August 5, 2020

The fifth edition of CLERA’s annual Argentine pulse conference attracted more than 1,500 attendees from 17 countries.

On Friday, July 31st, CLERA, Argentina’s national pulse industry association, hosted its annual pulse conference for the fifth year running. This year’s event, like many others of its kind in this time of COVID-19, was held online rather than in person. The half-day conference was emceed by Ricardo Bindi of Agrositio and attracted more than 1,500 viewers from 17 countries. Video recordings of the entire event are available here. Below, we summarize the major points made by each presenter.

Following a brief introduction by Bindi, CLERA President Sergio Raffaeli opened the event by touting the finalization of phytosanitary protocols with China, opening the door for the export of Argentine dry peas to the Asian Giant. Work continues to enable bean and chickpea exports, he said. Raffaeli also cited CLERA’s efforts to assist the country’s vulnerable populations during this global pandemic. In the first half of the year, Argentina’s pulse industry provided 115,000 MT of pulses to the nation’s foodbanks, enough to prepare a million meals. He then delivered a presentation on the Consejo Agroindustrial Argentino (Agroindustrial Council of Argentina), formed by more than 45 national agricultural organizations in representation of the agro-industrial economies of the country. The Council aims to grow annual ag exports from $65 billion to $100 billion, creating 700,000 new jobs and establishing Argentina as an international leader in the food trade. As member of the Council, CLERA is working with other ag associations to realize this vision.

Raffaeli’s remarks were followed by those of Juan Usandivaras, executive president of the Agencia Argentina de Inversiones y Comercio Internacional (Investment and International Trade Agency of Argentina). Usandivaras began by noting Argentina’s importance as an exporter of beans, peas and chickpeas, and the pulse sector’s significance to the economies of various regions of the country. The sector, he said, had performed well during the COVID-19 pandemic, with the value of pulse exports in the first semester of the year up 40% compared to the same period last year. Looking ahead, he highlighted opportunities for the pulse trade in India, Pakistan, the United Kingdom, Mexico and China, as well as those created by the innovation taking place in the plant-based ingredients segment. In regard to the latter, he singled out Beyond Meat and Impossible Foods, and encouraged the sector to add value to its pulse production in order to create similar products in Argentina. In the pursuit of these opportunities, the Investment and International Trade Agency of Argentina offers the sector its services and support, he said.

At the conclusion of Usandivaras’ remarks, Bindi introduced each of the sessions that followed.

Agustin Calderoni, a crop protection specialist, began his presentation by stating that, on average, the crops of the world realize only 24% of their yield potential. In the case of beans in Argentina, the average yield out in the fields is 1,400 kg/ha. compared to 6,000 kg/ha. in a controlled environment. He then ran through the developmental stages of a bean plant, comparing it to the stages of human development, and identified what the plant needs at each stage and how that need can be met.

Dr. Luciano Angles, a specialist in nutrition and obesity disorders, focused his presentation on the importance of eating healthy and nutritious foods to keep one’s immune system strong, especially during the current global pandemic. Pulses, he said, are especially important in this regard, as they provide the body with vitamins A, B, C and D, omega 3, zinc, iron and vital amino acids, particularly glutamine, which is considered the most important for a good immune response.

Dr. Angles reviews the health and nutritional properties of pulses.

Dr. Claudio Zuchovicki, a renowned financial specialist, shared his perspective on Argentina’s economic and financial outlook given the reality of the COVID-19 pandemic.

He began by suggesting that rather than imagining a post-pandemic future, we ought to think about how to co-exist with the coronavirus, as it is sure to have lasting effects into the future. He then highlighted some key financial factors about world economies. In the developed world, he pointed out, nations have responded to the pandemic by issuing currency to aid the affected citizenry and sustain demand. Additionally, throughout the world, interest rates have been and will continue to be low through 2022. This has contributed to a perception that currencies will devalue, and people have reacted by stocking up on tangible goods.

