August 1, 2019

If approved, the initial recommendation would allow 2,199 MT of dry beans to enter the country duty-free.

In July, Costa Rica’s National Production Council (Consejo Nacional de Producción) issued its recommendation for a duty-free dry bean shortfall quota of 2,199 MT for CY 2019/20. This recommendation is based on a technical study that assessed the supply-demand situation for this crop year and next, and added a set aside for a dry bean reserve to cover ten weeks’ worth of consumption.

For this crop year (July 2018 through June 2019), Costa Rica’s dry bean production is estimated at 8,111 MT, which is expected to cover 14% of demand during CY 2019/20. Carry-in is expected to cover an additional 25%. The remaining 61% will need to be covered by imports.

Most of these imports will come in the form of red beans from Nicaragua, with another 10,000 MT coming in the form of black beans from China. Dry bean imports from both of these origins enter Costa Rica duty-free. Nicaragua enjoys preferential status as a Central American trading partner; in the case of China, a bilateral agreement allows for dry beans from that origin to be imported duty-free during two specified times of the year: May through July and October through December.

The CNP’s 2,199 MT shortfall estimate for 2019/20 represents a 57% decrease from the 5,146 MTshortfall for 2018/19. The difference appears to be due to higher carry-in. Mauricio Corrales of Kani suggests that attractive international prices this campaign spurred increased buying on the part of importers and resulted in higher surplus inventories heading into the new marketing year. But Juan Carlos Sandoval of La Maquila Lama believes the recommended shortfall quota will not be enough to cover import demand. The crop that was harvested in April, he says, was expected to produce 170,000 cwt of beans, but ended up at around 100,000 cwt.

In any event, both Corrales and Sandoval agree that the shortfall quota will be used in its entirety to import black beans. Argentina will be the preferred origin, they concur, as it just recently harvested its bean crop and typically offers competitively priced black beans. Corrales sees China as a possible alternative, provided its new crop becomes available on time. The U.S. is another option. Under DR-CAFTA, tariffs and import quotas on U.S. origin dry beans are being phased out; for calendar year 2019, Costa Rican importers may bring in 2,640 MT of U.S. origin dry beans at preferential tariff rates (3.1% for black beans and 0.6% for red beans).

The CNP’s shortfall quota recommendation is presently awaiting ministerial level approval. Once it is officially issued, the 11 companies assigned import permits (see chart below) will have until the end of the year, or possibly till the end of January 2020, to bring the beans into the country.

On the news of the CNP’s shortfall quota recommendation, GPC offers its members the following overview of the Central American dry bean trade.

