October 24, 2019

Held in the major chickpea growing province of Cordoba, it was the most highly attended CLERA event there to date.

On October 22nd, with Argentina’s chickpea harvest in the early stages and the country’s general election just five days away, CLERA (Argentina’s Chamber of Pulses) hosted its largest pulse seminar in the city of Cordoba. The day-long event attracted more than 450 industry members from various parts of the country and, with nearly four dozen companies helping to make it possible, set a new CLERA sponsorship record, as well.

The province of Cordoba produces 80% of Argentina’s chickpea output. Not surprisingly, then, the event focused primarily on that specialty crop. With abundant global chickpea stocks weighing down prices, Argentine growers seeded fewer hectares to chickpeas this year. According to the Cordoba Grain Exchange, 49,300 hectares of chickpeas were planted in the province this past fall, a 42% reduction from last year. Additionally, dry conditions combined with some pest issues have growers worried about yields and caliber size. In fact, in recent weeks a yet-to-be-identified fly larvae infested some part of the crop and caused widespread damage (see more below).

Against this backdrop, CLERA President Sergio Raffaeli opened the seminar by acknowledging the challenges facing Argentina’s pulse sector and recapped CLERA’s efforts to address them, such as in the case of taxes and withholdings. On a positive note, he singled out China as the best opportunity for growth for Argentina’s pulse exports. The sentiment was echoed by Argentina’s Undersecretary for Agricultural Markets Jesus Maria Silveyra, who addressed the gathering and spoke of Argentina’s expanding dry pea production and China’s need for a source of protein to replace the animal protein lost due to the swine flu epidemic. Also on hand was Cordoba Agriculture Minister Sergio Busso, who spoke about the importance of Cordoba’s newly formed Chickpea Cluster and the province’s aim to elevate chickpea production and replicate the success of its peanut sector.

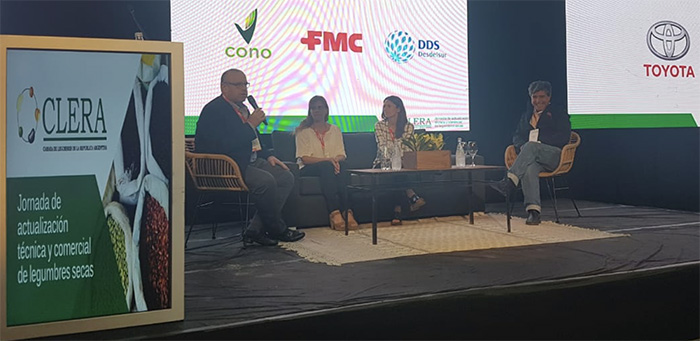

This panel discussion stressed the importance of considering the MRLs at destination markets when determining what agrochemicals to apply. The panel was moderated by Roberto Peralta of Halcón Monitoreos and was comprised of Daniel Mazzarela of Senasa (Argentina’s phytosanitary authority), Mercedes Amuchastegui of Tecnocampo and agronomy consultant Laura Britos.

This panel highlighted the major challenges facing processing plants as they work to meet quality standards and emphasized how the decisions growers make in the fields determine the raw quality of the product that processors then refine. The panel was moderated by Jorge Vidal and comprised of Gastón López of Vitulo Agro, Ian Jepsen Ely and Oliver do Brazil.

The panel stressed the importance of certified seed as a determinant of quality. The participants recapped the different chickpea varieties currently in use and spoke of the challenge of developing new varieties when growers fail to invest in renewing seed. The panel was moderated by Adrián Poletti and comprised of Julieta Reginatto of Vitulo Agro, Dr. Paola Campitelli of the University of Cordoba and INASE (National Seed Institute) President Raimundo Lavignolle.

Renowned economist Dr. Carlos Melconian shared his analysis of Argentina’s future outlook and concluded that the next administration, regardless of who wins the election, will find itself boxed in and, at least initially, have no choice but to do as follows: renegotiate with bondholders prior to restructuring its debt with the IMF; raise taxes to fill public coffers; and limit access to foreign currency to check capital flight. The latter measure will result in a growing gap between official and unofficial exchange rates (dollar blue).

Esteemed market analyst Dr. Enrique Erize of Nóvitas began by noting the moves China is making to realize its One Belt, One Road strategic agenda aimed at creating closer ties and economic corridors with Russia, Europe, the Mid-East, Africa and Oceania. With China and the U.S. currently locked in a trade war, the door is open for Argentina to emerge as an important soybean provider for China. Speaking on prices, Dr. Erize believes world soybean prices will remain firm, and anticipates global corn prices will spike sometime between March and June as U.S. exports slow as its stocks dwindle.

The panel on the market outlook for Argentina’s 2019/20 chickpea campaign was moderated by José María Lázara and comprised of Pablo Campo of Cono, Jorge Reynier of Primore, Nicolas Karnoubi of Olega, Matías Macera of Desdelsur and Mercedes Amuchastegui of Tecnocampo. Asked about old crop carryover, panelists gave estimates varying from 10,000 to 20,000 MT, and all agreed that the quality was poor, with as much as 15% of damaged grains, the consequence of harvest rains last year. As a result, the consensus was that old crop inventories had no other outlets than Pakistan and India. In terms of this campaign’s exportable supply, estimates varied widely, from 100,000 MT to 140,000 MT.

In Cordoba, the chickpea crop was seeded during the optimal planting window under favorable soil moisture conditions. Although dry conditions set in afterward, the crop was coming along nicely and decent yields were expected. Those expectations faded, however, when plants started suddenly yellowing. The cause: an apparent larvae infestation of a yet-to-be-identified fly.

Melisa Braun of Braun Relaciones Comerciales, a consulting company that works with 40 growers throughout the growing area, first received reports of the problem at the end of September. Marco Micolini of Ramagro, a chickpea producer and processor, says he first heard about the issue around September 19th. They as well as other sources indicated that the problem is widespread. In its latest report, the Cordoba Grain Exchange identifies the Department of Colon as the most affected.

The fly apparently lays its eggs inside the stalk of the chickpea plant. When the eggs hatch, the larvae attack the vascular system from within, eventually killing the plant. Sources GPC spoke with anticipate losses of 20 to 30%.

Adrian Poletti of Incrementar, an agricultural PR and marketing firm that helped organize the seminar, told GPC the infestation is limited to only some chickpea varieties, especially those that produce the smaller calibers, and to plants that suffered some sort of stress. Irrigated fields seem to have fared better, he said.

GPC will follow up on the issue and report on Argentina’s chickpea harvest in the coming weeks.