April 20, 2023

NAFED’s chickpea inventories are expected to reach record levels this year, what does this mean for markets, both domestic and international? AgPulse Analytica’s Guarav Jain reports.

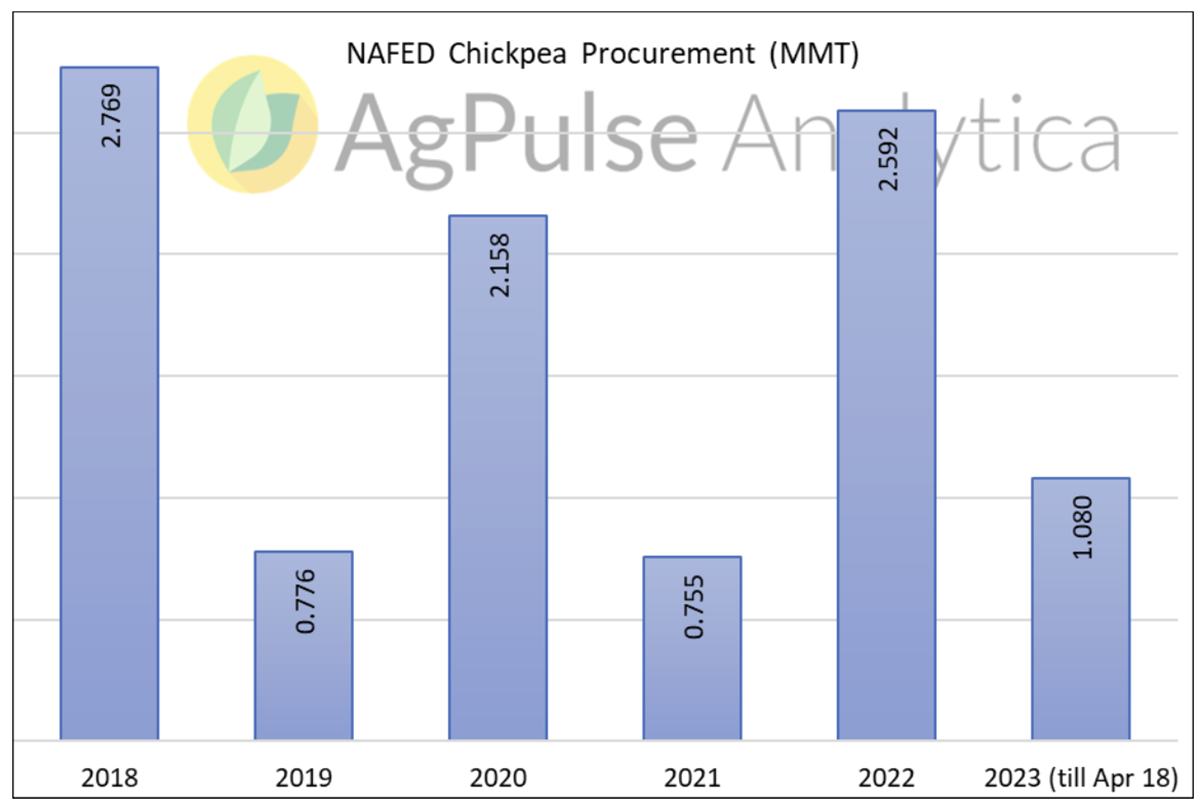

Among the various crops that NAFED procures annually, chickpea has emerged as one of the most important. Over the years, the procurement drive has benefited millions of farmers across the country. Last year, NAFED procured 2.6 million MT of chickpeas from farmers across multiple states, not far from the 2018 record of 2.77 MMT.