Eventually, the low interest rates will lead to increased investment in production driven not by greater consumption, but mostly by speculative interest. In this regard, he stressed that despite national lockdowns, productive capacity and demand have remained intact, as evidenced by how quickly China’s productive sector bounced back in two weeks following the country’s reopening, as well as long lines at retail stores in Europe.

Zuchovicki, therefore, foresees a strong recovery for world economies, with low interest rates for an extended period of time and increased opportunities for production. Some sectors will fare better than others, and in this respect the pandemic accelerated the rise of those parts of the economy that were trending upward and the fall of those headed in the opposite direction. For proof of this, one need look no further than the big tech sector, where companies like Google and Amazon have thrived during the pandemic. Today, the markets are betting on genetics, health, entertainment, esthetics and training.

In the case of Argentina, the country has a chance to seize the moment. To do so, its productive sectors need to be bold and increase production. Labor costs are low in Argentina and that will attract investment. The government, he advises, should undertake needed structural reforms for this to be more than just a fleeting moment and also incentivize investments in production.

The last session of the day consisted of a panel of industry insiders moderated by CLERA president Raffaeli. Each panelist gave a presentation on a specific pulse crop.

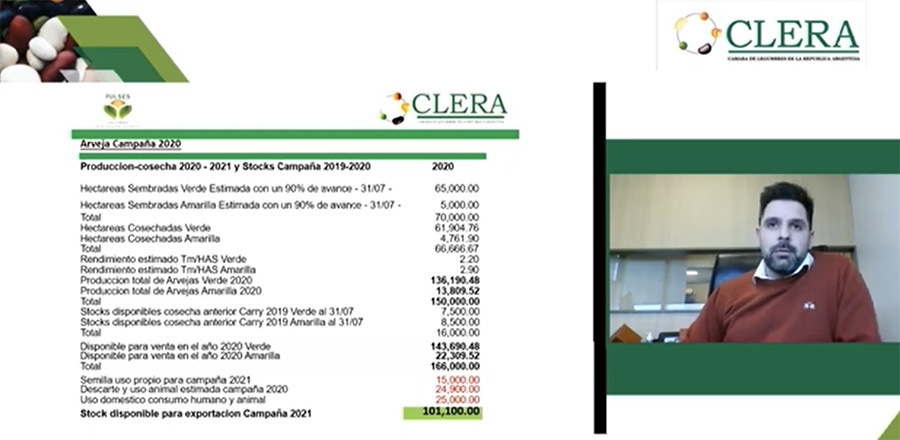

Dry peas: Lucas Genero of Agrofin provided the outlook for Argentine dry peas. The planting of the 2020 crop is nearly wrapped up with an estimated 70,000 hectares of peas seeded (65,000 hectares of green peas and 5,000 hectares of yellow peas). That represents a 30% increase over the prior years. Production is estimated at 150,000 MT, but dry conditions cast doubt on yields. The 2020/21 campaign starts with zero carry-in and, given the strong demand both domestically and internationally, no carry-out stocks are expected.

The finalization of phytosanitary protocols with China a few months ago represents a new opportunity for Argentine yellow pea exports. The challenge now is for Argentina to ramp up production in order to generate volume and offer competitive prices.

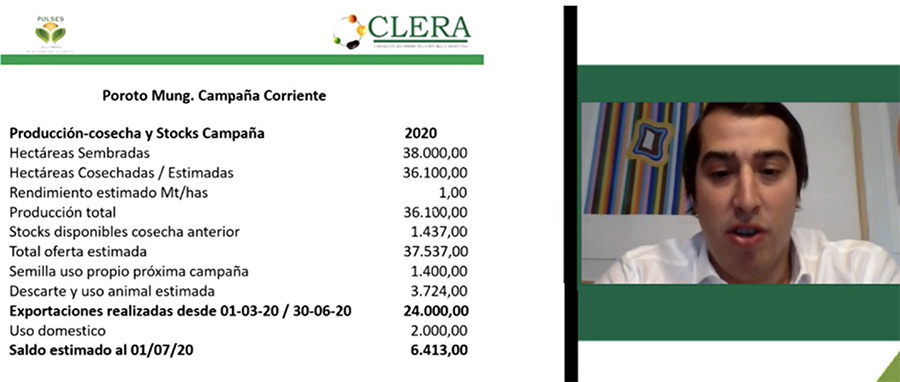

Mung beans: Martin Lazara of ALISOF reported on the outlook for Argentine mung beans. He projected exports of 38,000 MT this campaign and stated that Argentina has diversified its destinations and is no longer solely dependent on India. Today, he said, India remains the primary buyer, but Argentina also exports to a total of 30 countries, including Vietnam Malaysia and the UAE.

