August 3, 2021

The second Brazilian bean harvest of 2021 is already in its final stretch and has presented several obstacles for producers, including severe droughts and increased competition from corn.

CONAB

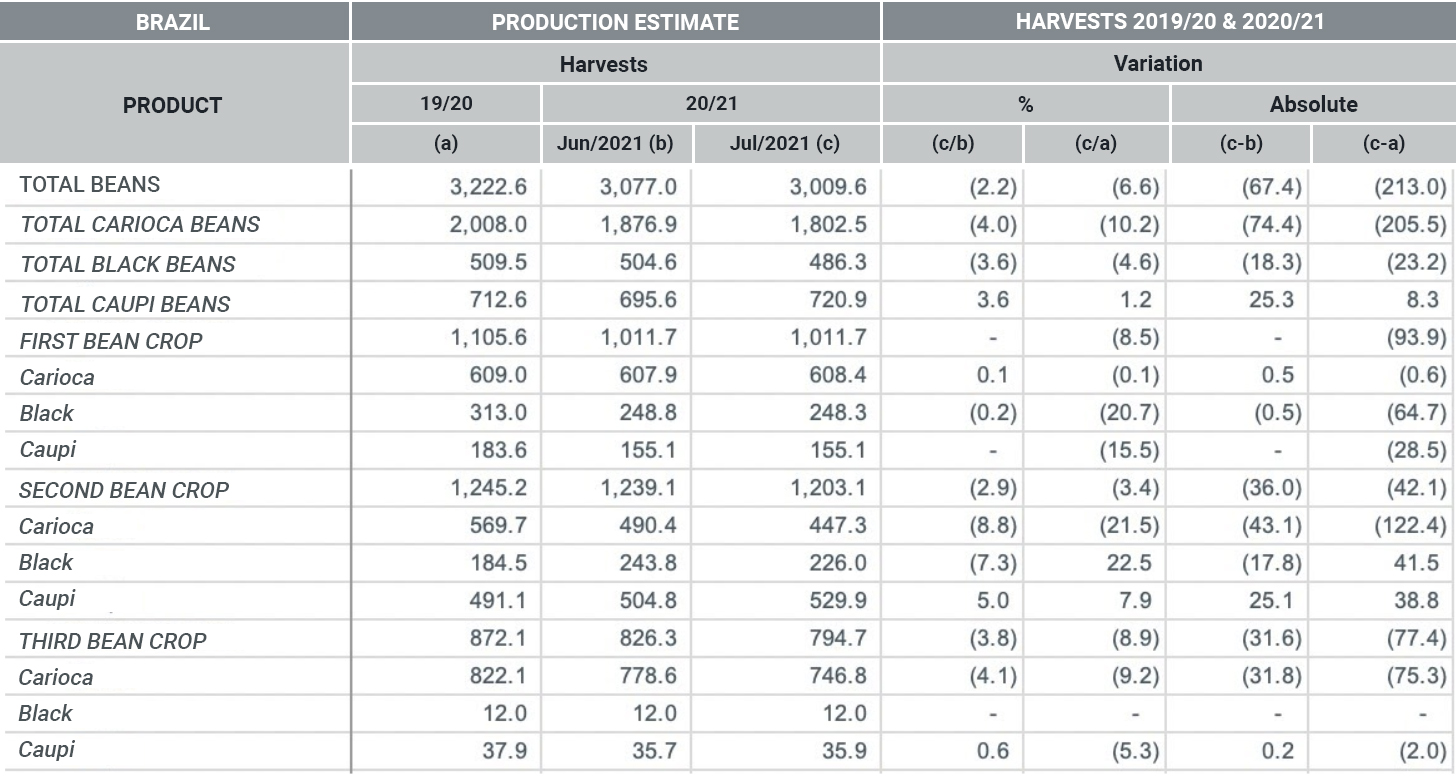

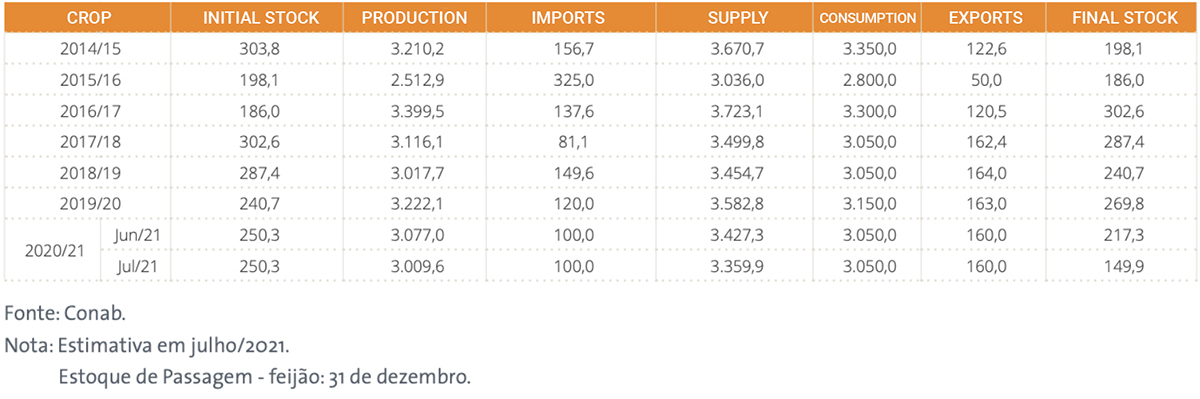

According to data provided by CONAB (Companhia Nacional de Abastecimento), a sown area of almost 1.46 million hectares was dedicated to the planting of beans, with total production estimated at 1.203 million tons of grain, a figure that represents a 3.4% decrease compared to 2019/20.

Source: Conab

The scenario suggested by CONAB differs slightly from that of IBRAFE (Instituto Brasileiro do Feijão e Pulses), which estimates that the total production of the second harvest should close at around 1.1 million tons. According to IBRAFE's accounts, the total production of beans will suffer a decrease of 5% compared to 2019/2020. The consumption of beans in Brazil this year would be 13kg per capita. Since it is generally known that the population's consumption potential is around 15kg per capita per year, this would create a ripple effect, increasing prices for the final consumer, who, according to IBRAFE, will suffer from inflation as of September this year.

One of the most important factors affecting the current situation is that many farmers switched from dry beans to corn and soybeans. This is mainly due to them being easier to grow combined with the extensive technology already known by and available to producers. "Although corn has a shorter planting window, several producers in the Midwest decided to risk entering the month of March planting corn", says Carla Borges, administrative director of the Fazendas Nova Geração group, who joined this trend, decreasing the area initially reserved for beans.