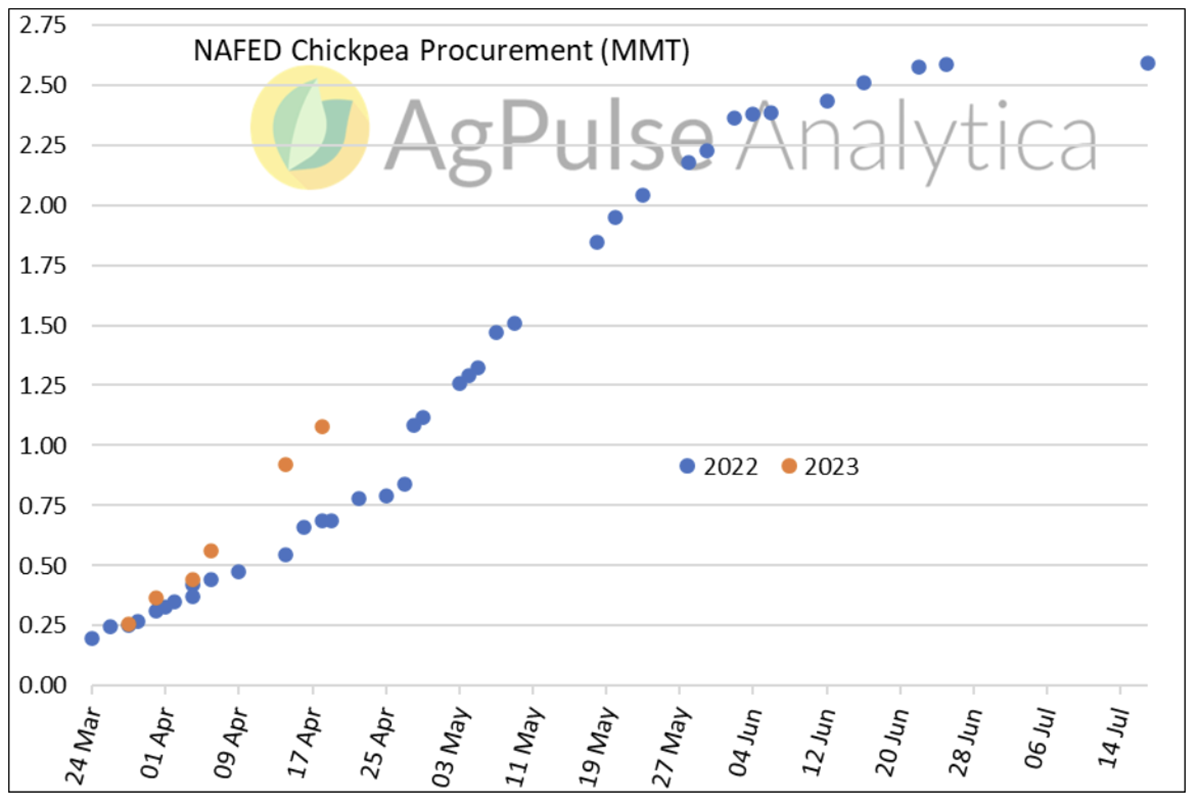

Rabi season chickpea procurement is currently in full swing and, according to the latest data, NAFED has procured over 1 million MT of chickpeas. The procurement season started with an inventory of approximately 1.4 MMT, making the current stock level close to 2.5 MMT. By the same time last year, NAFED had procured 2.6 MMT of chickpeas.

