September 12, 2024

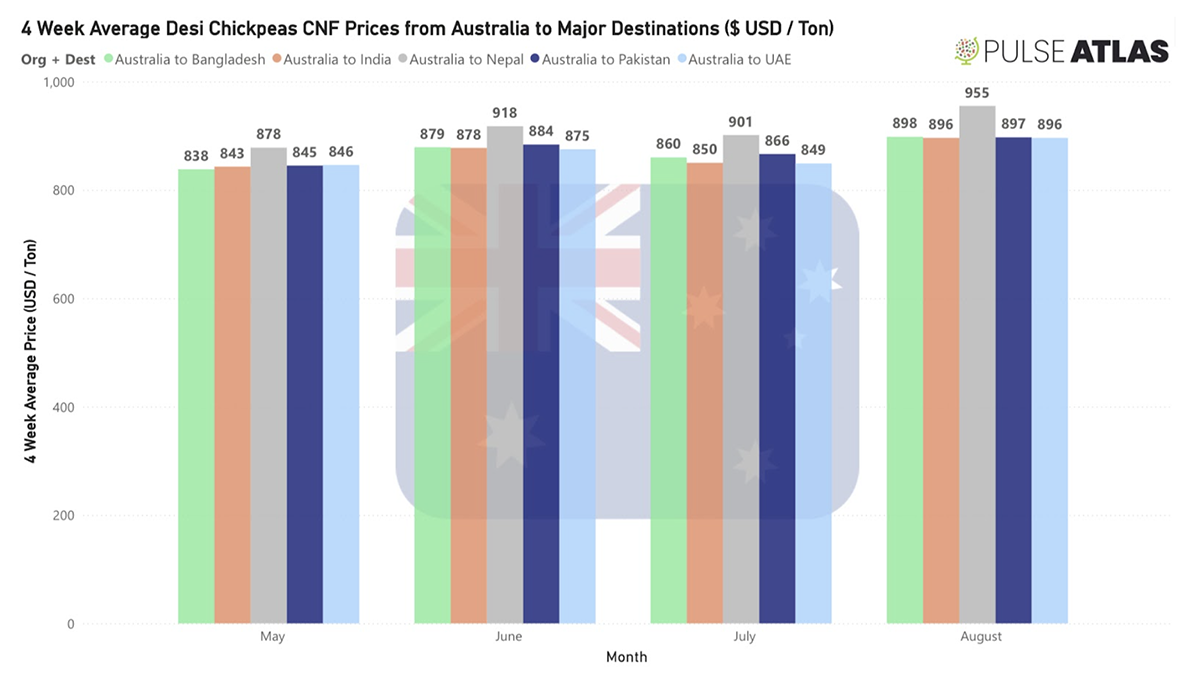

We take a look over the last few months of Australian desi chickpea prices, with Pulse Atlas insights based on up-to-date trade information

desi chickpea prices / desi chickpea / Australia / desis / India / BAngladesh / Pakistan / Nepal / Ramadan 2024

Disclaimer: The opinions or views expressed in this publication are those of the authors or quoted persons. They do not purport to reflect the opinions or views of the Global Pulse Confederation or its members.