According to Borges, the lack of both seed technology and new certified varieties of beans are demotivating factors for producers. Iuri Bruns, from Samba International, agrees. “There is not much technology for the seeds and there are no transgenics to help, let alone research into the development of these seeds”, he says, adding that the crops are consequently more susceptible to diseases and pests.

CONAB

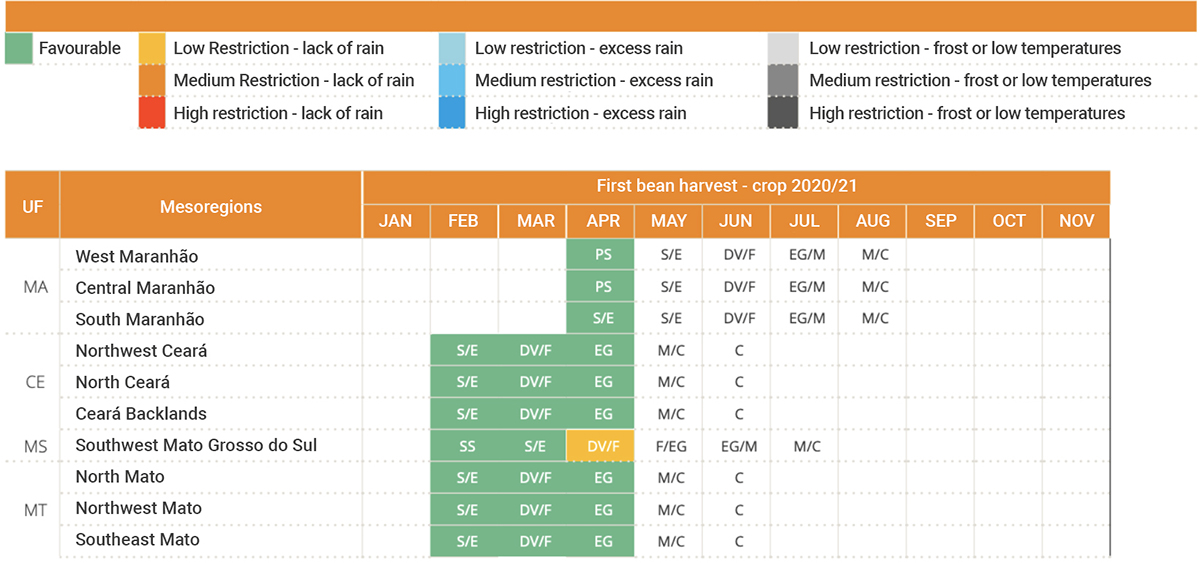

According to CONAB, the production of carioca beans was the most affected in the second harvest. This is due to the reduction in bean planting areas in all producing regions of Brazil and the drought that hit the Center-South region of the country. There was an unstable climate in all regions, particularly Paraná, which is the main producer of the second crop of beans in Brazil, and Mato Grosso, which had unusual rains in February, delaying the planting of beans.

“At the beginning of this year, we had high expectations for substantial growth in the total number of tons produced in Brazil. We did not, however, expect to have the biggest hybrid crisis and the driest year in almost a century”, says Leonardo Arnizaut from Iberica Corretora. As much as the drought had a negative impact on the quantity of production, it did not, according to Arnizaut, affect the quality of the beans. Quite the contrary, "This situation is actually favourable in terms of the quality of the beans as there’s virtually no chance of them being stained or containing any excess moisture”, affirms Arnizaut.