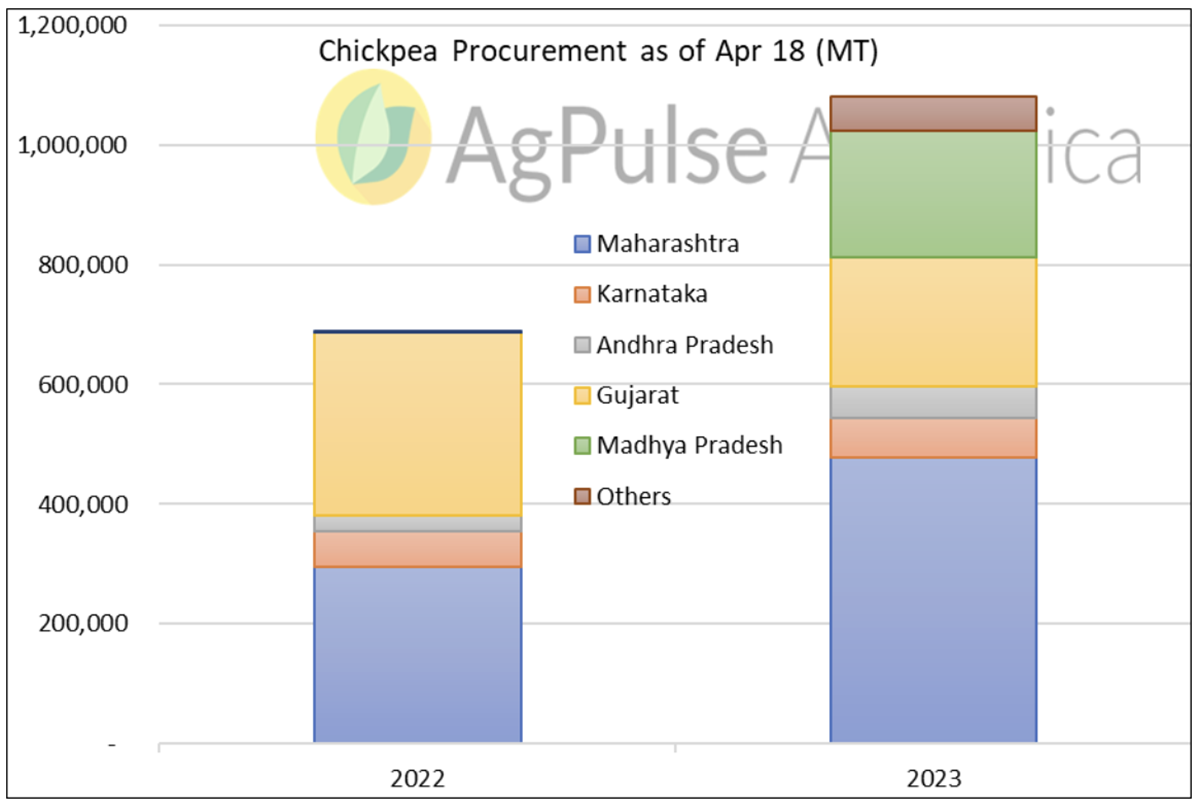

As of April 18, Maharashtra farmers have sold nearly half a million tonnes of chickpeas (compared to 296 KMT last year), while the drive is picking up pace in Madhya Pradesh (211 KMT)), which was absent from procurement at the same time in 2022.

NAFED inventories are expected to swell to a new record this season, which will have wide implications both domestically and on the international markets.

With inventories expected to stand at between 3.5-4 MMT (procurement of 2.1 MMT - 2.6 MMT), NAFED is likely to keep the selling pressure on in the domestic market, pushing prices lower and discouraging private traders to stock large inventories. With the general elections next year, the offtake is also likely to be from the Public Distribution System (PDS), where the chickpeas can be distributed for free or at a nominal price.