|

COMPANY NAME |

ALLOCATION (in MT) |

|

Corporación de Compañías Agroindustriales (Walmart) |

982.95 |

|

Compañía Arrocera Industrial |

226.06 |

|

La Maquila Lama |

200.11 |

|

Kani Mil Novecientos Uno |

196.81 |

|

Empaques Agroindustriales |

146.45 |

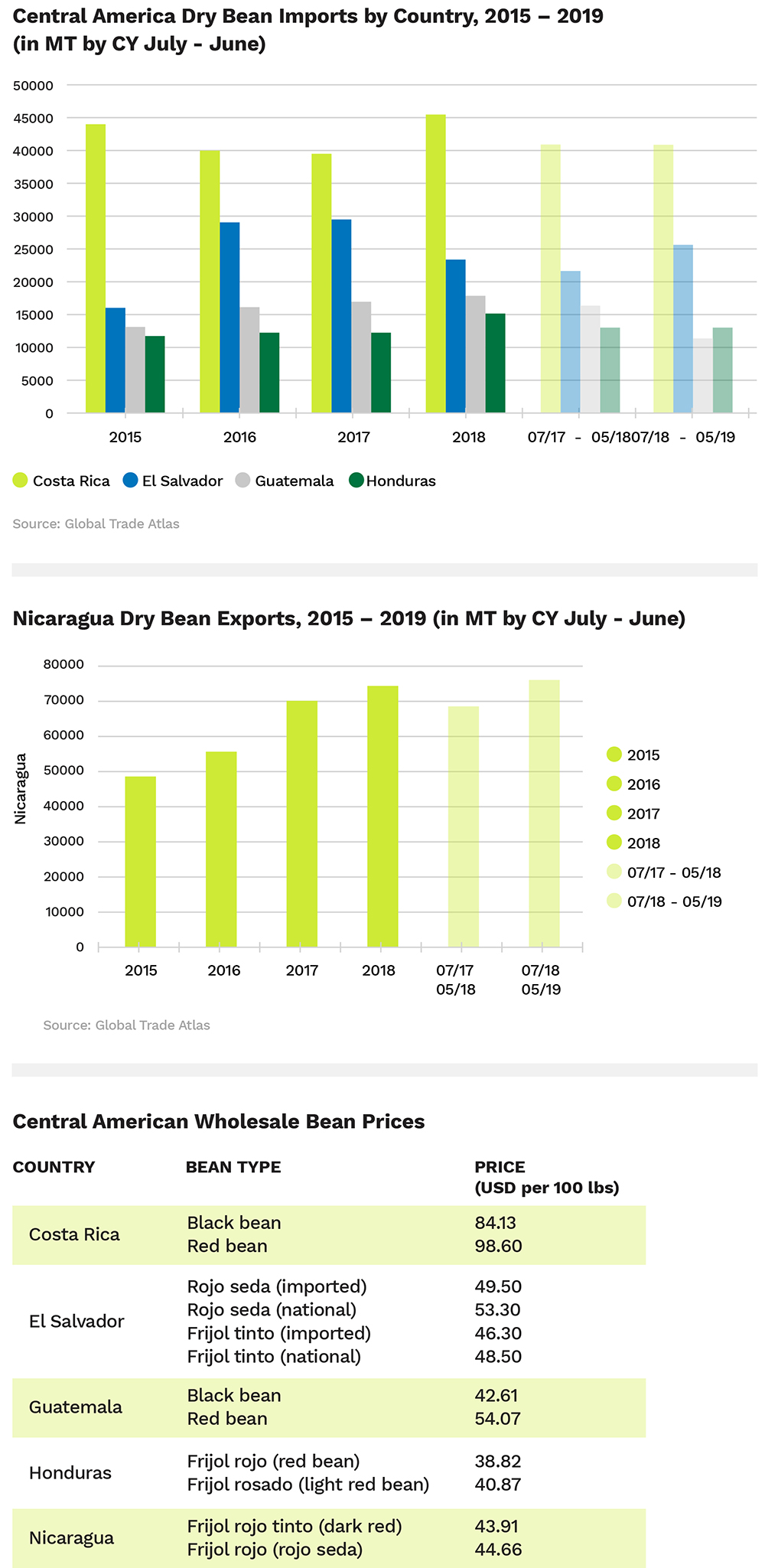

Beans are a staple food in Central America. Black and red beans are the most popular. Of the five Central American nations, Costa Rica is by far the largest dry bean importer, averaging 42,000 MT per year. El Salvador is a distant second, with an annual average of 24,500 MT, followed by Guatemala (16,500 MT) and Honduras (13,000 MT). Honduras is primarily a red bean market. Guatemala is mainly a black bean market. The other countries of the region consume both black and red beans in more equal measure.

Costa Rica is the only Central American country that imports more beans than it produces. El Salvador, Guatemala and Honduras use imports to supplement domestic production. Nicaragua, on the other hand, not only covers its own consumption, but is also the region’s top supplier of rojo sedabeans, the preferred red bean variety among Central American consumers. The rojo sedavariety is endemic to the region, and given Nicaragua’s abundant production of this unique, sought-after product, opportunities for red bean imports from other origins are limited.

This year, Central American bean growers had to contend with drought conditions brought on by El Niño. Although various news outlets reported bean crop losses, especially in the Dry Corridor region, official figures on the severity of the impact are unavailable. In Nicaragua, however, Agriculture Minister Edward Centeno estimated the Primera bean crop at 1.3 million cwt, a 16% increase over the previous Primera harvest.

“They are seeing some nice yields and having a good crop,” remarks Sandoval. “Nicaragua’s Primera crop should become available in the second week of August.”

It seems likely, therefore, that Nicaragua’s red bean exports will continue to trend upward in 2019/20, as they have for the past several campaigns.

Asked about what is driving the steady increase in Nicaragua’s dry bean production, Corrales points to the 2014 El Niño that decimated crops.

“That was the worst El Niño we saw in decades. Because of the devastation, bean prices back then were three times what they are today,” says Corrales.

The high prices helped the government and exporters promote bean production. This push was accompanied by favorable climate conditions. The combination allowed production to expand, Corrales summarizes.

For Sandoval, DR-CAFTA was also a contributing factor. The trade pact between the five Central American nations, the U.S. and the Dominican Republic, phases out import duties and quotas between member nations. As a result, growers in Central America have found it increasingly difficult to compete with U.S. ag imports, especially for the major commodity crops such as corn. For beans, though, it’s a different story.

“Because its endemic, the rojo seda is unlike what the U.S. has to offer,” explains Sandoval. “It is a different size and has a different taste, and so it doesn’t face competition from the U.S.”

Therefore, as Sandoval sees it, Nicaraguan growers are shifting away from crops that cannot compete with U.S. imports and planting more roja sedabeans instead.

Elsewhere in the region, despite alarming news reports, it appears El Niño will not have much of an impact on production either. Sandoval indicates Guatemala, which is predominately a black bean market, had a good bean harvest as well, and relies mainly on border trade with Mexico to supplement domestic production. In El Salvador, the harvest was adequate and good inventories will help meet domestic demand. Therefore, he expects prices will remain relatively stable throughout most of the region, with Honduras possibly being the lone exception.

News reports out of Honduras have been contradictory. Silvio Molina of Grupo Jaremar, based in San Pedro Sula, a major Honduran port city, says that early on the press warned about crop losses due to the dry conditions. But in July, newspapers began reporting on a drop in red bean prices, which suggests production may have ended up better than previously thought. Alternatively, the lower prices may be due to the deteriorating quality of remaining inventories as supplies dwindle. Another factor could be the downward pressure on prices resulting from the government’s selling of part of its bean buffer stock into the market.

According to a July 28 La Prensa article, Honduras lost 15% of its dry bean crop this Primera season. In the same article, Agriculture Secretary Mauricio Guevara is cited as assuring that production is sufficient to cover demand, at least through to the Postrera harvest, which typically accounts for 80% of the country’s dry bean production.

In any event, should Honduras find itself in need for greater red bean imports this cycle, it appears Nicaragua is poised to step in.

For Costa Rica, SIM report for week ending July 19

For El Salvador, MAG July 29 daily price report

For Guatemala, MAGA price report for week ending July 24

For Honduras, SIMPAH July 29 report Mercado Medina-Concepcion, San Pedro Sula

For Nicaragua, SIMPAH July 29 report Mercado Oriental, Managua

Prices converted from local currency to USD.