Argentina remains a relatively small player in the mung bean trade. The biggest exporter is Myanmar, which averages exports of 450,000 MT per year. Additionally, Argentina faces competition from regional exporters, namely Brazil and Venezuela.

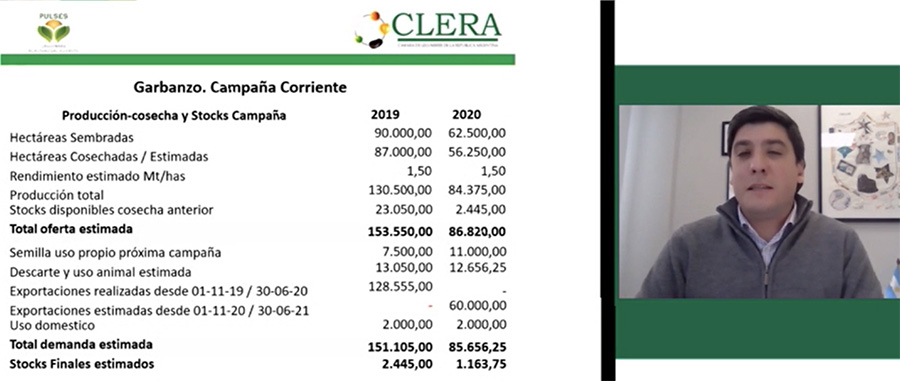

Chickpeas: Pablo Campo of Cono gave the outlook for Argentine chickpeas. He began by recapping the 2019/20 campaign, which was finishing up. At the start of the campaign, Argentina had a large carry-in. Initially, the big buyers were from the EU. Later, buying shifted to the Middle East. Then new crop became available at other origins and Argentine exports stalled. That is, until COVID-19 ignited a frenzy of buying and Argentine chickpeas began to be highly demanded once more, especially within the South American region. As a result, Argentina enters the 2020/21 campaign with zero carry-in.

Like the dry pea crop, the 2020 chickpea crop was planted in dry conditions. Consequently, seeding fell short of initial intentions, with an estimated 62,500 hectares planted to chickpeas this year. The crop will therefore be smaller, Campo summarized, and export volumes will be down as a result of the limited supplies.

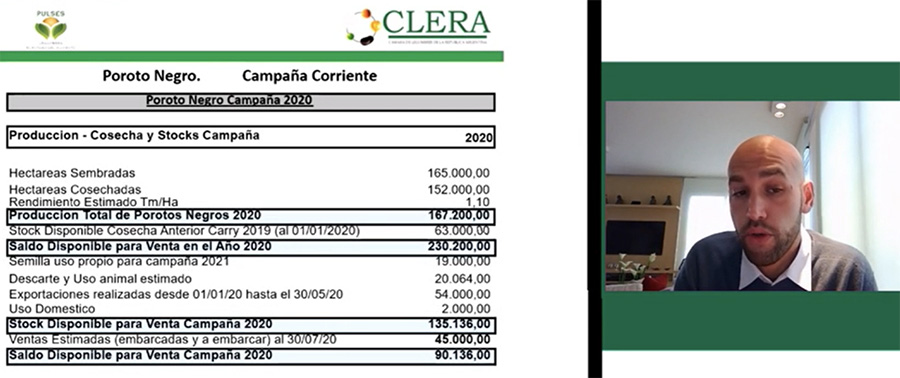

Black beans: Nicolas Karnoubi of Olega spoke next about the black bean crop. This year, the crop was seeded late because of low soil moisture levels. Frost in late May then caused significant losses. An estimated 120,000 hectares were seeded to black beans this year, but as much as 10% was left unharvested. Yields were below average, at 1,100 kg/ha.

