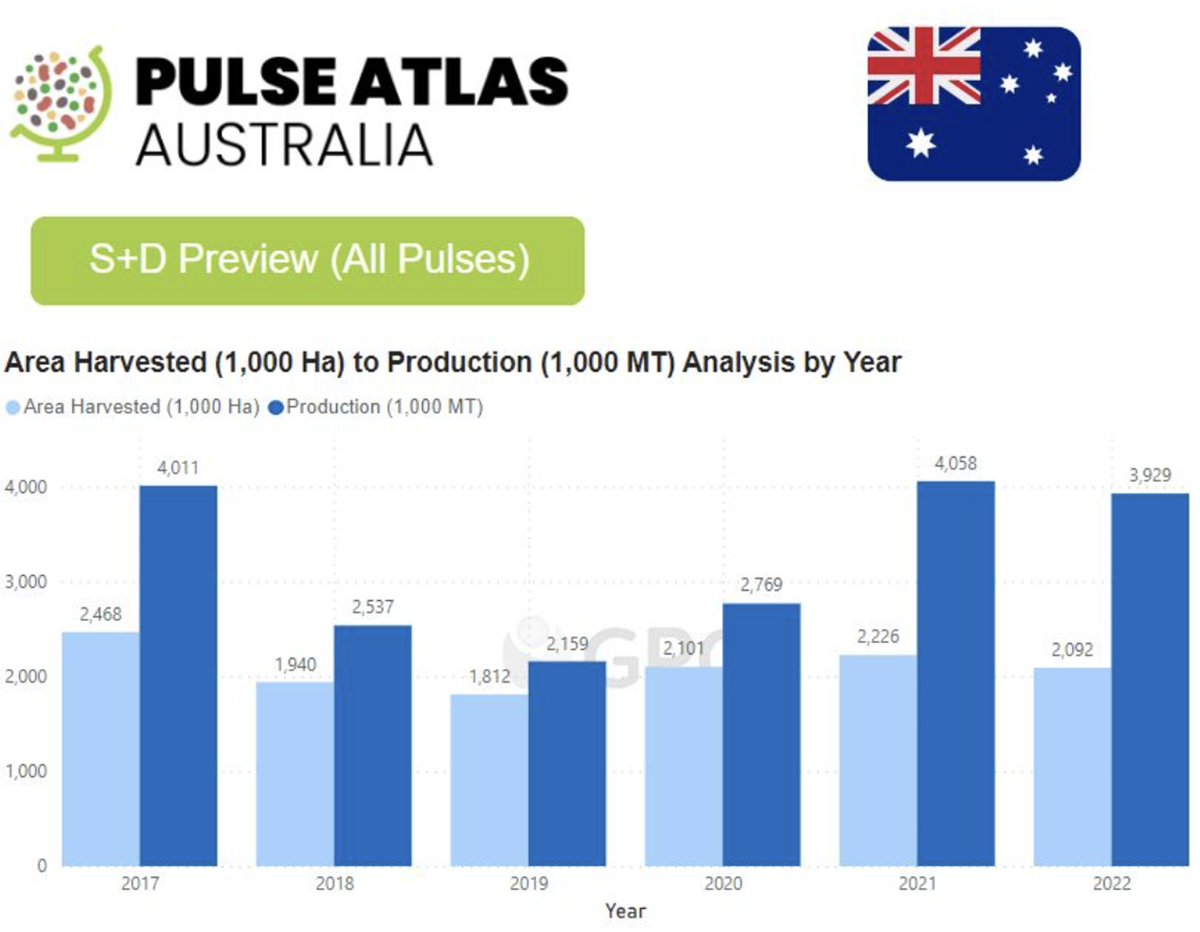

All Australian Pulses – Area Harvested vs. Production 2017-2022.

Exclusive Pulse Atlas data presents a strong picture for the last five years of Australian pulses. Overall yield has increased significantly since 2019, with harvested acreage remaining stable for the last three years in a row but production growing. The recent success has been a result of strong yields and a rise in lentil production and exports, although a return to trendline yields is set to curb the upward trend of recent years.

Data from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) suggests that while high acreage is set to continue for lentils and chickpeas, fabas, lupins, and peas will decrease and yields of all pulse classes are to drop significantly compared to 2022/23’s all round strong harvest — particularly in lentils. The 2022 red lentil harvest of 1078 MT was the largest over a six-year period but according to ABARES, 2023 lentil production is expected to drop 506 KMT.

Peter Wilson, Wilson International Trade & Australian Pulse Council

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.