October 28, 2019

As October comes to a close, the pea and lentil harvests are nearly complete, and the bean harvest is past the halfway mark.

Photo courtesy of the Saskatchewan Pulse Growers

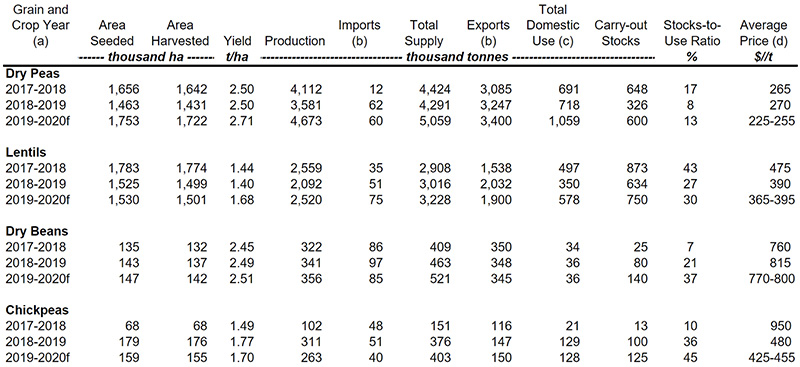

In its latest Outlook for Principal Field Crops, issued on October 18th, Agriculture and Agri-Food Canada estimated production increases for all pulse crops this year except chickpeas. Canada’s dry pea production is estimated at 4.7 million MT, a 30% increase over last year, lentil production at 2.5 million MT, up 20% from a year ago, and dry bean production at 356,000 MT, up 4% from 2018. In the case of chickpeas, production was estimated at 263,000 MT, a 15% decrease from 2018.

It has been a challenging harvest season for Canadian growers. On-and-off rains and a recent snowfall have continually interrupted fieldwork, but things are finally coming to a close. As of late October, only the tail end of the pea and lentil harvests remain, and the bean harvest was past the halfway mark.

In Saskatchewan, the country’s major pulse producing province, the Saskatchewan Agriculture Ministry reported harvest progress as of October 21st at 95% for lentils, 97% for peas and 82% for chickpeas.

Carl Potts, executive director of the Saskatchewan Pulse Growers, told GPC that, except for some good weather at the start, moisture in the form of rain and snow has made it stop-and-go since then. In neighboring Alberta, the situation is similar. The two provinces account for nearly 96% of this year’s dry pea production.

“It’s been slower than normal, but now we are coming to the end,” said Potts, adding that the harvest got off to a late start to begin with because of dry conditions during the growing season, which delayed germination and slowed crop development.

The wet weather not only prolonged the harvest but also resulted in significant downgrading of crop quality, as a good part of the pulses received at elevators arrived tough or damp and required aeration and drying.

“We’ll have a lower quality profile because of the lateness of the crop and the wet conditions, but even so we should have decent supplies of #2 grade and better,” said Potts.

Quality issues are more pronounced in green lentils and green peas, he noted, with lesser downgrading in yellow peas and red lentils.

Elsewhere in Canada, the situation is similar. In Alberta, the latest provincial crop report indicates the dry pea harvest was 95% complete as of October 15th, but wet weather and cool temperatures in recent weeks slowed progress to a crawl. Additionally, frost in the southern parts of the province caused damage to specialty crops, with some fields likely to go unharvested as a result of extensive losses.

In Manitoba, the latest provincial crop report indicates that as of October 15, growers finished harvesting the 112,574 hectares they seeded to field peas and harvested 56% of the 155,752 hectares seeded to dry beans. Central Manitoba was recently hit with a spate of poor weather that impacted bean crop quality and may see some lots left unharvested due to heavily damaged crops.

In Ontario, a key dry bean growing province, news reports indicate wet weather caused harvest delays as well. Additionally, this is the first year growers are not using glyphosate on their beans and this is a challenge in and of itself as they adapt to new production methods. Ontario seeded 124,270 hectares to white and colored beans this year.

In its Outlook for Principal Field Crops report, Agriculture and Agri-Food Canada provided an analysis of the supply and demand situation for each pulse crop.

During the 2018/19 campaign, Canada exported 3.25 million MT of dry peas, up 5% from the previous campaign. Exports to the U.S. and China fell but were offset by record exports to Bangladesh. For 2019/20, the total supply is estimated at more than 5 million MT, with domestic use estimated at 1 million MT and exports projected to increase to 3.4 million MT, leaving a carryout of 600,000 MT.

The U.S., meanwhile, exported 230,000 MT of dry peas in 2018/19 and is expected to produce a crop of 1.1 million MT this year, up 44% from last year.

In 2018/19, Canada exported 1.3 million MT of red lentils and 700,000 MT of green lentils, for a total of 2 million MT, a 32% increase over the previous campaign. For 2019/20, the total supply is estimated at slightly more than 3.2 million MT, up 7% from last year. The new crop consists of 1.5 million MT of red lentils and 700,000 MT of green lentils, as well as smaller amounts of other types. Exports are projected to fall to 1.9 million MT and carryout to increase to 750,000 MT.

In the U.S., this year’s crop is estimated at less than 300,000 MT, a 22% decrease from last year. Average exports of 200,000 MT are projected for 2019/20.

In 2018/19, Canada exported 348,000 MT of dry beans, slightly less than last campaign. For 2019/20, the total supply is expected to hit 521,000 MT, its highest level in three years, due to higher carry-in stocks (80,000 MT). Exports are forecast at 345,000 MT and carryout at 140,000 MT.

In the U.S., dry bean production is estimated at 1.1 million MT and exports are expected to end up in the typical range of 300,000 to 400,000 MT.

In 2018/19, Canada exported 147,000 MT of chickpeas, up 21% from the previous campaign thanks to record shipments to Pakistan. Even so, the total supply for 2019/20 is expected to rise by 7% to 403,000 MT on high carry-in stocks (100,000 MT). Exports for 2019/20 are forecast at 150,000 MT and carryout at 125,000 MT.

In the U.S., 2019 chickpea production is estimated at slightly more than 300,000 MT, a 44% decrease from 2018.

Source: Agriculture and Agri-Food Canada’s Outlook for Principal Field Crops, issued October 18, 2019.