The biggest buyer of Argentine black beans is Brazil, usually taking 80% of the crop. Prices at the border, Karnoubi reported, stood at $750 MT. Argentina is also seeing greater demand from Chile and Colombia, as well as domestically, which is likely the result of immigration from Venezuela, where black beans are a staple food. European demand is also up and Karnoubi hopes China will become an important importer in the near future as well.

Addressing the recent negotiations with Mexico regarding its 100,000 MT non-NAFTA quota, Karnoubi noted that in the past Mexico used this quota as leverage to lower prices from NAFTA partners. Argentina, he said, has never managed to export more than 10,000 MT to Mexico. He hopes, though, the recent negotiations will change that.

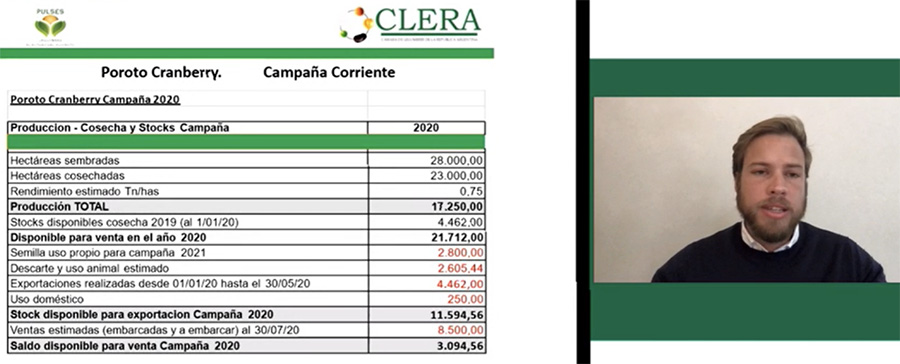

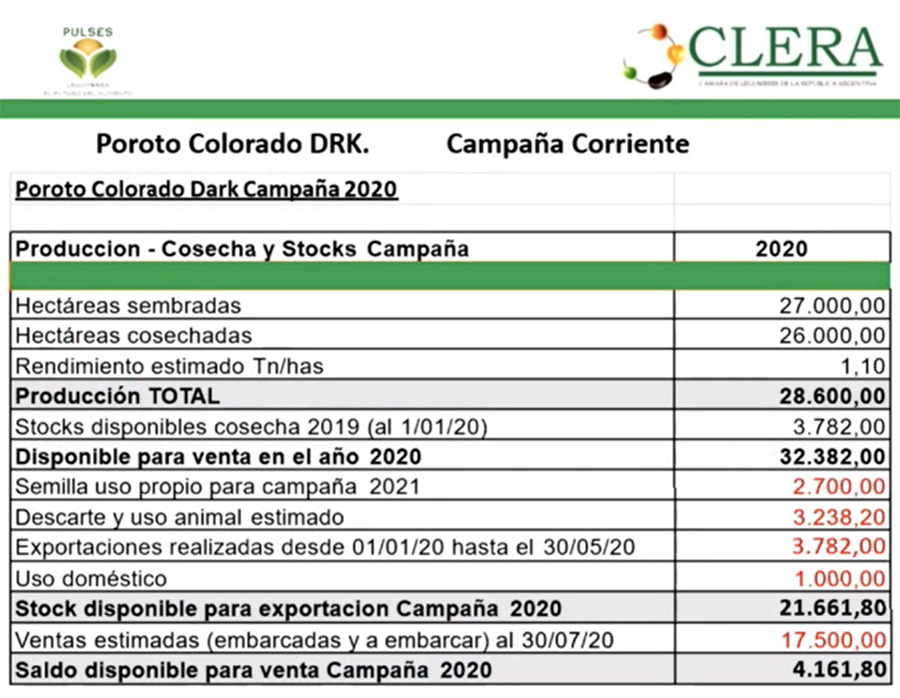

Colored beans: Matias Macera of Desdelsur reported on Argentina’s cranberry, dark red kidney and light red kidney bean crops. On average, Argentina exports 60,000 MT of these bean types per year.