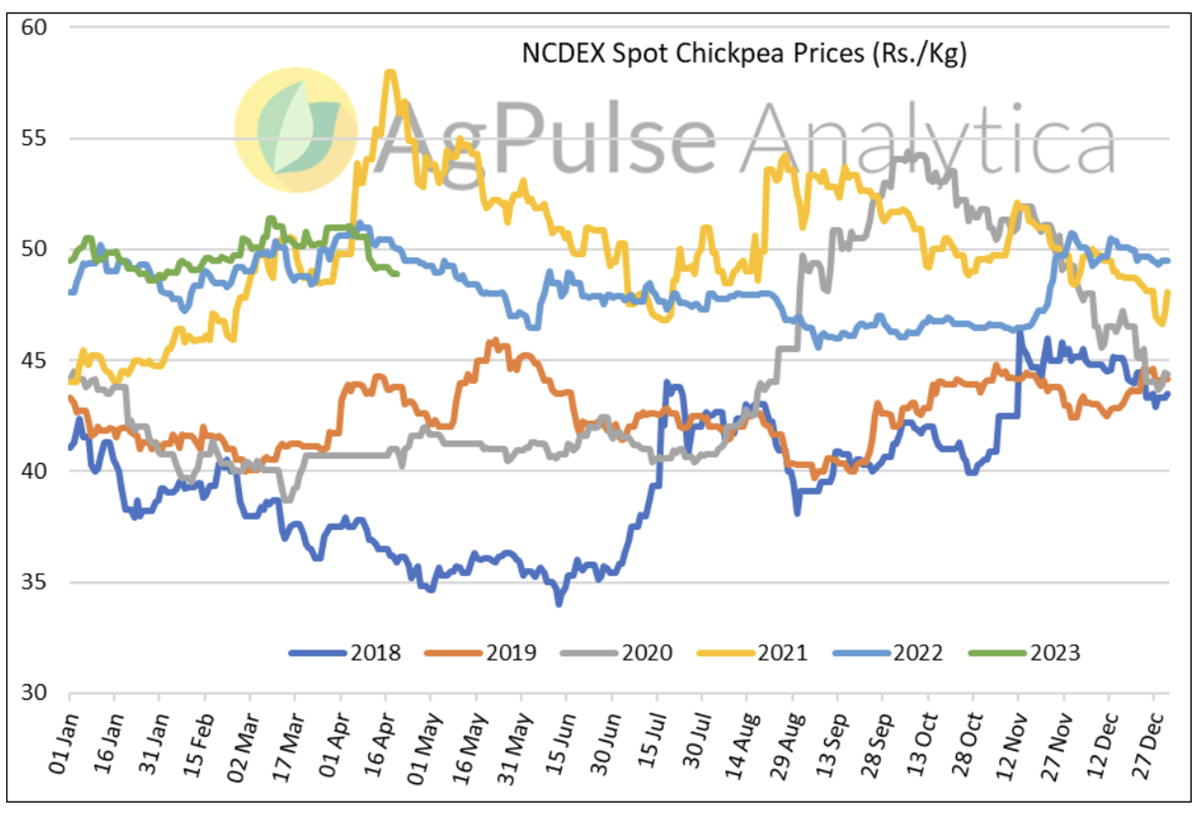

In previous years when NAFED procurement and stocks were high, prices remained subdued for the rest of the year. 2023 is unlikely to be an exception; local prices have already started dropping. From the 2023 high, benchmark NCDEX spot prices have already cooled off by Rs.2.50/kg ($30.50/T).

Dampened chickpea prices will increase their substitutability with other pulses. Though the core demand is unlikely to change for pulses like pigeon peas, mungbean, black matpe and even lentils, the wide spread of those crops with chana dal will still ease some of the burden.

Import parity is hard to come by with dampened domestic prices, even for the produce from duty exempted Least Developed Countries (LDCs). Desi chickpea imports from Tanzania and other minor exporters took a hit in 2022 when the domestic prices ruled below Rs.50/kg (~$610/T). Exporters in those countries moved to other desi chickpea destinations like Pakistan and the UAE to find a home for their produce. We expect a similar trade flow in 2023, with the bulk of Tanzanian chickpeas being taken by Pakistani importers, which will finally hit the Australian export campaign.

Due to payment issues, the Australian export campaign was hit hard this season, with lower than expected volumes shipped to South Asian markets for Ramadan. Tough competition from East Africa in the second half of 2023 will make marketing more difficult.

The National Agricultural Cooperative Marketing Federation of India Ltd (NAFED) was established in 1958 with the object of promoting the co-operative marketing of agricultural produce to benefit farmers. The agency is tasked with ensuring a Minimum Support Price (MSP) for many crops in the country, which is achieved by procuring produce directly from farmers at the time of harvest.

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.