DOMESTIC MARKET

The domestic market for carioca beans and black beans is currently facing some resistance in prices, which have reached a ceiling. This movement is discouraging producers, even with regards to future crops, as confirmed by Bruns. "No one is talking about next year's first crop, despite the fact that planting should be starting in two months."

CONAB/Divulgação

Much of this is due to the pandemic. While at first consumers were rushing to supermarkets to make sure they had enough of their beloved beans to feed their families, in the second half of the crisis consumption became more discreet. This is mainly because of the increase in prices, which remain high to this day.

Initially, the expectation for black beans was that there would be an increase of 32% in production, guaranteeing a well-supplied domestic market. In actual fact, the unfavourable weather conditions mean that production will be lower than expected, making Brazil more dependent on black bean imports from Argentina, a traditional exporter of this variety to Brazil. The volume of Argentine black bean imports, however, will depend on prices. While before 2020 Argentina depended on Brazil to supply 80% of its production, the current scenario is very different. Last year, Argentina sold black beans to more than 40 countries, reducing its dependence on other market options to around 60%.

Eduardo Balestreri, from Arbaza, has a hunch. "The expectation is that Brazil will import between 60 and 100 thousand tons from Argentina, out of an approximate total of more than 200 thousand tons", but he considers it to be still too early to say. “Central America and some Caribbean islands will take good import volumes from Argentina as well,” he concludes.

EXPORT

Cowpea beans are widely consumed in the Brazilian domestic market and producers end up having both the option of selling the product for export or marketing the product in the domestic market. Mung beans, however, are produced for the sole purpose of exporting to markets in India, Vietnam, Thailand, Pakistan, and the Philippines.

From the end of February to mid-June, many export deals were settled to be shipped between June and August. With the drastic fall of the dollar in recent weeks, it has become more difficult to make new sales abroad. Producers continue to ask for high prices in crops and the exchange rates prevent the numbers from “matching” for new export business.

CONAB

In 2021, Brazil is selling cowpea beans at higher prices than in previous years. For comparison, in 2020 the price of cowpea beans was around 750 USD per MT. By late 2020, they increased to 1,000 USD/MT. In 2021, the price of cowpea beans has been around 950 USD and should remain firm until the next crop in 2022.

It was suggested that there could be a 10% increase in mung bean production and, consequently, exports in 2021 could also rise. However, the dry climate changed this scenario and the harvest should be slightly lower than last year, which guaranteed exports of 50,000 tons. Expectations regarding exports were very good until recently but the change in the dollar exchange rate could have a big impact on exports during the second half of the year. It is worth highlighting that the dollar reached a maximum price of R$ 5.80 in March and today is around R$ 4.90, representing a reduction of 15.5%.

THE FUTURE IS PLANT-BASED

Despite the challenges facing the bean crop in Brazil, there is light at the end of the tunnel. Contrary to some predictions that by 2030 there could be a 30% reduction in the areas of bean planting, the Plant-Based phenomenon is spreading fast in both Brazil and the world. “This week, people from a company in the interior of São Paulo got in touch because they wanted to understand more about the proteins in beans. Another company also got in touch, wanting to know what is the percentage of protein in each of the beans”, comments Marcelo Luders, from IBRAFE.

Along with lentils and chickpeas, beans have enormous potential in the fast-growing healthy food market. Pulses contain enormous amounts of protein, which in omnivorous diets generally comes from meat and fish. In vegan and vegetarian diets, it is necessary for individuals to get their protein from other sources and that's why more and more people are looking to pulses for their high protein value.

The Brazilian bean industry is already exploring other forms and uses of pulse protein, such as flour and other raw materials which can be used to create plant-based products. However, for this to become a real opportunity for added value, there’s a lot of work required to promote the benefits of beans within Brazil.

LONG LIVE BEANS

To promote pride in Brazilian bean consumption, IBRAFE is creating, with the support of sponsors such as Sebrae and the Brazilian Association of Bars and Restaurants, a festival called Viva Feijão. Over the next year, campaigns will be organized to inform the population about the benefits of the grain and how to avoid wasting it, such as by choosing the traditional “prato feito” (ready-made plate) over the more wasteful “buffet delivery”.

Viva Feijão will involve promotions, videos and events in which chefs will create new dishes, as well as focus on educating people about the development of beans, not just as a ready-to-eat product but also as raw material for bean flour, isolated bean protein, and many other products.

“There is not enough meat for everyone - we will not reach 2050 with everyone consuming meat. Proteins will have to be extracted from plants, right? Beans fit very well with the need for something powerful and sustainable”, believes Marcelo Luders.

CONAB / IBRAFE / Marcelo Luders / Carla Borges / Eduardo Balestreri / Iuri Bruns / Leonardo Arnizaut

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.