Argentina is the top exporter of cranberry beans and therefore the driver of international prices. The top markets for Argentine cranberry beans are Italy, Türkiye and Pakistan. Brazil also comes into the market when carioca bean prices are high. Macera noted that cranberry beans are delicate and were the hardest hit by the dry conditions in April and May. Because of the lack of moisture, seeding fell short of intentions and the yields were a paltry 750 kg/ha. on average. Supplies, therefore, are tight for 2020/21.

On dark red kidney beans, Argentina’s crop is mainly destined for the cannoning industries of Italy, Spain and Portugal. This year, 28,600 MT of dark red kidney beans were harvested and have already nearly sold out. Argentina’s dark red kidney beans generally sell prior to the start of the North American harvest in September.

Lastly, turning to light red kidney beans, Macera said Argentina typically produces a crop of 6-8,000 MT. The top buyers are Colombia, Portugal and the UAE. The 2019/20 campaign also saw good movement into the U.S. because of a poor crop there. This year, Argentina’s light red kidney bean crop is marked by smaller than usual caliber sizes. Nonetheless, the beans were well received by buyers and fetched good prices ($1,400 to $1,450 C&F), mostly because no other supplies were available.

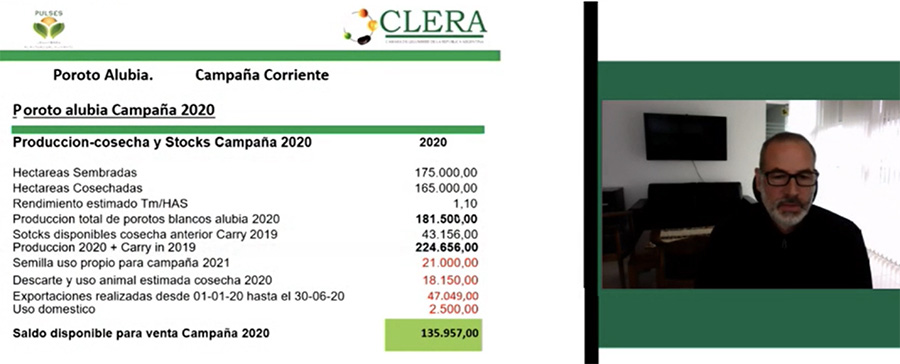

Alubia beans: Horacio Fragola of Alicampo delivered the final presentation on Argentina’s alubia bean crop. He started by recapping the 2019 alubia bean harvest, one of the best in history, with yields of 1,600 kg/ha. and production in excess of 200,000 MT, a record volume. Planting dates varied and as a result so did the quality and caliber sizes of the crop. Despite this variation and the large volume, the entire crop sold fast, with 160,000 MT sold in the second semester of 2019 alone; that is the amount typically sold over the course of an entire campaign. Additionally, Argentina has had success diversifying its markets. Over the past 10 years, the number of destinations increased from 50 to 65. This has helped Argentina decrease its dependence on its traditional European markets.

Given the success of the 2019/20, there was strong grower interest this planting season and the area seeded to alubia beans grew by 15-20% to 175,000 ha. The dry conditions, however, adversely impacted yields, which came in at 1,100 kg/ha. on average. The caliber size of the beans was also affected. Normally, Argentina’s alubia beans are in the 180-200 caliber range, but this year the average is 220-240, with some product as small as 300. Even so, demand has been strong and Fragola expects stocks to sell out in the next few months. There has also been increased demand in the domestic market due to the COVID-19 pandemic. He estimated remaining unsold inventories at 70-75,000 MT.

Argentina / CLERA / Sergio Raffaeli / Agustin Calderoni / Luciano Angles / Claudio Zuchovicki / Lucas Genero / Martin Lazara / Pablo Campo / Nicolas Karnoubi / Matias Macera / Horacio Fragola

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.